CHP MODELING AS A TOOL FOR ELECTRIC POWER UTILITIES

ESL-IE-97-04-12

CHP MODELING AS A TOOL FOR ELECTRIC POWER UTILITIES

TO UNDERSTAND MAJOR INDUSTRIAL CUSTOMERS

Jimmy D. Kwnana / Francisco J. Alanis

Principal Engineers

Linnhoff March, Inc.

Houston, TX

Tony Swad

Senior Engineer

Oklahoma Gas & Electric Co.

Oklahoma City, OK

Jigar V. Shah

Consultant

EPRI Chemical & Petroleum Office

Pittsburgh, PA

ABSTRACT

In the face of pending deregulation, many electric utilities are struggling to retain major industrial customers. The strategies for retaining customers, especially those with cogeneration options, include:

• superior customer service and innovative contract terms

• identifying cost-effective alternatives to cogeneration that are in fact better for the customer and what alternatives there might be to offering discounted rates (eg. ASDs) in the first place. The objective, of course, is to minimize utility revenue loss, while keeping the customer happy.

The revenue erosion problem for electric power utilities has been in the making for some time, ever since deregulation set in. About five years ago, there were a series of papers (Refs 1, 2, 3, and 4] that began to deal with this issue. Although the concept was similar to the one presented in this paper, the focus was a bit different. The CHP simulation model was written in Fortran, and an optimization package

(LINDO) was used to find the least-eost design and operating policy. This was a labor-intensive effort, requiring very high skill level, and turned out to be too expensive for general application.

• treating potential cogeneration candidates as partners in a "distributed generation and supply" chain.

The first step in understanding the available options and appropriate strategy is to properly understand the customers' thermal and electric energy needs, and the existing Combined Heat and

Power (CHP) system. This paper outlines an approach for developing such models at low cost, and using them as a tool towards the aforementioned goal.

With recent advances in spreadsheet software capability, and the availability of stearn properties

"add-in" packages, it has become possible to accomplish essentially the same objectives at much lower cost. The new strategy is to use a simplified spreadsheet simulation model to calculate the exact break-even point for the customer's make-versus-buy or stay-versus-go decision. The way this approach has been used by OG&E is illustrated through an actual case study, funded in part by EPRI's Customer services division.

BACKGROUND

In the approaching era of deregulation, the established electric utility companies face stiff competition for large base-load power consumers.

Many utilities are enticing such customers to stay with them by offering steeply discounted rates on long-term contracts. While this may be a successful short-term load retention strategy, the consequence is long-term revenue loss.

In this paper, we are outlining an alternate strategy by which the electric utility can make better decisions about how much it can afford to give up, and when. We show that once you have understood the customer's energy system it is possible to calculate exactly how big a rate discount will be required to swing the customer's stay/go decision,

PROPOSED APPROACH

There are four key elements in the proposed new approach:

1. Construct a simulation model of the customer's

Combined Heat and Power (CHP) system, using an electronic spreadsheet linked to a steam properties database.

2. Test sensitivity of customer economics to key variables such as hardware, operating/control policies, and contract provisions. This is done by simulating various alternative scenarios.

Proceedings from the Nineteenth Industrial Energy Technology Conference, Houston, TX, April 23-24, 1997

65

ESL-IE-97-04-12

3. Identify opportunity for cost reduction through introducing new degrees of freedom - whether physical (eg. new hardware, controls) or contractual (it may be necessary to consider innovative rate structures and schedules)

4. Work with the customer's engineers to jointly develop the optimum solution

CASE STUDY

Oklahoma Gas and Electric Company (OG&E) has introduced a real-time pricing (RTP) option within its service territory. One of its largest customers had expressed interest in using this option, but was reluctant to make a decision until the full implications were better understood

OG&E used the CHP modeling approach to effectively resolve this customer's concerns. Model development and related sensitivity studies were carried out with four interrelated objectives in mind:

For the example case, both process and HV AC heating needs are provided by steam withdrawn from the extraction steam turbines (ESTs). Normally, only one extraction turbine is needed to supply the heating steam demand. When this demand exceeds the maximum allowable extraction flow, the pressure reducing valves (pRV) are opened. In most cases, the PRY flow is so small that bringing another extraction turbine on line is not justified.

The performance of the turbines was coded into the model by using data provided by the client.

These performance data determine the limits within which the turbines can operate and include power generation at different extraction and condensing flows, and steam conditions in and out of the turbine.

