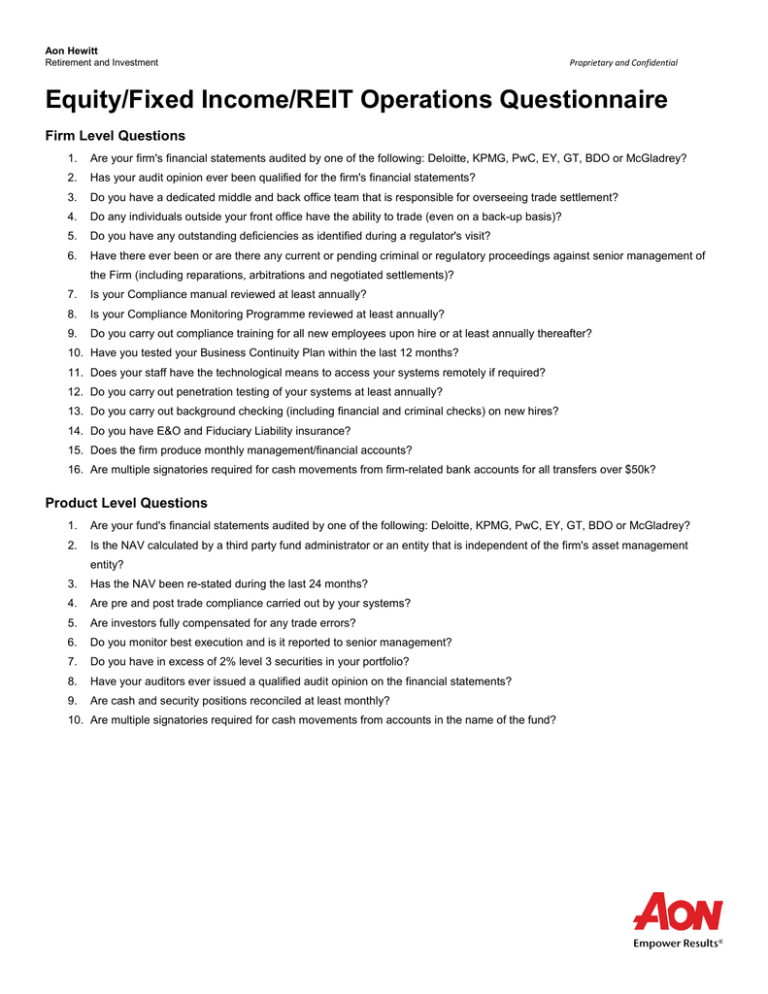

Equity/Fixed Income/REIT Operations Questionnaire

advertisement

Aon Hewitt Retirement and Investment Proprietary and Confidential Equity/Fixed Income/REIT Operations Questionnaire Firm Level Questions 1. Are your firm's financial statements audited by one of the following: Deloitte, KPMG, PwC, EY, GT, BDO or McGladrey? 2. Has your audit opinion ever been qualified for the firm's financial statements? 3. Do you have a dedicated middle and back office team that is responsible for overseeing trade settlement? 4. Do any individuals outside your front office have the ability to trade (even on a back-up basis)? 5. Do you have any outstanding deficiencies as identified during a regulator's visit? 6. Have there ever been or are there any current or pending criminal or regulatory proceedings against senior management of the Firm (including reparations, arbitrations and negotiated settlements)? 7. Is your Compliance manual reviewed at least annually? 8. Is your Compliance Monitoring Programme reviewed at least annually? 9. Do you carry out compliance training for all new employees upon hire or at least annually thereafter? 10. Have you tested your Business Continuity Plan within the last 12 months? 11. Does your staff have the technological means to access your systems remotely if required? 12. Do you carry out penetration testing of your systems at least annually? 13. Do you carry out background checking (including financial and criminal checks) on new hires? 14. Do you have E&O and Fiduciary Liability insurance? 15. Does the firm produce monthly management/financial accounts? 16. Are multiple signatories required for cash movements from firm-related bank accounts for all transfers over $50k? Product Level Questions 1. Are your fund's financial statements audited by one of the following: Deloitte, KPMG, PwC, EY, GT, BDO or McGladrey? 2. Is the NAV calculated by a third party fund administrator or an entity that is independent of the firm's asset management entity? 3. Has the NAV been re-stated during the last 24 months? 4. Are pre and post trade compliance carried out by your systems? 5. Are investors fully compensated for any trade errors? 6. Do you monitor best execution and is it reported to senior management? 7. Do you have in excess of 2% level 3 securities in your portfolio? 8. Have your auditors ever issued a qualified audit opinion on the financial statements? 9. Are cash and security positions reconciled at least monthly? 10. Are multiple signatories required for cash movements from accounts in the name of the fund?