Clinigen Group Full Year Results FY15 and

Proposed Acquisition of Link Healthcare

September 2015

Peter George (CEO), Shaun Chilton (Deputy CEO),

Robin Sibson & Martin Abell (CFO)

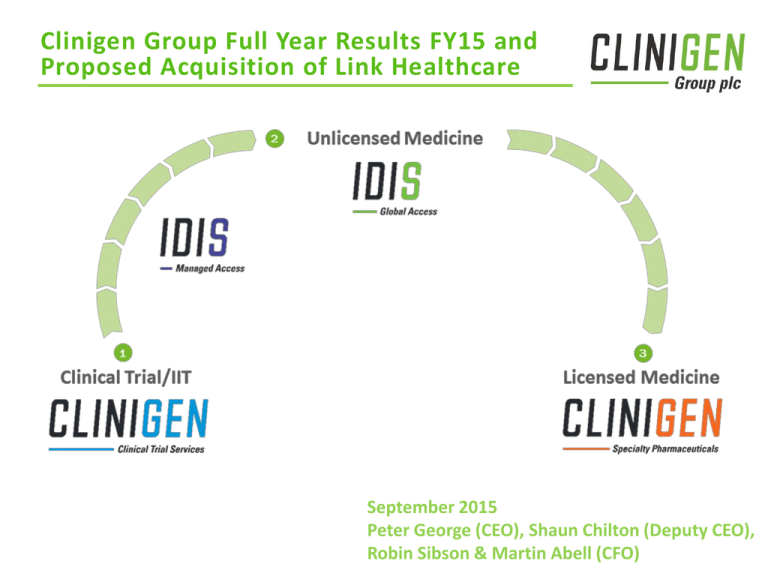

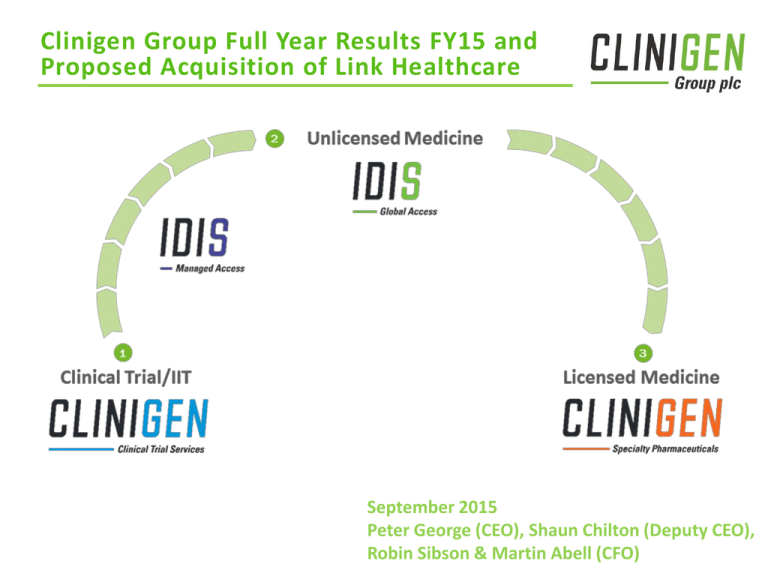

Group overview

Global specialty pharmaceuticals and services business, supplying clinical trial, licensed and unlicensed

critical, life saving drugs

Four distinct operating businesses which benefit from important synergies between them:

Clinigen CTS – Global leader in the specialist supply and management of quality-assured medicines for

patients in clinical trials

Idis MA – Global leader in ethical worldwide access to the most promising innovative early stage

medicines on behalf of pharma and biotech companies to meet an unmet patient need

Idis GA – Ethical Supply of unlicensed or short supply medicines to patients via their physicians

