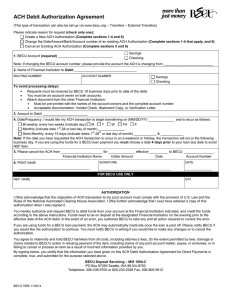

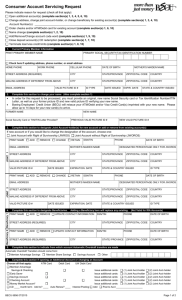

account agreements

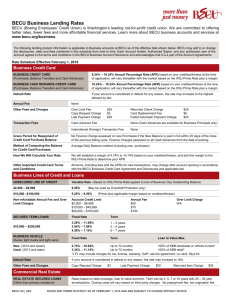

advertisement