Q2 2016

The Deloitte Consumer Tracker

Confidence remains flat but job

worries cloud outlook

Deloitte’s latest Consumer Tracker

shows that consumer confidence

in job security has fallen three

points in the immediate aftermath

of the EU referendum, and is down

six points compared to this time

last year.

Confidence in job opportunities

has also fallen since last quarter,

showing consumers feel less

certain about their job prospects

as the consequences of Brexit

continue to unfold. Overall, our

headline measure of consumer

confidence remains at -8, its

lowest level since Q4 2014.

When asked how the result of

the EU referendum would impact

upon their personal financial

situation and spending habits in

the next 12 months, consumers’

response was strongly negative.

Consumers are also concerned

about the affordability of their

grocery and non-essential

spending. Post-Brexit inflation

forecasts predict a rise in the next

year. The Treasury recently raised

its forecast to an average of 1.3%

inflation for 2016, up from 0.5% in

June, and to 2.5% in 2017.

Sentiment about jobs among

younger consumers is more

negative than for older

consumers. While overall

confidence is flat quarter-onquarter for 18-34 year olds due

to an 18 point rise in health and

well-being, their confidence about

job security falls by seven points,

and confidence in their career

progression by nine points.

Consumer spending remains

largely stable. Expenditure

continues to shift from essentials

to discretionary categories. Net

spending on essentials was

flat quarter-on-quarter, while

net spending on discretionary

categories rose by three points,

suggesting more consumers are

spending more in non-essential

areas. This is reflected in retail

sales growth of 2% in the first

half of the year. However, leisure

spending continues to grow at a

faster rate than retail spending,

as consumers prioritise spending

on experiences.

It remains to be seen what impact

political and economic uncertainty

will have on the consumer

market. Consumer-focused

economic fundamentals remain

favourable – for example, inflation,

unemployment and the cost of

borrowing are still all low – but for

how much longer?

Consumers expect to spend more

in most categories in the next

three months, but beyond then

their outlook is more cautious.

Significantly, it is consumers

in the higher social grades as

well as younger consumers that

are reporting lower levels of

confidence for the next 12 months

across a range of measures

relating to their personal finances.

