The Maturity and Payment Schedule of Sovereign Debt

advertisement

The Maturity and Payment Schedule of Sovereign Debt∗

Yan Bai†

University of Rochester

NBER

Seon Tae Kim‡

ITAM Business School

Gabriel Mihalache§

University of Rochester

September 29, 2014

Abstract

This paper studies the maturity and stream of payments for sovereign debt. Using Bloomberg bond

data for 11 emerging economies, we document that countries react to crises by issuing debt with

shortened maturity but back-load payments schedules. To account for this pattern, we develop a

sovereign default model with an endogenous choice of debt maturity and payment schedule. During recessions the country prefers its payments to be more back-loaded—delaying relatively larger

payments—in order to smooth consumption. Such a back-loaded schedule is, however, expensive

given that later payments carry higher default risk. To reduce borrowing costs, the country optimally shortens maturity. When calibrated to the Brazilian data, the model can rationalize the

observed patterns of maturity and payment schedule, as an optimal trade-off between consumption

smoothing and endogenous borrowing cost.

∗

We are grateful to Cristina Arellano, Juan Carlos Hatchondo, Ignacio Presno, Juan Sanchez, and the participants

to the 2014 Midwest Macro meeting, the North America Econometric Society Meeting, and the Society for Economic

Dynamics conference for helpful comments and suggestions.

†

Yan Bai: Department of Economics, University of Rochester, Rochester, NY, 14627. E-mail address:

yan.bai@rochester.edu

‡

Seon Tae Kim: Department of Business Administration, Business School, ITAM, Rio Hondo #1, Col. Pregreso

Tizapan, Mexico, D.F., Mexico, C.P. 01080. E-mail address: seon.kim@itam.mx

§

Gabriel Mihalache: Department of Economics, University of Rochester, Rochester, NY, 14627. E-mail address:

gabriel.mihalache@rochester.edu

1

Introduction

At least since Rodrik and Velasco (1999)’s work on the maturity of emerging market debt, international economists have been puzzled by emerging economies’ heavy issuance of short-term debt

during crises. Short-term debt is particularly subject to roll-over risk which hurts consumption

smoothing. We argue that this is less puzzling than one might think. Countries also adjust the

stream of promised payments, or the payment schedule, to be more back-loaded, i.e. relatively larger

payments are scheduled closer to maturity, while the smaller payments are due sooner. This allows

the sovereign to partially mitigate the downsides of short-term borrowing.

To understand how an emerging economy chooses the maturity and, more importantly, the

payment schedule of its external debt, we explore the individual bond data of 11 emerging markets

from the Bloomberg Professional service using panel regressions and document two major findings

on sovereign debt issuance. First, the promised payments are more back-loaded during downturns,

when output is low and spread is high. Second, the maturity is shorter during periods of low output

or high spread, consistent with the evidence presented by Arellano and Ramanarayanan (2012) and

Broner, Lorenzoni, and Schmukler (2013).

Our model extends the standard sovereign default framework of Eaton and Gersovitz (1981),

Aguiar and Gopinath (2006), and Arellano (2008) by introducing a flexible choice of payment

schedule. A small, open economy can issue only state-uncontingent bond in the international

financial markets. Its government can choose to default over its bond, subject to a punishment

of output loss and temporary exclusion from international markets. We depart from the literature

and allow the government to issue bonds with different maturities and schedules. For example,

the government may issue a T -period, back-loaded (front-loaded) long-term bond. Before the bond

matures, the government makes periodic payments increasing (decreasing) over time.

The payment schedule and maturity of sovereign debt are determined by the interplay of two incentives: smoothing consumption and reducing default risk. To smooth consumption, the sovereign

would like to align payments with future output, i.e. larger payments ought to to be scheduled

for periods with higher expected output. Thus, a more back-loaded payment is preferable during

economic downturns since the government can repay the bulk of its obligation in the future, when

the economy is expected to recover. Under the consumption-smoothing incentive, the growth rate

of payments and current output should be negatively correlated.

The government must also takes into consideration its default risk when making choices over

payment schedule, since high default risk leads to high borrowing cost. A more back-loaded bond

is particularly expensive during downturns. Such contract specifies that most payments are to be

made in the far future, which subjects lenders to large losses if the government defaults in the

meantime. To reduce borrowing cost while enjoying the consumption-smoothing benefit of backloaded contracts, the government chooses a shorter maturity in economic downturns. Contracts

with shorter maturity allow lenders to receive their investment returns sooner. Lenders therefore

2

bear less default risk and offer a higher bond price.

We calibrate the model to match key moments for the Brazilian economy. Our model generates

volatilities of consumption and trade balance similar to the data. The model replicates key features

of sovereign debt. The median maturity is about 9 years in the model and 10 years in the data. The

median growth rate of payment is 5.3% in the data, which implies that on average countries issue

back-loaded bonds. Our model also predicts that on average countries issue back-loaded bonds:

payment growth is 6.0% for the model.

Most importantly, our model matches well the cyclical behavior of issuance. When the spread

increases above its mean, maturity shortens from 7 to about 3 years, while the payment growth

rate increases from 3.4% to roughly 8%. By looking across quartiles of spread or GDP we find that

the cyclical properties of issuance are fairly monotonic, and similar between model and data.

This paper makes two contributions. Empirically, we construct a parsimonious measure of payment schedule and document the role of back-loading for consumption smoothing during downturns.

Most works in the literature, such as Broner, Lorenzoni, and Schmukler (2013), and Arellano and

Ramanarayanan (2012), address this margin by focusing on the portfolio composition, over short

and long debt.

Theoretically, we model the endogenous choice of payment schedule and maturity. The literature

often restricts borrowing to a one-period bond or to exogenous payment schedules. A new line of

work studying long-term sovereign debt as in Arellano and Ramanarayanan (2012), Chatterjee and

Eyigungor (2012), and Hatchondo and Martinez (2009) uses perpetuity bonds to avoid the curse

of dimensionality. Such perpetuity bonds are restricted to have a front-loaded payment schedule1 ,

opposite to the data. Another line of work studying maturity structure of sovereign debt uses the

zero-coupon bond. The bond-level dataset from Bloomberg shows that emerging economies rarely

issue such bonds.

2

Empirical Analysis

This section documents how maturity and payment schedule vary with underlying fundamentals,

using bond-level data. Our key finding is that during financial distress the sovereign shortens

maturity and schedules payments to be more back-loaded, i.e. they promise smaller payments in

the near future and larger payments later.

1

For example,

in Arellano and Ramanarayanan (2012), one unit of the perpetuity bond promises payments

1, δ, δ 2 , . . . and so forth, forever. This requires the gross growth rate δ to be bounded above by 1, as to keep

the state space bounded.

