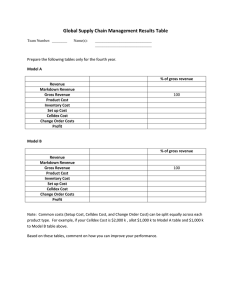

Income Measurement and Profitability Analysis

advertisement