Issue Brief

No. 297

September 2006

Measuring Retirement Income Adequacy:

Calculating Realistic Income Replacement Rates

By Jack VanDerhei, Temple University and EBRI Fellow

•

•

•

•

•

•

•

The limitations of traditional “replacement rate” calculations: For decades, “replacement rates” have been the

primary “rule-of-thumb” measure used in the retirement planning process. However, replacement rate calculations

are overly simplistic and potentially inaccurate because they often are based on methodologies limited to

replacement of preretirement cash flow after adjustment for taxes, savings, and age and/or work-related expenses.

Importance of investment, longevity and health risks: One of the biggest weaknesses of replacement rate models

is that one or more of the most important retirement risks is ignored: investment risk, longevity risk, and risk of

potentially catastrophic health care costs.

A new “building block” approach: This Issue Brief illustrates the problematic nature of using conventional

replacement rates for retirement planning through a “building block” approach: Building Block 1 focuses

exclusively on investment risk; Building Block 2 introduces longevity risk into the planning process, in addition to

the investment risk from the previous level; Building Block 3 introduces the risk of catastrophic health care costs

into the calculations, in addition to investment and longevity risk.

A more realistic way to calculate replacement rates: Building Block 3 represents the approach that will be used in

a new Web-based planning tool to assist preretirees in their attempt to choose a meaningful replacement rate for

purposes of retirement planning. This resource will be released in 2007 as a free online tool called the Ballpark

E$stimate® Monte Carlo.

The importance of probabilities: Some retirement planning models that, by default, use average values for

longevity, investment, and health costs implicitly are using a 50 percent probability of success. Since most

preretirees will want a higher probability of success, the Ballpark E$stimate® Monte Carlo model also shows results

for 75 and 90 percent probability of success.

Individualized results: In reality, there is no “correct” single replacement rate. Even at a specified probability of

success, an “adequate” replacement rate depends dramatically on the level of retirement expenditures, retirement

age, gender, asset allocation, percentage of annuitization, and other variables detailed in this Issue Brief.

Conversion of the savings needed to a multiple of final earnings that is needed in retirement savings can provide

a clearer picture for some, so the Issue Brief presents that as well (see pages 11, 16, and 29).

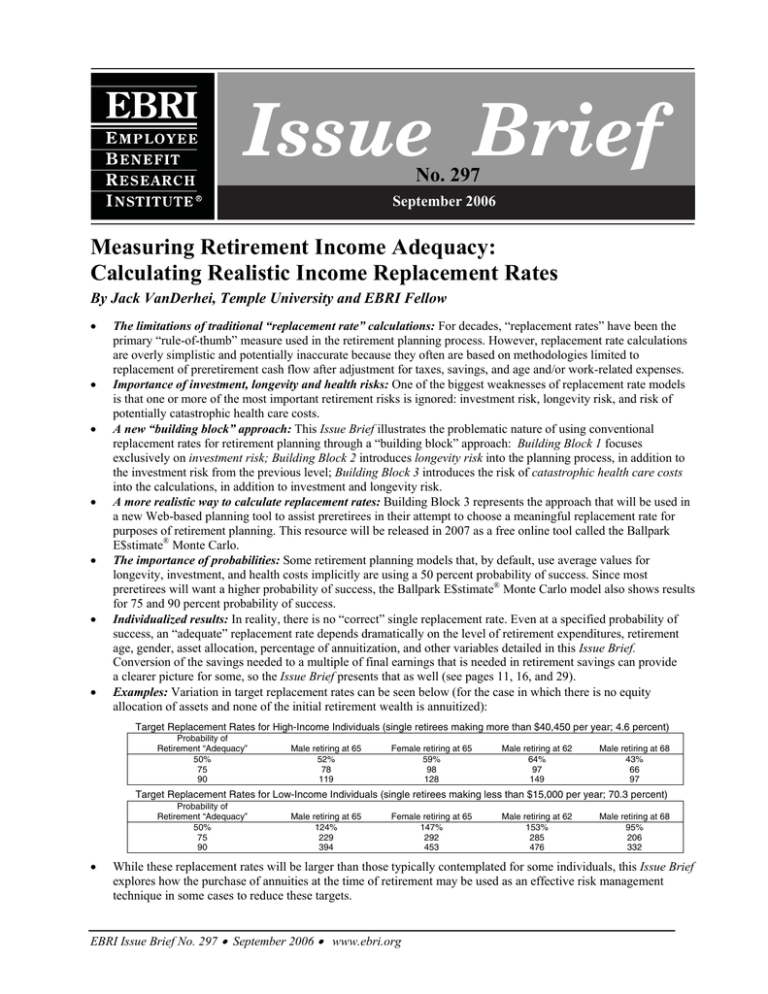

Examples: Variation in target replacement rates can be seen below (for the case in which there is no equity

allocation of assets and none of the initial retirement wealth is annuitized):

Target Replacement Rates for High-Income Individuals (single retirees making more than $40,450 per year; 4.6 percent)

Probability of

Retirement “Adequacy”

50%

75

90

Male retiring at 65

52%

78

119

Female retiring at 65

59%

98

128

Male retiring at 62

64%

97

149

Male retiring at 68

43%

66

97

Target Replacement Rates for Low-Income Individuals (single retirees making less than $15,000 per year; 70.3 percent)

Probability of

Retirement “Adequacy”

50%

75

90

•

Male retiring at 65

124%

229

394

Female retiring at 65

147%

292

453

Male retiring at 62

153%

285

476

Male retiring at 68

95%

206

332

While these replacement rates will be larger than those typically contemplated for some individuals, this Issue Brief

explores how the purchase of annuities at the time of retirement may be used as an effective risk management

technique in some cases to reduce these targets.

EBRI Issue Brief No. 297 • September 2006 • www.ebri.org

Jack VanDerhei, Temple University, is research director of the EBRI Fellows Program. Special thanks to

Craig Copeland, senior research associate at EBRI, for his assistance with this report. Several of the

assumptions used in this report are based on findings published by Paul Fronstin, senior research associate

and director of the health research and education program at EBRI, in “Savings Needed to Fund Health

Insurance and Health Care Expenses in Retirement,” EBRI Issue Brief no. 295, July 2005.

Note: The electronic version of this publication was created using version 6.0 of Adobe® Acrobat.® Those having

trouble opening the pdf document will need to upgrade their computer to Adobe® Reader® 6.0, which can be

downloaded for free at www.adobe.com/products/acrobat/readstep2.html

Table of Contents

Introduction.......................................................................................................................................4

Recent EBRI Research......................................................................................................................5

Methodology.....................................................................................................................................6

Results...............................................................................................................................................8

Building Block 1: Investment Risk Only.................................................................................................... 8

Building Block 2: Investment and Longevity Risk..................................................................................... 9

Building Block 3: Investment, Longevity and Long-Term Care Risk ...................................................... 12

Conclusion ......................................................................................................................................18

References.......................................................................................................................................19

Endnotes .........................................................................................................................................20

Figures

Figure 1, Impact of Initial Retirement Wealth on the Probability of Retirement Income "Adequacy,"

by Equity Allocation. For: Males Retiring at Age 65 in the Lowest Income Category.................... 8

Figure 2, Impact of Initial Retirement Wealth on the Probability of Retirement Income "Adequacy,"

by Equity Allocation. For: Males Retiring at Age 65, Retirement Income Category 2.................... 10

Figure 3, Impact of Initial Retirement Wealth on the Probability of Retirement Income "Adequacy,"

by Equity Allocation. For: Males Retiring at Age 65, Retirement Income Category 3.................... 10

Figure 4, Impact of Initial Retirement Wealth on the Probability of Retirement Income "Adequacy,"

by Equity Allocation. For: Males Retiring at Age 65 in the Highest Income Category................... 11

