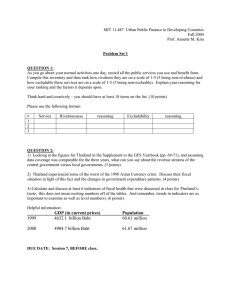

Future Prospects of Selected Supporting Industries in Thailand

advertisement