Clinigen SP – SP acquires the rights to and then revitalises essential niche hospital only medicines and

has a portfolio of oncology support and infectious disease medicines

Global network serving 130 countries with a broad, blue chip customer base of global

pharmaceutical/biotech companies and contract research organisations

Highly profitable, cash-generative business with impressive continuous growth over the past five years

Good visibility of earnings with significant growth opportunities, both organically and through acquisition

© Copyright Clinigen Group plc. All rights reserved

Right Drug Right Patient Right Time

2

FY15 results - key highlights

Financial Highlights

Revenues increased in excess of 45% to £184.4m (FY14: £126.6m), +27% on proforma basis

Gross profit increased 30%, mainly driven by greater than 25% growth in Specialty

Pharmaceuticals (SP) gross profits and the acquisition of Idis

Underlying EBITDA* up 20% to £32.3m (FY14: £26.8m)

Final dividend of 2.3 pence per share proposed, bring the total dividend to 3.4 pence per share

(FY14 3.1 pence per share)

Business Highlights

Clinigen acquired Idis April 2015; creating the global market leader in both the ethical supply of

unlicensed medicines and access to short supply medicines.

Proposed acquisition of Link Healthcare strengthens Clinigen’s global footprint across Asia,

Africa and Australasia, allowing access to more healthcare professionals around the world to the

medicines they need for their patients

The Group’s owned oncology support portfolio was strengthened with the acquisition of Ethyol®

(amifostine) from AstraZeneca in August 2014

Underlying

EBITDAGroup

& EPSplc.

adjusted

to reserved

exclude amortisation

©*Copyright

Clinigen

All rights

Right Drug Right Patient Right Time

3

FY15 results - key highlights

Clinigen Clinical Trial Services (CTS)

CTS developing new Expanded Value Services; “Just in Time” smarter supply and labelling

and direct to site services

Idis Managed Access (MA)

Increase in deliveries to 418,000 units, through 62,000 shipments; up from 263,000 units

across 40,000 shipments in FY14

As the market leader; in FY15 we have 99 products under active management with 19 of

the top 25 pharma and biotech companies, shipping to 95 countries

Idis Global Access (GA)

The acquisition of Idis has created this new business unit

Idis GA together with Link Healthcare creates huge potential to dominate and shape the

ethical on-demand unlicensed supply market, estimated at $5-7bn.

Clinigen Specialty Pharmaceuticals (SP)

Foscavir “risk” diluted by new products, now 70% of SP sales and profit, significantly

reduced from 86% at the end of FY14.

Completed the transfer of market authorisations for Cardioxane from Novartis, Savene from

Norgine and Ethyol from Astra Zeneca.

Strategic Alliance with Cumberland Pharmaceuticals will provide support for Clinigen

products in the US, with Clinigen supporting Cumberland outside the US.

© Copyright Clinigen Group plc. All rights reserved

Right Drug Right Patient Right Time

4

Income statement 2015

£m

year ended 30 June

Sales

Gross profit

Gross profit margin (%)

Overheads1

2015 Gross profit (£53.7m)

2014

2015 Growth

126.6

184.4

46%

41.2

33%

-14.4

53.7

29%

-21.4

EBITDA1 (underlying)

Margin (%)

26.8

21%

32.3

18%

20%

Pre tax profit (underlying)1

23.1

26.2

13%

24.5p

28.0p

14%

3.1p

3.4p

10%

Earnings per share (underlying)2

Total dividend

30%

Audited

GP

49%

1: Overheads, EBITDA & underlying PBT represent underlying performance, see slide 8 for reconciliation to reported