3

2.1

Data Source

We study a sample of 11 emerging market sovereigns: Argentina, Brazil, Mexico, Russia, Colombia,

Uruguay, Venezuela, Hungary, Poland, Turkey, and South Africa.2 Using the Bloomberg Professional

database, we extract information on the schedule of coupons and principal for external debt, at a

the weekly frequency.

We construct promised cash flows, coupons and principal, for each bond which we convert to

real US Dollars using the CPI series from the Bureau of Labor Statistics, exchange rates provided

by the IMF, and LIBOR rates from EconStats.com. LIBOR rates are needed whenever coupon

rates are specified relative to such a reference rate. We document key facts about these bond-level

issuance data, in connection with GDP and the spread series provided by Broner, Lorenzoni, and

Schmukler (2013).3 Appendix A contains further information on the data used.

2.2

Maturity and Payment Structure

We start by defining key concepts and measures. Consider a sovereign country i in period t. Let

dt (s; i) denote the cash flow—in real U.S. Dollars terms—promised by the portfolio issued at period

t to be paid s ∈ {1, 2, . . . , Tt (i)} periods later. Tt (i) refers to the number of periods until the last

payment is scheduled.

Whenever multiple bonds are issued during a given time period, e.g. in the same week, we sum

over the cross-section of promised cash flows, at each future period, resulting in a single stream of

payments dt (s; i), as if the country had issued a single bond which pays all the payments scheduled

by the actual bonds issued. Such constructed streams are assigned a maturity given by the average

maturity of the actually issued bonds, weighted by each bond’s real principal value. We label the

promised cash-flow profile {dt (s; i)}Ts=1 as payment schedule.

We characterize the payment schedule by two statistics: maturity and the growth rate of payments δt (i). To compute the annualized growth rate of payment, we regress the promised cash flows

over the number of years elapsed since the issue date t,

log(dt (s; i)) = constant + log(1 + δt (i))

s

+ t (s; i)

M

(1)

where M denotes the number of periods per year and t (s; i) is the error term.

2.3

Regression Analysis

We investigate how emerging markets vary issuance characteristics around periods of financial distress. The two measures of financial conditions, 3- and 12-year interest rate spreads, are from

2

This is the same set of countries considered in Broner, Lorenzoni, and Schmukler (2013).

The spread are at a weekly frequency and measured by the differences in the (annualized) yield-to-maturity

relative to equivalent U.S. (or German) bonds. Their yield curve estimates deliver spread for bonds of the maturities

either up to 3-years, between 6- and 9-years, or over 12-years.

3

4

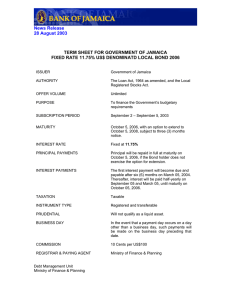

Table 1: Regression: Payment Growth and Maturity

Dependent Variable: Payment Growth Rate (δ)

3-Year Spread

OLS

IV

0.210***

[0.031]

0.241***

[0.019]

12-Year Spread

Controls

R-squared

Num. Obs.

OLS

IV

0.257***

[0.020]

Yes

0.173

4,217

Yes

Yes

0.264***

[0.034]

Yes

0.188

4,515

0.178

4,217

0.193

4,515

Dependent Variable: Maturity (T )

3-Year Spread

OLS

IV

-2.240***

[0.163]

-4.447***

[0.280]

12-Year Spread

Controls

R-squared

Num. Obs.

OLS

IV

-4.777***

[0.293]

Yes

0.360

4,240

Yes

Yes

-2.986***

[0.189]

Yes

0.383

4,538

0.337

4,240

0.391

4,538

Note: this table reports OLS and 2SLS (IV) regressions of the growth rate of payments

and the maturity on the short- and long-term spreads, controlling for country fixedeffects, a time trend, the real exchange rate, terms of trade, and an investment grade

dummy. For the IV regressions, spread variables are instrumented by the Credit Suisse

First Boston (CSFB) High Yield Index, which is a measure of the spread on high-yield

debt securities in the US corporate sector. Standard errors, reported in brackets, are

robust to heteroskedasticity. ** significant at 5%; *** significant at 1%.

Broner, Lorenzoni, and Schmukler (2013). Their yield curve estimation produces 3-year, 6-year,

9-year, and 12-year spreads.

We regress maturity and payment growth on each of two alternative measures of financial conditions, controlling for country fixed-effects, a time trend, the real exchange rate, terms of trade, and

an investment grade dummy. In addition to our ordinary least-squares results, we report two-stage

least-squares estimates, where we instrument the financial condition measures using the Credit Suisse First Boston (CSFB) High Yield Index. This index measures the spread on high-yield debt

securities issued by the US corporate sector. Conditions in the US corporate debt market are a

demand-side factor for sovereign debt markets via the joint portfolio problem investors face.

Table 1 reports our estimates. In all specifications, financial conditions are statistically signifi-

5

cant determinants of issuance choice, with a positive coefficient in maturity regressions and negative

in payment growth regressions. Our results are robust to heteroskedasticity, serial correlation of

error terms, and using measures of debt stocks rather than issuance flows. Appendix A documents

these additional cases.

Our analysis highlights two main results. First, the maturity of newly issued bonds shortens

during crisis periods. This is consistent with the existing work on maturity choice of emerging

markets. Our second finding is, to the best of our knowledge, new to the literature: sovereigns also

adjust payment schedules in response to crises, by issuing more back-loaded bonds.

3

Model

We study optimal maturity and payment schedule of sovereign debt in a small, open economy model

with default. A benevolent government borrows from a continuum of competitive lenders by issuing

uncontingent debt with a flexible choice of maturity and payment schedule. The debt contract has

limited enforcement, in that payments are state-uncontingent and the sovereign government has the

option to default.

3.1

Technology, preference, and international contracts

The economy receives a stochastic endowment y which follows a first-order Markov process. The

government is benevolent and its objective is to maximize the utility of the representative consumer

given by,

E0

∞

X

β t u(ct ),

t=0

where ct denotes consumption in period t, 0 < β < 1 the discount factor, and u(·) the period utility

function, satisfying the usual Inada conditions. Each period, the government may borrow abroad

by issuing a long-term bond contract and decides whether to default on the outstanding debt. All

the proceeds of the government are transfered lump sum to the representative consumer.

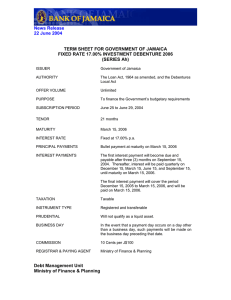

A bond contract specifies a maturity T and a payment schedule, given by the growth rate of

payments δ. For such a contract, conditional on not defaulting, the government repays (1 + δ)−τ

with 0 ≤ τ ≤ T periods to maturity. When δ is negative, the payments shrink over time (frontloaded).4 When δ equals zero, the contract is “flat” as the payments are constant over T periods.

