GAAP for Small Businesses Working Group

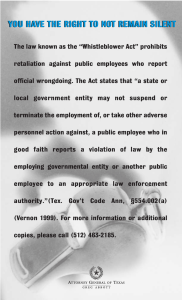

advertisement