Figure 5 Impact of Final Earnings Multiple on the Probability of Retirement Income "Adequacy,"

by Retirement Income Category (Assumes 100% Equity Allocation). For: Males Retiring

at Age 65........................................................................................................................................... 11

Figure 6, Replacement Ratios Required for Various Probability Levels of "Adequacy," by Income

Category and Equity Allocation. For: Males Retiring at Age 65 ..................................................... 13

Figure 7, Necessary Replacement Rates for Retirement Income "Adequacy," by Retirement Income

Category and Equity Allocation (Various Probabilities). For: Males Retiring at Age 65 ................ 13

Figure 8, Impact of Replacement Rates on the Probability of Retirement Income "Adequacy," by

Retirement Income Category and Equity Allocation........................................................................ 14

EBRI Issue Brief No. 297 • September 2006 • www.ebri.org

2

Figure 9, Impact of Initial Retirement Wealth on the Probability of Retirement Income "Adequacy,"

by Equity Allocation. For: Males Retiring at Age 65 in the Lowest Income Category ................... 14

Figure 10, Impact of Initial Retirement Wealth on the Probability of Retirement Income "Adequacy,"

by Equity Allocation. For: Males Retiring at Age 65 in the Highest Income Category................... 16

Figure 11, Impact of Final Earnings Multiple on the Probability of Retirement Income "Adequacy,"

by Retirement Income Category (Assumes 100% Equity Allocation and No Annuitization).

For: Males Retiring at Age 65 .......................................................................................................... 16

Figure 12, Impact of Replacement Rates on Probability of "Adequate" Retirement Income, by Income

Category, Equity Allocation, and Rate of Annuitization. For: Males Retiring at Age..................... 17

Figure 13, Impact of Replacement Rates on Probability of "Adequate" Retirement Income, by Rate of

Annuitization (Assumes Lowest Income Category and No Equity Investment).............................. 18

Figure 14, Impact of Replacement Rates on Probability of "Adequate" Retirement Income, by Income

Category, Equity Allocation, and Rate of Annuitization. For: Males Retiring at Age 65................ 22

Figure 15, Impact of Defined Contribution Balance on Probability of "Adequate" Retirement Income,

by Annuitization (Assumes 0% Equity Allocation). For: Males Retiring at Age 65 in the Lowest

Income Category .............................................................................................................................. 23

Figure 16, Impact of Defined Contribution Balance on Probability of "Adequate" Retirement Income,

by Annuitization (Assumes 50% Equity Allocation). For: Males Retiring at Age 65 in the Lowest

Income Category .............................................................................................................................. 23

Figure 17, Impact of Defined Contribution Balance on Probability of "Adequate" Retirement Income,

by Annuitization (Assumes 0% Equity Allocation). For: Males Retiring at Age 65 in the Highest

Income Category .............................................................................................................................. 24

Figure 18, Impact of Defined Contribution Balance on Probability of "Adequate" Retirement Income,

by Annuitization (Assumes 50% Equity Allocation). For: Males Retiring at Age 65 in the Highest

Income Category .............................................................................................................................. 24

Figure 19, Replacement Ratios Required for a 50% Chance of "Adequacy." For: Males Retiring at

Age 65 in the Lowest Income Category ........................................................................................... 25

Figure 20, Replacement Ratios Required for a 75% Chance of "Adequacy." For: Males Retiring at

Age 65 in the Lowest Income Category ........................................................................................... 25

Figure 21, Replacement Ratios Required for a 90% Chance of "Adequacy." For: Males Retiring at

Age 65 in the Lowest Income Category ........................................................................................... 26

Figure 22, Replacement Ratios Required for a 50% Chance of "Adequacy." For: Males Retiring at

Age 65 in the Highest Income Category .......................................................................................... 26

Figure 23, Replacement Ratios Required for a 75% Chance of "Adequacy." For: Males Retiring at

Age 65 in the Highest Income Category .......................................................................................... 27

Figure 24, Replacement Ratios Required for a 90% Chance of "Adequacy." For: Males Retiring at

Age 65 in the Highest Income Category .......................................................................................... 27

Figure 25, Impact of Replacement Rates on Probability of "Adequate" Retirement Income, by Income

Category, Equity Allocation, and Rate of Annuitization. For: Males Retiring at Age 65................ 28

Figure 26, Impact of Final Earnings Multiple on the Probability of Retirement Income "Adequacy,"

by Retirement Income Category (Assumes 100% Equity Allocation and No Annuitization).

For: Males Retiring at Age 65 .......................................................................................................... 29

Figure 27, Impact of Replacement Rates on Probability of "Adequate" Retirement Income, by Income

Category, Equity Allocation, and Rate of Annuitization. For: Females Retiring at Age 65 ............ 30

EBRI Issue Brief No. 297 • September 2006 • www.ebri.org

3

Figure 28, Impact of Replacement Rates on Probability of "Adequate" Retirement Income, by Income

Category, Equity Allocation and Rate of Annuitization. For: Males Retiring at Age 62................. 31

Figure 29, Impact of Replacement Rates on Probability of "Adequate" Retirement Income, by Income

Category, Equity Allocation, and Rate of Annuitization. For: Males Retiring at Age 68................ 32

Figure 30, Replacement Ratios Required for a 50% Chance of "Adequacy." For: Males Retiring at

Age 65, Lowest Income Category .................................................................................................... 33

Figure 31, Replacement Ratios Required for a 75% Chance of "Adequacy." For: Males Retiring at

Age 65 in the Lowest Income Category ........................................................................................... 33

Figure 32, Replacement Ratios Required for a 90% Chance of "Adequacy." For: Males Retiring at

Age 65 in the Lowest Income Category ........................................................................................... 34

Figure 33, Replacement Ratios Required for a 50% Chance of "Adequacy." For: Males Retiring at

Age 65 in the Highest Income Category........................................................................................... 34

Figure 34, Replacement Ratios Required for a 75% Chance of "Adequacy." For: Males Retiring at

Age 65 in the Highest Income Category........................................................................................... 35

Figure 35, Replacement Ratios Required for a 90% Chance of "Adequacy." For: Males Retiring at

Age 65 in the Highest Income Category........................................................................................... 35

Introduction

For decades, “replacement rates” have been the primary measure used in the retirement planning process.

This is defined as the annual amount of an individual’s retirement income, divided by his or her yearly

earnings just prior to retiring. For instance, someone who retires from a job with a $100,000 annual salary

and has $75,000 a year in retirement income has a “replacement rate” of 75 percent.

A “Part 1” article by EBRI (VanDerhei, EBRI Notes, September 2004) reviewed how these rates have

traditionally been used to establish minimum targets for future retirees by calculating the amount needed to

provide the same amount of after-tax income in retirement as that received prior to retirement after adjusting

for differences in savings, age, and work-related expenses. Results from one of the most commonly cited

studies indicated that for a one wage-earner family retiring at 65 with a spouse age 62, the target replacement

rates were between 75–89 percent (depending on income) in 2004 (Alford, Farnen, and Schachet, 2004).

Previous research on projected replacement rates found that typical 401(k) participants at very large

employers were well positioned to replace 85–95 percent of preretirement income when current Social

Security and existing profit-sharing and defined benefit plans are taken into account (Steinberg and Lucas,

2004). However, the likely adequacy of these income replacement rates is a function of what type of postretirement health care coverage a worker has from a previous employer.

