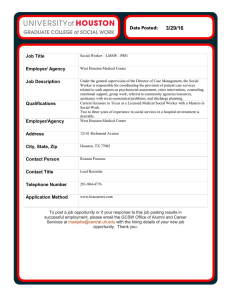

Employee resources and state workforce

advertisement