Hydro_One_Annual_Information_Form_2012_ENG

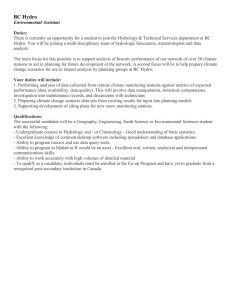

advertisement