When δ is positive, the payments grow over time (back-loaded). The contract also nests the zero

coupon bond, when we let δ go to infinity. Figure 1 shows examples of schedules for different cases

of δ, for 10-year bonds. To make contracts comparable, we pick the number of bond units issued b

to finance one unit of consumption for all cases.

4

This is the case covered by the perpetuity bond in Arellano and Ramanarayanan (2012).

6

Figure 1: Examples payment Schedules

Payment

Front−loaded (b = 0.10, δ = −6%)

Flat (b = 0.13, δ = 0%)

0.2

0.2

0.15

0.15

0.1

0.1

0.05

0.05

0

0

9 8 7 6 5 4 3 2 1 0

Back−loaded (b = 0.16, δ = 6%)

9 8 7 6 5 4 3 2 1 0

Zero Coupon (b = 1.33)

0.2

1

Payment

0.15

0.1

0.5

0.05

0

0

9 8 7 6 5 4 3 2 1 0

Periods to Maturity (τ)

9 8 7 6 5 4 3 2 1 0

Periods to Maturity (τ)

Note: Payment schedules for bond contracts with different δ, against periods to maturity τ . The number of units

issued b is picked so that all bonds finance 1 unit of consumption.

7

To mitigate the curse of dimensionality implicit in using richer descriptions of debt contracts,

we assume that the government can only hold one type of bond at a time. If the government wants

to change its payment schedule, it has to buy back the outstanding debt before it can issue a new

contract.

While in good credit standing, the government has the option to default over its debt. Following

the sovereign default literature, we assume that after default the debt is written off but the government switches to bad credit standing and is punished with output losses and temporary exclusion

from international financial markets. With probability φ, international lenders forgive a government

in bad standing and resume lending to it.5 Given default risk, lenders charge bond prices which

compensate them for expected losses.

The state of a government with good credit standing is s = (T, δ, b, y), including its income

shock y and the outstanding units b with remaining maturity T and growth rate of payments δ.

3.2

Equilibrium

The government’s problem

The government in good credit standing chooses whether to default

d, with d = 1 denoting default

V (s) = max

n

o

dV d (y) + (1 − d) V n (s) .

(2)

d∈{0,1}

where V d is the defaulting value and V n repaying value.

If it defaults, the government gets its debt written off but receives a lower endowment h(y) ≤ y.

Moreover, the government remains in bad credit standing until lenders forgive it, with probability

φ. The defaulting value satisfies

n

o

V d (y) = u [h (y)] + β E (1 − φ) V d y 0 + φV 0, 0, 0, y 0 .

(3)

If it repays, the government can continue the current contract, with value V c , or issuing new debt

and receive value V r . We use x = 0 to denote continuing the current contract and x = 1 to denote

issuing new debt. Specifically, the problem under no default is given by

V n (s) = max {xV r (s) + (1 − x) V c (s)}

(4)

x∈{0,1}

where the value when continuing is

"

V c (s) = u y −

#

b

T

(1 + δ)

+ β EV T − 1, δ, b, y 0 ,

(5)

5

Our model abstracts from renegotiation. Yue (2010), D’Erasmo (2008), and Benjamin and Wright (2009) study

debt renegotiation explicitly. Quantitatively, the predictions of such models in terms of standard business-cycle

statistics of emerging economics are similar as that in Arellano (2008), without renegotiation.

8

and the value when choosing a new bond is

0 0 0 0

V r (s) = max

u

(c)

+

β

E

V

T

,

δ

,

b

,

y

0 0 0

T ,δ ,b

s.t. c = y −

b

(1 + δ)T

+ q T 0 , δ 0 , b0 , y b0 − q rf (T − 1, δ) b.

(6)

If it chooses to issue, the government must buy back outstanding obligations by paying q rf (T − 1, δ) b.

The proceeds from the sale of the new bond are q (T 0 , δ 0 , b0 , y) b0 , where the bond price schedule for

new issuance, q, reflects future default risk and thus depends on the current endowment level y and

the payment structure.

We assume that when buying back old bonds, the government faces a cost given by the risk-free

bond price q rf , the upper limit for the secondary-market price. This high cost is consistent with

the evidence on expensive buy-backs discussed in Bulow and Rogoff (1988) and proxies for issuance

costs in a reduced form. Here we abstract from issues of debt dilution, as studied by the recent

literature on long-term sovereign debt, e.g. Hatchondo, Martinez, and Sosa-Padilla (2014) and

Sanchez, Sapriza, and Yurdagul (2014). We conduct sensitivity analysis with respect to alternative

buy back costs, allowing for dilution, in section 4.4.

International financial intermediaries

Lenders are risk neutral, competitive, and face a con-

stant world interest rate r. The bond price schedule must guarantee that lenders break even in

expectation. For a bond with remaining maturity T 0 and growth rate δ 0 , its risk-free price is defined

recursively as

q rf

#

"

1

1

+ q rf (T 0 − 1, δ)

T0

T 0 , δ 0 = 1 + r (1 + δ)

1

1+r

for T 0 ≥ 1

(7)

for T 0 = 0

With default risk, lenders charge a higher interest rate to compensate for losses in the default event.

For T 0 ≥ 1, the bond price is therefore given by,

1

q T 0 , δ 0 , b0 , y =

E 1 − d T 0 , δ 0 , b0 , y0 ×

1+r

"

#)

rf 0

1

0 0 0 0

0

0 0 0

0 0 0 0

0

q T − 1, δ , b , y + x T , δ , b , y q T − 1, δ

0 + 1 − x T ,δ ,b ,y

(1 + δ)T

(8)

and for T 0 = 1 the bond price reduces to the usual one-period bond case

q 0, δ 0 , b0 , y =

1

E 1 − d 0, δ 0 , b0 , y0

1+r

(9)

The risky bond price reflects expected payments to lenders. If the government repays next period,

0

lenders receive a payment of (1 + δ)−T per unit outstanding. The repaying government may choose

9

to restructure its debt x0 = 1 and so repurchase its outstanding debt with risk-free rate q rf . Note

that maturity T 0 and payment schedule δ 0 affect the risky bond price in two ways. On the one

hand, conditional on not default, they matter for expected discounted payment and thus the riskfree component of q, the corresponding q rf . On the other hand, both maturity and payment schedule

matter for future default decisions and thus the default premium priced into q.

Definition of equilibrium

The equilibrium consists of policy functions T 0 , δ 0 , b0 , d0 , x0 , value

functions V , V d , V n , V c , the bond price schedule q, and the risk-free schedule q rf , such that, given

the world interest rate r,

(a) policies and values solve the government’s problem (2-6), given the bond prices, and

(b) lenders charge break-even bond prices (9) consistent with government policies, while the risk-free

bond price schedule is given by (7).

