Gas engines emerge from the shadows

advertisement

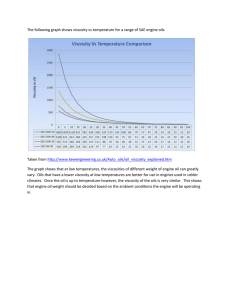

Article Gas engines emerge from the shadows Introduction With gas back in vogue as the fuel of choice for power generation, one of the oldest established engine technologies – gas engines – is newly resurgent as a power source. Plentiful supplies of natural gas and the increasing availability of ‘alternative’ gases such as biogas and anaerobic gas encouraged by policies favouring clean, renewable energy - is driving the take up of localised power. Energy security has climbed to the top of the business agenda, as shifting government policies towards other fuel sources are persuading industrial users to invest in localised gas generation. n Gas Engine Oil Manufacturers (selling lubricating oil for gas engines) n Gas Engine Oil Additives Manufacturers (selling additives to gas engine oil manufacturers) The gas engine market There is no reliable public domain data for sales of gas engines as trade statistics are not (discretely) logged. Also engine manufacturers are understandably nervous about sharing data because recent acquisitions have concentrated manufacturing capacity, prompting a 2011 EEA monopolies investigation. The economic case is compelling. Combined Heat and Power (CHP) has become one of the most profitable ways that companies can use to reduce their energy bills, providing heat to the site and achieving cost savings of between 15% - 40% over conventional electricity. (Source: CHPA). Manufacturing plants and major new office buildings which strive for security from the grid, can embed gas engines on site, positioned close to suitable heat loads and/or sources of low cost fuel. EMEA demand It is in Europe where the use of gas engines for power generation is growing rapidly. Andrew Stone, Director of Energy Solutions at Cummins, says EMEA is their biggest sales region for gas engines globally. Stone believes in keeping the proposition to new customers simple “We are not selling an engine, we are selling a solution”. Richard Holdsworth, Global Marketing Manager, Lubricants at Shell believes there is a shift towards independent back up power and a real move away from heavy fuel towards gas. He believes LNG will become an alternative option to heavy fuel in many parts of the world. But the focus of this particular research is on the expanding use of gas engines for the power generation market in Europe, where two thirds of all gas engines are sold, accounting for some 3800MW of power. (Source: TSW). To study whole of market, The Strategy Works conducted in depth interviews with 25 companies involved in different parts of the supply chain split into these defined sectors: n O&Ms (operating and maintaining fleets of gas engines) n OEMs (manufacturers of gas engines) 18 Power Engineer September 2013 Annual sales (In MW) of Gas Engines over 500kW = 6,000MW/year Combining desk research with interviews conducted, TSW estimates that global annual gas engine sales (over 500kW in power) exceed 6,000 MW per annum, of which 64% is in EMEA at over 3,800 MW. (Chart Source: TSW) In fact Europe, apart from accounting for two thirds of global sales, is also the epicentre for production of gas engines with CAT having relocated their excellence centre (for gas engines) to MWM in Mannheim and GE confirming that 90% of their worldwide sales of gas engines are manufactured by Jenbacher in Austria. Another large USA manufacturer Cummins has 42% of its gas engine sales in EMEA. Germany is a particularly important market for biogas with rapid take up because of feed-in tariff incentives. This is confirmed by Sharanie Patterson, Category Portfolio Manager for Power Generation, Natural Gas Engine Oils at PetroCanada. “Our largest market would be Germany, which is the biggest market in biogas, followed by the UK. Germany has large potential with some 7,000 gas engines right now running on biogas. Our focus is www.idgte.org Gas engines emerge from the shadows going to be on Germany, UK, France, Spain, Italy. Gas Engines is a category that is growing double digit every year.” The growth in biogas is recognised by Philippe Poudou, Product Line Manager IEO Specialities EAME at Oronite “In Germany the production from biogas increased by almost 20% in 2011.” Source: Biogas Barometer, EUROBSERV’ER December 2012 Kirill Chervyakov, Industrial Marketing Advisor, Mobil Industrial Lubricants, agrees: “Germany, Italy and Benelux are our main markets for gas engine oils in Europe. Germany has developed a strong biogas market and Benelux is using gas engines extensively for their greenhouse operations.” Frank Merbitz, (Chief) Applications Consultant at Addinol echoes these