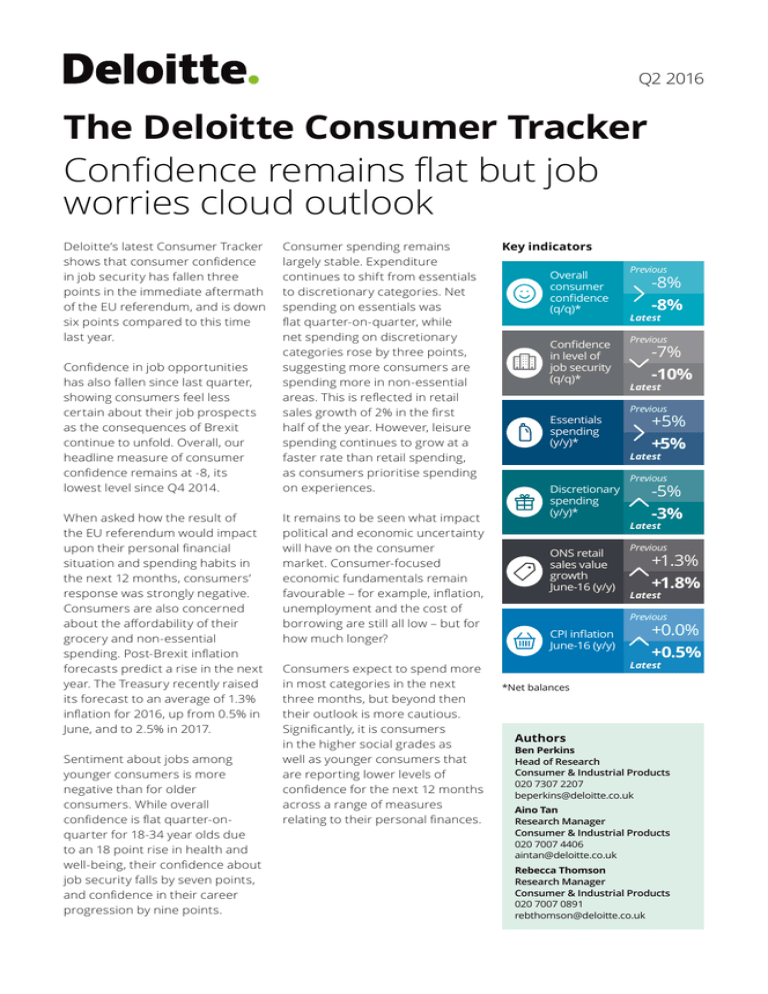

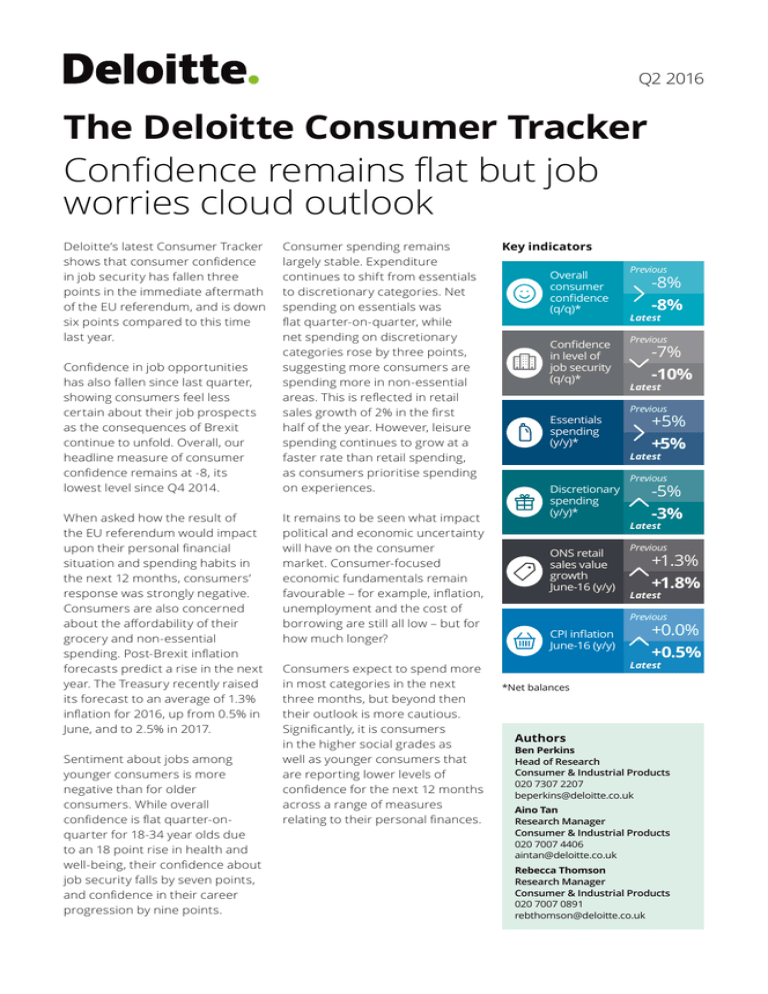

Key indicators

Overall

consumer

confidence

(q/q)*

Confidence

in level of

job security

(q/q)*

Essentials

spending

(y/y)*

Previous

-8%

-8%

Latest

Previous

-7%

-10%

Latest

Previous

+5%

+5%

Latest

Discretionary

spending

(y/y)*

Previous

-5%

-3%

Latest

ONS retail

sales value

growth

June-16 (y/y)

Previous

+1.3%

+1.8%

Latest

Previous

CPI inflation

June-16 (y/y)

+0.0%

+0.5%

Latest

*Net balances

Authors

Ben Perkins

Head of Research

Consumer & Industrial Products

020 7307 2207

beperkins@deloitte.co.uk

Aino Tan

Research Manager

Consumer & Industrial Products

020 7007 4406

aintan@deloitte.co.uk

Rebecca Thomson

Research Manager

Consumer & Industrial Products

020 7007 0891

rebthomson@deloitte.co.uk

The Deloitte Consumer Tracker Q2 2016 | Confidence remains flat but job worries cloud outlook

