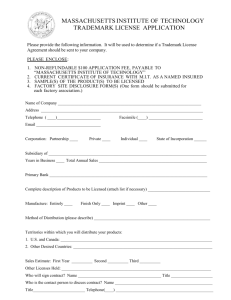

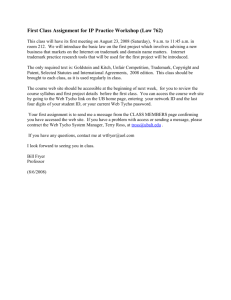

trademarks in business transactions

advertisement