Steinberg and Lucas subtracted retiree medical costs net of subsidies from retirement income levels to

determine a “net” replacement income ratio, reflecting the percentage of preretirement income available to

meet all needs other than medical. As a result, the overall average replacement ratio for their analysis drops

from 95 percent under the high medical coverage assumption to 83 percent under the medium assumption

and 80 percent under the low medical coverage assumption. This is true for employees retiring at a “normal”

retirement age of 65, and who are relying primarily on Medicare for their health care benefits. Employees

retiring at an earlier age will experience even larger financial modifications. While these techniques provide

EBRI Issue Brief No. 297 • September 2006 • www.ebri.org

4

simple rule-of-thumb measures for the retirement planning process,1 there have been recent attempts to

conceptually redefine retirement income adequacy (Schieber, 1996 and 1998). Moreover, it is important to

understand that the current methodologies (however modified) only solve for the amount of money needed to

provide the same annual cash flow available prior to retirement (albeit adjusted for taxes, savings, age and/or

work-related expenses and, in some cases, the cost of post-retirement health care), and ignore some or all of

the risks of longevity, investment of retirement assets, and catastrophic health care costs (such as a prolonged

stay in a nursing home without the benefit of long-term care insurance).

Recent EBRI Research

EBRI has recently completed a simulation model—the EBRI/ERF Retirement Security Projection

Model® (RSPM)—that incorporates a wide range of data in order to produce a far more inclusive and refined

projection of likely retirement income. The model projects defined benefit accruals, defined contribution,

cash balance, and individual retirement account (IRA) balances, Social Security income, and net housing

equity for Americans born between 1936 and 1965, inclusive (VanDerhei and Copeland, 2003). At

retirement age, the model simulates 1,000 alternative life paths for each family unit to assess whether the

retirement accumulations will be sufficient to pay both basic (deterministic) and health-related (stochastic)

expenditures for the simulated life-path, or whether additional outside savings would be required to prevent

deficits in retirement.

The purpose of this Issue Brief is to show the results obtained by utilizing the concepts already adopted

by RSPM for the entire population of certain age cohorts and apply them to stylized examples. These results

will provide useful information for individuals attempting to include such crucial factors as longevity,

investment, and health care risk into their retirement planning process. In 2007, EBRI plans to roll out

Ballpark E$timate® Monte Carlo2⎯ a companion Web site to its current Ballpark E$stimate® retirement

planning worksheet⎯that will allow preretirees to determine the appropriate replacement rate target before

attempting to determine their desired savings rates.

After a brief review of the methodology, this Issue Brief takes the results of the new model and simulates

what replacement rates are required to provide “adequate” retirement income 50 percent, 75 percent, and

90 percent of the time.3 Depending on which of the risk elements are introduced into the planning process

and what statistical confidence is desired, the new replacement rate targets will be seen to be larger (in some

cases considerably so) than the previous benchmarks.

Moreover, the huge variation in the range of replacement rate targets—depending on the individual's

income, degree of annuitization for initial retirement wealth, and the asset allocation of the post-retirement

investments—call into question whether the use of a single rule-of-thumb measure is realistic to use in the

retirement planning process. Given the huge variation of individual circumstances (such as age, health, and

income) and the complexity of retirement risks that need to be dealt with—such as longevity (addressed

through annuitization of assets), old-age infirmity (addressed through long-term care insurance), and asset

preservation (addressed through investment allocation)—a simple one-size-fits-all replacement rate will not

work for most Americans.

The results of this model reveal, in many cases, the sobering (if not staggering) amounts of money

needed to provide a reasonable high chance of being able to afford retirement. However, they also show the

positive results that can be obtained by annuitizing assets in retirement to protect against the risk of

longevity. In this regard, the model points not only to a more realistic size of the retirement income problem

but also ways that individuals can begin to deal with it.

EBRI Issue Brief No. 297 • September 2006 • www.ebri.org

5

Methodology

Although the Web-based version of the Ballpark E$timate® Monte Carlo will allow individuals4 to input

their specific information, for purposes of illustrating its capacities in this Issue Brief, we start with stylized

situations whereby each of the following variables are specified:5

• Gender.

• Retirement age.

• Equity allocation after retirement.

• Percentage of initial retirement wealth to be annuitized at retirement.6

• Preretirement income.

• Initial Social Security benefit.

• Defined benefit amount (if any).7

At this point the model user is given a choice of:

1. Specifying the amount of initial retirement wealth available8 and having the program simulate a

probability of having "adequate" retirement income (defined below); or

2. Specifying the probability of having "adequate" retirement income and having the program simulate

the amount of initial retirement wealth needed.

In either case, the initial retirement wealth can be specified as (a) a dollar amount, (b) a multiple of final

earnings, or (c) a replacement ratio.

Once the initial values are chosen, the program runs a large number of simulated life paths9 that include

the following calculations on an annual basis for either the specified level of initial retirement wealth in the

first option above, or an entire vector of initial retirement wealth balances in the second option:

1. Simulate the annual expenditures and the annual rate of return.

2. Calculate the Social Security benefit, the annuitized portion of the initial retirement wealth (if any)

and the amount paid from the defined benefit plan (if any) for the year.

3. If the sum of the simulated investment income and amounts paid from Social Security, the annuitized

portion of the initial retirement wealth (if any) and the defined benefit plan (if any) exceed the

simulated expenditures for the year, any excess amounts are invested. If the sum of the simulated

investment income and amounts paid from Social Security, the annuitized portion of the initial

retirement wealth (if any) and the defined benefit plan (if any) is less than the simulated expenditures

for the year, any difference is removed from the accumulated retirement wealth.

4. If the accumulated retirement wealth is simulated to turn negative, it is assumed that loans are taken

out to continue consumption at the specified levels.10

At the end of the simulated life path,11 the program determines whether there is a non-negative amount

left in the retirement wealth balance. If so, there is “adequate” retirement income for this life path. After the

entire range of simulated life paths have been run for each level of initial retirement wealth, a probability of

“adequate” retirement income is computed. This value is defined as the percentage of simulated life paths

with “adequate” retirement income.

Replacement rates are computed by taking each of the initial retirement wealth levels and assuming they

have been annuitized at retirement age at current annuity purchase prices. The initial value of the assumed

initial Social Security annual benefit (before any COLAs) is added to this value.12 The sum of these values is

divided by the assumed terminal earnings to produce the replacement rates. Linear interpolation is used to

estimate the replacement ratio required to produce “adequate” retirement income for three different levels:

1. 50 percent of the time (this has about the same result as using averages for life expectancy,

investment experience, and health care costs, as often done in some applications).

2. 75 percent of the time.

3. 90 percent of the time.

EBRI Issue Brief No. 297 • September 2006 • www.ebri.org

6

Although users of the Web version of the model will be allowed to input their own assumptions with

respect to investment income, for purposes of illustration, this Issue Brief assumes just two asset classes: (1)

a diversified equity portfolio with a stochastic return with a real mean of 6.5 percent and a 100 basis point

investment expense, and (2) a non-equity option that is chosen to be deterministic with a net real rate of

return equal to 2.5 percent.13

The model allows users to specify their inflation assumptions for several components, but this Issue Brief

assumes that general inflation will be 2.8 percent per annum and that inflation for health care components

(unless otherwise denoted) will be 7 percent.

Retirement expenditure data may be input by the users but guidance will be provided based on four

stylized examples with different combinations of preretirement income, Social Security benefits, and

retirement expenditures. For purposes of the Issue Brief, retirement expenditures are based on total

expenditures net of health care (which is calculated separately) for the following four retirement income

categories:

1.

2.

3.

4.

Those making less than $15,000 a year (70.3 percent of single retirees based on the 2000

Consumer Expenditure Study14).

Those making at least $15,000 but less than $30,000 (20.6 percent of single retirees).

Those making at least $30,000 but less than $40,450 (4.5 percent of single retirees).