4

Quantitative Analysis

We calibrate the model to the Brazilian economy over the period of 1996 to 2011. We then study the

model’s implications for standard business cycle statistics and, most importantly, for the maturity

and payment schedule of sovereign debt. We study the incentives faced by a country when designing

its bond issuance. Finally, we conduct sensitivity analysis related to the cost of retiring outstanding

debt.

4.1

Calibration

We calibrate the parameter values of the model to match key moments in the Brazilian data. The

length of one period in the model is set to be one year. The per-period utility function u(c) exhibits

a constant coefficient of relative risk aversion, σ,

u(c) =

c1−σ − 1

.

1−σ

(10)

The economy is subject to two, independent shocks: an endowment shock and a sudden stop

shock, following Bianchi, Hatchondo, and Martinez (2012). The endowment of this economy follows

an AR(1) process

log(yt ) = ρ log(yt−1 ) + ηεt ,

(11)

where the idiosyncratic shock εt is standard Normal.

Every period, with constant probability pss , the country enters a sudden stop state, during which

endowment is reduced and the country can only lower its debt burden. While in this state, the

10

country has a constant probability pret of recovering in the next period.6 .

Following Arellano and Ramanarayanan (2012), output of a country in bad credit standing h(y)

is given by

h(y) = min {{y, (1 − λd )Ey}}

(12)

where Ey is the unconditional mean of y and λd ∈ [0, 1] captures the default penalty. During sudden

stop, the endowment is capped by (1 − λs )Ey.

To compare model and data, we define the yield to maturity as the constant interest rate r̂ such

that the present value of payments, computed using this interest rate, is equal to the market price

of the bond, i.e. r̂ is implicitly defined by

0

X

q T 0 , δ 0 , b0 , y =

exp −r̂ T 0 − τ

τ =T 0

1

.

(1 + δ 0 )τ

(13)

The spread s is the difference between the yield to maturity r̂ and the risk-free rate r:

s T 0 , δ 0 , b0 , y ≡ r̂ T 0 , δ 0 , b0 , y − r.

(14)

Table 2: Benchmark Parameter Values

Value

Target/Source

Parameters calibrated independently

σ

r

ρ

η

φ

pss

pret

Risk-aversion

Risk-free rate

Shock persistence

Shock volatility

Prob. of return to market

Prob. of sudden stop (s.s.)

Prob. of s.s. recovery

2.0

3.2%

0.9

0.017

0.17

0.10

0.75

Standard value

Arellano and Ramanarayanan (2012)

Brazil, Arellano and Ramanarayanan (2012)

Brazil, Arellano and Ramanarayanan (2012)

Arellano and Ramanarayanan (2012)

Bianchi, Hatchondo, and Martinez (2012)

Bianchi, Hatchondo, and Martinez (2012)

Parameters calibrated jointly

β

λd

λs

T

Discount factor

Output loss due to default

Output loss due to s.s.

Max. maturity

0.88

0.05

-0.005

15

Jointly: Mean of 9y and 3y spreads, median maturity, and the debt service to

GDP ratio.

Note: this table provides the benchmark parameter values used in calibrating the model.

Table 2 presents the calibrated parameter values. The risk-aversion parameter σ is set to 2 as

standard in the literature. The risk-free interest rate is set to 3.2% to target the average annual

yield to maturity for US government bonds. The persistence and volatility of the AR(1) output

process are taken from Arellano and Ramanarayanan (2012), who calibrate these two parameters to

6

For a version of the model with an explicit sudden stop state, see appendix B

11

the HP-filtered Brazilian GDP. They pick ρ = 0.9 and compute the standard deviation η = 0.017.

The probability of a defaulting country regaining access to the international financial market φ is

set to 0.17, following Arellano and Ramanarayanan (2012). The annual probability of sudden stop

pss and recovery pret are chosen to be 0.10 and 0.75, consistent with the quarterly values used by

Bianchi, Hatchondo, and Martinez (2012). The four remaining parameters, the discount factor β,

the output loss parameters λd and λs , together with the maximum maturity T are chosen jointly,

to match the average 3-year and 9-year spreads, median maturity, and a debt service to GDP ratio

of 5.3%.

Table 3: Key Statistics: Data vs. Model

Targeted Moments

Mean 9-year

Mean 3-year

Debt Service / GDP

Median Maturity

Other Moments

Median Payment Growth

Std 9-year

Std 3-year

Std(C) / Std(Y)

Std(NX/Y) / Std(Y)

Corr(B/Y, Y)

Corr(Spread, Y)

Data

Model

4.4%

4.5%

5.3%

10.3

3.7%

5.2%

4.5%

9.0

5.3%

2.7%

4.0%

110.0%

36.0%

-0.87

-0.53

6.0%

4.2%

5.9%

112.7%

54.7%

-0.23

-0.34

Note: Std denotes standard deviation and Corr correlation. C

is consumption, Y is GDP, NX is net export, B is total debt.

Table 3 compares model and data statistics for Brazil. Among the targeted moments, the

model matches well average spreads, median maturity, and debt service to GDP. It generates excess

volatility of spreads relative to the data. The median maturity in the data is 10.3 years and 9 years

for the model. The model predicts a 6% growth rate of payments, consistent with the data, where

the median growth rate of payments is 5.3%, implying a back-loaded payment schedule for new

issuance.

The model replicates key business cycle features of emerging markets. Consumption is more

volatile than output, as documented by Neumeyer and Perri (2005). The volatility of consumption

is 1.1 times that of output in both the model and the data. The model produces a volatile trade

balance (normalized by GDP), 55% in the model and 36% in the data. In Brazil, the spreads for

all maturities are countercyclical. The correlations are -0.49, -0.57, and -0.52 for 3-y, 9-y, and 12-y

with GDP, respectively. Table 3 reports the average of the correlations of 3-y and 9-y, -0.53. This

correlation is also negative in the model, -0.34. Both the model and the data feature a countercyclical

12

debt-to-GDP ratio.

4.2

Bond Price Schedule

The choice of optimal contract depends on government’s preferences and the bond price schedule

it faces. This schedule depends on future governments’ default incentives, which are determined

by two channels: lack of commitment and debt burden. Contracts which make eventual default

more tempting for the government (lack of commitment) or which require higher payments, either

on average or when the country is poorer (debt burden), will carry higher default risk, lower prices

and therefore be less attractive for debt finance.

The bond price also reflects the lender’s opportunity cost, the equivalently-structured risk-free

bond price q rf . This price varies with T 0 and δ 0 , due to the changes they induce in the size and

number of payments. All other contract characteristics constant, longer maturity implies more

payments and thus a higher risk-free bond price, see Figure 2(a). A high δ 0 is associated with

back-loaded payments, which are subject to compounded discounting and thus have lower present

value, resulting in a lower risk-free price, see Figure 2(b).

