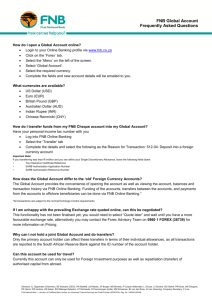

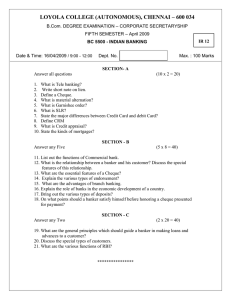

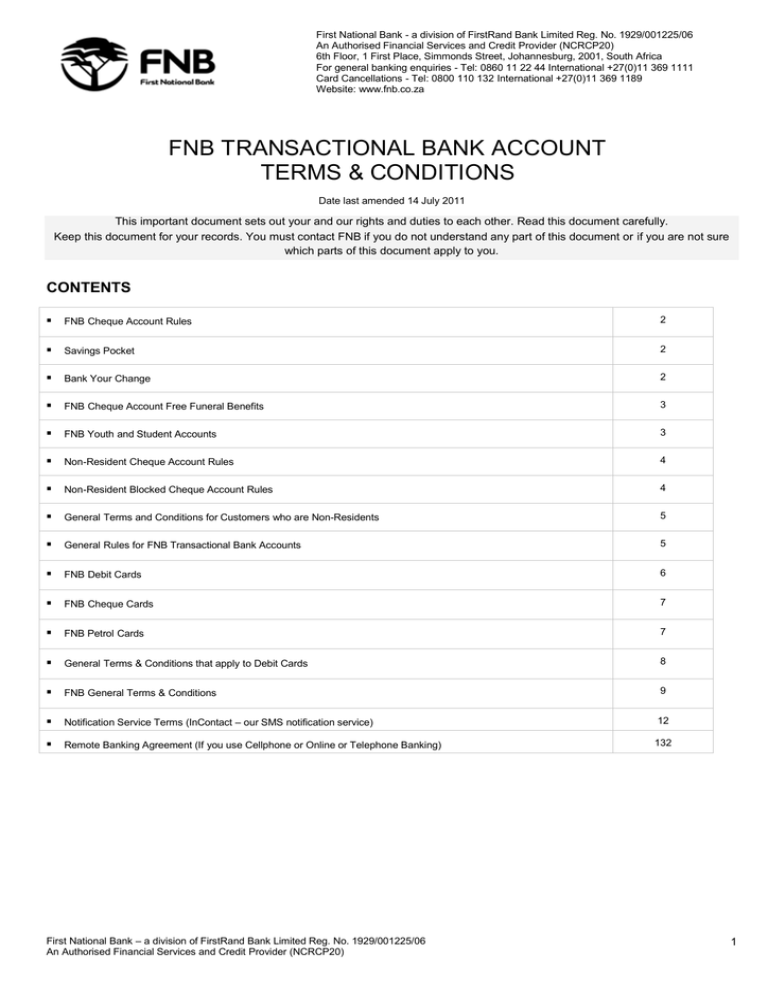

FNB Cheque Account

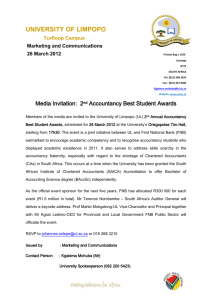

advertisement