views. “Europe is most important to us as there are more gas engines than in other places, especially in Eastern European countries like the Czech Republic, Bulgaria or Estonia, but also in Italy and in Germany. Nowadays it accounts for a large share of our total turnover and it’s growing still.” Michael Wagner, Marketing Director of leading engine manufacturer Jenbacher explains: “Western Europe and secondly Eastern Europe are still our traditional segments. Germany and Italy are historically among the important segments for us.” T-Po 101 Gasmotor Jenbacher supplied by ExxonMobil Maxim Donde, LLK (Lukoil) General Director in Russia also sees the growth in gas engines. “The dynamics of sales is positive. Market volume of these oils around the world is growing at about 5% per year, which is associated with an increase in the number of working gas engines.” David Burke, Service Director of leading O&M Clarke Energy who maintain 300 engines in the UK and has installed units with over 2,750 MW capacity worldwide, confirms the drivers in the UK “The two big markets now are natural gas for combined heat and power and the anaerobic digestion biogas markets.” “In general we see that there is a lot of growth in gas engines and especially on the natural gas side” says Mark Hensen, Senior Product Line Manager – Energy, of Q8Oils. Installed capacity – 40GW TSW estimates that to total installed capacity of gas engines in EMEA is 40GW and is growing at around 8% per year. www.idgte.org Based on average oil consumption figures this equates to over 270 million litres per year for gas engine oil within EMEA making the EMEA market alone worth around £500m ($750m) for lubricant. The use of gas engines In EMEA the main application for gas engines has traditionally been and continues to be for power generation, whereas in North America it is for pipeline applications such as gas transmission and compression. In fact GE produces its Waukesha gas engines range in the US, primarily for gas compression and the European built Jenbacher gas engines range for power generation, reflecting their different profiles and are offering those to worldwide customers. The rapid availability of low cost shale gas in the USA produced by fracking could change the market dynamics there in the future but gas generation will remain the dominant driver within EMEA. Examples of embedded generation On-site energy demand On site “free” fuel Factories, Hospital Energy Centres, Broadcasting Studios, Hotels, Leisure Centres, Horticulture, etc Farms with organic waste, Meat or vegetable processing plants, Water/Sewage treatment plants Landfill sites, Waste recycling plants Disused and operational coal mines Operation and maintenance companies play a pivotal role in the market as power generation is rarely the business of the enterprises where the engines are installed. Therefore the work is farmed out to specialist operation and maintenance providers (O&Ms) as plants can be required to operate 24/7 and at full power. Many companies who sell plant also seek to secure the O&M contracts. Any loss of output is lost revenue, so choosing and buying the right gas engine oil is a critical decision (for the O&M) Gas engine oil approval/trial procedures Alan Beckman, Natural Gas Engine Oil OEM Liaison of Oronite in California, USA outlines the lengthy process that gas engine oil companies are required to navigate to get their oil on an approvals list. “Each OEM has its own specific approval process that you need to satisfy, so there’s a lot of coordination and careful planning that has to go into running the field test and putting the data packages together and then making the presentations to the OEMs.” The process starts with the gas engine manufacturers (OEMs) specifying the performance parameters of the lubricating oil their engines require. Some go further and also provide a ‘long list’ of approved oils allowing the end user - typically the O&M - to select from the list according to the type of application and gas. They strive to provide a wide choice of Power Engineer September 2013 19 Article approved oil brands, so the lists are generally comprehensive and OEMs strongly avoid ‘recommending’ any particular brand from their list and rarely ‘specify’ that a particular gas engine oil is used solely. There are some OEMs like Cummins who also have their own brand of oil. Stone explains: “We have a marketing agreement with Valvoline. If you had a maintenance agreement with Cummins we do have a preference for Valvoline but have the option to use other specified oils dependent on availability, application etc.” The one exception is Guascor owned by Dresser Rand who recommend only its own brand of gas