Figure 2: Risk-Free Bond Price q rf

5.5

4

3.5

5

qrf

qrf

3

2.5

4.5

2

4

1.5

3.5

1

0

2

4

6

−0.05

8

T

(a)

0

0.05

δ

0.1

0.15

0.2

(b)

To isolate the consequences of default risk, Figure 3 plots the market bond price schedule

q(T 0 , δ 0 , b0 , y) relative to the risk-free bond price q rf (T 0 , δ 0 ) as a function of q rf (T 0 , δ 0 )b. We normalize

the number of units b with q rf to facilitate comparisons of debt values across different contracts. For

any given T 0 and δ 0 , issuing more units means a higher debt burden and thus higher risk of default

and a lower bond price.

Figure 3(a) compares the bond price across growth rates of payments, δ = −3% versus δ = 18%,

for a fixed T = 14 and mean endowment. Consider an increase in δ, i.e. a more back-loaded contract.

In the absence of commitment, distant promises are less credible, leading to higher default incentives

and a lower bond price. On the other hand, more back-loading induces smaller payments in the

13

Figure 3: Bond Price Schedule

1

1

0.9

0.8

0.7

0.7

0.6

0.6

q / qrf

q / qrf

0.8

Back−loaded (δ = 18%)

0.5

0.4

0.3

0.3

0.2

0.2

0.1

0.1

0.05

0.1

0.15

0.2

qrf b

0.25

0.3

0.35

0

0

0.4

Long−term (T’ = 14)

0.5

0.4

0

0

Short−term (T’ = 4)

0.9

Front−loaded (δ = −3%)

0.05

(a) T = 14, average y

0.1

0.15

0.2

qrf b

0.25

0.3

0.35

0.4

(b) δ = 18%, average y

1

High Income,

Front−loaded

0.9

0.8

q / qrf

0.7

Low Income,

Back−loaded

0.6

High Income,

Back−loaded

0.5

0.4

0.3

0.2

Low Income,

Front−loaded

0.1

0

0

0.05

0.1

0.15

0.2

qrf b

0.25

0.3

0.35

0.4

(c) T = 4

near future and larger payments later. Overall, due to compound discounting, this implies a lower

debt burden, lower default risk, and a higher bond price. For back-loaded contracts the debt burden

effect dominates for low levels of borrowing and the government gets better bond prices.

Figure 3(b) compares the bond price across maturity choices, T = 4 versus T = 14, for a fixed

δ = 18% and mean endowment. When lengthening maturity, there is a greater lack of commitment

and the bond price is lower. At the same time, debt burden in any one period is decreased, reducing

default incentives. Overall, when borrowing less the price schedule is higher for short term debt.

When maturity is short, the bond price schedule becomes insensitive to the choice of δ, as shown

in Figure 3(c). This is because the two channels are fairly balanced. Figure 3(c) also illustrates the

14

role of income in determining bond prices: higher income implied less incentives to default and thus

the country can borrower cheaper.

4.3

Maturity and Payment Schedule

We now turn to our focus: understanding how maturity and payment structure vary with the

business cycle. We use the spread and output as our preferred cyclical indicators. Table 4 reports

key statistics for Brazil and their model counterparts. In the data, during normal times when the

spread is below its historic mean, the maturity of new issuance is roughly 13 years, with a growth

rate of payments of about 1%. During periods of financial stress, when the spread is above average,

maturity shortens to about 7 years and payments become more back-loaded, with a growth rate

of 8.6%. These patterns are consistent with the findings in section 2 where we studied a broader

set of countries, at a weekly frequency. Using GDP as cyclical indicator we get a similar message:

countries shorten maturity and back-load payments during downturns.

Table 4: Maturity and Payment Growth: Cyclical Properties

Below

Mean

Above

Mean

Q1

Q2

Q3

Q4

17.7

6.0

10.8

11.8

11.1

6.7

5.3

3.5

0.2%

2.5%

3.3%

5.6%

1.6%

7.6%

14.3%

8.1%

11.7

4.4

8.0

8.8

8.3

5.8

5.0

3.5

6.4

1.1

10.7

10.0

13.1

10.8

13.3

11.7

8.6%

8.8%

4.6%

8.4%

-2.0%

6.7%

10.0%

0.1%

5.5

1.7

7.9

8.3

9.6

8.2

9.1

7.0

Spread

Maturity (T, Years)

Data

13.2

7.1

Model

7.0

2.8

Payment Growth (δ, %)

Data

1.0%

8.6%

Model

3.4%

7.9%

Duration (D, Years)

Data

9.3

6.0

Model

5.2

3.0

GDP

Maturity (T, Years)

Data

9.8

12.4

Model

3.3

11.4

Payment Growth (δ, %)

Data

7.9%

2.0%

Model

8.5%

1.8%

Duration (D, Years)

Data

7.5

8.8

Model

3.4

7.3

Our model matches well the observed cyclicality of maturity, payment growth, and duration.

When the spread increases above its mean, maturity shortens from 7 to about 3 years, while the

15

payment growth rate increases from 3.4% to roughly 8%. By looking across quartiles of spread

or GDP we find that the cyclical properties of issuance are fairly monotonic, and similar between

model and data.

We also report issuance behavior in terms of Macaulay duration, which has almost exclusively

been the focus of the literature. Duration is a weighted maturity measure in which the size of

each payment determines the weight of its timing. It increases either due to longer maturity or

higher payment growth. In our model and in the data, maturity and payment growth move in

opposite directions, with potentially ambiguous consequences for duration, but on average maturity

dominates.

The payment schedule and maturity of sovereign debt are determined by the interplay of two

incentives: (i) smoothing consumption, and (ii) reducing default risk. To smooth consumption,

the sovereign would like to align payments with future output, i.e. larger payments ought to to

be scheduled for periods with higher expected output. Given the mean-reverting nature of the

output process considered, the growth rate of output decreases with the current output. Thus,

a more back-loaded schedule is preferable during economic downturns since the government can

repay the bulk of its obligation in the future, when the economy is expected to recover. Under

the consumption-smoothing incentive, the growth rate of payments and current output should be

negatively correlated.

The government also takes into consideration the borrowing cost it faces when making choices

over payment schedules. During downturns, when income is low, the range of debt levels for

which back-loaded contracts offer better bond prices shrinks, as shown in Figure 3(b). This makes

the sovereign more likely to face a tighter bond price if it were to choose a more back-loaded

contract. To reduce borrowing cost while enjoying the consumption-smoothing benefit of more

back-loaded contracts, the government chooses a shorter maturity in downturns to mitigate its lack

of commitment. Moreover, for short maturities the differences in bond price schedules for different

payment growth rates are small, as shown in Figure 3(c).

4.4

Sensitivity Analysis

In our main analysis we used the risk-free bond price q rf to retire outstanding debt, thus abstracting

from any issues raised by long-term debt dilution. In this section we consider alternative specifications, full and partial dilution.

