MIDASLETTER.COM

BUENOS AIRES BEIJING LIMA LONDON VANCOUVER NEW YORK ZURICH SYDNEY

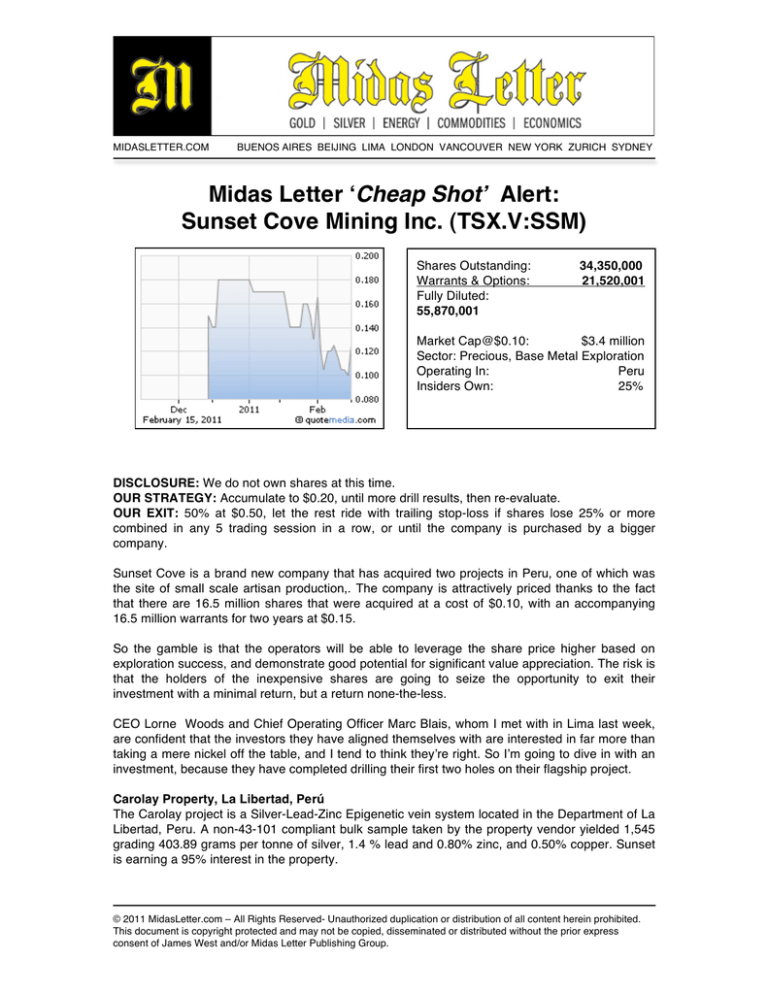

Midas Letter ʻCheap Shotʼ Alert:

Sunset Cove Mining Inc. (TSX.V:SSM)

Shares Outstanding:

Warrants & Options:

Fully Diluted:

55,870,001

34,350,000

21,520,001

Market Cap@$0.10:

$3.4 million

Sector: Precious, Base Metal Exploration

Operating In:

Peru

Insiders Own:

25%

DISCLOSURE: We do not own shares at this time.

OUR STRATEGY: Accumulate to $0.20, until more drill results, then re-evaluate.

OUR EXIT: 50% at $0.50, let the rest ride with trailing stop-loss if shares lose 25% or more

combined in any 5 trading session in a row, or until the company is purchased by a bigger

company.

Sunset Cove is a brand new company that has acquired two projects in Peru, one of which was

the site of small scale artisan production,. The company is attractively priced thanks to the fact

that there are 16.5 million shares that were acquired at a cost of $0.10, with an accompanying

16.5 million warrants for two years at $0.15.

So the gamble is that the operators will be able to leverage the share price higher based on

exploration success, and demonstrate good potential for significant value appreciation. The risk is

that the holders of the inexpensive shares are going to seize the opportunity to exit their

investment with a minimal return, but a return none-the-less.

CEO Lorne Woods and Chief Operating Officer Marc Blais, whom I met with in Lima last week,

are confident that the investors they have aligned themselves with are interested in far more than

taking a mere nickel off the table, and I tend to think theyʼre right. So Iʼm going to dive in with an

investment, because they have completed drilling their first two holes on their flagship project.

Carolay Property, La Libertad, Perú

The Carolay project is a Silver-Lead-Zinc Epigenetic vein system located in the Department of La

Libertad, Peru. A non-43-101 compliant bulk sample taken by the property vendor yielded 1,545

grading 403.89 grams per tonne of silver, 1.4 % lead and 0.80% zinc, and 0.50% copper. Sunset

is earning a 95% interest in the property.

© 2011 MidasLetter.com – All Rights Reserved- Unauthorized duplication or distribution of all content herein prohibited.

This document is copyright protected and may not be copied, disseminated or distributed without the prior express

consent of James West and/or Midas Letter Publishing Group.

MIDASLETTER.COM

BUENOS AIRES BEIJING LIMA LONDON VANCOUVER NEW YORK ZURICH SYDNEY

The Carolay Property is located approximately 550km NNW of Lima, Peru. The property consists

of 2,747.24 hectares distributed in 7 concessions. Two areas of importance were sampled for

both silver and copper mineralizations respectively. They are called the Carolay underground

silver vein (Area 1) and the Juayobal (Area 2) surface copper dissemination.