engine oil “We incentivise the use of our oil which has been tested and designed for our engines and the specific applications that we’re in. During the warranty period we will not warrant the engine unless our oil is used.” comments José Maria Bilbao, Sales Director, Power Environmental Solutions David Burke of Clarke Energy confirms that O&Ms have a wide list of oils to choose from “GE Power & Water’s gas engine business leave it open for you to select from their approved oils list.” If a choice is made from outside that list without the OEM’s agreement, then the warranty may be invalidated. “They won’t favour one oil company over the other. In their field trials they are simply concerned whether the oils are suitable for use in their engines” says Addinol‘s Merbitz. However, once outside the OEMs’ warranty period (around 12 months), O&Ms are then free to choose the gas engine oil that they use, but they usually won’t switch oils until they have run trials to prove that the new oil is better for them in their fleet. These trials conducted over many months are often funded by oil manufacturers. “As part of the product development process, ExxonMobil will sponsor field tests to obtain OEM approvals and provide lubricant proof of performance, including oil supply, power cylinder assembly installation, borescopic inspections and in-service oil analysis.” says Kathleen Tellier, Commercial, Marine & Gas Engine Oils, Product Research & Technology, ExxonMobil. confirmed by Praveen Nagpal, Global Product Application Specialist, Lubricants for Shell: “There are extensive field trials involved before we finally secure approval for a product.” Arevon Energy who operate and maintain 35 mature landfill sites in the UK with a total output of 64 MW explain how the trial procedure works from their perspective as an end customer. Mark Woollams, Asset Manager explains that if the oil is less expensive, then the first stage is a like for like trial, without altering oil change intervals; if satisfactory, they will adopt the new product but run further tests to see what benefits can be achieved by increasing oil change intervals. Woollams confirms initial trials can take six months to a year with the oil company usually underwriting the commercial risks, and providing the test oil either free or at a reduced cost, allowing O&Ms to benefit from effectively being the trial resource for oil companies. This detailed testing process is confirmed by Stone at Cummins “There are a number of tests and a number of gates that the oil companies have to pass, some of them are static, some of them are dynamic.” Hensen of Q8Oils explains the step by step process. “How they [OEMs] approve their oils is done through a trial, so we agree it with them, we find an engine, we agree on the test conditions, test length, number of samples, at the end usually inspection or intermediate inspections are required.” The conclusion is that the O&M will only switch oil suppliers if the oil is first trialled on engines in its fleet and it reduces operating costs. EnerG plant in situ at Tesco Types of gas Mobil SHC Pagasus supplied by ExxonMobil Paul Nadin-Salter, Technical Manager at Chevron emphasises this point: “Everything in this business is about trials”. This is 20 Power Engineer September 2013 Sub-sectors exhibit different growth characteristics; the consensus of those interviewed is that anaerobic digestion and biogas are both increasing and following the trend of natural gas. David Hatherill, Head of Power Technologies & Engineering Manager, at Finning (UK) Ltd. part of the world’s largest www.idgte.org Gas engines emerge from the shadows The majority of O&Ms and OEMs interviewed did not regard natural gas as a problem; the major technical issues were always around biogas and other contaminated or ‘sour’ gases; these present the greatest challenges for the O&Ms and also the OEMs in the design of the gas engines. The chart below demonstrates the % fleet by types of gas for the OEM’s interviewed. This shows that (on average) 60% of their UK fleet runs on contaminated gases. 