Consumer confidence

Overall consumer confidence was flat

Consumers reported feeling less

Chart 1. Consumer sentiment about job security

Net % of UK consumers who said their level of confidence in job security has improved

confident about the security of their

over the past three months

jobs in the immediate aftermath of

the EU referendum. The confidence

0%

readings fell three points from the

-4%

previous quarter and is now down six

points compared to this time last year. -8%

-12%

Unemployment data up to May 2016

-16%

shows the unemployment rate in

-20%

the UK has continued to fall over the

Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2

past year, reaching its lowest level

11 11 12 12 12 12 13 13 13 13 14 14 14 14 15 15 15 15 16 16

since 2005. This indicates that while

consumers are clearly concerned

about jobs, these concerns are not yet

being reflected by the official statistics.

Chart 2. UK consumer sentiment about personal situation

Net % of consumers who said their level of confidence has improved in the past three months

-40%

Q2 2012

Overall consumer confidence was

flat at -8, its lowest level since 2014.

-2%

0%

2%

1%

-4%

-11%

-7%

-4%

-4%

-10%

Your children’s

education

and welfare

-36%

-30%

Your job

security

-29%

-20%

-3%

-5%

-7%

-10%

Your general

Your job

health and opportunities/

wellbeing

career

progression

-12%

-10%

-8%

-5%

-4%

-1%

0%

Your level

of debt

-13%

-8%

-5%

-12%

-11%

Your

household

disposable

income

-15%

10%

-18%

-15%

-14%

Three of the six measures of

confidence fell compared to the

same time last year. Confidence in

job security, career opportunities

and progression, and children’s

education and welfare all fell.

Confidence in disposable income,

level of debt, and health and

well-being all rose.

Q2 2013

Q2 2014

Q2 2015

Q2 2016

Chart 3. Deloitte consumer confidence

Net % of consumers who said their level of confidence has improved in the past three months

0%

-4%

-8%

-12%

-16%

-20%

2

Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2

11 11 12 12 12 12 13 13 13 13 14 14 14 14 15 15 15 15 16 16

The Deloitte Consumer Tracker Q2 2016 | Confidence remains flat but job worries cloud outlook

Consumer confidence

Confidence among high earners falls significantly

Sentiment about job security was

significantly lower for younger

consumers than it was for older

consumers. It fell by seven points

compared to the previous quarter

for 18-34 year olds, but remained

flat for those aged 55 and over.

Chart 4. Consumer sentiment about job security by age group

Net % of consumers who said their level of confidence has improved in the past three months

10%

0%

-10%

-20%

-30%

Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2

11 11 12 12 12 12 13 13 13 13 14 14 14 14 15 15 15 15 16 16

18-34

Consumers earning over

£100,000 a category representing

only 2.3% of consumers

surveyed, reported a fall in

overall confidence of 13 points

compared to last quarter, and a

fall in job security of 28 points.

35-54

55+

Chart 5. Consumer confidence for high earners

Net % of UK consumers with annual household earnings of over £100,000 who say their

confidence has improved

20%

10%

0%

-10%

-20%

-30%

Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2

11 11 12 12 12 12 13 13 13 13 14 14 14 14 15 15 15 15 16 16

Consumer confidence

Chart 6. Overall confidence of low earners

Net % of UK consumers with annual household earnings of under £25,000 who say their

confidence has improved

Your job

security

-30%

-35%

-40%

-45%

-50%

-10%

-8%

-5%

-7%

-7%

-7%

-10%

-8%

-15%

-13%

-8%

-10%

-4%

-20%

-15%

-25%

-29%

-26%

-19%

-15%

-20%

-20%

-20%

-14%

-20%

-17%

0%

-5%

-10%

Your children’s

education

and welfare

1%

Your general

Your job

health and opportunities/

wellbeing

career

progression

-2%

-2%

Your level

of debt

-3%

-2%

5%

Your

household

disposable

income

-44%

-41%

People with an annual household

income of less than £25,000 a year

reported rises in confidence in

nearly every category year-on-year,

with the exception of job security,

which has remained flat.

