The Wage Effects of Experience in Self-Employment

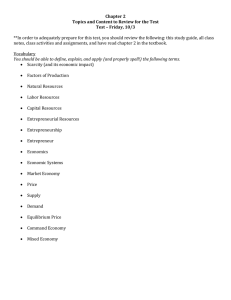

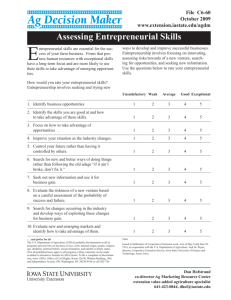

advertisement