Those making more than $40,450 (4.6 percent of single retirees).

The 2006 values for retirement expenditures net of health care vary from $15,969 for the lowest income

category to $38,097 for the highest income category. 15

Initial Social Security benefits and terminal wages may be input by the users,16 but for purposes of the

Issue Brief these amounts were calculated for the four income categories above from 2004 Current

Population Survey (CPS) data and brought forth to 2006 by increasing the amounts by 6.9 percent. Early and

late retirement assumes terminal wages are adjusted by 3.9 percent per year and that the appropriate actuarial

modifications were made to Social Security benefits.

Nursing home assumptions are coded into the model with separate simulations for the probability and

severity of each event. The probability of being admitted to a nursing home is simulated each year as a

function of age and previous health care needs category based on results from the 1999 National Nursing

Home Survey (NNHS). The length of stay is simulated based on the duration of stays at nursing homes found

in the NNHS. The monthly cost was based on a figure of $3,947 and adjusted to 2006 for inflation.17 Home

health care assumptions were simulated in a similar fashion, with the monthly cost based on a figure of

$1,280 and adjusted to 2006 for inflation.18

Other health care assumptions are bifurcated based on Medicare eligibility. If the individual is Medicareeligible for any portion of the simulated life path, then the other health care expenditures in that year are

equal to the sum of the premiums for Medigap and Medicare Part B plus the simulated drug cost. The annual

Medigap premium was assumed to be $1,755 adjusted for future inflation at 7 percent, and the Medicare part

B premium was assumed to be $1,062 adjusted for future inflation at 3.9 percent (Fronstin, 2006). The

simulated drug cost was based on age-specific quartiles of drug expenses adjusted for Medicare Part D

premiums and benefits and adjusted for inflation at 8.6 percent per year (Fronstin, 2006). For ages in the

simulated life path when the individual is not Medicare eligible, other health care expenditures are equal to

an HMO (health maintenance organization) cost that is age-specific and adjusted for inflation at the general

healthcare inflation rate.19

Taxes are based on federal income taxes for a single taxpayer using 2005 tax rates. The amount of Social

Security benefits included in taxable income as a result of the 1983 amendments are coded into the program

which will result in increased amounts of retirement income needed for future cohorts to pay for the same

after tax amount of consumption in retirement. For purposes of this Issue Brief, it is assumed that all

retirements take place in the year 2006.20

EBRI Issue Brief No. 297 • September 2006 • www.ebri.org

7

Results

This section illustrates the problematic nature of using conventional replacement rates for retirement

planning through a “building block” approach:

Building Block 1 focuses exclusively on investment risk. As retirees increase their equity allocation, they

could potentially benefit from a higher expected investment income; however, they will also face more

volatility in annual results and a larger potential downside. The calculations presented in this approach use

average longevity as well as average long-term care costs for the retirees.

Building Block 2 introduces longevity risk into the planning process, in addition to the investment risk

from the previous level. In addition to providing the retiree with decisions with respect to investments, this

also provides the opportunity to mitigate overall risk through the purchase of immediate annuities at

retirement age (as noted earlier, actual annuity purchase prices are utilized in the calculations). The

calculations presented in this approach use average long-term care costs for the retirees.

Building Block 3 introduces the risk of health care costs into the calculations. This provides the

framework necessary to evaluate the potential benefits of long-term care insurance as a way of increasing

overall probability of retirement adequacy.21

Building Block 1: Investment Risk Only

Figure 1 shows the results of the simulations for a male in the lowest income category retiring at age 65

and living to exactly age 82. If this retiree were to retire with an account balance of $300,000 and chose an

asset allocation that included no equities, he would have virtually no chance of having “adequate” retirement

income. If the equity allocation were increased to 25 percent, the probability of success increases

substantially to 43 percent. Additional increases in the equity allocation result in larger probabilities of

adequate retirement income: 50 percent equities yields a 52 percent probability of success, 75 percent

equities translates to a 56 percent probability of success, and an all-equity portfolio would provide

“adequate” retirement income in 58 percent of the simulated runs.

Figures 2 through 4 provide similar results for males retiring at age 65 in income categories 2 though 4 (lower

to highest), respectively. Given that expenditures are assumed to increase with income, each successive income

Figure 1

Impact of Initial Retirement Wealth on the Probability of

Retirement Income "Adequacy," by Equity Allocation

For: Males Retiring at Age 65 in the Lowest Income Category

Option: Building Block 1 (investment income stochastic, longevity and health care expenses

Probability of Adequacy

100%

90%

80%

Equity Allocation

70%

60%

50%

40%

30%

20%

0%

25%

50%

75%

100%

10%

$1 $

00 0

$2 ,00

00 0

$3 ,000

00

$4 ,00

00 0

$5 ,000

00

$6 ,00

00 0

$7 ,000

00

$8 ,00

00 0

$9 ,000

0

$1 0,0

, 0 00

0

$1 0,0

, 1 00

0

$1 0,0

, 2 00

0

$1 0,0

, 3 00

0

$1 0,0

, 4 00

0

$1 0,0

, 5 00

0

$1 0,0

, 6 00

0

$1 0,0

, 7 00

0

$1 0,0

, 8 00

0

$1 0,0

, 9 00

0

$2 0,0

, 0 00

00

,0

00

0%

Initial Retirement Wealth

Source: Employee Benefit Research Inst it ute, Ballpark E$timate® M onte Carlo, August 2006 version.

EBRI Issue Brief No. 297 • September 2006 • www.ebri.org

8

category will require a larger initial retirement wealth for the same probability of success. Conversely, the

probability of adequate retirement income will decrease for a given initial retirement wealth and equity

allocation as the income category increases. The following table demonstrates this:

Probability of Adequate Retirement Income for Building Block 1

for a Male Retiring at Age 65 With an Account Balance of $300,000

Equity Allocation

Retirement Income Category

0%

25%

50%

75%

100%

1 (Lowest)

0%

43%

52%

56%

58%

2

0

29

47

51

51

3

0

18

39

48

47

4 (Highest)

0

0

4

17

23

The higher expected return but larger volatility of equity returns is demonstrated in these graphs. In each

case, a 50 percent probability of adequate retirement income can be provided for a smaller initial retirement

wealth when the assets are invested 100 percent in equities. However, the increased volatility of equities

causes these lines to cross, and if a retiree desired a 90 percent chance of adequate retirement income, the

100 percent equity allocation would require the largest initial retirement wealth.

Some financial planners will attempt to simplify the threshold needed for adequate retirement income by

converting the initial retirement wealth to a multiple of final earnings. Figure 5 demonstrates the results of

restating the previous figures into this metric for the highest and lowest income categories for 100 percent

equity allocations. If the retiree were in the highest income group and desired a 75 percent chance of

adequate retirement income, he would require an initial retirement wealth of 4.2 times final earnings if he

were to invest 100 percent in equities. However, if the same equity allocation were chosen by a low-income

retiree, he would require an initial retirement wealth of 12.1 times final earnings.

Figure 6 demonstrates the probability of retirement adequacy expected for each replacement rate for the

highest and lowest income categories for both zero and 100 percent equity allocations (Figure 7).22 If a highincome retiree were simply interested in a 50 percent probability of adequacy, he would require a 48 percent

replacement rate if he invested 100 percent in equities and a 58 percent replacement if no assets were

invested in equities. The same figures jump to 117 percent (all equity) and 146 percent (no equity) for the

low-income retiree. If, instead, a male retiring at age 65 desired a 90 percent probability of adequate

retirement income, the necessary replacement rate would be 66 percent for a high-income retiree with no

investment in equities and 87 percent with 100 percent investment in equities. His low-income counterpart

would require a 185 percent replacement rate with no equity investments and a 232 percent replacement rate

with 100 percent investment in equities.