First, the extraction flow is determined as described in the next paragraph. The condensing stage flow is back-calculated from the power output specified from the turbine. A warning flag prevents the user from specifying operating conditions which cannot be handled by the turbine.

• to provide a tool to assist in allocating costs between steam and power generation.

• to calculate the true cost of running each of the steam turbine drives associated with the boiler feed water (BFW) pumps, boiler # 4 fan and the

1200 ton steam-driven chiller.

• to make an economic comparison of the various drive options for the 1200 ton chiller (viz. steam turbine, synchronous and induction ASD motors).

• to facilitate the customer's decision-making process for selecting between generating electricity in-house and buying electricity at

OG&E's RTP rates.

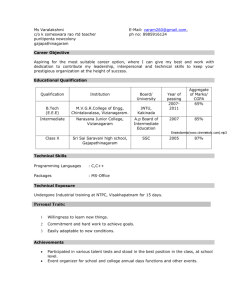

A schematic representation of the CHP system is shown in Figure 1. The model was developed using an electronic spreadsheet (Excel 5) with an add-in software package for calculating steam thermo dynamic properties and turbine performance.

Several such packages are commercially available

[Ref 5, 6].

For accurate simulation, the computational logic coded into the model must follow actual operating policies and equipment performance constraints. It is therefore important to understand the system extremely well.

In order to solve the steam balance, there must be one "floating" value for each header. The key header in this model is the 50 psig header. The model was set up such that the extraction flow from

EST -3 floats, and the let-down flow through the

PRVs is user-specified, which mimics normal operating practice. If the actual steam demand exceeds the maximum extraction flow of one of the turbines, the user has the choice of adding another turbine or increasing PRY flow.

Boilers B3 and B4 usually operate from the end of September through May, and boilers B1 and B5 operate from June through September. The user selects which boilers are to be used by typing "on" or "off'in the "Input Data" worksheet (Table 1).

The program incorporates a correlation for boiler fuel usage as a function of steam generation. This is based on regression of the best available correlation for boiler efficiency.

In addition to modeling the physical equipment and operation, it is important to model the contract provisions for purchase of fuel and electricity. Fuel and pipeline lease costs are a function of the boiler fuel load. Normally, electricity costs would be calculated exactly the same as if the customer were actually buying that amount of power. Fuel and electricity costs are then summed to give a total cost for operation of the boiler plant and associated utility system during the billing period.

Proceedings from the Nineteenth Industrial Energy Technology Conference, Houston, TX, April 23-24, 1997

66

Figure 1: Combined Heat and Power (CHP) Model

ESL-IE-97-04-12

Fuel o

MMBtulh

Fuel o

MMBtu/h

Fuel o

MMBtu/h

Fuel

72 MMBtulh

Fuel o

MMBtulh

1

570381b/h

525 Ib/h

50 psig

391 F o

Iblh off OkW

I o

Iblh

OkW o

Ib/h o

Iblh

2lb/h h-o

BFW Pom",

B4 Fan

~~1b1 on

J

2591 Ib/h

5000 Ib/h

59414Ib/h BFW

225 F

360 psig

~

OkW

500001b/h

0.40 psia

CW

Total Steam Generation

II

57038 Ib/h

II

Chiller o ton o

Iblh

~r--Olb/h

BFW o

Ib/h

Stm Users

50000lblh

160 F Condensate

425001b/h

80 F Make up

9877lblh

Base Case 720 hr/month

Heat and Power Costs

Natural Gas 52,062 MMBtu

Natural Gas Cost 107,248 $/month

Gas Pipeline Lease 21,450

--"'---

$/month

Total Gas Bill 128,698 $Imonth

Wamings: None

OSU Electricity Usage 10,800,000 kWh/month

OSU Electricity Generated 1,008,000 kWh/month

Net Electricity from OG&E 9,792,000 kWh/month

RTP 0.02 $lI<wh

Electricity Bill @ RTP 195,840 $/month

Proceedings from the Nineteenth Industrial Energy Technology Conference, Houston, TX, April 23-24, 1997

67

ESL-IE-97-04-12

Steam and Power Needs

Steam for Heating Duties

Steam Driven Chiller Load

Site Electrical Demand

Chilled Water Plant Electricity Demand

Natural Gas and Electricity Costs

Purchased gas

Transmission charge (pipeline lease)