© Copyright

plc. on

All underlying

rights reserved

2: Adjusted

earnings Clinigen

per shareGroup

is based

PAT adjusted to exclude amortisation and associated tax

Proforma 2015

Gross profit

Proforma

GP

Right Drug Right Patient Right Time

5

Group balance sheet

Goodwill and intangibles increase driven by Idis

acquisition (£240m) and Ethyol, also

incorporates full writedown of Vibativ £3.4m

Current working capital requirement remains

low

£140m debt facility in place (term loan £45m

and RCF £95m) until April 2020, utilisation at

June 2015; £106m

Net debt of £78m will increase on completion of

Link acquisition and expected to reduce to

current levels in FY16

Opening fair value adjustments amounted to

£91.8m, the main element being the valuations

assigned to brand/contracts/clients relationships

£m

Year ended 30 June

Property, plant and equipment

Goodwill & other intangible assets

Deferred tax asset

Total non-current assets

2014

2015

1.0

50.5

1.9

53.4

1.6

308.2

3.9

313.7

2.5

27.1

21.8

51.4

11.1

67.1

27.8

106.0

Total assets

104.8

419.7

Trade and other payables

Loans and borrowings

Current and deferred tax

Provisions

Total current liabilities

(19.5)

(87.7)

(16.5)

(69.5)

(2.5)

(2.9)

(1.5)

(38.5) (161.6)

Inventories

Trade and other receivables

Cash and cash equivalents

Total current assets

Deferred tax

Loans and borrowings

Total non-current liabilities

Total liabilities

Total equity

© Copyright Clinigen Group plc. All rights reserved

-

(19.0)

(34.5)

(53.5)

(38.5) (215.1)

66.3

204.6

Right Drug Right Patient Right Time

6

Group cash flow

Strong cash generation from underlying

operations and £12.1m after tax and

non underlying items

Purchase of Intangibles of £188.1m is

£180m Idis and £8m Ethyol

£106m drawn down on new facility in

April 2015 to fund Idis acquisition. Loan

advances reflect this offset by

settlement of previous Clinigen and Idis

loans of £16.5m and £36m

27,000,000 new ordinary shares issued

April 2015 at a price of 500 pence per

share to fund Idis acquisition

© Copyright Clinigen Group plc. All rights reserved

£m

2014

2015

16.2

5.3

Add: Corporation tax

5.1

3.1

Interest paid

0.2

0.8

D&A, impairment and loss on disposal

3.5

12.2

Share based payment expense

1.2

1.3

Year ended 30 June 2013

Profit after tax

(Increase)/decrease in net working capital

Increase in provisions

(5.5) (10.2)

-

1.5

Income taxes paid

(1.1)

(1.9)

Net cash flows from operating activities

19.6

12.1

Purchase of PP&E

(0.6)

(0.2)

Purchase of intangibles

(21.8) (188.1)

Net cash used in investing activities

(22.4) (188.3)

Interest paid

(0.2)

(0.8)

Loan (repayments) and advances

16.5

53.3

Dividends

(2.5)

(2.6)

Issue/(purchase) of shares

Net cash generated from financing

activities

(0.3) 132.4

Total cash flows

10.7

13.5 182.3

6.1

Right Drug Right Patient Right Time

7

Reconciliation for EBITDA to PAT

Underlying

Reported

£m’s

Underlying EBITDA

Interest expense

D&A, impairment and disp. loss

Underlying PBT

2014

26.8

(-0.2)

(-3.5)

23.1

2015

32.3

(-0.8)

(-5.3)

26.2

2014

26.8

(-0.2)

(-3.5)

23.1

2015

32.3

(-0.8)

(-5.3)

26.2

Share based payment charge

Impairment/amortisation of intangibles

Idis acquisition costs/restructuring

PBT

Taxation (underlying)

Taxation (non-underlying)

PAT

23.1

(-5.4)

26.2

(-5.7)

17.6

20.4

(-1.8)

21.3

(-5.4)

0.4

16.2

(-2.3)

(-5.9)

(-9.5)

8.4

(-5.7)