Figure 8 illustrates the probable levels of adequacy and equity allocations with respect to the required

replacement ratios.

Building Block 2: Investment and Longevity Risk

This approach relaxes the assumption that the retiree will live to the average life expectancy (the point at

which 50 percent of those reaching the retirement age are still alive and 50 percent have passed⎯currently

82 for men and 85 for women at age 65) and introduces longevity risk. Figure 9 provides the same analysis

for a low-income retiree as was presented in Figure 1, although when longevity risk is introduced there will

be opportunities for those with low initial retirement wealth to have a non-zero probability of adequacy

(meaning those who are simulated to die within a few years of retirement before they have exhausted their

initial retirement wealth). However, the additional longevity risk requires larger initial retirement wealth for

those seeking a 90 percent probability of retirement adequacy. In Figure 1, a zero equity allocation would

require approximately $500,000 in initial retirement wealth, whereas in Figure 9, the same probability would

need approximately a $600,000 balance. Figure 10 shows similar results for a high-income retiree.

EBRI Issue Brief No. 297 • September 2006 • www.ebri.org

9

Figure 2

Impact of Initial Retirement Wealth on the Probability of

Retirement Income "Adequacy," by Equity Allocation

For: Males Retiring at Age 65, Retirement Income Category 2

Option: Building Block 1 (investment income stochastic, longevity and health care expenses deterministic)

100%

90%

80%

Probability of Adequacy

Equity Allocation

70%

0%

60%

25%

50%

50%

75%

40%

100%

30%

20%

10%

$0

$1

00

,0

00

$2

00

,0

00

$3

00

,0

00

$4

00

,0

00

$5

00

,0

00

$6

00

,0

00

$7

00

,0

00

$8

00

,0

00

$9

00

,0

00

$1

,0

00

,0

00

$1

,1

00

,0

00

$1

,2

00

,0

00

$1

,3

00

,0

00

$1

,4

00

,0

00

$1

,5

00

,0

00

$1

,6

00

,0

00

$1

,7

00

,0

00

$1

,8

00

,0

00

$1

,9

00

,0

00

$2

,0

00

,0

00

0%

Initial Retirement Wealth

Source: Employee Benefit Research Institute, Ballpark E$timate® Monte Carlo, August 2006 version.

Figure 3

Impact of Initial Retirement Wealth on the Probability of

Retirement Income "Adequacy," by Equity Allocation

For: Males Retiring at Age 65, Retirement Income Category 3

Option: Building Block 1 (investment income stochastic, longevity and health care expenses deterministic)

100%

90%

80%

Probability of Adequacy

Equity Allocation

70%

0%

60%

50%

40%

25%

50%

75%

100%

30%

20%

10%

$0

$1

00

,0

00

$2

00

,0

00

$3

00

,0

00

$4

00

,0

00

$5

00

,0

00

$6

00

,0

00

$7

00

,0

00

$8

00

,0

00

$9

00

,0

00

$1

,0

00

,0

00

$1

,1

00

,0

00

$1

,2

00

,0

00

$1

,3

00

,0

00

$1

,4

00

,0

00

$1

,5

00

,0

00

$1

,6

00

,0

00

$1

,7

00

,0

00

$1

,8

00

,0

00

$1

,9

00

,0

00

$2

,0

00

,0

00

0%

Initial Retirement Wealth

Source: Employee Benefit Research Institute, Ballpark E$timate® Monte Carlo, August 2006 version.

EBRI Issue Brief No. 297 • September 2006 • www.ebri.org

10

Figure 4

Impact of Initial Retirement Wealth on the Probability of

Retirement Income "Adequacy," by Equity Allocation

For: Males Retiring at Age 65 in the Highest Income Category

Option: Building Block 1 (investment income stochastic, longevity and health care expenses deterministic)

100%

90%

80%

Probability of Adequacy

Equity Allocation

70%

0%

60%

25%

50%

50%

75%

40%

100%

30%

20%

10%

$0

$1

00

,0

00

$2

00

,0

00

$3

00

,0

00

$4

00

,0

00

$5

00

,0

00

$6

00

,0

00

$7

00

,0

00

$8

00

,0

00

$9

00

,0

00

$1

,0

00

,0

00

$1

,1

00

,0

00

$1

,2

00

,0

00

$1

,3

00

,0

00

$1

,4

00

,0

00

$1

,5

00

,0

00

$1

,6

00

,0

00

$1

,7

00

,0

00

$1

,8

00

,0

00

$1

,9

00

,0

00

$2

,0

00

,0

00

0%

Initial Retirement Wealth

Source: Employee Benefit Research Institute, Ballpark E$timate® Monte Carlo, August 2006 version.

Figure 5

Impact of Final Earnings Multiple on the Probability of

Retirement Income "Adequacy," by Retirement Income Category

(Assumes 100% Equity Allocation)

For: Males Retiring at Age 65

Option: Building Block 1 (investment income stochastic, longevity and health care expenses deterministic)

100%

90%

Probability of Adequacy

80%

70%

Low Income

60%

High Income

50%

40%

30%

20%

10%

0%

-

5

10

15

20

25

30

35

40

Final Earnings Multiple

Source: Employee Benefit Research Institute, Ballpark E$timate® Monte Carlo, August 2006 version.

EBRI Issue Brief No. 297 • September 2006 • www.ebri.org

11

Figure 11 provides similar analysis in terms of final earnings multiples and Figure 12 demonstrates the

impact of replacement rates on the probability of adequate retirement income by income category, equity

allocation and rate of annuitization.

Figures 13 and 14 demonstrate the value of purchasing an immediate annuity at retirement age for those

interested in a high probability of retirement income adequacy. Assuming a low-income male retiring at age

65 with no equity investments desires a 90 percent chance of retirement income adequacy, the necessary

replacement rate without an annuity would be approximately 241 percent. If 25 percent of the initial

retirement wealth were annuitized immediately, the replacement rate could be reduced to approximately

213 percent. Additional increases in the percentage of account balances annuitized result in further drops in

the necessary replacement rate: 50 percent annuitization would require a replacement rate of 188 percent,

75 percent annuitization would require approximately 177 percent and 100 percent annuitization would

require approximately 166 percent.

Although Figure 13 was a convenient educational device to illustrate how annuitization may help those

desiring higher probabilities of adequate retirement income to achieve it with lower replacement rates, it is

important to note that in reality the optimal degree of annuitization will vary by income category as well as

asset allocation.23 Figures 15 and 16 demonstrate how the optimal degree of annuitization varies by asset

allocation for a low-income individual. In Figure 15, a retiree with no equity allocation would be better off

annuitizing if he or she desired more than a 40 percent chance of adequate retirement income; however, in

Figure 16, a retiree investing 50 percent of the initial retirement wealth in equities would need at least a

55 percent chance of adequate retirement income as a target before annuitization would be useful. Figures 17

and 18 show similar results for high-income retirees.

The tradeoffs between equity allocation and degree of annuitization are shown directly for various

probabilities of adequacy in Figures 19, 20, and 21 for those in the lowest income category. Similar analyses

are provided for the highest income category in Figures 22, 23, and 24.

Building Block 3: Investment, Longevity, and Long-Term Care Risk

For purposes of retirement planning, it is typically assumed that most, if not all, of the retiree expenses

will behave in a predictable fashion. For example, in this model, it is assumed that knowing one's retirement

income, age, and real estate status, one can make reasonable predictions regarding many of the expenditures

in retirement. However, one major exception to this deals with long-term care costs. This section adds in the

third of these “building blocks” to try to deal with a situation that could prove financially catastrophic to a

retirement plan that otherwise has dealt adequately with investment and longevity risk. Although this Issue

Brief does not attempt to provide private market alternatives to dealing with this risk, as it did with longevity

risk in the previous section, plans are under way to include such options in the Web-based version of this

model.

