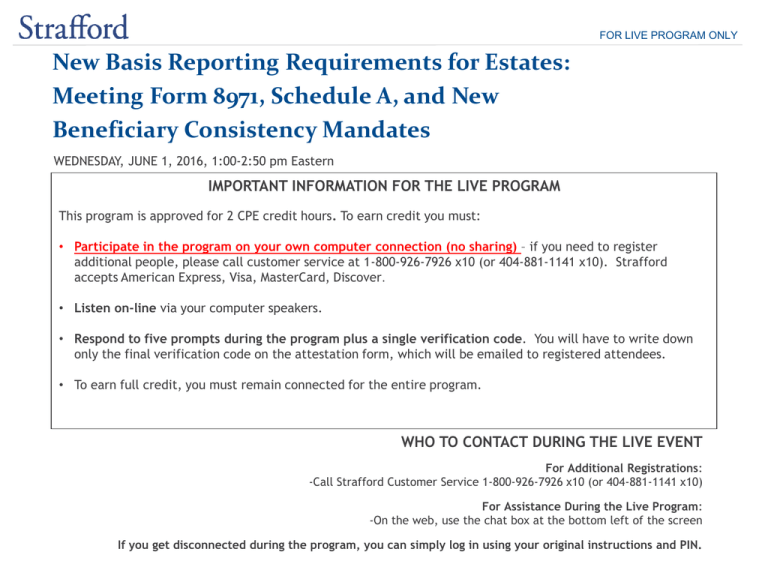

New Basis Reporting Requirements for Estates: Meeting Form 8971

advertisement