AFA Authorisation Guide - Financial Markets Authority

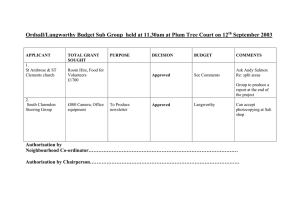

advertisement