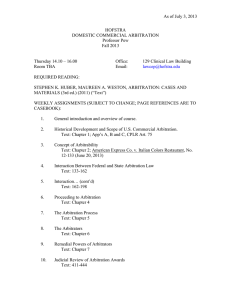

Investment Treaty News Quarterly, Volume 3, Issue 3, March 2013

advertisement