Figure 25 demonstrates the relationship between replacement rates and probability of retirement

adequacy by equity allocation and annuitization for each of the four income categories for a male retiring at

age 65. Figure 26 shows a similar relationship in terms of final earnings multiples for the highest and lowest

income category. The following provides a simple example of the impact of adding long-term care as a

stochastic variable for a retiree in the highest income category, assuming no equity allocation and none of the

initial retirement wealth is annuitized:

Replacement Rate Needed Under:

Probability of Adequate

Retirement Income

50%

75%

90%

Building Block 2

50%

68

87

Building Block 3

52%

78

119

Difference Between

the Two:

2%

10

32

EBRI Issue Brief No. 297 • September 2006 • www.ebri.org

12

Figure 6

Replacement Ratios Required for Various Probability Levels

of "Adequacy," by Income Category and Equity Allocation

For: Males Retiring at Age 65

Option: Building Block 1 (investment income stochastic, longevity and health care expenses deterministic)

250%

Equity Level

Lowest Income, 0% Equity

Lowest Income, 100% Equity

200%

Highest Income, 0% Equity

Replacement Rate

Highest Iincome, 100% Equity

150%

100%

50%

0%

50%

75%

90%

Probablity of Retirement Income "Adequacy"

Source: Employee Benefit Research Institute, Ballpark E$timate® Monte Carlo, August 2006 version.

Figure 7

Necessary Replacement Rates for Retirement Income "Adequacy," by

Retirement Income Category and Equity Allocation (Various Probabilities)

For: Males Retiring at Age 65

Option: Building Block 1 (investment income stochastic, longevity and health care expenses deterministic)

Equity Allocation3

Probability of Retirement

1

Income "Adequacy"

50%

75%

90%

50%

75%

90%

50%

75%

90%

50%

75%

90%

Retirement

2

Income Category

1

2

3

4

0%

146%

156

185

75

80

96

61

65

80

57

59

66

25%

131%

150

175

71

78

90

61

66

75

53

58

64

50%

124%

148

178

67

78

93

58

67

77

51

58

69

75%

120%

153

204

66

82

103

55

69

84

48

61

73

100%

117%

166

232

65

88

119

56

73

103

48

63

87

Source: Employee Benefit Research Institute, Ballpark E$timate ® Monte Carlo, August 20, 2006 version.

See text for definition of retirement income adequacy (90% is most likely to have adequate income in retirement).

2

See text for definition of retirement income category (1 is lowest, 4 is highest).

3

Percentage of retirement assets invested in stocks (equities).

1

EBRI Issue Brief No. 297 • September 2006 • www.ebri.org

13

Figure 8

Impact of Replacement Rates on the Probability of Retirement Income

"Adequacy," by Retirement Income Category and Equity Allocation

For: Males Retiring at Age 65

Option: Building Block 1 (investment income stochastic, longevity and health care expenses deterministic)

100%

90%

Probability of Adequacy

80%

70%

Lowest Income, No Equity

60%

Lowest Income, All Equity

50%

Highest Income, All Equity

40%

Highest Income, No Equitiy

30%

20%

10%

0%

0%

100%

200%

300%

400%

500%

600%

700%

Replacement Rate

®

Source: Employee Benefit Research Institute, Ballpark E$timate Monte Carlo, August 2006 version.

Figure 9

Impact of Initial Retirement Wealth on the Probability of

Retirement Income "Adequacy," by Equity Allocation

For: Males Retiring at Age 65 in the Lowest Income Category

Option: Building Block 2 (investment income and longevity stochastic, health care expenses deterministic)

100%

90%

Probability of Adequacy

80%

70%

Equity Allocation

60%

50%

0%

25%

50%

40%

30%

75%

100%

20%

10%

$0

$1

00

,0

00

$2

00

,0

00

$3

00

,0

00

$4

00

,0

00

$5

00

,0

00

$6

00

,0

00

$7

00

,0

00

$8

00

,0

00

$9

00

,0

00

$1

,0

00

,0

00

$1

,1

00

,0

00

$1

,2

00

,0

00

$1

,3

00

,0

00

$1

,4

00

,0

00

$1

,5

00

,0

00

$1

,6

00

,0

00

$1

,7

00

,0

00

$1

,8

00

,0

00

$1

,9

00

,0

00

$2

,0

00

,0

00

0%

Initial Retirement Wealth

Source: Employee Benefit Research Institute, Ballpark E$timate® Monte Carlo, August 2006 version.

EBRI Issue Brief No. 297 • September 2006 • www.ebri.org

14

Similar analyses are presented for females retiring at age 65 in Figure 27. The following is a simple

summary of the impact of the gender differentials. In each case, it is assumed there is no equity allocation

and none of the initial retirement wealth is annuitized:

Lowest-Income Category

Replacement Rate Needed for:

Probability of Adequate

Retirement Income

Male

Female

50%

124%

147%

75%

229

292

90%

394

453

Highest-Income Category

Replacement Rate Needed for:

Probability of Adequate

Retirement Income

Male

Female

50%

52%

59%

75%

78

98

90%

119

128

The impact of early retirement on replacement rates is explored in Figure 28. In this case, a male is

assumed to retire at age 62, take a permanently subsidized early retirement benefit from Social Security, and

pay the cost of health coverage himself until he is eligible for Medicare at age 65. Figure 29 shows the

impact of late retirement by analyzing the relationship between replacement rates and probability of adequate

retirement income for a male retiring at age 68. In this case, we assume that initial receipt of Social Security

benefits is delayed until retirement age.

The following is a simple summary of the impact of various retirement ages for males. In each case we

assume there is no equity allocation and none of the initial retirement wealth is annuitized:

Highest-Income Category

Replacement Rate Needed Under:

Probability of Adequate

Retirement Income

50%

75%

90%

Male, 65

52%

78

119

Male, 62

64%

97

149

Male, 68

43%

66

97

Lowest-Income Category

Replacement Rate Needed Under:

Probability of Adequate

Retirement Income

50%

75%

90%

Male, 65

124%

229

394

Male, 62

153%

285

476

Male, 68

95%

206

332

The tradeoffs between equity allocation and degree of annuitization are shown directly for various

probabilities of adequacy in Figures 30, 31, and 32 for those in the lowest income category. Similar analyses

are provided for the highest income category in Figures 33, 34, and 35.

EBRI Issue Brief No. 297 • September 2006 • www.ebri.org

15

Figure 10

Impact of Initial Retirement Wealth on the Probability of

Retirement Income "Adequacy," by Equity Allocation

For: Males Retiring at Age 65 in the Highest Income Category

Option: Building Block 2 (investment income and longevity stochastic, health care expenses deterministic)

100%

90%

Probability of Adequacy

80%

70%

60%

Equity Allocation

50%

0%

25%

40%

50%

30%

75%

100%

20%

10%

$$1

00

,0

00

$2

00

,0

00

$3

00

,0

00

$4

00

,0

00

$5

00

,0

00

$6

00

,0

00

$7

00

,0

00

$8

00

,0

00

$9

00

,0

00

$1

,0

00

,0

00

$1

,1

00

,0

00

$1

,2

00

,0

00

$1

,3

00

,0

00

$1

,4

00

,0

00

$1

,5

00

,0

00

$1

,6

00

,0

00

$1

,7

00

,0

00

$1

,8

00

,0

00

$1

,9

00

,0

00

$2

,0

00

,0

00

0%

Initial Retirement Wealth

®

Source: Employee Benefit Research Institute, Ballpark E$timate Monte Carlo, August 2006 version.