First, we consider the “full dilution” case with buy-back at the competitive, second market

price. This price results from valuing outstanding debt using the default probabilities implied by

new issuance. The logic is that if the government retires all but a measure zero of outstanding

bonds, these bonds’ remaining payments would be subjected to the same default risk as the newly

issued bond. This makes the buy-back price a function both current state variables (T, δ, y) and

16

issuance characteristics (T 0 , δ 0 , b0 ). The full dilution bond price is given by

1

n

q fd T, δ, y, T 0 , δ 0 , b0 = E 1 − d0 T 0 , δ 0 , b0 , y 0

(1 + δ)−T

R

+ x T 0 , δ 0 , b0 , y 0 · q fd T − 1, δ, y 0 , T 00 , δ 00 , b00

o

+ 1 − x T 0 , δ 0 , b0 , y 0 · q fd T − 1, δ, y 0 , T 0 − 1, δ 0 , b0

(15)

where hT 00 , δ 00 , b00 i are the optimal choices in state hT 0 , δ 0 , b0 , y 0 i, conditional on restructuring. Consistent with Sanchez, Sapriza, and Yurdagul (2014) we find that under full dilution short-term debt

strictly dominates and only one period bonds are issued in the ergodic distribution of the model.

This is clearly inconsistent with the data.7

Given the lack of variation in optimal maturity under full dilution we study a hybrid case,

labeled “partial dilution,” in which the buy-back price is a weighted average of the risk-free price

and the full dilution price. The partial dilution price is given by

q pd T, δ, y, s, T 0 , δ 0 , b0 = (1 − ξ) q rf (T, δ) + ξq fd T, δ, y, s, T 0 , δ 0 , b0

(16)

where ξ controls the degree of dilution. For our numerical results, we set ξ = 0.5, keep maximum

maturity T = 15 as in the baseline, and recalibrate other parameters. The partial dilution model

can deliver cyclicality results in line with our baseline and the data. It however produces shorter

maturity and higher payment growth on average, relative to baseline. The government shortens

maturity as to avoid expensive long-term borrowing, due to the effect of dilution, and back-loads

payments to compensate for the worsened maturity trade-off.

5

Conclusion

The international literature has puzzled over emerging economies’ issuance of bonds with short

duration, especially during crises. Our contribution lies in decomposing duration into maturity

and a measure of the timing of payments. Maturity exhibits the same pattern as discussed in

the literature using duration. Countries in crisis tend to issue short maturity bonds. The payment

schedule, however, makes this maturity choice less puzzling since the government chooses more backloaded payments and so schedules larger payment later. This helps risk sharing during downturns.

7

Sanchez, Sapriza, and Yurdagul (2014) develop extensions which partially revert this extreme result.

17

Table 5: Baseline versus Partial Dilution

Below

Mean

Above

Mean

Q1

Q2

Q3

Q4

2.8

2.8

6.0

4.2

11.8

12.2

6.7

4.4

3.5

3.1

7.9%

9.4%

2.5%

6.6%

5.6%

7.0%

7.6%

8.6%

8.1%

9.7%

3.0

3.0

4.4

3.8

8.8

9.5

5.8

4.2

3.5

3.2

11.4

11.9

1.1

0.4

10.0

8.5

10.8

11.4

11.7

12.3

1.8%

6.2%

8.8%

10.5%

8.4%

8.8%

6.7%

8.2%

0.1%

4.9%

7.3

8.8

1.7

1.3

8.3

7.1

8.2

9.1

7.0

8.7

Spread

Maturity (T, Years)

Baseline

7.0

Partial Dilution

5.9

Payment Growth (δ, %)

Baseline

3.4%

Partial Dilution

6.8%

Duration (D, Years)

Baseline

5.2

Partial Dilution

5.0

GDP

Maturity (T, Years)

Baseline

3.3

Partial Dilution

2.2

Payment Growth (δ, %)

Baseline

8.5%

Partial Dilution

9.1%

Duration (D, Years)

Baseline

3.4

Partial Dilution

2.6

References

Aguiar, M. and G. Gopinath (2006). Defaultable debt, interest rates and the current account.

Journal of international Economics 69 (1), 64–83.

Arellano, C. (2008). Default risk and income fluctuations in emerging economies. The American

Economic Review , 690–712.

Arellano, C. and A. Ramanarayanan (2012). Default and the maturity structure in sovereign

bonds. Journal of Political Economy 120 (2), 187–232.

Benjamin, D. and M. L. Wright (2009). Recovery before redemption: A theory of delays in

sovereign debt renegotiations. unpublished paper, University of California at Los Angeles.

Bianchi, J., J. C. Hatchondo, and L. Martinez (2012). International reserves and rollover risk.

Technical report, National Bureau of Economic Research.

Broner, F. A., G. Lorenzoni, and S. L. Schmukler (2013). Why do emerging economies borrow

short term? Journal of the European Economic Association 11 (s1), 67–100.

18

Bulow, J. and K. Rogoff (1988). The buyback boondoggle. Brookings Papers on Economic Activity 2, 675–698.

Chatterjee, S. and B. Eyigungor (2012). Maturity, indebtedness, and default risk. American

Economic Review 102 (6), 2674—2699.

D’Erasmo, P. (2008). Government reputation and debt repayment in emerging economies.

Manuscript, University of Texas at Austin.

Eaton, J. and M. Gersovitz (1981). Debt with potential repudiation: Theoretical and empirical

analysis. The Review of Economic Studies 48 (2), 289–309.

Hatchondo, J. C. and L. Martinez (2009). Long-duration bonds and sovereign defaults. Journal

of International Economics 79 (1), 117–125.

Hatchondo, J. C., L. Martinez, and C. Sosa-Padilla (2014). Debt dilution and sovereign default

risk. Technical report.

Neumeyer, P. A. and F. Perri (2005). Business cycles in emerging economies: the role of interest

rates. Journal of Monetary Economics 52 (2), 345–380.

Rodrik, D. and A. Velasco (1999). Short-term capital flows. Technical report, National Bureau

of Economic Research.

Sanchez, J., H. Sapriza, and E. Yurdagul (2014). Sovereign default and the choice of maturity.

Technical report.

Yue, V. Z. (2010). Sovereign default and debt renegotiation. Journal of International Economics 80 (2), 176–187.

19

A

Data Appendix

A.1

Exchange Rate, U.S. CPI, and LIBOR

Sovereigns often schedule payments over the course of 20 or 30 years in the future since the issue

date. In order to evaluate such promised payments in terms of real U.S. dollars, several assumptions

are necessary:

• Exchange Rate: Under the assumption that foreign exchange rates are Martingales, the expected future exchange rate is equal to the current value.

• U.S. CPI: For the U.S. CPI, we assume perfect-foresight because the U.S. CPI is quite stable.

