Consolidated Statements of Condition

advertisement

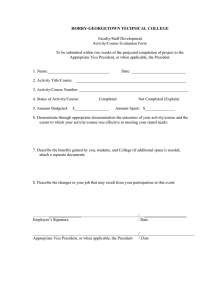

TIOGA STATE BANK EXECUTIVE OFFICERS George J. Bowen Robert M. Fisher Anne E. McKenna Christopher P. Powers Lisa J. Welch Sharon L. Yaple Senior Vice President, Chief Lending Officer Chairman of the Board, President & Chief Executive Officer Senior Vice President, Finance & Control Senior Vice President, Human Resources Senior Vice President, Chief Credit Officer Senior Vice President, Retail Banking & Business Development David R. Allen Tioga State Investment Services Jody Bensley Internal Auditor Jennifer M. Brockner Assistant Vice President, Finance Manager Anne C. Catalano Tioga State Investment Services Manager Sandy J. Crawford Commercial Services Officer Kimberly M. Depew Marketing Manager Susan P. Hogben Assistant Vice President, Loan Operations Manager Lori A. Micha Vice President, Compliance Officer Michael S. Miller Commercial Services Officer Jennifer I. MoraczewskiAssistant Vice President, Deposit Operations Manager Laura A. Ryan Vice President & Chief Information Technology Officer Jonathan P. Ward Commercial Services Officer Richard S. Zur Vice President, Commercial Services Officer COMMUNITY OFFICE MANAGERS Community Office Manager Community Office Manager Assistant Vice President, Community Office Manager Community Office Manager Community Office Manager Community Office Manager Assistant Vice President, Community Office Manager Assistant Vice President, Community Office Manager BROOME COUNTY OWEGO Brian Kradjian, Maureen Mangan, Esq. Kent Pennell, William Starring, John Stevens Shawn Fahey, Robert Layman, John Hornick, David Radigan, John Schumacher, Dean Smith David Woodburn Ruth Bowen, Cindy Hoffman Timothy Schwender, Bern Smith, Pete Clare 800-523-4TSB (4872) OFFICE LOCATIONS Binghamton 191 Conklin Avenue Binghamton, NY 13903-2176 l (607) 779-6023 1430 Upper F­­­­­ront Street Binghamton, NY 13901-1147 l (607) 722-3335 Candor 73 Main Street, PO Box 125 Candor, NY 13743-0125 l (607) 659-5125 Endwell 510 Hooper Road Endwell, NY 13760-1980 l (607) 748-2281 Newfield 183 Main Street Newfield, NY 14867-9458 l (607) 564-9947 Owego 923 State Route 17C Owego, NY 13827-4819 l (607) 687-4646 1387 State Route 96 Owego, NY 13827-3204 l (607) 687-4647 BUSINESS DEVELOPMENT BOARD MEMBERS CANDOR/NEWFIELD/SPENCER/VAN ETTEN 888-303-4TSB (4872) Xpress Telephone Banking MANAGERS & OFFICERS Rose E. Blinn Christopher M. Byrne Brian R. DeBoyace Mary Beth Gehring Katherine E. Lilley Susan B. Manzer Kimberly K. Potter James M. Savage Customer Service WAVERLY Richard Blauvelt, Nancy Brittain, Patricia Brunk, Kenneth Jacobson, Thomas King OUR CORE VALUES Customer Focused - Genuine personal concern for our customers. We strive to exceed customer expectations. Community Citizenship Since 1864 - We reinvest personally and financially in our communities. Honesty and Integrity - We keep our promises. Mutual Trust and Respect at All Times TIOGA STATE BANK MISSION STATEMENT Continuous Professional Development Safe, Sound and Profitable Performance Tioga State Bank’s mission is to be a successful, Balance Personal and Professional Life customer-focused service and sales organization. Positive Attitudes Producing Positive Results Spencer 1 N. Main Street, PO Box 386 Spencer, NY 14883-0386 l (607) 589-7000 Van Etten 6 Main Street Van Etten, NY 14889-0276 l (607) 589-7090 Vestal 1250 Vestal Parkway East PO Box 1254 Vestal, NY 13851-1254 l (607) 785-3175 Waverly 436 Cayuta Avenue Waverly, NY 14892-1507 l (607) 565-8166 www.tiogabank.com Member FDIC l Equal Housing Lender TSB Services, Inc. Consolidated Statements of Financial Condition December 31, 2013 TSB Services, Inc. A Message From The President TSB Services, Inc. has achieved its sixth consecutive year of record earnings. We ended 2013 slightly ahead of 2012 with Consolidated Net Income of $4,445,055 versus $4,413,319. We also finished the year with record equity of $46,128,699, up from $43,985,258 in 2012. Our total assets grew from $391,251,121 to $396,470,494 in the same period. 