2.6

5.3

© Copyright Clinigen Group plc. All rights reserved

Right Drug Right Patient Right Time

8

Operating Businesses

Clinigen Clinical

Trial Services

Clinigen has consolidated its global market leader

position with the acquisition of Idis

CTS remains the main revenue generator in the Group

with 61% of sales (38% proforma), with the lowest GM%

Addressable outsourced drug sourcing market c. $2.5bn,

estimated to grow at 8% over next 3 years, with

expanded value services market a further c.$1bn

Introduction of expanded value services; “Just in Time” smarter supply and labelling and “direct

to site” services, will improve margins during FY16

30-50% of purchased clinical trial drugs are wasted, due to poor purchasing decisions; “Just in time”

services aimed at reducing this waste

Increasing demand for Real World Data driving demand for labelling and direct to site services

Currently running direct to site projects for 8 companies, on 22 clinical studies, supplying 33

medicines to 252 sites

© Copyright Clinigen Group plc. All rights reserved

Right

DrugRight

RightPatient

PatientRight

RightTime

Time

Right

Drug

10

Clinigen Clinical

Trial Services

£m

Clinigen CTS

Audited

12 months ended 30 June FY15

Sales

112.7

YoY Growth %

34%

Gross Profit

13.4

YoY Growth %

7%

Gross Profit Margin (%)

12%

Audited Pro forma Pro forma Pro forma

FY14

FY15

FY14

FY13

83.6

134.8

93.0

92.9

12.6

15%

45%

0%

16.2

13.6

19%

13%

12%

15%

12.0

13%

Financial Year 2015

Sales up 34% and an even better 45% on a proforma basis

Gross profit performance, up 7% (19% proforma) at a 12% gross

margin. This will improve with expanded value services

Underlying activity up, with medicines supplied up 13% and number

customers up from 73 to 85

Sales pipeline strong @ c.£137m, H1 pipeline of 80-100% probability

is at £42.8m, GM 14.7% (Prior Year £20.6m)

Deeper customer presentation

7 customers with sales greater than £5m, up from 5 in FY14

Half of the top 25 pharmaceutical companies, by R&D spend,

are CTS customers

© Copyright Clinigen Group plc. All rights reserved

Right

DrugRight

RightPatient

PatientRight

RightTime

Time

Right

Drug

11

Idis Managed Access

Idis MA is the global market leader in the exclusive managed access to the most promising

innovative early stage medicines on behalf of pharma and biotech companies

The Idis acquisition allowed the Group to combine the Idis MAP and Clinigen GAP businesses

under the Idis Managed Access (MA) brand.

The integration has fully amalgamated these businesses with immediate effect and

seamlessly, post-acquisition

Proforma FY15 has seen an increase to 418,000

units delivered through 62,000 shipments; up

from 263,000 units across 40,000 shipments in

FY14

Idis MA is the market leader in this rapidly

evolving sector valued at c.$500-600m

Idis MA has 99 products under active

management, is working with 19 of the top

25 pharma and biotech companies, and over

50 in total, and distributed unlicensed

medicines to 95 countries in FY15.

© Copyright Clinigen Group plc. All rights reserved

Right Drug Right Patient Right Time

15

12

Idis Managed Access

Idis MA

£m

12 months ended 30 June

Sales

Audited

FY15

28.8

YoY Growth %

78%

Gross Profit

8.3

YoY Growth %

53%

Gross Profit Margin (%)

29%

Audited

FY14

16.1

5.4

34%

Pro forma Pro forma Pro forma

FY15

FY14

FY13

124.3

91.8

84.4

35%

9%

25.3

18.3

38%

2%

20%

20%

18.0

21%

Financial Year 2015

Significant sales growth, up 78%. On a proforma basis still excellent 35%

Very strong gross profit performance, up 53%, again strong on a proforma basis +38%

The healthy deal flow seen in FY15 has carried forward into FY16

Number of opportunities and value of the sales pipeline remains strong

A “Strategic Support Services” offering has been developed, helping larger pharma

companies take a more strategic approach to managing access to their portfolio globally.