• LIBOR: When the coupon rate is expressed as a spread over the LIBOR rate, e.g., the floating

coupon-rate bond, we take as our benchmark the perfect-foresight case in measuring the

LIBOR rates in the future.

Note that our sample includes bonds with non-fixed coupon rate, e.g., floating and variable

coupon-rate bonds, as well as the fixed coupon-rate bond. By contrast, frequently in the literature,

non-fixed coupon-rate bonds are excluded from the analysis mainly for convenience rather than for

economic reasons. We must address all of these cases consistently in order to produce a coherent picture of payments’ timing and size. For example, a variable coupon bond often specifies that coupon

rates rise with the length of time to payments in a step-wise form; this has important implications

for the growth rate of promised payments, i.e., positive growth rate of promised payments.

A.2

Sample Selection: Excluding Bonds with Special Features

We exclude from the sample bonds that are either denominated in local currencies or of special

features for the reason as in Broner, Lorenzoni, and Schmukler (2013). First, we focus on bonds

that are denominated in foreign currencies for the reason as follows: In many cases for emerging

market economies, sovereign bonds are denominated in foreign currencies. Sovereigns do issue bonds

denominated in their local currencies; in such a case, sovereigns would have an option to dilute their

debt burden by adjusting the inflation rate in local currency terms, which is not the case for the

bonds denominated in foreign currencies and ruled out by the standard sovereign-default models

as the one studied in this paper.

8

Thus, we simply focus on foreign-currency denominated bonds

by excluding local-currency denominated bonds from our sample. Second, for the same reason as

above, we exclude from the sample bonds with special features that are absent in our model and

not so much frequently observed in the data: for instance, we exclude either collateralized bonds

8

Moreover, as discussed in Broner, Lorenzoni, and Schmukler (2013), if both foreign- and local-currency denominated bonds were included in the sample, then the regression analysis of bond characteristics would require controlling

for the time-varying exchange-rate risk premium which is difficult to measure.

20

Table 6: Determinants of Two Measures of Financial Conditions: Supply- vs. Demand-Side Factors

Dependent Variable

3-Year

12-Year

Spread

Spread

0.0011***

0.0011***

[0.0002]

[0.0002]

4.202***

2.680***

[0.571]

[0.586]

-0.011

-0.035***

[0.009]

[0.008]

0.717

0.686

4,922

4,922

High Yield Index

Debt-to-GDP Ratio

Year

Within R-squared

Num. Obs.

Note: this table reports ordinary least-squares regressions of the 3- and 12year spreads on the supply- and demand-factors of the spread: the Credit

Suisse First Boston (CSFB) High Yield Index, which is a measure of the

average spread on high-yield debt securities in the U.S. corporate sector,

and the bond issuer’s debt-to-gdp ratio. Variables are semi-annual averages

calculated using a 26-week rolling window. Year of issue dates is included

to capture a trend, if any, over time. Country dummies are also included.

Standard errors are in brackets, which are robust to both heteroskedasticity

and within-country serial correlation. * Significant at 10%; ** significant

at 5%; *** significant at 1%.

or bonds with the special guarantees provided by the third-party institutions such as IMF, World

Bank, and leading foreign governments/banks.

B

B.1

Full Model with Sudden Stop Shock and (Partial) Dilution

Value Functions

n

o

V (T, δ, b, y, s) = max V d (y) , max {V c (T, δ, b, y, s) , V r (T, δ, b, y, s)}

d

x

n

o

V d (y) = u [hd (y)] + β Ey0 |y (1 − ψ)V d y 0 + ψV 0, 0, 0, y 0 , 0

h

i

V c (T, δ, b, y, s) =u shs (y) + (1 − s)y − (1 + δ)−T b

+β Ey0 |y,s0 |s 1T >0 · V T − 1, δ, b, y 0 , s0 + 1T =0 · V 0, 0, 0, y 0 , s0

V r (T, δ, b, y, s) = max

u (c) + β Ey0 |y,s0 |s V T 0 , δ 0 , b, y 0 , s0

0 0 0

T ,δ ,b

s.t. c =shs (y) + (1 − s)y − (1 + δ)−T b

− q bb T − 1, δ, y, s, T 0 , δ 0 , b0 b + q T 0 , δ 0 , b0 , y, s b0

q bb T − 1, δ, y, s, T 0 , δ 0 , b0 b ≥ q T 0 , δ 0 , b0 , y, s b0 if s = 1

21

Table 7: Average maturity: Case of country-level clustered errors

3-Year Spread

12-Year Spread

Debt-to-GDP

Ratio

Real Exchange

Rate

Terms of Trade

Investment Grade

Dummy

Year

Within R-squared

Num. Obs.

Dependent Variable: Average Maturity of Issues

OLS

IV

OLS

IV

-2.499**

-3.937**

[1.228]

[1.771]

-2.755* -4.083**

[1.414]

[2.075]

0.575

6.652

-2.928

1.929

[6.064]

[9.055]

[5.944]

[8.865]

-0.039

-0.046

-0.034

-0.035

[0.026]

[0.032]

[0.029]

[0.033]

0.511

0.795

-0.153

-0.078

[1.529]

[1.815]

[1.639]

[1.979]

-0.724

-0.908

-1.201

-1.632

[0.994]

[1.050]

[1.279]

[1.450]

0.634***

0.572***

0.581*** 0.507***

[0.101]

[0.111]

[0.100]

[0.109]

0.238

0.181

0.239

0.181

3,847

3,549

3,847

3,549

Note: this table reports ordinary least-squares and two-stage least-squares instrumental

variables (IV) regressions of the average maturity of issues on the short- and long-term

spreads, including the real exchange rate, terms of trade, and an investment grade dummy

as control variables. Year of issue dates is included to capture a trend, if any, over time.

For the IV regressions, spread variables are instrumented by the Credit Suisse First

Boston (CSFB) High Yield Index, which is a measure of the average spread on highyield debt securities in the U.S. corporate sector. Variables are semi-annual averages

calculated using a 26-week rolling window. All regressions include country dummies.

Standard errors are in brackets, which are robust to both heteroskedasticity and withincountry serial correlation. * Significant at 10%; ** significant at 5%; *** significant at

1%. Results are almost the same for those in the case in which debt-to-GDP ratio is

excluded from the control variables.

22

Table 8: Average payment growth: Case of country-level clustered errors

3-Year Spread

12-Year Spread

Debt-to-GDP

Ratio

Real Exchange

Rate

Terms of Trade

Investment Grade

Dummy

Year

Within R-squared

Num. Obs.