Minimum Pipeline Lease

RTP Electricity Price

Local Tax (Fuel only)

Table 1: Input data (typical)

Operating Data

50000 Iblh On Stream Time (billing period) o ton of refrlg PRVs Flow

15000 kwhlh o kwhlh

Condensing Stage Pressure

Condensate Return Flow

Condensate Return Temperature

2.00 $/MMBtu

0.40 $/MMBlu

25000 $fmo

0.02 $/kwh

3.00 %

Make up Water Temperature

Boiler Feed Water Temperature

Boller Feed Water Pressure

HP Steam Pressure

HP Steam Temperature

LP Steam Pressure

Deaerator Pressure

EqUipment Perfonnance Data

Boiler 10

Boiler Maximum Continuous Ratings:

Boiler switches (on/off)

Boiler Blow-down

Turbine 10

Status operating mode

Steam Turbine Capacity:

Maximum Extraction Flow

Actual Extraction Flow

Actual Power Generation

Setting Units of Measurements

Ib/h

%

WV

Iblh

Iblh

KW

0

81

40,000 off

4.00

EST 1 off

1500

50000

0

1000

82

40,000

"SWing"

83

40,000 on

84

125,000 on

85

100,000 off

EST2 off

1500

50000

0

0

EST3 on

1500

55000

Floating

1400

CST 4 off

5000

N/A

N/A

5000

720 hr/month o

Ib/h

0.4 PSIA

85 %

160 F

80 F

225 F

360 pslg

250 psig

590 F

50 psig

18 psla

Proceedings from the Nineteenth Industrial Energy Technology Conference, Houston, TX, April 23-24, 1997

MODEL.XLS

ESL-IE-97-04-12

The procedure for detennining the best operating strategy under the RTF program was as follows:

1. A base case is established. This is done by running the model with the expected steam and electricity hourly usage to calculate the base case fuel and electricity bills.

2. One of the parameters in the base case is then perturbed by a small amount. For example, power generation from the condensing turbine might be increased by 1 MW. The model is then run again.

3. The fuel and electricity bills, and the total operating costs, for the two cases are compared.

The difference between the total operating costs of the two cases reflects the benefit (or penalty) of the change that has been made.

The variation of marginal power generation cost with turbine load for two typical gas prices is shown in Figure 2. It was found that the average cost of power generation drops approximately 17% as the condensing turbine load increases from 1 to 5 MW.

This reflects increased turbine efficiency at higher loadings. Obviously, when the RTF price is below the break-even cost of generation, there would be no incentive to generate power. Conversely, at an RTF price above the break-even, there is strong incentive to generate power.

Similar calculations were carried out, using the

ClIP model, to evaluate the economics of replacing the existing steam turbine drive on the 1200 ton chiller compressor with an electric motor equipped with an ASD drive. The following assumptions were made:

• a (typical) motor efficiency of 94%

• Induction ASD cost of $150 $/HP

• Induction ASD installation cost of $1 00 IHP

• Induction ASD motor cost of $80 /HP

• Synchronous ASD cost of $300 /HP

• Synchronous ASD installation cost of $200 /HP

In Figure 3, the total operating cost savings for an ASD motor compared to the steam turbine drive are plotted against RTF for three different refrigeration loads. The motor turns out to offer net savings of around $90,000 per year (assuming 2000 hr/yr operation) when the RTP is 2 centslkwh.

Clearly, the optimum customer strategy is to have a dual drive compressor, with the motor being used during off-peak. rates and the turbine being used during on-peak. rates. The capital cost of adding an

ASD/motor was estimated at $350,000, yielding a simple payback of 4 years at an RTF rate of 2 clkwh.

The results obtained from the simulation study indicate that

• The customer will obtain maximum benefit from

OG&E's RTF program by maximizing in-house power generation in their existing condensing turbine when the RTP price is greater than the computed break-even generating cost.

• For RTF prices less than break-even, the customer's condensing turbine should not be operated. The model can be used to re-assess the break-even price as it changes with the economic environment (eg. gas prices, contract terms).

• Under all realistic RTP prices, the customer should continue to drive the BFW pumps and

Boiler # 4 fan with back pressure steam turbines.

• Based on projected gas prices and RTF rates, installing an induction ASD on the 1200 ton chiller will pay back in less than 4 years.

However, the economics are also sensitive to the refrigeration load on the chiller and the number of operating hours per year. The break even point (fuel savings vs. electricity cost) occurs at an average RTF of7.5 centslkwh.