Job security

Q2 2012

Q2 2013

Q2 2014

Q2 2015

Q2 2016

3

The Deloitte Consumer Tracker Q2 2016 | Confidence remains flat but job worries cloud outlook

Consumer spending

Consumer spending remains stable

On balance net consumer

spending on essentials remains

flat. However, the shift from

essentials to discretionary

spending continues, with net

spending on both big and small

ticket discretionary items rising.

The categories with the biggest

quarter-on-quarter rises in net

spending were alcoholic beverages,

clothing and footwear, and long

break holidays.

Consumer expenditure data up

to the first quarter of 2016 shows

growth in spending is flattening,

with a marginal fall of 0.1% in the

growth rate from the first quarter

of 2015.

Our data shows that over the last

three months consumers report

spending more in almost every

category compared to last year.

The only category where spending

has fallen year-on-year is for

long-break holidays. Quarter-onquarter, every category with the

exception of utilities has risen.

Chart 7. Essentials vs discretionary spending

Net % UK consumers spending more by category spending

20%

15%

10%

5%

0%

-5%

-10%

-15%

-20%

Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2

11 11 12 12 12 12 13 13 13 13 14 14 14 14 15 15 15 15 16 16

Essentials

Small-ticket items

Big-ticket items

Chart 8. Consumer expenditure

Annual % change year on year

4%

3%

2%

1%

0%

-1%

-2%

-3%

-4%

-5%

Q1

06

Q1

07

Q1

08

Q1

09

Q1

10

Q1

11

Q1

12

Q1

13

Q1

14

Q1

15

Q1

16

Chart 9. Category spending in the last three months

Net spending in the last three months

30%

20%

10%

0%

-10%

-20%

4

Q2 2012

Q2 2013

Q2 2014

Q2 2015

Q2 2016

Holidays (long break)

Restaurants and hotels

Going out

Electrical equipment

Transport

Landline/mobile phone,

Internet and TV subscriptions

Health

Major household appliances

Furniture and homeware

Utility bills (e.g. water,

electricity, fuels)

Housing (e.g. rent, mortgage)

Clothing and footwear

Alcoholic beverages

and tobacco

Grocery shopping for food

and non-alcoholic beverages

-30%

The Deloitte Consumer Tracker Q2 2016 | Confidence remains flat but job worries cloud outlook

Consumer spending

Consumer spending remains stable

Retail sales data shows sales values

have performed relatively well over

the first half of the year. In June,

retail sales values were up by 1.8%

on the previous year.

Chart 10. Retail sales

% change in volume and value year-on-year

8%

6%

4%

2%

0%

-2%

-4%

-6%

Q2

06

Q2

07

Value

Inflation is still low across most

categories, with competition

keeping prices down in grocery and

promotions doing so in clothing

and footwear. However, in June

overall inflation rose to 0.5% from

0.3% in May. Inflation forecasts

have started to predict a larger rise

in the second half of 2016 and

into 2017.

Q2

08

Q2

09

Q2

10

Q2

11

Q2

12

Q2

13

Q2

14

Q2

15

Q2

16

Volume

Chart 11. Inflation (CPI)

% change year-on-year

0.5%

0.0%

1.1%

0.1%

2.3%

1.9%

Total inflation

Miscellaneous goods & Services

Hotels, Cafes & Restaurants

Education

Recreation & Culture

-1.0%

Communication

-0.2%

-1.8%

Transport

Health

-0.5%

-0.3%

Furn,HH equip & Repair of the house

Housing, Water & Fuels

-0.7%

-0.8%

Clothing & Footwear

Alcoholic beverages, Tobacco & Narcotics

-2.9%

4.8%

10.0%

0.8%

1.1%

3.7%

2.7%

1.6%

0.1%

0.4%

0.5%

2.3%

Food & Non-alcoholic beverages -2.2%

June 2016

Compared to a year ago, the

proportion of consumers

displaying both expansionary

and defensive behaviours has

remained static. The gap between

the two has continued to narrow

quarter-on-quarter, suggesting

consumers are becoming more

measured in their spending.