1% Cogenco 90% Edina 50% 20% 5% 25% Finning 12% 5% 72% 11% Clarke Energy 26% 6% 55% 5% Arevon 30% LPG 60% Other biogases ENER-G Anaerobic digestion gas O&M Landfill gas The consensus is that landfill gas is declining in the UK, where no new sites are permitted (the move is now to anaerobic digestion) but, in contrast, landfill is increasing in the rest of the world. However, this creates an opportunity for the UK to export its expertise to other markets. “The good thing for UK people involved in landfill is that they’re taking that experience out to the world now, with hindsight, to countries like Mexico, Brazil, Mauritius, and they’re recognising that landfill is a viable technology” says Nadin-Salter of Chevron. All O&Ms use regular oil analysis to ensure that the oil never fails to protect the engine and is changed in good time. So they are well aware of the effect of different gases on the oil. Coal mine/coal bed methane gas Edina only entered the UK market about 5 years ago, but has grown rapidly. Tony Fenton, CEO, attributes part of the growth to their focus on anaerobic digestion biogas: “Anaerobic gas has many problems and no two sites are the same. Along with our CHP business we took the strategic decision to focus on AD and have seen major business growth as a result.” Problems caused by contaminated gases and the role of additives Natural gas Caterpillar distributor, Finning International Inc, confirms their investment in the potential of biogas from anaerobic digestion: “We have just finished our first anaerobic digestion plant for a major customer in the UK, so we are expanding the scope of our Caterpillar distribution business in a complementary manner with our Clean Power, Contracting and Technologies division. We firmly believe that there is a growing demand and that will continue for gas power generation in the future.” Finning’s UK Power Generation business contributes £50m in revenues to the Group. 3% 5% 1% 10% 8% 100% % of fleet (in MW) by gas type (Source : TSW) A measure of the difference between clean natural gas and the dirtier biogases is that O&Ms typically analyse the engine oil monthly, if it runs on natural gas, but weekly if it runs on biogas. Landfill installation in Finland 4 2032 15MW supplied by MWM The decline in the UK landfill market is endorsed by Julian Packer, Director at Cogenco. “The whole drive away from dumping landfill, moving to recycling and making use of these materials means that there will be no great prospects for landfill.” Cummins who have a global perspective confirm this “….elsewhere in the world landfill is booming” adds Stone. Trends in the UK are confirmed by David Burke at Clarke Energy: “In the UK, landfill operators may have excess capacity on their engines” The gas type also affects the specification of the engine. Wagner of GE’s Jenbacher gas engines explains: “There are about 13 or 14 different types of engine, all differently optimised for differing gases and customised for differing applications” www.idgte.org There was widespread agreement that the main contaminants that condemn engine oil were hydrogen sulphide and siloxanes. Without additives in the oil, the hydrogen sulphide would make the oil acidic, attacking the engine, and abrasive deposits from the siloxanes, would cause extreme wear, particularly on the cylinder surface. For engines operating on landfill gas, siloxanes, which form a silicon dioxide deposit, are usually the worst offender. Unchecked these deposits on the inside of the combustion chamber would raise the operating temperature and increase nitrogen oxide emissions. For engines operating on gas from anaerobic digestion and other biogases, hydrogen sulphide was usually the worst. Hydrogen sulphide in biogas reduces oil life by creating acids in the oil that must be neutralised by additives. The key purposes of additives are: Power Engineer September 2013 21 Article n Protection against corrosive substances such as acids that form in the oil n Improving upper cylinder and head lubrication and reduce valve recession. n Protection against harmful compounds that are abrasive Stone of Cummins sees the benefit of the additives to combat these problems “It’s the secret of that additive package and how it deals with the siloxanes and the hydrogen sulphide that is the unique selling point.” This is endorsed by a leading independent oil analysis laboratory, Spectro whose Global Power Systems Advisor Don Wootton, comments “There is definite evidence that in high silicon engines certain additive types can reduce the friction caused by the silicon in the combustion chamber.” Dean Clark, Global Segment Manager for Gas Engine Oil Additives at Infineum agrees: “Regular oil testing and changes work well but do not provide complete engine protection. For example damage caused by Silicon dioxide deposits triggered by the impurities in landfill gas drive frequent and expensive top-end engine rebuilds (costing ~$25,000-$40,000). We are working with our oil company partners to further develop our additive packages so that they effectively suspend and disperse these impurities thus reducing both the harmful effects and the cost of maintenance.” Holdsworth of Shell stresses that sewage gases, landfill gases and other non-traditional gas types can cause problems to engine operation