BENEFITS TO CUSTOMER

The customer derived a number of benefits from the ClIP model. They now have a tool that enables them to

• Quickly and easily evaluate economics of alternate system configurations, hardware, control strategies, and contract options from their energy suppliers

• Compute break-even cost of power generation at varying gas prices, turbine loads, and other parameters

• Make accurate real-time decisions regarding optimum operating policy

Proceedings from the Nineteenth Industrial Energy Technology Conference, Houston, TX, April 23-24, 1997

69

9.00

8.00

7.00 o

6.00

() c::: o

:;:;

~

Q) c:::

Q)

(9

5.00

4.00

3.00 +"'===~

OWNV 1 WNV 2WNV 3WNV 4 WNV 5WNV

Additional Power Generation in Condensing Turbines

6WNV

Figure 2: Marginal Cost of Incremental Power Generation

ESL-IE-97-04-12

150

100

50

(50)

(100)

(150)

RTP ($/kWh)

Figure 3: ASD Cost Savings vs. RTP

Proceedings from the Nineteenth Industrial Energy Technology Conference, Houston, TX, April 23-24, 1997

70

ESL-IE-97-04-12

Specifically, the study helped this customer make appropriate decisions regarding the operating policies for their existing extraction and condensing turbines, and to evaluate the economics of using induction motors in place of stearn turbine drives.

The decision to participate in OG&E's new RTP option was confirmed once the magnitude of potential cost savings became clear.

BENEFITS TO OG&E

OG&E too derived a number of benefits. First,

OG&E has helped to improve the financial health and well-being of its customer, the company's most valuable asset. The customer has optimized its participation in the RTP program, which has certain revenue benefits to OG&E as well.

Second, OG&E has cemented its relationship with a large and valued customer. Although hard to quantify, one need only compare the relative economics of retaining an existing customer versus acquiring a new one.

Third, OG&E has improved its understanding of the technical, economic and social issues that drive customer decisions. Because OG&E strives to excel in its chosen markets by exceeding customer expectations, rather than merely meeting minimum customer needs, this enhanced understanding will help shape future customer service initiatives and marketing priorities.

Finally, OG&E has identified additional opportunities for customer system (hardware) improvements as a result of this work, which should further enhance the customer's perception of OG&E as a value-added energy supplier and potential energy partner for the future.

CONCLUSION

The experience with this study highlights the usefulness of a simulation model to understand and quantify the interactions between the various components of a customer's CHP system. In several previous EPRI/utility projects, such models provided an important basis for helping the customer make appropriate decisions with respect to issues such as

• Electric versus non-electric drives

• Assessment of cogeneration options

• Avoiding capital investment in new boiler capacity by saving steam through heat recovery and by switching to electric drives

• Correctly pricing steam at different pressure levels

• Reducing net energy costs through exploiting time-of-use electric power rates

• Overall planning of the site utility system to accommodate future production plans

As competition in the energy utility business intensifies, large base-loaded power consumers are expected to be offered a proliferation of energy pricing options; the ability to accurately model their economic impact will become more and more critical as a decision-support tool. Such models can also be used by electric power utilities to evaluate innovative contract terms for optimum rate design.

REFERENCES

1. Kumana, J D and R Nath, "Demand Side

Dispatching, Part 1 - A Novel Approach for

Industrial Load Shaping Applications", IETC

Proceedings (March 93)

2. R Nath, D A Cerget, and E T Henderson,

"Demand Side Dispatching, Part 2 - An

Industrial Application", IETC Proceedings

(March 93)

3. R Nath and J D Kumana, "NOx Dispatching in

Plant Utility Systems using Existing Software

Tools", IETC Proceedings (April 92)

4. R Nath, J D KUJIl3I13, and J F Holiday,

"Optimum Dispatching of Plant Utility Systems to Minimize Cost and Local NOx Emissions",

Proceedings of the ASME Industrial Power

Conference, New Orleans (March 92), Vol 17, p59

5. "STEAM for Microsoft Excel" brochure,

LinnhoffMarch Inc, Houston, TIC, phone 713

787-6861

6. "SteamTab for Excel and Lotus" brochure,

ChemicaLogic, Woburn, MA, phone 617-938

7722

Proceedings from the Nineteenth Industrial Energy Technology Conference, Houston, TX, April 23-24, 1997

71