The first real world data projects are expected to start in Q2 FY16, but discontinuation services

continue to be strong

© Copyright Clinigen Group plc. All rights reserved

Right Drug Right Patient Right Time

13

Idis Global Access

£m

12 months ended 30 June

Sales

Idis GA

Audited

FY15

9.2

Audited

FY14

-

YoY Growth %

Gross Profit

2.8

-

YoY Growth %

Gross Profit Margin (%)

30%

-

Pro forma Pro forma Pro forma

FY15

FY14

FY13

61.0

66.4

70.9

-8%

-6%

14.6

13.3

10%

-20%

24%

20%

16.7

24%

Financial Year 2015

Sales declining year on year as described in acquisition roadshow, due to changes in UK

“specials” market and one poor performing low margin commercial supply agreement

Decline in sales will continue in FY16 as commercial contract (+£25m sales) is closed

Strong gross profit performance, up 10%, following a period of decline related to loss of

UK Specials contracts in 2013/14

© Copyright Clinigen Group plc. All rights reserved

Right Drug Right Patient Right Time

14

Access across the lifecycle

Access across the lifecycle

Unlicensed

Licensed

Specialty

Pharmaceuticals

No approval

Ex-trial

Clinigen Clinical

Trial Services

Pre-launch

Phased

launch

Phase II

Phase III

EARLY

Pre-Approval

Phased Launch

EXPANDED

Market Exit

MATURE

Idis GA and Link together will help Clinigen meet the huge opportunity to supply the

global unmet for ethical medicines, estimated to be up to $7bn annually

Marketing the services globally to hospital and regional pharmacist and investment in

the e-commerce platform to reach the global market will be a feature of FY16 and FY17

© Copyright Clinigen Group plc. All rights reserved

Right Drug Right Patient Right Time

15

Clinigen Specialty

Pharmaceuticals

£m

Clinigen SP

Audited

FY15

33.7

Audited

FY14

26.9

Audited

FY13

24.3

YoY Growth %

25%

11%

12%

Gross Profit

29.1

23.2

19.8

YoY Growth %

25%

17%

8%

Gross Profit Margin (%)

86%

86%

82%

12 months ended 30 June

Sales

Audited

FY12

21.7

18.3

84%

Financial Year 2015

Sales and gross profit both showing 25% growth

SP remains the largest contributor to the Group’s gross profit accounting for 54%, 34% in the

new enlarges group on a proforma basis

Foscavir “risk” diluted by new products to 70% of SP sales and profit, significantly reduced from

86% at the end of FY14.

Ethyol acquired August 2014

Completed the final transfer of market authorisations for Cardioxane, Savene and Ethyol

Strategic Alliance with Cumberland Pharmaceuticals will provide support for Clinigen

products in the US, with Clinigen supporting Cumberland outside the US

© Copyright Clinigen Group plc. All rights reserved

DrugPatient

Right Patient

Right

Time

Right DrugRight

Right

Right

Time

16

Clinigen Specialty

Pharmaceuticals

Dexrazoxane – Savene and Cardioxane

All marketing authorisations (MA) and technical transfers completed

Savene sales ahead of those achieved by previous MA holder

Strong KOL support for Clinigen’s strategy of challenging Article 31 restrictions, from the worldrenowned Children’s Oncology Group (COG), with the paper co-authored by 25 global Key Opinion

Leaders. We anticipate a response from the regulators in the next six months

Ethyol

Rapid steps made in the revitalisation of Ethyol in FY15, transferring the MA for the US and Europe

Well underway with the technical transfer of the manufacturing, which will complete by end FY16

Good potential in the growth of Ethyol; new radiotherapy techniques still cause a reasonable

incidence xerostomia, which is untreated. No significant competitor currently in development

Foscavir

Growth reflects underlying disease it treats both growing at 4-5%

Launch in South Korea and US distribution agreement extended with Hospira through to end 2019