Figure 11

Impact of Final Earnings Multiple on the Probability of

Retirement Income "Adequacy," by Retirement Income Category

(Assumes 100% Equity Allocation and No Annuitization)

For: Males Retiring at Age 65

Option: Building Block 2 (investment income and longevity stochastic, health care expenses deterministic)

100%

90%

Probability of Adequacy

80%

70%

Low Income

60%

High Income

50%

40%

30%

20%

10%

0%

0

10

20

30

40

50

60

70

80

Final Earnings Multiple

®

Source: Employee Benefit Research Institute, Ballpark E$timate Monte Carlo, August 2006 version.

EBRI Issue Brief No. 297 • September 2006 • www.ebri.org

16

50%

50

50

50

50

75%

75

75

75

75

90%

90

90

90

90

2

0%

25

50

75

100

0%

25

50

75

100

0%

25

50

75

100

% of Equity

Investment

0%

25

50

75

100

0%

25

50

75

100

0%

25

50

75

100

65%

62

59

55

55

90

81

78

80

78

120

108

105

105

117

0%

122%

111

105

101

99

178

157

151

146

142

241

213

209

219

237

65%

61

59

57

56

83

79

75

74

75

104

101

98

98

105

25%

119%

113

105

101

100

158

151

143

143

144

213

194

182

195

213

63%

61

59

59

57

81

78

74

74

73

98

93

94

89

91

63%

61

61

59

58

77

74

74

71

72

92

88

86

85

88

Annuitization Level

50%

75%

114%

113%

112

112

105

108

106

109

103

106

151

144

146

141

140

134

139

136

141

134

188

177

180

172

178

155

179

160

179

167

62%

61

61

61

60

74

72

72

71

70

87

85

82

82

80

100%

112%

111

110

110

109

137

137

130

132

133

166

160

153

156

153

4

Income

Category

3

50%

50

50

50

50

75%

75

75

75

75

90%

90

90

90

90

Probability

of Adequacy

50%

50

50

50

50

75%

75

75

75

75

90%

90

90

90

90

0%

25

50

75

100

0%

25

50

75

100

0%

25

50

75

100

% of Equity

Investment

0%

25

50

75

100

0%

25

50

75

100

0%

25

50

75

100

50%

46

42

41

40

68

59

58

55

57

87

76

76

78

86

0%

56%

52

49

47

47

75

69

65

64

66

102

91

87

91

105

48%

45

44

42

42

60

57

55

54

56

74

72

67

70

75

25%

55%

52

50

49

48

71

67

63

63

65

91

83

80

83

88

47%

46

43

43

42

57

55

53

53

53

67

66

63

63

66

Annuitization Level

50%

54%

52

51

50

49

67

63

61

62

62

79

76

75

75

76

Option: Building Block 2 (investment income and longevity stochastic, health care expenses deterministic)

Source: Employee Benefit Research Institute, Ballpark E$timate ® Monte Carlo, August 2006 version.

Probability

of Adequacy

50%

50

50

50

50

75%

75

75

75

75

90%

90

90

90

90

For: Males Retiring at Age 65

47%

45

45

44

44

55

53

51

53

51

63

61

59

59

59

75%

53%

52

51

51

50

63

63

62

60

60

75

74

72

71

71

46%

46

46

45

45

52

52

51

51

51

58

58

58

58

58

100%

52%

52

52

52

51

62

61

60

60

59

72

71

69

69

67

Figure 12

Impact of Replacement Rates on Probability of "Adequate" Retirement Income, by Income Category, Equity Allocation, and Rate of Annuitization

Income

Category

1

17

Figure 13

Impact of Replacement Rates on Probability of

"Adequate" Retirement Income, by Rate of Annuitization

(Assumes Lowest Income Category and No Equity Investment)

Option: Building Block 2 (investment income and longevity stochastic, health care expenses deterministic)

100%

90%

Probability of Adequacy

80%

70%

0% Annuitization

60%

25% Annuitization

50%

50% Annuitization

40%

75% Annuitization

30%

100% Annuitization

20%

10%

0%

0%

100%

200%

300%

400%

500%

600%

700%

Replacement Rate

®

Source: Employee Benefit Research Institute, Ballpark E$timate Monte Carlo, August 2006 version.

Conclusion

Most Americans have always been on their own when it comes to savings and the ability to retire well.

Since 1937, Social Security has provided a base level of income for those workers who reached retirement

age, became disabled, or their survivors. With an average income replacement rate around 40 percent, Social

Security was never designed to be the sole source of income. The Internet age for the first time makes

savings planning tools readily available to all individuals. All workers can open an individual retirement

account, and savings tools can help them determine how much they need to save. The same is true for

workers who have a 401(k) or similar savings plan at work.

It has always been important for most employees or their advisors to be able to construct a savings plan

for retirement that will allow them to determine, inter alia, the appropriate savings rates at an early age.

There are various financial programs and calculators available to assist employees with this process, but

many of them require the user to input a desired replacement rate or its equivalent. Although there have been

many studies that provide readily available rules of thumb, often these are based on methodologies limited to

replacement of preretirement cash flow after adjustment for taxes, savings and age and/or work-related

expenses.

One of the most problematic aspects of using the results of these models is that one or more of the most

important retirement risks is ignored: investment risk, longevity risk, and risk of potentially catastrophic

health care costs. The Ballpark E$timate® Monte Carlo Web site that EBRI and its American Savings

Education Council and Choose to Save® programs will make available to the public in coming months, at

www.choosetosave.org, specifically addresses each of these risks and allows the user to determine what

replacement rate (or initial retirement wealth expressed in either dollar values or a multiple of earnings

approach) will provide a 50-, 75-, or 90 percent chance of successfully providing a specified amount of nonhealth retirement expenditures as well as simulated health care expenses. Users will be able to construct

individualized "what-if" scenarios that will provide instant feedback on the changes in replacement rates,

dollar values, or multiples of earnings required as a result of changing retirement age, asset allocation, and/or

percentage of initial retirement wealth annuitized.24

EBRI Issue Brief No. 297 • September 2006 • www.ebri.org

18

How much of a difference will this process make in the initial determination of a target replacement rate?

If it is assumed that there is no equity allocation of assets nor is any of the initial retirement wealth

annuitized, the stylized high-income category male modeled in this Issue Brief would need a 52 percent

replacement rate in order to have a 50 percent chance of covering his retirement expenses if he retires at age

65.25 If he is not comfortable with a 50–50 prospect of "running out" of retirement income, he could increase

his chances of success to 75 percent by raising his income replacement rate to 78 percent; if he wants a 90

percent chance of success, he would have to raise his replacement rate to 119 percent.

What would it mean if this high-income male took early retirement as soon as he is eligible for Social

Security (age 62)? The replacement rates jump considerably: For a 50–50 chance of success, his income

replacement rate would be 64 percent; for a 75 percent chance of success, his replacement rate is 97 percent;

and for a 90 percent chance of success, his replacement rate is 149 percent. If, on the other hand, he decides

to delay retirement until age 68, he can decrease the figures to 43, 66, and 97 percent, respectively.

The same simulations for the stylized low-income category male would require significantly larger

replacement rates, since non-health care retirement expenditures are not reduced proportionally with

retirement income nor is the health care expense typically a function of income. In this case, a low-income

male retiring at 65 would have to replace 124 percent of his annual income just for a 50 percent chance of

success, while a 75 percent chance requires a replacement rate of 229 percent; for a 90 percent chance of

success, he would require a huge increase in the replacement rate to 394 percent! Similar modifications for

early and late retirement would take place at this income level.

