JLL Hotel Intelligence London Sept 2015 FINAL

advertisement

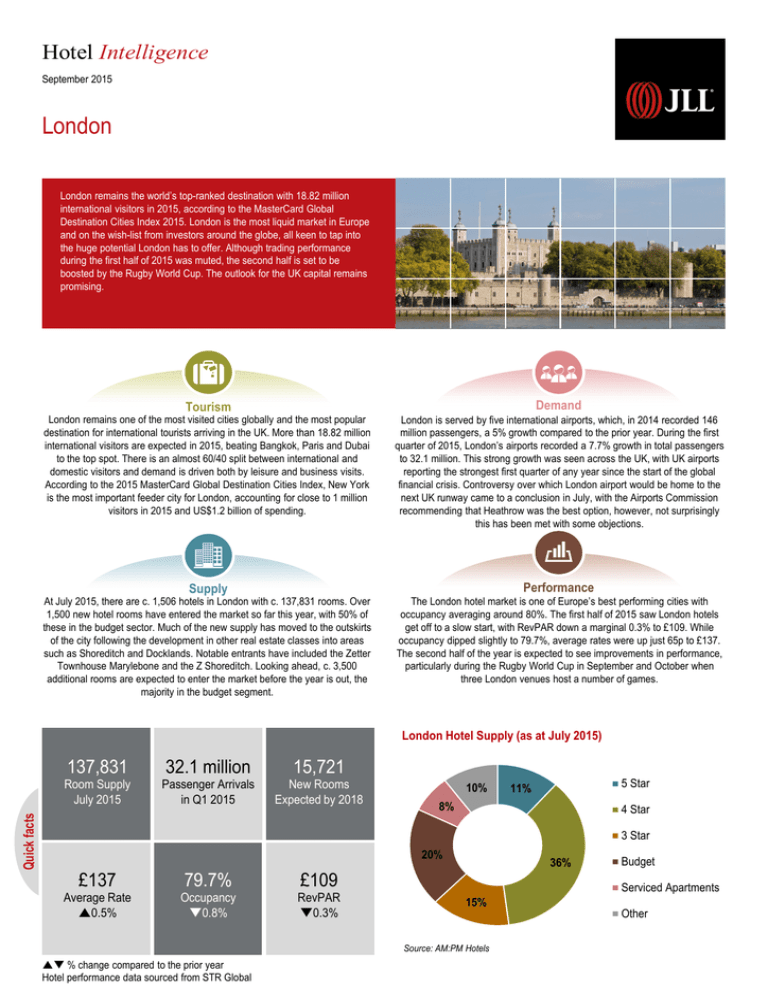

Hotel Intelligence September 2015 London London remains the world’s top-ranked destination with 18.82 million international visitors in 2015, according to the MasterCard Global Destination Cities Index 2015. London is the most liquid market in Europe and on the wish-list from investors around the globe, all keen to tap into the huge potential London has to offer. Although trading performance during the first half of 2015 was muted, the second half is set to be boosted by the Rugby World Cup. The outlook for the UK capital remains promising. Demand Tourism London remains one of the most visited cities globally and the most popular destination for international tourists arriving in the UK. More than 18.82 million international visitors are expected in 2015, beating Bangkok, Paris and Dubai to the top spot. There is an almost 60/40 split between international and domestic visitors and demand is driven both by leisure and business visits. According to the 2015 MasterCard Global Destination Cities Index, New York is the most important feeder city for London, accounting for close to 1 million visitors in 2015 and US$1.2 billion of spending. London is served by five international airports, which, in 2014 recorded 146 million passengers, a 5% growth compared to the prior year. During the first quarter of 2015, London’s airports recorded a 7.7% growth in total passengers to 32.1 million. This strong growth was seen across the UK, with UK airports reporting the strongest first quarter of any year since the start of the global financial crisis. Controversy over which London airport would be home to the next UK runway came to a conclusion in July, with the Airports Commission recommending that Heathrow was the best option, however, not surprisingly this has been met with some objections. Performance Supply At July 2015, there are c. 1,506 hotels in London with c. 137,831 rooms. Over 1,500 new hotel rooms have entered the market so far this year, with 50% of these in the budget sector. Much of the new supply has moved to the outskirts of the city following the development in other real estate classes into areas such as Shoreditch and Docklands. Notable entrants have included the Zetter Townhouse Marylebone and the Z Shoreditch. Looking ahead, c. 3,500 additional rooms are expected to enter the market before the year is out, the majority in the budget segment. The London hotel market is one of Europe’s best performing cities with occupancy averaging around 80%. The first half of 2015 saw London hotels get off to a slow start, with RevPAR down a marginal 0.3% to £109. While occupancy dipped slightly to 79.7%, average rates were up just 65p to £137. The second half of the year is expected to see improvements in performance, particularly during the Rugby World Cup in September and October when three London venues host a number of games. London Hotel Supply (as at July 2015) 137,831 Quick facts Room Supply July 2015 32.1 million Passenger Arrivals in Q1 2015 15,721 New Rooms Expected by 2018 10% 5 Star 11% 8% 4 Star 3 Star 20% £137 Average Rate 0.5% 79.7% Occupancy 0.8% 36% £109 RevPAR 0.3% Serviced