due to their fluctuating quality over time and from location to location: “For these sour gas applications, there’s a tremendous variation in the amount of acidity and other contaminants that comes through the gas and that can really impact the oil drain intervals.” Base oils Gas Engine Oils are carefully formulated blends of base stock that provides the lubrication, into which are blended additives that customise the oil to the demands of the application, unlike automotive oils, where multigrades are more common. Most base oils fall into one of two categories: those made by refining crude oil through solvent extraction (Group I) and those made by a more sophisticated refinement processes (Groups II and III). Stone of Cummins sees the benefit of the additives to combat these problems “It’s the secret of that additive package and how it deals with the siloxanes and the hydrogen sulphide is their unique selling point.” Oil change intervals may vary from 150 hours in the case of highly contaminated gases to 1,000 to 2,000 hours for clean gases. To put this in context, 150 hours would be only 6 days of operation and 1000 hours is 6 weeks. Nadin-Salter explains that Chevron is striving to extend oil drain intervals. “Some people want highly improved extended drain periods, up to 8,000 hours and some in the landfill market are content if they can achieve 1,000 hours, depending on the quality of the gas. To combat the very aggressive gases in landfill technology, our HDAX 6500 can extend drain periods by 50% or more in the same application, and it is highly resistant to abrasive silicones produced in landfill.” But extended life oil is more expensive and some OEMs believe that changing the oil more frequently is a financially better solution. Oil field test inspections supplied by Oronite There are split opinions prevalent in the market. There are companies such as Q8OILS and Lukoil who are only using Group I. Conversely, Petro Canada produce and use Group II oils and Chevron has made a strategic decision to move all its gas engine oils to Group II. Woollams of Arevon confirms their on-going trial: “Currently, the whole of our fleet is on Group I products but we’re currently on a trial with Chevron on a Group II product, if it proves successful we’ll move all our fleet onto the Group II because of the future long-term life and availability.” Poudou of Chevron Oronite believes the decision to switch to Group II base oils to achieve high performance is correct ‘Mainly in gas engine oil it’s Group I, Group II category, some are using Group III to make it a bit different...I would say that Group II oils currently are the bulk of the high performance products in natural gas engine oils.” Peter Law, Operations Director at ENER-G is not convinced about the premium placed on extended life oil: “The cost of an oil that will do 10,000 hours is massive compared to an oil that does 1,000 hours, so you may as well go for an oil which will do you 1,000 hours... we do look at alternative ways of extending the oil life but we then have to weigh the cost of the oil versus the benefit it provides you.” Damian Perez de Larraya, Technical Director, Power Environmental Solutions at Dresser Rand has concerns about cost effectiveness of Group II oils “We hold a different view, group two oils are nice oils, but they may not be cost-effective.” Shorter maintenance regimes are favoured by other O&M’s. Woollams at Arevon Energy confirms: “We are actively shortening the routine maintenance and overhaul regimes to combat the aggressive nature of the gas.” Hensen explains Q8Oil’s preference for Group I: “New developments are more related to the thermal stability of Gas Engine Oils, deposit control in combination with good dispersancy, so looking at different components but also different base fluids, that’s really critical for 22 Power Engineer September 2013 www.idgte.org Gas engines emerge from the shadows the moment... we know that there are a lot of companies going to the Group II base oils, we think that Q8 Oils produces one of the best Group I base oils with very good oxidation stability and therefore very suitable for gas engines of the newest generation.” can lead to deposits which in turn change your compression ratio and impinges on the running of the engine. We clearly state that with natural gas the ash content must not exceed 0.5% and with biogas it has to be in a range of 0.5% - 1.0%.” Spectro believes that both additive and oil manufacturers are moving towards the use of higher quality base stocks for their new packages, giving advantages such as longer oil drains, cleaner upper cylinders and reduced volatilisation. Spectro believe in the importance of