June 2015

Chart 12. Expansionary and defensive spending behaviour

% UK consumers spending more or less

28%

26%

24%

22%

20%

Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2

1 1 1 2 1 2 12 12 13 13 13 13 14 14 14 14 15 15 15 15 16 16

Defensive

Expansionary

5

The Deloitte Consumer Tracker Q2 2016 | Confidence remains flat but job worries cloud outlook

Brexit

Uncertainty over the next 12 months

When asked about prospects

for the coming 12 months in

the light of the result of the EU

referendum, consumers’ response

was strongly negative in all seven

areas. Non-essential spending is the

area where consumers feel least

confident over the next 12 months.

This was closely followed by their

overall personal financial situation,

and savings and investments. UK

house prices was the area where

people feel least concerned.

Chart 13. Consumer confidence after EU Referendum

People in higher social grades

reported significantly lower levels

of confidence across all measures

than people in lower social grades.

Chart 14. Consumer confidence by social grade

Net % of UK consumers who said their confidence about the next 12 months has improved

0%

-10%

-20%

-30%

-25%

ABC1

Affordability

UK house prices

-17%

Affordability

UK house prices

-17%

Your job security

-22%

-27%

Your income before

tax e.g. wages,

overtime, bonus

-28%

-37%

Your spending on

grocery shopping for

food and non-alcoholic

beverages

-38%

-30%

Your savings/

investments

Your overall personal -40%

financial situation

-29%

-50%

Your spending on

non-essential -41%

categories e.g.

-33%

holidays, going out, etc.

-40%

-21%

-10%

-9%

0%

-30%

C2DE

Chart 15. Consumer confidence by age

Net % of UK consumers who said their confidence about the next 12 months has improved

0%

25-34

35-44

55+

-7%

-1 8 %

- 2 1%

- 1 1%

- 12 %

Affordability UK

house prices

- 37 %

-3 8%

- 39 %

- 31 %

- 3 3%

Your savings/

investments

-3 4 %

- 42 %

- 40 %

- 3 2%

- 2 6%

Your spending on

groceryshopping for

food and nonalcoholic beverages

- 34 %

- 3 6%

- 31 %

-2 3 %

-15%

45-54

Your spending on non- - 48 %

%

essential categories - 45

- 4 3%

e.g. holidays, going

-3 4 %

- 30 %

out, etc.

18-24

Your income before

tax e.g. wages,

overtime, bonus

Your overall

personal financial

situation

-50%

Your job security

-40%

- 41 %

-4 2 %

- 38 %

- 30 %

-30%

-20%

- 3 2%

-2 9 %

- 27 %

-21%

-6 %

-10%

-30%

6

Your job security

Net % of UK consumers who said their confidence about the next 12 months has improved

-20%

Younger consumers, who in the

past have shown greater levels of

optimism, are significantly more

negative about the coming 12

months than older consumers.

-14%

-33%

Your income before

tax e.g. wages,

overtime, bonus

Your spending on

non-essential

categories e.g.

holidays, going out, etc.

Your overall personal

financial situation

-35%

Your spending on

grocery shopping for

food and non-alcoholic

beverages

-35%

-37%

Your savings/

investments

-40%

-19%

The Deloitte Consumer Tracker Q2 2016 | Confidence remains flat but job worries cloud outlook

Outlook

Possible headwinds in the coming months

In the coming three months

consumers plan to spend more on

holidays and going out, groceries

and big ticket items such as

furniture and appliances. They

expect to spend less on clothing

and footwear.

Chart 16. Spending over next three months

Net % of UK consumers spending more by category

20%

10%

0%

-10%

Q2 2012

Q2 2013

Q2 2014

Q2 2015

Sentiment among the Chief Financial

Officers of the UK’s largest corporates

has fallen sharply in the wake of the EU

referendum, the Deloitte CFO survey

has shown in Q2 2016. Perceptions of

uncertainty have soared in the wake

of the vote to levels associated with

the euro crisis five years ago. The spike

in uncertainty has had an immediate

effect on business sentiment with

optimism dropping to the lowest

level since the survey started in 2007,

lower than in the wake of the failure of

Lehman Brothers in late 2008.