Supporting Japanese study to extend treatment into HHV6

Vibativ

Diagnostic e-Test continues to be a problem and although reimbursement agreed in UK, Ireland,

Germany and Austria, reimbursement has been refused in a number of other European markets

The e-Test, inconsistent reimbursement and current loss making position due to regulatory

demands has led to a review of its commercial viability in Europe

© Copyright Clinigen Group plc. All rights reserved

DrugPatient

Right Patient

Right

Time

Right DrugRight

Right

Right

Time

17

15

Key Strategic Objectives

The Clinigen Model

Only 3 routes to get a drug into a

patient, clinical trial, as a licensed

or unlicensed medicine. Clinigen

uniquely supplies all three

But;

80% of the world’s population, some

5.5bn people, have low or non-existent

access to medicines

An estimated 50% of drugs sold on-line

are fake

The proportion of counterfeit or substandard medicines can be as high 1030% in some regions

This is Global Healthcare Crisis!

A healthcare professional has to know the drug they want to treat their patient is; available (right

drug) and can be imported to his/her hospital (right patient) quickly (right time), this is the Clinigen

model

© Copyright Clinigen Group plc. All rights reserved

Right Drug Right Patient Right Time

19

Strengthening The Clinigen Model

To strengthen the right drug, right

patient, right time model, Clinigen

has:

Acquired Idis, giving it market

leader status in unlicensed and

Clinical Trial drug supply

Formed a strategic alliance with

Cumberland Pharmaceuticals in the

US to better control its own

products

Acquired Link Healthcare to give it

a local footprint in Southern Africa,

Australia, New Zealand, Singapore,

Malaysia, Hong Kong and Japan

© Copyright Clinigen Group plc. All rights reserved

Right Drug Right Patient Right Time

20

Key Strategic Objectives

Utilise Clinigen products database to identify opportunities in top 50 pharma

SO 1: Acquisition of product

opportunities from top

50 pharma

Develop relationships within pharma to identify opportunities

Develop relationship with “acquisition brokers”

Develop global distribution relationships and capabilities

Target is 5 products over next 5 years

Maintain Foscavir – new markets, South Korea. New indication

SO 2: Revitalize acquired assets

Dexrazoxane strategy to reverse article 31

Ethyol growth strategy

Strengthen sourcing capabilities for CTS and unlicensed medicines

SO 3: Extend global capabilities

Develop “international pharmacy” type unlicensed supply model to pharmerging markets

Develop a better direct supply model to key pharmerging markets for licensed and unlicensed supply

Extend business with current customers

SO 4: #1 Global CTS Company

Target key pharma, CRO, re-packers who are not current customers

Develop exclusive sourcing agreements

Develop “smart” global sourcing capabilities

Extend business with current customers

SO 5: #1 Global MA Company

Target key pharma who are not current customers

Develop software to create unique offering

Develop “international pharmacy” type unlicensed supply model to pharmerging markets

SO 6: Corporate Acquisitions

© Copyright Clinigen Group plc. All rights reserved

Acquisition of companies that both strengthen Clinigen’s portfolio and/or global footprint and

distribution capabilities

Right Drug Right Patient Right Time

21

Strategic Progress

SO 4: #1 Global CTS Company

Consolidated global market leader position with acquisition of Idis

SO 5: #1 Global MA Company

The Idis acquisition allowed us to combine the Idis MAP and Clinigen GAP businesses

under the Idis MA brand, catapulting the Group into the global market leader

position in the exclusive managed access sector

SO 6: Corporate Acquisitions

Acquisition of companies that both strengthen Clinigen’s portfolio and/or global

footprint and distribution capabilities

© Copyright Clinigen Group plc. All rights reserved

Right Drug Right Patient Right Time

22

© Copyright Clinigen Group plc. All rights reserved

Right Drug Right Patient Right Time

23

Acquisition of Link Healthcare

© Copyright Clinigen Group plc. All rights reserved

Right Drug Right Patient Right Time

24

Overview of Acquisition

Clinigen is acquiring Link Healthcare, a specialist Pharmaceutical and Medical Technology business

focussed in the regions of Asia, Africa and Australasia, for an initial consideration of £44.5 million

