The Real Effects of Capital Controls: Credit Constraints, Exporters

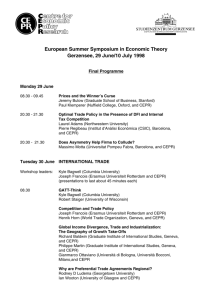

advertisement

The Real E¤ects of Capital Controls: Credit Constraints, Exporters and Firm Investment (by Alfaro et al.) Discussion Alessandra Bon…glioli UPF, BGSE and CEPR Barcelona, 10 June 2014 A. Bon…glioli (UPF, BGSE and CEPR ) Discussing Alfaro et al. (2014) Barcelona, 10 June 2014 1 / 10 The Paper in a nutshell aim: estimating the e¤ects of various types of capital controls on the value of …rms event-study approach: Brazil between March 2008 and April 2012 I I capital controls (taxes) on …xed-income, debt and equity investment + FX derivatives 15 events = policy interventions (on/o¤ or variation in intensity) outcome of interest: 2-day Cumulated Abnormal Returns (CAR) I 69 …rms of the BOVESPA results: I I I I I A. Bon…glioli negative CAR for all interventions (both pooled and by type) larger …rms su¤ered less large exporters su¤ered less …rms with higher external …nance dependence su¤ered more investment dropped (UPF, BGSE and CEPR ) Discussing Alfaro et al. (2014) Barcelona, 10 June 2014 2 / 10 Theoretical Framework: CAPM capital controls hurt …rms if the returns required by investors rise assume returns required to …rm i, E R̃i follow the CAPM E R̃i = rf + βiM E R̃M I I rf M = market portfolio, rf = risk-free interest rate βim = Cov (Ri , RM ) /Var (RM ) if no capital restrictions and perfect int’l portfolio diversi…cation: I h i h i E R̃M = E R̃W , βiM = βiW , rf = rfW ! E R̃iM = E R̃iW if complete autarky: I I A. Bon…glioli i h i h rf > rfW ! E R̃iM > E R̃iW (most likely for an emerging market) βim T βiW ? depends on i’s correlation with domestic vs world market (UPF, BGSE and CEPR ) Discussing Alfaro et al. (2014) Barcelona, 10 June 2014 3 / 10 Theoretical Framework: Abnormal Returns express abnormal returns at the time of policy announcement, t, as ARit Rit E [Rit jno policy] compute E [Rit jno policy] as E [Rit jno policy] = α̂i + β̂iM RMt I coe¢ cients α̂i and β̂iM estimated from market model: Ris = αi + βiM RMs + εis I for s 2 [t 280, t 30] days ARit < 0 if E R̃itM > E R̃itW : I I I A. Bon…glioli increase the risk-free rate …rm i is more subject to domestic systemic risk than international risk …rm i’s expected dividends drop ! Rit drops (UPF, BGSE and CEPR ) Discussing Alfaro et al. (2014) Barcelona, 10 June 2014 4 / 10 Empirical Strategy compute cumulated AR over a two-day window after each event CARit,t +1 = ARit,t +1 + ARit +1 estimate CARit,t +1 = c + bXit I I I 1y + eit c = constant (captures average CAR) Xit 1y = …rm-level controls: size, leverage, debt maturity, export status, credit constraints consider all events t jointly (panel) split the sample to distinguish b/w controls on equity vs debt beyond the news e¤ect: I A. Bon…glioli estimate e¤ect of lagged event on …rm-level quarterly investment (UPF, BGSE and CEPR ) Discussing Alfaro et al. (2014) Barcelona, 10 June 2014 5 / 10 Results negative average CAR: ĉ < 0 "less negative" for large …rms "less negative" for big exporters (> $100 million) stronger for …rms with low cash ‡ow relative to capital expenditure (high EFD) both controls on debt and equity a¤ect stock returns investment falls, mainly after the event of October 2008 A. Bon…glioli (UPF, BGSE and CEPR ) Discussing Alfaro et al. (2014) Barcelona, 10 June 2014 6 / 10 Questions and Comments β̂ from t 280 to t 30 may incorporate the e¤ects of prior events: I downward/upward (?) bias on β̂ and α̂? repeat the CAR estimation for single events with constant only I which events were more e¤ective? "placebo" tests + comparison with other events: I I CAR over other no-news days or capital controls unrelated events di¤erent in size from other announcement e¤ects? graphical analysis: I I A. Bon…glioli plot the distribution of CARit,t +1 for each event plot the distribution of CARit,t +1 by size bin/ export status (UPF, BGSE and CEPR ) Discussing Alfaro et al. (2014) Barcelona, 10 June 2014 7 / 10 Questions and Comments large …rm + big exporter + unconstrained ! MNCs! I I MNC typically big exporters + "internal capital market" would MNC capture the entire e¤ect? interesting to-do list: longer-term e¤ects on …rm-level investment + I I I I number of export destination markets, number of products... productivity? markups? Varela (2014) shows that Hungarian …rms reacted to FX liberalization F F A. Bon…glioli increasing TFP and technology adoption (especially credit constrained non-MNCs) lowering markups (especially MNCs) (UPF, BGSE and CEPR ) Discussing Alfaro et al. (2014) Barcelona, 10 June 2014 8 / 10 Questions and Comments …rm-speci…c heterogeneity: βs or dividends? can you separately estimate "good" and "bad" β’s? I disentangle news on cash ‡ow from news on discount rate e¤ects on volatility of returns? that was (in part) the policy goal... can you estimate post-event β? I give an idea of whether and how …rm returns correlation with the market return changed very low R2 : is it due to high dispersion in CAR relative to (quarterly) …rm characteristics? quantifying the contribution of …rm characteristics: are coe¢ cients (semi) elasticities? A. Bon…glioli (UPF, BGSE and CEPR ) Discussing Alfaro et al. (2014) Barcelona, 10 June 2014 9 / 10 Conclusions pleasant reading good data richness of well identi…ed events (unless other events coinciding on the same day) signi…cant results leaves me eager to learn more on the mechanism A. Bon…glioli (UPF, BGSE and CEPR ) Discussing Alfaro et al. (2014) Barcelona, 10 June 2014 10 / 10