Dependent Variable: Average payment Growth of Issues

OLS

IV

OLS

IV

0.327***

0.289***

[0.076]

[0.072]

0.322***

0.300***

[0.094]

[0.094]

-1.208*

-1.350**

-0.680

-1.004*

[0.682]

[0.577]

[0.563]

[0.579]

0.003**

0.003*

0.002*

0.002

[0.001]

[0.0015]

[0.001]

[0.002]

-0.009

-0.240

0.051

-0.177

[0.179]

[0.236]

[0.207]

[0.258]

0.025

0.028

0.076

0.081**

[0.066]

[0.029]

[0.058]

[0.034]

-0.034***

-0.016***

-0.027***

-0.012**

[0.008]

[0.005]

[0.007]

[0.005]

0.128

0.132

0.114

0.099

3,835

3,537

3,835

3,537

Note: this table reports ordinary least-squares and two-stage least-squares instrumental variables

(IV) regressions of the average growth rate of payment of issues on the short- and long-term spreads,

including the real exchange rate, terms of trade, and an investment grade dummy as control variables.

Year of issue dates is included to capture a trend, if any, over time. For the IV regressions, spread

variables are instrumented by the Credit Suisse First Boston (CSFB) High Yield Index, which is a

measure of the average spread on high-yield debt securities in the U.S. corporate sector. Variables

are semi-annual averages calculated using a 26-week rolling window. All regressions include country

dummies. Standard errors are in brackets, which are robust to both heteroskedasticity and withincountry serial correlation. * Significant at 10%; ** significant at 5%; *** significant at 1%. Results

are almost the same for those in the case in which debt-to-GDP ratio is excluded from the control

variables.

23

24

Dependent Variable: payment Growth

OLS

IV

OLS

IV

-0.011*** 0.010***

[0.002]

[0.004]

0.008*** 0.012***

[0.002]

[0.004]

-0.00016***

0.00003

0.00008

-0.00002

[0.00006] [0.00007] [0.00006] [0.00006]

0.102***

-0.011 0.101***

-0.006

[0.010]

[0.007]

[0.010]

[0.007]

-0.041*** -0.033*** -0.034*** -0.031***

[0.002]

[0.002]

[0.002]

[0.002]

-0.003*** -0.003*** -0.003*** -0.003***

[0.0003]

[0.0003]

[0.0003]

[0.0003]

0.812

0.853

0.811

0.859

5,470

4,084

5,470

4,084

Note: this table reports ordinary least-squares and two-stage least-squares instrumental variables (IV) regressions of the average maturity

and average payment growth, respectively, of accumulated outstanding bonds on the short- and long-term spreads, including the real exchange

rate, terms of trade, and an investment grade dummy as control variables. Spreads are in terms of the log of one plus their levels. Year of

issue dates is included to capture a trend, if any, over time. For the IV regressions, spread variables are instrumented by the Credit Suisse

First Boston (CSFB) High Yield Index, which is a measure of the average spread on high-yield debt securities in the U.S. corporate sector,

and the country’s one-year-lagged debt-to-GDP ratio. Independent variables are semi-annual averages calculated using a 26-week rolling

window. All regressions include country dummies. Standard errors are in brackets, which are estimated by the Newey-West estimator with

bandwith option of three and robust to both heteroskedasticity and autocorrelation. * Significant at 10%; ** significant at 5%; *** significant

at 1%.

R-squared

Num. Obs.

Investment Grade

Dummy

Year

Real Exchange

Rate

Terms of Trade

12-Year Spread

3-Year Spread

Dependent Variable: Maturity

OLS

IV

OLS

IV

-0.386*** -1.025***

[0.067]

[0.112]

-0.615*** -0.995***

[0.086]

[0.123]

-0.002 -0.012***

-0.001

-0.006*

[0.003]

[0.004]

[0.003]

[0.003]

0.418 -0.915***

0.393 -1.326***

[0.375]

[0.278]

[0.377]

[0.306]

0.171 -0.315***

0.034 -0.458***

[0.118]

[0.090]

[0.125]

[0.0926]

0.111*** 0.141*** 0.095*** 0.120***

[0.013]

[0.013]

[0.013]

[0.0140]

0.509

0.587

0.517

0.617

5,733

4,347

5,733

4,347

Table 9: Average maturity and payment growth: Case of Accumulated Outstanding Bonds

.05

.1

.15

9−Year Spread: MA

0

Repayment Growth: MA

0

.5

1

1.5

Figure 4: payment Growth and Maturity for Brazil, 1996-2006: 6-Month Moving Averages of Weekly

Issuances

1995

2000

2005

2010

year

9−Year Spread: MA

0

0

Maturity: MA

10

20

30

.05

.1

.15

9−Year Spread: MA

Repayment Growth: MA

1995

2000

2005

2010

year

Maturity: MA

9−Year Spread: MA

Note: this figure plots the time series of the annual growth rate of the promised payments (solid line, top panel)

and maturity (solid line, bottom panel) of weekly issuances for Brazil during the period 1996-2009. All variables are

6-month moving averages over the period since 26 weeks before and until the issue date. The dashed line refers to the

9-year spread measured as the difference in the annualized percentage yield-to-maturity between the Brazilian and

U.S. government’s bonds of maturities between 6- and 9-years. We delete two observations for which payment growth

is higher than 1.5 (i.e., annual growth rate of payment higher than 150 percent).

B.2

Bond Prices

o

1 n

(1 + δ)−T + q rf (T − 1, δ)

R

1

n

−T 0

q T 0 , δ 0 , b0 , y, s = Ey0 |y,s0 |s 1 − d0 T 0 , δ 0 , b0 , y 0 , s0

1 + δ0

R

+ x T 0 , δ 0 , b0 , y 0 , s0 · q bb T 0 − 1, δ 0 , y 0 , s0 , T 00 , δ 00 , b00

+ 1 − x T 0 , δ 0 , b0 , y 0 , s0 · q T 0 − 1, δ 0 , b0 , y 0 , s0

q bb T, δ, y, s, T 0 , δ 0 , b0 = q rf (T, δ)

q rf (T, δ) =

25

B.3

Full Dilution Buy-Back Price

1

n

q fd T, δ, y, s, T 0 , δ 0 , b0 = Ey0 |y,s0 |s 1 − d0 T 0 , δ 0 , b0 , y 0 , s0

(1 + δ)−T

R

+ x T 0 , δ 0 , b0 , y 0 , s0 · q fd T − 1, δ, y 0 , s0 , T 00 , δ 00 , b00

o

+ 1 − x T 0 , δ 0 , b0 , y 0 , s0 · q fd T − 1, δ, y 0 , s0 , T 0 − 1, δ 0 , b0

hT 00 , δ 00 , b00 i are the optimal choices in state hT 0 , δ 0 , b0 , y 0 , s0 i, conditional on restructuring.

B.4

Partial Dilution Buy-Back Price

q pd T, δ, y, s, T 0 , δ 0 , b0 = ξq rf (T, δ) + (1 − ξ) q fd T, δ, y, s, T 0 , δ 0 , b0

ξ controls the degree of dilution.

26