Whether a significant percentage of workers will be able to accumulate sufficient retirement wealth to

achieve these replacement rate targets is a question that requires separate modeling. EBRI is currently in the

process of updating the EBRI/ERF Retirement Security Projection Model® to account for the changes

recently enacted in the Pension Protection Act of 2006 and will use the projected retirement accumulations

from that model to determine the impact on various demographic groups under a variety of assumptions with

respect to plan sponsor and plan participant reactions to the new provisions.26

As longevity continues to increase, as health expenses continue to climb, and as Social Security

replacement rates slowly decline, the need for individuals to save for retirement has never been greater. The

need has always been great for detail beyond a “rule-of-thumb” replacement target of “75 to 85 percent,” but

only now are free tools being made broadly available via the Internet so that all individuals have the

opportunity to do the needed planning without the necessity of seeking professional advice.

References

Alford, Susan, D. Bryan Farnen, and Mike Schachet. “Light At The End Of The Tunnel: Getting On Track

for Affordable Retirement.” Benefits Quarterly (4th Quarter, 2004).

Ameriks, John, Robert Veres, and Mark J. Warshawsky. “Making Retirement Income Last a Lifetime.”

Journal of Financial Planning (December 2001).

Fronstin, Paul. “Savings Needed to Fund Health Insurance and Health Care Expenses in Retirement.” EBRI

Issue Brief no. 295 (Employee Benefit Research Institute, July 2005).

Holden, Sarah, and Jack VanDerhei. “The Influence of Automatic Enrollment, Catch-Up and IRA

Contributions on 401(k) Accumulations in Retirement.” EBRI Issue Brief no. 283 (Employee Benefit

Research Institute, July 2005).

Hurd, Michael D., and Susann Rohwedder. “Alternative Measures of Replacement Rates.” Prepared for the

8th Annual Joint Conference for the Retirement Research Consortium, “Pathways to a Secure

Retirement.” August 10–11, 2006.

Schieber, Sylvester J. “Conceptual and Measurement Problems in Contemporary Measures of Income Needs

in Retirement.” Benefits Quarterly. Vol. 12, no. 2 (Second Quarter 1996): 56–68.

EBRI Issue Brief No. 297 • September 2006 • www.ebri.org

19

____. “Deriving Preretirement Income Replacement Rate Targets and the Savings Rates Needed to Meet

Them.” Benefits Quarterly. Vol. 14, no. 2 (Second Quarter 1998): 53–69.

Steinberg, Allen and Lori Lucas. “Shifting Responsibility: The Future of Retirement Adequacy In America.”

Benefits Quarterly (4th Quarter, 2004).

VanDerhei, Jack, and Craig Copeland. “Can America Afford Tomorrow’s Retirees: Results From the EBRIERF Retirement Security Projection Model.” EBRI Issue Brief no. 263 (Employee Benefit Research

Institute, November 2003).

VanDerhei, Jack. “Measuring Retirement Income Adequacy, Traditional Replacement Ratios, and Results

for Workers at Large Companies.” EBRI Notes, no. 9 (Employee Benefit Research Institute, September

2004).

Endnotes

1

Indeed, the choice of a replacement rate is often the first step in determining the appropriate savings rate during the

accumulation process. See the interactive Ballpark E$stimate at http://choosetosave.org/ballpark/ for an example.

2

A method for computer modeling based on chance; a technique for producing distributions of outcomes of stochastic

(variable) processes by running many iterations of the model process. Distinct from “deterministic” projections, which

are based on set assumptions that exclude the possibility of variation.

3

The terms adequate or adequacy when used to describe the results in this Issue Brief refer to whether there was

sufficient retirement income under a simulated set of circumstances to allow the individual to maintain a pre-specified

consumption pattern in retirement as well as the ability to afford simulated health care expenditures. The consumption

patterns used in the four hypothetical examples are averages from government surveys and in no way represent a value

judgment on whether these amounts are sufficient in a social welfare context. Nor do they necessarily reflect an

individual's perception of adequacy. However, the Web version of the model will allow an individual to choose what he

or she believes to be an adequate level of expenses.

4

Currently, the model is designed only to simulate results for individuals, but a future version of the model will allow

families to use the model in an integrated manner.

5

The model also differentiates the calculations based on whether the retiree rents or owns a house and, if the latter,

whether there is still a mortgage on the house at the time of retirement

6

Currently, the only option in the model is to purchase an immediate annuity at retirement. Further enhancements are

currently in the planning stages, including the use of longevity insurance.

7

For purposes of simplicity, the analysis in this Issue Brief assumes the retiree does not have an accrued benefit from a

defined benefit plan. However, the lump-sum equivalent of the benefit could be computed to use with this analysis.

8

In most cases, it is assumed that the vast majority of the initial retirement wealth is composed of 401(k) and IRA

balances that are not Roth variants of these programs. Although the program allows input of both taxable and nontaxable amounts, for purposes of the Issue Brief it is assumed that all amounts other than certain specified amounts of

Social Security benefits will be subject to federal income tax.

9

The numbers illustrated in this Issue Brief are based on 1,000 simulated life paths.

10

In reality, retirees may be forced to decrease their consumption instead.

11

This is defined as life expectancy for Building Block 1 approach (below) and a stochastic age for Building Blocks 2

and 3.

12

It is important to realize that this methodology is implicitly adding a nominal annuity to a real annuity; however, the

purchase of the latter appears to be de minimis. The Web version of the program will allow real annuities to be selected

for the initial retirement wealth if the user prefers.

13

This option was chosen to reflect a guaranteed investment contract (GIC) or stable value option, where the rate of

return realized is net of expenses.

14

The Consumer Expenditure Survey (CES) is conducted by the Bureau of Labor Statistics of the U.S. Department of

Labor. The survey targets the total noninstitutionalized population (urban and rural) of the United States and is the basic

source of data for revising the items and weights in the market basket of consumer purchases to be priced for the

Consumer Price Index. The CES data allow for the total expenditures that these elderly individuals make annually by

EBRI Issue Brief No. 297 • September 2006 • www.ebri.org

20

gender and home ownership. The expenditures used in this study are the total expenditures net of health care costs for

just the single individuals of the respective genders.

15

Hurd and Rohwedder (2006) report 2001 CES expenditure averages of $31,700 for those aged 65−74 and $22,800 for

those age 75 or over. These numbers include health care expenditures and include expenditures from families. They also

compare these numbers with those derived from the Consumption and Activities Mail Survey (CAMS) and find larger

expenditure averages: 12 percent larger for the younger group and 30 percent larger for the older group. The authors

speculate the differences may be due to the problem of the reference person and the difference in numbers reflects a

difference in the populations represented. We are unable to discern which set of expenditure numbers are likely to be

more representative; however, it is clear that the replacement rates derived in this study for any specific set of

circumstances would increase if the CAMS expenditure numbers were used.

16

A link to the benefits estimators on the SSA.gov Web site will be provided in the Web site interface.

17

The estimates were a national average of monthly nursing home costs found from the NNHS. The NNHS is a

nationwide sample survey of nursing homes, their current residents and discharges that was conducted by the National

Center for Health Statistics from July through December 1999.

The home health care use, length of stay (use), and monthly expenses were determined from the 2000 National Home

and Hospice Care Survey (NHHCS). The NHHCS is a nationwide sample survey of home health and hospice care

agencies, their current and discharged patients that was conducted by the National Center for Health Statistics from

August through December 2000.

18

19

We utilized the CareFirst BlueChoice HMO HIPAA plan quotes for the Washington, DC area from their Web site in

2006.

20

No state or local income tax is assumed in this Issue Brief, but Web users will be able to input values to override the

default values.

21

This evaluation feature will be added to the model once we determine the best way to introduce actual or generic

long-term care insurance policy parameters and pricing information into the model.

22