calendarisation, says Wootton “I'm aware that there’s a desire to calendarise oil change to synchronise with service intervals because, particularly with natural gas engines where the oil change cycles are getting longer and longer, synchronisation with the service cycle is a more appropriate emphasis than simply the longevity of the oil change.” Merbitz of Addinol also believes that the attributes of the oil need to match the type of gas. “It is better if you can offer a tailor made oil for the situation it is needed for. There is a huge difference between the demands biogas makes on an engine and natural gas” Some lubricant manufacturers like Addinol use highquality mineral and synthetic base oil components for longer life products. However the consensus from manufacturers is clear in that 5 or 6 different oil products were needed in an oil company’s gas engine oil portfolio in order to meet all of the various needs, including some with extended life. The role of additives Gas engine oil companies create their unique gas engine oil formulations to suit different applications by blending their selected additives into the chosen base oil. The additives must be carefully blended together first before they can be mixed into the oil. This process, to create the additive cocktail, is complex and an additive mixture that works well in one base oil will produce different results in another. When a lubricant burns in the combustion chamber it will form a carbon deposit and the additives form ash. All OEMs will have specifications for the permissible amount of ash and oil companies therefore determine how much ash their oil contains (e.g., medium ash, low ash, etc.) and their products are marketed in this fashion. This point is confirmed by Woollams at Arevon Energy: “The additives introduced to the oil to combat the siloxanes create ash and ash causes problems within the engines”. David Burke at Clarke Energy explains: “Ash is there primarily as one of the safeguards against the acid increase, it adds some absorbency to protect against acid build-up, so that would be the reason why you would normally see a medium ash oil for a non-natural gas application or a low ash oil for natural gas”. Lube Oil Ash is an essential component for the effective ‘lubrication’ of the gas engine exhaust valve seat & face. Engine design is driving the development of gas engine oil and hence the choice of additives and base oil, as explained by Hensen of Q8Oils. “OEMs are pushing towards higher efficiency engines, and this means that temperatures and pressures in the engines will go up. Of course this is also important for the lubricant because if pressure and temperature goes up we have to deal with more thermally stable additives.” Iban Bascones Oset, Power Plants and Cogeneration Lubricants Expert for REPSOL in Spain explains that: “We add detergent/dispersant additives for cleaning and to prevent the build-up of engine deposits, antioxidants to prolong oil life, prevent corrosion/wear to protect the engine, de-foamers etc.” Additive packs versus components Oil companies have a choice how they create their additive mixtures; they can buy the additives either as pre-formulated ‘packs’ or as individual chemical components to make their own additive packs in-house if they have the equipment and expertise to do so. Whether produced in-house from components or bought-in, the additive pack contains all of the components to create the final gas engine oil when blended into the chosen base oil. Beckman at Oronite in California explains the difference: “An individual piece of an additive package would be termed a component. A particular type of detergent would be a component; a formulated additive would contain all of the components necessary for the final product to be blended from the customer’s base oils” ExxonMobil (acknowledged by most to be the market leader) is firmly in the components camp and sees it as a point of difference with competitors. “Mobil Pegasus™ gas engine MWM in Germany (acquired by CAT in 2011) clearly believes in the effectiveness of additives but they specify the oil not the additive itself. This is confirmed by Armin Roeseler, Head of Product Line Management at MWM. “We do not specify exactly which and how many additives have to be included in the engine oil; this is done by the oil producers. However, our specialists work very closely together with the oil manufacturers as they understand additives.” Roeseler also explains the difference in approach between natural gas and biogas “Generally, the issue is not to have as many additives as possible, for instance with natural gas you should have only the amount of additives that you really need in your