Historically, work started in the 1870s when Portuguese colonials mined a silver vein from 3

access adits, drifts and subdrifts. Only limited small scale artisanal mining was realized. The area

was visited in the 1950ʼs by the geologists of Minera Retamas and a couple of others but the

claims were abandoned.

Recent works were completed in 2008 by Minera Carolay with geologists Fredy Huanqui, P. Eng.

Geol. and F. Llerena, P. Eng. Geol., completed topographic and geological surveys in the mine

area as well as mapping and sampling of the drifts, subdrifts and chimneys followed by a work

report.

Azulcunca

On May 10, 2010, Sunset signed through its subsidiary Minera Sunset Del Peru S.A.C. a Mining

Concessions Option Agreement to acquire 100% of the shares and rights of 2 mining

concessions called here after the Azulcunca Property. The option term is for five years and

expires on May 10, 2015. Minera Sunset Del Peru S.A.C. will pay to the titleholders a total

amount of US$1,000,000 for 100% of the value of the 2 mining concessions in five yearly

instalments and the obligation of exploration expenditures of US$1,000,000 over 3 years

including US$500,000 during the first 2 years, of which of the first installment of $15,000 has

been paid.

Paved road access stops six (6) Km from the property. National power line grid at 10 Km. Ocuviri,

a medium size community, is at about 20 Km from the project. Mining activity is present in the

area; qualified workforce and basic services are available.

The project is located in the SE extension of the prolific Apurimac Copper Porphyry-Skarn Belt.

Major exploration and mining operations are located in this geological environment (skarn &

porphyry types): Las Chancas (200 Mi T @ 1% Cu; Southern Copper Corp), Las Bambas (+300

Mi T @1.1% Cu; X-Strata Copper), Tintaya +200 Mi T @ 1.5% Cu; X-Strata Copper), Antapacay

(390 Mi T @ 0.83% Cu; X-Strata Copper), as well as the Antillas, Trapiche, Haquira,

Cotabambas, , Katanga, Anty and Quechua properties.

Sunset Coveʼs team collected 18 samples on the property, five (5) of which returned copper

values from 3730 to 7350 ppm (note: 10,000 ppm = 1% Cu) and two (2) others returned values of

3.83% Cu and 8.30% Cu. For the silver, values have range up to 6.3 g/T and for the gold values

have range up to 0.334 g/T.

CONCLUSION

I think there is a very high probability that Sunset Cove will experience drilling success at one or

both of the projects in Perú, and given the very low price of the shares, it shouldnʼt be too much of

a stretch to get the shares up over the $0.20 range, where the company will likely raise more

money.

© 2011 MidasLetter.com – All Rights Reserved- Unauthorized duplication or distribution of all content herein prohibited.

This document is copyright protected and may not be copied, disseminated or distributed without the prior express

consent of James West and/or Midas Letter Publishing Group.

MIDASLETTER.COM

BUENOS AIRES BEIJING LIMA LONDON VANCOUVER NEW YORK ZURICH SYDNEY

Management is confident that the holders of the outstanding shares and warrants are interested

in a much higher exit price than $0.20, and so, if they play ball and allow the company to

generate some enthusiasm based on the current activity, all should be well. Given that Peru is

elephant country, investors may even be in for a big surprise.

ABOUT “CHEAP SHOT” ALERTS:

Cheap Shot Alerts are a new service within the MidasLetter Premium Edition subscriber services.

We track stocks that are falling in price, and when we think theyʼve bottomed and hold maximum

value, we bring them to your attention. The reason is simple: in our pursuit of stocks that double

or better within 12 to 18 months, weʼve learned that its much easier for a stock to go from twenty

cents to forty cents than it is to go from two dollars to four dollars. Cheap Shot Alerts are issued

without warning, and are always under CA$0.25. The built-in, proprietary strategy of Midas Letter

applies: sell half on the double, let the rest ride with a 25% cumulative 5 day stop less. (If the

shares lose 25% in total over 5 trading sessions in a row, a sell signal is triggered. Whether we

actually sell them or not depends on the intelligence we can glean from the company and the

market.)

DISCLAIMER: The publisher of the Midas Letter, James West, is not a registered securities

professional and as such is not qualified to give personal or individual investment advice.

Subscribers to the Midas Letter Premium Edition are cautioned that while we select companies

based on the quality of management, projects and capital structures, there is always the risk

when investing that you could lose a substantial portion of or even your entire investment.

The information contained herein is derived from sources believed to be reliable, but no warranty

expressed or implied exists between the subscriber and James West that this information is

accurate. Resource investing is risky and you could lose part or all of your investment. Consult a

registered investment professional in your area before making any investment in any security.

The information contained herein is for information purposes only and is no way intended to be

construed as advice to buy or sell shares in any security or asset.

© 2011 MidasLetter.com – All Rights Reserved- Unauthorized duplication or distribution of all content herein prohibited.

This document is copyright protected and may not be copied, disseminated or distributed without the prior express

consent of James West and/or Midas Letter Publishing Group.