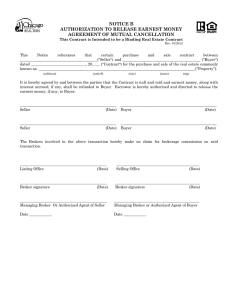

hotline questions - Michigan REALTORS

advertisement