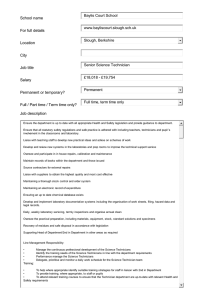

space for technicians?

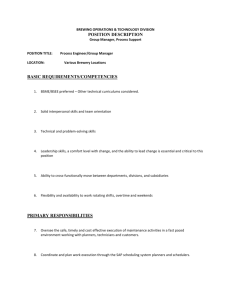

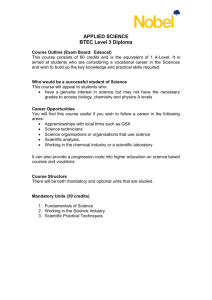

advertisement