Apartments 15% Source: AM:PM Hotels % change compared to the prior year Hotel performance data sourced from STR Global Budget Other € Investment London Transaction Volumes Investment activity in the London hotel market reached £1.5 billion during 2014, despite falling 14% compared to 2013. The cooling off in the market was due to the lack of available stock, which led investors to seek opportunities in other UK cities. £2,500 £2,000 Millions During the first half of 2015, hotel transaction volumes exceeded £2.3 billion - a result never recorded in the UK capital. However, we must note that c. 70% of this deal volume came from the sale of the Maybourne Hotel Group to the Middle East Sovereign Wealth Fund Constellation Hospitality LLC for £1.6 bn. If this deal was excluded from overall volumes, London deal volumes would be up 10% compared to H1 2014. Apart from the aforementioned deal, other notable deals included the sale of the Ace Hotel Shoreditch by Starwood Capital Group to Deerbrook Group and the Think Serviced Apartments, both closing in the first quarter. £1,000 £500 £- With robust trading performance and a steady market environment, London continues to be on the wish-list of investors from across the globe. Cash-rich investors from Asia Pacific and the Middle East, in particular are keen to secure their footprint in the capital city. Recent Openings £1,500 2010 2011 2012 2013 2014 H1 2014 Source: JLL Hotels & Hospitality Notable Deals Pipeline H1 2015 Infrastructure Developments M by Montcalm Shoreditch London Tech City 269 rooms, Opened 2015 Hub London Spitalfields 189 rooms, Due 2015 Grosvenor House Hotel July 2015, Debt Transaction Thameslink Programme Completion Due 2018 Zetter Townhouse Marylebone 26 rooms, Opened 2015 Nadler Victoria 73 rooms, Due 2015 Maybourne Group April 2015, £1.6bn Cross Rail Due 2018 Z Shoreditch 111 rooms, Opened 2015 InterContinental at The O2 452 rooms, Due 2015 Ace Hotel London Shoreditch March 2015, Price Confidential One Nine Elms Due 2018 Holiday Inn Express ExCeL 204 rooms, Opened 2015 CitizenM Tower of London 370 rooms, Due 2016 Think Serviced Apartments January 2015, Price Confidential Battersea Power Station Due 2023 Outlook While hotel performance during the first half of the year was relatively muted for the UK capital, the second half is expected to see a boost in performance, thanks to the Rugby World Cup. However, with more than 3,500 new rooms expected to enter the market, this uplift may level out again towards the end of the year. We have already seen a shift to the East in terms of both new hotel supply and investment, as a result of result of oversupply and lack of available product in the historic centre of the capital. We expect this trend to continue in the near future. New infrastructure developments within the city are driving regeneration and unlocking interest into hidden corners of the capital. Not only is this likely to heighten visitor demand and trading performance in the future, it will aid the absorption of new supply. Contacts William Duffey Hotels & Hospitality Northern Europe Will.Duffey@eu.jll.com +44 (0)207 087 5587 Jessica Jahns Head of EMEA Hotels & Hospitality Research jessica.jahns@eu.jll.com +44 (0)20 7399 5821