The acquisition is for a maximum consideration of £100m on a debt-free cash-free basis, payable

in 3 tranches over 3 years, subject to performance:

£44.5m payable at completion, 50% in new shares and 50% in cash

Up to two further tranches, to a maximum of £55.5m in total, depending on the

achievement of EBITA for the financial years ending June 2016 and June 2017.

Initial cash element of the consideration will be financed from Clinigen’s existing debt

facilities

Will apply for listing of new share’s, the consideration will comprise 3,102,558 Ordinary

Shares, calculated based on the average share price over the 10 trading days ending 18th

September 2015, and will be admitted to trading on 30 October

The Acquisition is expected to be immediately earnings enhancing

Completion is expected to be 30 October, following the Clinigen AGM

© Copyright Clinigen Group plc. All rights reserved

Right Drug Right Patient Right Time

25

Overview of Link

Link was founded in 1997 and focussed in the regions of Asia (Singapore, Malaysia, Hong Kong & Japan),

Southern Africa and Australia, New Zealand, employing c.150 people

Link offers a range of services on a local or cross-regional basis:

Full commercial launch services

Mature and discontinued product lifecycle management

Comprehensive regulatory services

Marketing and logistics

Early market access programs, including the sourcing of “Named Patient based Supply” (NPS) for more

than 200 essential medicines

Link is the holder of over 100 Marketing Authorisations in its local markets

Has long-term partnerships with over 40 global blue chip pharma and medical technology clients

For the financial year ended 31 March 2015, Link achieved revenue of £31.6 million and EBITDA of £4.2 million.

It has gross assets of £23.3 million as at 31 March 2015. In the LTM period to June 2015 Link achieved revenue

of £33.7 million and EBITDA of £5.1 million.

Link’s mission is a commitment to excellence in the provision of vitally important specialty products and to

securing innovative medicines and technology, delivering access to world class therapies

© Copyright Clinigen Group plc. All rights reserved

Right Drug Right Patient Right Time

26

Strategic Benefits

The acquisition fulfils a number of Clinigen’s strategic ambitions and will increase future growth opportunities,

both in new markets and globally, and will support all areas of the business through:

A significant AAA (Asia, Africa & Australasia) footprint, with an established, profitable and trusted

business in key markets

Immediately growing the portfolio of products and services

Increasing distribution capabilities in line with our hub and spoke model

Providing registration and commercialisation capabilities in the region

The new combined entity will further strengthen our position as the global market leader in ethical unlicensed

supply - a large addressable and under-penetrated market with the opportunity to shape and develop a

$5+billion market

Providing regional on-demand unlicensed supply capabilities in established and ‘pharmerging’ markets

Strengthening key customer links with hospital pharmacists and KOL across the AAA region

Providing access to Link’s exclusive relationships for both licensed and unlicensed products

Providing complementary customer lists in unlicensed supply

Further accelerates Clinigen’s goal of market leader status

© Copyright Clinigen Group plc. All rights reserved

Right Drug Right Patient Right Time

27

Summary

Key Acquisition Highlights

1

Strategic rationale – significant step in achieving stated strategy to develop global footprint

2

Significantly expanded distribution and sales capability – opportunity to leverage market leadership as

Link has complementary relationships with pharma, biotech, health authorities and regulators

3

Direct access to fast growing pharmerging markets through existing established Link customers

