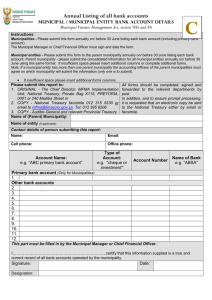

Guiding Circular - City of Cape Town

advertisement