Chart 17. Deloitte UK CFO Survey

Consumers’ confidence in the

wider economy has seen a sharp

fall since the EU referendum.

Confidence in the general

economic situation is now 33

points lower than at the same time

last year, as uncertainty about the

UK’s prospects once it leaves the

EU affects consumer sentiment.

Chart 18. Economic confidence

Utility bills (e.g. water,

electricity, gas and

other fuels)

Transport

Grocery shopping for

food and non-alcoholic

beverages

Housing (e.g. rent,

mortgage,

maintenance)

Holidays (long break)

Furniture and

homeware

Major household

appliances

Electrical equipment

Going out (e.g. cinema,

theatre, concerts, etc.)

Alcoholic beverages

and tobacco

Restaurants and hotels

(eating out and

short break)

Clothing and footwear

-20%

Q2 2016

Net % of CFOs who are more optimistic about the financial prospects of their company

than three months ago

50%

40%

30%

20%

10%

0%

-10%

-20%

-30%

-40%

-50%

-60%

-70%

-80%

Q3

07

Q3

08

Q3

09

Q3

10

Q3

11

Q3

12

Q3

13

Q3

14

Q3

15

Q2

16

Consumer confidence in the general economic situation over the coming 12 months

20%

10%

0%

-10%

-20%

-30%

-40%

-50%

-60%

Q2

06

Source: GfK

Q2

07

Q2

08

Q2

09

Q2

10

Q2

11

Q2

12

Q2

13

Q2

14

Q2

15

Q2

16

7

Contacts

Nigel Wixcey

Industry Leader, Consumer & Industrial Products

020 7303 5007

nigelwixcey@deloitte.co.uk

Ian Geddes

Lead Partner, UK Retail

020 7303 6519

igeddes@deloitte.co.uk

Graham Pickett

Lead Partner, UK Travel, Hospitality and Leisure

01293 761232

gcpickett@deloitte.co.uk

Deloitte refers to one or more of Deloitte Touche Tohmatsu Limited (“DTTL”), a UK private

company limited by guarantee, and its network of member firms, each of which is a legally

separate and independent entity. Please see www.deloitte.co.uk/about for a detailed

description of the legal structure of DTTL and its member firms.

Deloitte LLP is the United Kingdom member firm of DTTL.

This publication has been written in general terms and therefore cannot be relied on

to cover specific situations; application of the principles set out will depend upon the

particular circumstances involved and we recommend that you obtain professional

advice before acting or refraining from acting on any of the contents of this publication.

Deloitte LLP would be pleased to advise readers on how to apply the principles set out

in this publication to their specific circumstances. Deloitte LLP accepts no duty of care or

liability for any loss occasioned to any person acting or refraining from action as a result

of any material in this publication.

© 2016 Deloitte LLP. All rights reserved.

Deloitte LLP is a limited liability partnership registered in England and Wales with

registered number OC303675 and its registered office at 2 New Street Square, London

EC4A 3BZ, United Kingdom. Tel: +44 (0) 20 7936 3000 Fax: +44 (0) 20 7583 1198.

Designed and produced by The Creative Studio at Deloitte, London. J7354

About this research

The Deloitte Consumer Tracker

is based on a consumer survey

carried out by independent

market research agency, YouGov,

on our behalf. This survey was

conducted online with a nationally

representative sample of over 3,000

UK adults aged 18+ between 24 and

27 June 2016.

A note on the methodology

Some of the figures in this research

show the results in the form of a

net balance. This means that in a

survey of 100 respondents, assume

that 30 reported they are spending

more, 50 reported no change and

20 reported they are spending

less. The net balance is calculated

by subtracting the number that

reported they spent less from the

number that reported they spent

more, i.e. 30 – 20 = 10. This means

10% of consumers reported that

they spent more rather than less.