oil, as too many www.idgte.org MWM TCG2020K 350 engine Power Engineer September 2013 23 Article oils are component based formulations, and therefore we do not deploy additive packages like some of the competition. This approach allows each additive to be specifically selected and optimised to meet the required performance levels. Types of additives which are selected include, detergents, dispersants, antioxidants, antiwear, metal passivators to name but a few” says Tellier. Holdsworth of Shell is another who believes in monitoring feedback “We get data from the customer locations and specifically customers with operational issues and subsequently use a ‘demonstrated value record’ to document what happened to the customer, what we’ve done, and how that has solved their problem.” Chevron is the only oil company that has an additives company (Oronite) within the same group and it believes that gives them an edge. “It’s that combination of knowing base oil technology and additive technology and blending them all together and we can quite confidently say we’re the only integrated lubricant manufacturer” comments Nadin-Salter. B2B relationships Oil analysis Spectro has an independent view of the market because it conducts oil analysis for a number of oil companies and O&Ms, claiming a majority share of the outsourced UK gas engine oil analysis market and substantial penetration of the EU market Spectro is competing with those oil companies who now provide their own analysis service. It still provides services to many oil companies (who offer Spectro’s analysis to their customers), but it has focused strongly on serving the O&Ms and they actively strive to understand their needs. In this respect, Wootton sees one of Spectro’s core strengths as the quality of its technical staff. Stewart Wilson, Manager, Centre of Excellence, at landfill operator Infinis comments: “Spectro’s turnaround times coupled with the accuracy of reporting are excellent. We rely heavily on their analysis and would find the maintenance task much more challenging without their input.” David Burke of Clarke Energy confirms the importance of oil analysis. “Our primary method for determining oil change frequency is through lube oil analysis.” Merbitz at Addinol in Germany is also an advocate of oil analysis: “The application of our gas engine oils is accompanied by substantiated technical support and regular oil analyses. Based on analysis results and comprehensive experience, we determine the optimum oil change intervals for each gas engine, individually and tailored to the particular operating conditions. Therefore, operators do not only have operating and maintenance costs under control, but monitor the state of the plants and ensure their trouble-free operation.” “If the customer is used to drain interval of 1,000 hours, we do regular oil analysis every few hundred hours, an analysis of 1,000 hours, look at the oil quality but still drain the oil and then the next oil drain we go to 1,100, look at the results, so just stretch the oil life” says Joris van der List, Research Scientist at Q8Oils The relationships matrix below demonstrates where the main marketing and technical dialogue takes place. Groups they generally talk to Company groups O&Ms OEMs GEOs GEO As O&Ms OEMs GEOs GEO As Good relationship Limited relationship No relationship Relationship matrix The main oil companies (GEOs) maintain relationships with the O&Ms because they are their key customers, but also with the OEM’s because they specify the range of oils that can be used within the initial warranty period. Additive companies (GEOAs) have virtually no relationship with final users of the product, as the product is not added separately (by OEMs); it’s always part of the gas engine oil formulation. Therefore the gas engine oil companies are in effect their customers. “Generally, it is not recommended to add additives yourself as you might damage the engine. So, all our additives for gas engines come blended in the oil. It’s important not to underestimate the expertise needed to marry oils and additives. We have 20 years’ experience in doing that for the lubrication of gas engines, our overall experience in the composition of lubricants reaches back as far as 1936” adds Merbitz. Hatherill of Finning also advises against end users blending additives separately into the gas engine oil: “We would not recommend anybody did that.” Woollams of Arevon Energy is another advocate of oil analysis: “We use condition based monitoring for the oil. It is sent away weekly to laboratories.” Bascones of REPSOL is just as strong on this point: “REPSOL does not recommend introducing any other additives to the oil or engine as