4

Further enhances life cycle management service offering through local registration and commercialisation

in the pharmerging markets for discontinued, rare and orphan drugs

5

Established methodology for commercial supply agreements which can be extended

6

Earnings enhancing and cash generative

© Copyright Clinigen Group plc. All rights reserved

Right Drug Right Patient Right Time

28

Cumberland Pharma

Clinigen Group signs strategic alliance with

Cumberland Pharmaceuticals

Partnership strengthens Clinigen’s global footprint

and gives Cumberland Pharmaceuticals access to

new international markets

Cumberland Pharmaceuticals acquires, develops and commercializes branded

prescription products designed to improve quality of care and address unmet medical

needs. The company focuses on underserved niche markets in the US and currently

markets five FDA approved products. These products include Acetadote® (acetylcysteine)

injection for the treatment of acetaminophen poisoning and Vaprisol® (conivaptan)

injection, for the treatment of hyponatremia. Cumberland also has a development

pipeline with candidates in Phase II studies.

© Copyright Clinigen Group plc. All rights reserved

Right Drug Right Patient Right Time

29

Next Steps for the Enlarged Group

Integration of acquisitions

Idis; focus on commercial synergies and e-commerce platform

Link; start 100 day integration plan

Cumberland; map out product opportunities

Launch of new added value services in MA and CTS and continue revitalisation of products

The Board remains confident in the outlook for the full year

This has been a transformational year

whilst delivering strong financial performance

© Copyright Clinigen Group plc. All rights reserved

Right Drug Right Patient Right Time

30

Appendices

Senior Management

Peter George – Chief Executive Officer

Joined Clinigen when it formed in June 2010

Former CEO at Penn Pharma, having led a GBP67m management buy-out (2007)

Previously executive VP for Wolters Kluwer Health with responsibility for Europe/Asia Pacific

Former Chief Operating Officer of Unilabs Clinical Trials International Limited

Shaun Chilton – Deputy CEO

Joined Clinigen in January 2012

Previously President within KnowledgePoint360 Group, a global pharmaceutical information and

services operation

20 years’ commercial, strategic and operational experience, including sales and marketing in Pfizer

and Sanofi-Aventis (now Sanofi)

Robin Sibson – Chief Financial Officer

Joined ADL Healthcare Limited, a company owned by Clinigen’s former Executive Chairman (2003)

Over 30 years’ experience in the pharmaceutical industry, including 15 years as Finance Director

Formerly Finance Director of BASF’s UK Pharmaceuticals, sales and R&D divisions

Previously Finance Director at Boots UK Pharmaceutical business, leading the integration

following its sale to BASF

Martin Abell – Chief Financial Officer Elect

• Martin joined Clinigen in August 2015 as CFO Elect.

• Previously at the FTSE250 recruitment group Hays plc. as Head of Investor Relations and M&A,

and most recently as Finance Director for the Continental Europe and Rest of World division

• Prior to Hays Martin held financial roles in Exel plc (now part of Deutsche Post)

• Qualified Chartered Accountant, having trained at PwC in the M&A Transaction Services team.

© Copyright Clinigen Group plc. All rights reserved

Right Drug Right Patient Right Time

32

Clinigen Specialty

Pharmaceuticals

Dexrazoxane

Cardioxane acquired from Novartis in 2013, used for as a cardioprotective drug against

anthracycline toxicity and Savene acquired from Norgine in 2014, used to treat extravasation

caused by anthracycline treatment

Ethyol

Acquired from AstraZeneca August 2014, it is a cytoprotective drug indicated to reduce the

incidence of xerostomia (dry mouth) in patients undergoing radiation treatment for head and

neck cancer and to reduce renal toxicity associated with cisplatin in patients with advanced

ovarian cancer

Foscavir

Acquired global rights from AZ in 2010; Anti-viral last line treatment predominantly used for

CMV in bone marrow transplant patients

Vibativ

In-licensed Vibativ from Theravance in 2013, used to treat hospital acquired pneumonia of an

MRSA cause

© Copyright Clinigen Group plc. All rights reserved

DrugPatient

Right Patient

Right

Time

Right DrugRight

Right

Right

Time

33

15