2013 proved to be a more difficult year to achieve loan growth however our total loan portfolio did increase about $5,000,000 between 2012 and 2013. We value quality over quantity when it comes to adding assets to our loan portfolio. Overall, 2013 was another successful year for TSB Services Inc. Our nation continues to recover from one of the deepest recessions in history and the recovery has been the slowest on record. Despite all of this, Tioga State Bank received the Bauer Financial Five Star rating for the 89th consecutive quarter, which is over Robert M. Fisher, 22 years. This is the highest rating awarded. Our record puts the bank in elite Chairman of the Board, company with fewer than 6% of the nation’s banks. I attribute a great deal of our President & CEO financial strength to the fact that TSB has continued to focus on the basics of banking. TSB is guided by the core values put in place by my predecessors. We follow a conservative business model of lending to borrowers with solid cash flow who have a high probability of repaying their loans. Our loan portfolio continues to compare favorably to our peers in all major key ratios. We continue to stress the importance of being local. Community banking helps the economy of its area by taking local deposits and reinvesting that money back into the community in the form of mortgage loans, business loans and even municipal projects funded by loans or bonds. Money deposited stays in the community and helps invigorate the area economy. 2014 marks Tioga State Bank’s 150th anniversary. In 1961, The Farmers and Merchants Bank of Spencer, which was founded in 1884, merged with the First National Bank of Candor, founded in 1864. The bank has grown from those first two offices in Spencer and Candor to roughly $400 Million in assets with 11 offices in four counties. The Family Firm Institute says only 30% of family-owned businesses make it to the second generation, 10% to the third generation and 3% to the fourth. We are very proud to be a fifth generation family owned business. We have even had two members of the sixth generation work for us the past two summers. As a community bank, we feel a strong commitment to the communities we serve. They are critical to our success. To help kick off our celebration year, we made a $20,000 contribution to our local food pantries to help them restock after the Holiday Season. The money was distributed to: The Spencer Food Cupboard, Bread of Life Food Pantry in Candor, Tioga County Rural Ministries, Tioga Catholic Charities, Valley Food Pantry, CHOW and the Newfield Good Neighbor Fund. Additionally, our employees volunteer many hours to local community organizations and donate generously to the United Way and other local charities. Technology continues to play a vital role in our future. In 2014, we will roll out additional products and services which will enhance customer satisfaction and strengthen their banking relationship with us. iChat will allow our on-line customers to communicate with our Customer Service Center. Deposit Automated ATMs will provide the avenue for customers to deposit cash and checks to our ATMs. Remote Deposit Anywhere will allow our customers to deposit checks via their smart phones. We will continue to pursue bank processing efficiencies and enhanced customer satisfaction through the utilization of new technologies. As you can see, 2014 will be very exciting for us on many fronts – celebrating our heritage, expanding markets in the communities we serve and embracing technology to enhance customer satisfaction. We thank you for your continued support. Consolidated Statements of Condition (thousands/unaudited) ASSETS TSB’s first president, M.D. Fisher The Farmers and Merchants Bank which would later become Tioga State Bank. 2013 2012 Cash and due from banks 6,301 7,794 Investments 113,273 107,495 Unrealized Gains/(Losses) (636) 2,578 Net Loans 255,754 250,716 Fixed Assets 5,125 5,392 Other Assets 16,653 17,276 TOTAL ASSETS $396,470 $391,251 LIABILITIES DEPOSITS Non-Interest Checking Deposits 63,563 63,373 Interest Checking Deposits 46,915 48,197 Savings Deposits 61,941 58,275 Money Market Deposits 39,926 46,709 Certificates of Deposit (CD) 85,623 90,476 TOTAL DEPOSITS Repurchase Agreements Other Borrowed Money Other Liabilities The Fisher family today: front left to right, Marv & Jean Fisher. Back, left to right: Josh Fisher, Allison Fisher, Beth Fisher, Bob Fisher, Kate Fisher DECEMBER 31 $297,698 11,478 37,147 3,748 $307,030 12,416 21,962 5,858 TOTAL LIABILITIES $350,341 $347,266 CAPITAL Capital Stock 388 388 Less Treasury Stock (1,886) (1,765) Surplus 3,587 3,587 Undivided Profits 40,539 36,211 Operating Income 4,445 4,413 Unrealized Gains/Losses (944) 1,151 TOTAL CAPITAL $46,129 $43,985 TOTAL LIABILITIES AND CAPITAL $396,470 ­­­$391,251