this can alter the original formula of oils and threatens the balance of the different components of the formula. If this occurs, any guarantee, assurances or approvals are null and void.” Packer of Cogenco also believes in regular oil monitoring: “Every service and in-between services we take oil samples and have them analysed.” The universal industry view is that the additive formulations are the intellectual property of the additive companies and, if 24 Power Engineer September 2013 www.idgte.org Gas engines emerge from the shadows they were to release that information into the market, they would compromise their IP. Therefore they are only effectively sold as an ‘ingredient’ to oil companies, not for later use within the end customer supply chain. This is confirmed by Merbitz at Addinol in Germany. “Every company has their own secret mix of one or several additives with the oil. The additives help to increase the base properties in the process and obviously the lubrication. Our engine oil used for biogas and fermented gases mainly possesses an outstanding neutralising capacity towards acid components; it is a so-called high-ash product containing a special additive package.” Patterson of Petro-Canada sees it as a partnership “Ultimately, it’s about a partnership with the additive company.” “You are only able to make it if you have a good sales staff, good service, good support and that the customer knows that’s someone taking care of me”, explains Hensen of Q8Oils. OEMs - gas engine power bands Gas engines can be split into two major power bands, over 5 MW which operates almost entirely on natural gas and below 5 MW. The 500 KW to 3.5 MW bands account for 68% of all new capacity and it is these power bands where there is the highest use of contaminated gas. as it will determine which renewable energies profit from subsidies and to what levels.” says Wagner. The gas engine still sits below the radar, without an SIC product code and does not appear in official statistics. Yet this long established technology has become one of the most cost effective ways of generating electricity, with over 40GW of installed capacity (over 500kW) across EMEA and growing. The market is growing rapidly because it makes compelling financial sense for investors and helps mitigate the risk of electricity shortages. Still to come is the unknown impact of shale gas development which may secure further investment in distributed generation in Europe, using gas engines. All market sectors interviewed for this article stand to benefit from the projected market growth but gas engine oil companies in particular face the ‘perfect storm’. They are secure in the knowledge that oil consumption (per se) is increasing faster than the market, because of the rapid growth of biogases in the mix which greatly increase oil consumption. Gas engines have indeed proved to be ‘the stalking horse’, silently booming again, some 140 years after they were first invented. n Acknowledgements The Strategy Works acknowledges the support of the following companies who co-operated in the research programme for this article: % of Global sales of gas engines in MW by power band The future Most are optimistic about the future and the prospects for gas. Thoralf Lemke Director of Marketing at MWM is positive: “Gas has become, not just in the US, a lot cheaper and in one or two years the US will become an exporter of gas. Then this lower cost gas will be available outside the US as well. For the future we are very optimistic and expect good growth opportunities” Hermann Kling, Sales Gas Engines Export, of MAN forecasts a 5% growth in gas engines sales in EMEA. “The biogas share will grow depending on energy politics and the natural gas share will become more important.” he adds. Wagner of Jenbacher, believes that in Germany and Western Europe biogas will increase further. Going forward, government energy policies and, in particular the subsidies and incentives, will have a profound effect on the market. “It will be very important to watch the debate on energy diversity and safety www.idgte.org OEMs O&Ms Oil/lab Additive companies/ Oil companies Cummins Arevon Infineum Addinol Dresser Rand Clarke Energy Oronite Chevron Jenbacher Cogenco ExxonMobil MAN Edina Petro-Canada Rolls Royce/ Finning Q8 Oils Spectro Bergen Wärtsilä Repsol Shell The Strategy Works This article has been prepared by Michael Herson and Bob Bell of London based The Strategy Works - a strategic marketing consultancy specialising in market sizing and original business to business insight on a global basis. Contact: 44 208 868 0212 or mherson@thestrategyworks.com Website: www.thestrategyworks.com Power Engineer September 2013 25