Guaranteed maturity benefit on your investment Regular income

advertisement

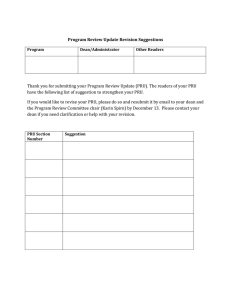

This advertisement is designed for combination of benefits of two or more individual and separate products named (1) ICICI Pru Savings Suraksha, (2) ICICI Pru iCare II and (3) ICICI Pru Immediate Annuity. The customer has the choice of purchasing any one or more products as per his/her need and choice and there is no compulsion whatsoever that these products are to be taken together as suggested by the Insurer and presented in this advertisement. The customer is expected to ask questions, understand and satisfy himself that this combination meets his/her specific needs better before deciding to purchase this combination. This benefit illustration is the arithmetic combination and chronological listing of combined benefits of individual products. The customer is advised to refer to the detailed sales brochure of the individual products mentioned herein. Guaranteed maturity benefit on your investment Regular income Security for your family Presenting ICICI Prudential Family Income Solution Conservative, a combination of ICICI Pru Savings Suraksha (a non-linked insurance plan; UIN: 105N135V01), ICICI Pru iCare II (a non-linked term insurance plan; UIN: 105N140V01) and ICICI Pru Immediate Annuity (a non-linked insurance plan; UIN: 105N009V06). This solution protects your hard earned money as well as takes care of your family’s security. Your need Retire early, Retire happy Regular income after retirement, for whole of life Leave a legacy for your children Family to be financially secure even if you are not around Our solution Build a retirement corpus with a Guaranteed Maturity Benefit (GMB) and Guaranteed Additionsconditions apply* Option to have lifelong income for you and your spouse. Once the income starts, the amount is guaranteedconditions apply# for life! Option to have your entire corpus returned to your children, after the death of you and your spouse In the unfortunate event of your death, option to receive a lifelong income or a lump-sum, depending on your nominee * Guaranteed benefits are payable only if you pay all premiums as per the premium payment term chosen by you and the policy remains in-force till the date of maturity. GMB is the guaranteed amount payable on maturity of ICICI Pru Savings Suraksha, as set out in the individual benefit illustration of the product. # Guaranteed lifelong income will be provided if you opt to purchase an immediate annuity plan at the end of the 10th policy year. In this solution, you purchase an ICICI Pru Savings Suraksha and an ICICI Pru iCare II option II at inception. You have the option to purchase an immediate annuity plan on maturity of this policy. Currently, we are offering ICICI Pru Immediate Annuity. Assuming you pay: Year 1 Year 2 to 10 Consolidated premiums payable (inclusive of service tax) ` 2,50,000 ` 2,46,474 p.a. The premium amounts shown here are inclusive of service tax and education cess, as per the prevalent rates. Tax laws are subject to change from time to time. What you get on survival till the end of the policy term: At the end of the 10th year, you can use the Maturity Benefit of ICICI Pru Savings Suraksha to purchase an ICICI Pru Immediate Annuity policy and choose “Joint Life Last Survivor with Return of Purchase Price” annuity option. The benefits of choosing this option are: Lifetime Income: You will receive a regular income as long as you are alive. After you, your spouse will continue receiving the same regular income as long as she will be alive. Legacy: The purchase price of ICICI Pru Immediate Annuity (legacy amount) will be returned to your nominee, after the death of you or your spouse, whichever is later. Please refer to the illustration below for more details: Details of projected benefits 8% Assumed rate of return 4% ` 27,87,507 Amount used to purchase IA* (Maturity benefit of ICICI Pru Savings Suraksha) ` 23,53,760 ` 2,09,099 Lifetime income for you and your spouse ` 1,76,563 ` 27,87,507 Lump sum to be paid to your nominee ` 23,53,760 The above illustration is for a 40 year old healthy male Age: 40 years Pay ` 2,50,000 for the first year and ` 2,46,474 p.a from the 2nd to the 10th year. 50 years Income of ` 2,09,099 p.a. for you and spouse Death of Policyholder Income of ` 2,09,099 p.a. for your spouse Death of spouse Nominee gets lump sum of ` 27,87,507 Total premiums payable is ` 24,68,266 and total benefits receivable is ` 90,60,477^ * IA stands for ICICI Pru Immediate Annuity This illustration assumes that you choose to use the Maturity Benefit of ICICI Pru Savings Suraksha to purchase ICICI Pru Immediate Annuity with ‘Joint Life Last Survivor with Return of Purchase Price’ annuity option. Please note that purchase of ICICI Pru Immediate Annuity or a similar product will be subject to its availability at the time of purchase and you can opt for any annuity option available at that time. The annuity amounts have been calculated with your and your spouse’s age to be 40 years and 35 years respectively and are based on indicative annuity rates. Annuity rates are not guaranteed and are subject to change from time to time. The actual annuity amount will depend on the prevailing annuity rates at the time of purchase of ICICI Pru Immediate Annuity or a similar product. Please contact us or visit our website for details. ^ Assuming you live till age 75 years and your spouse lives for 5 more years after that. Death benefit during the policy term: Payment of lump sum: Your nominee will receive a lump sum consisting of the death benefits of ICICI Pru iCare II and ICICI Pru Savings Suraksha. If the death happens due to an accident, there will be an additional lump-sum in the form of the Accidental Death Benefit of ICICI Pru iCare II. Example Continuing with our earlier example, in the unfortunate event of death of the policyholder at the end of the 3rd policy year, following death benefit will be payable: Details of projected benefits 8% Assumed rate of return 4% ` 50,00,000 Guaranteed lump sum to be paid on death (Death Benefit of ICICI Pru iCare II) ` 50,00,000 ` 50,00,000 Additional guaranteed lump sum to be paid on accidental death (Accidental Death Benefit of ICICI Pru iCare II) ` 50,00,000 ` 25,85,560 Death Benefit of ICICI Pru Savings Suraksha ` 25,45,015 Additional option if nominee is aged 45 years or above at the time of death of the policyholder: If the nominee is aged 45 years or above at the time of death of the policyholder, he or she will have the option to use a part of this benefit amount to purchase an ICICI Pru Immediate Annuity policy with “Life Annuity with Return of Purchase Price” annuity option. The benefits of choosing this option are the following: Lifetime Income: Your nominee will receive a regular income as long he or she is alive. Legacy: The purchase price of ICICI Pru Immediate Annuity (legacy amount) will be returned after the death of the nominee. In the above example, if • the policyholder dies at the end of the 3rd policy year • the nominee chooses to receive the death benefit of ICICI Pru iCare II as a lump sum and uses the rest to purchase an annuity with the option mentioned above following benefits would be payable: Details of projected benefits if nominee is aged 45 years at the time of the death of the policyholder 8% Assumed rate of return 4% ` 50,00,000 Guaranteed lump sum to be paid to your nominee ` 50,00,000 ` 25,85,560 Amount used to purchase IA* (Death Benefit of ICICI Pru Savings Suraksha) ` 25,45,015 ` 1,94,234 p.a. Lifetime income for your nominee ` 1,91,188 p.a. ` 25,85,560 Lump sum to be paid after death of nominee ` 25,45,015 * IA stands for ICICI Pru Immediate Annuity Please note that purchase of ICICI Pru Immediate Annuity or a similar product will be subject to its availability at the time of purchase and the eligibility of the nominee for the said product. The nominee can opt for any annuity option available at that time. The annuity amounts are based on indicative annuity rates. Annuity rates are not guaranteed and are subject to change from time to time. The actual annuity amount will depend on the prevailing annuity rates at the time of purchase of ICICI Pru Immediate Annuity or a similar product. Please contact us or visit our website for details. If your policy offers guaranteed returns, then these will be clearly marked “guaranteed” in the Benefit Illustration. Since your policy offers variable returns, the given illustration shows two different rates (4% & 8% p.a.) of assumed future investment returns The returns shown above are not guaranteed and they are not the upper or lower limits of what you might get back, as the maturity value of your policy depends on a number of factors including future investment performance. The above information must be read in conjunction with the sales brochure and policy documents. For the purpose of illustration, we have combined the premiums payable and benefits that you may receive under each plan of this solution. To know the details of this solution, please go through the “Terms and conditions”. Solution at-a-glance Min / Max annual premium ` 1.5 lakh / Unlimited Min / Max age at entry 35 / 54 years Premium payment term Regular Pay Policy term 10 years Payment frequency Annual, Half yearly, Monthly Sum Assured ICICI Pru Savings Suraksha: 10 times of annual premium; ICICI Pru iCare II: If age at entry is <=45: ` 50 lakh If age at entry is 46 - 50: ` 25 lakh If age at entry is 51 - 54: ` 15 lakh Terms & Conditions • This combination solution comprises set of policies across one or more products of the company. These products are also available individually with the Company and it is not mandatory for the customer to apply for this combination only. The customer is requested to go through the individual benefit illustrations of the products in this solution. • This is not a product brochure. The customer is requested to separately go through the product brochure of ICICI Pru Savings Suraksha (UIN: 105N135V01), ICICI Pru iCare II (UIN: 105N140V01) and ICICI Pru Immediate Annuity (UIN: 105N009V06) and to take the decision to opt for this combination solution after having fully understood the risk factors, product terms and conditions as briefly indicated below: - ICICI Pru Savings Suraksha: Guaranteed Maturity Benefit, Sum Assured, Guaranteed Additions, Reversionary bonus, Terminal Bonus, Premium Discontinuance, Policy revival, Surrender, Paid up, Death benefit, Maturity benefit etc. - ICICI Pru iCare II: Death benefit, Accidental Death benefit, Premium Discontinuance, Policy revival, Surrender etc. - ICICI Pru Immediate Annuity: Annuity options, Purchase price etc. • The individual products under this solution have certain product features like Sum Assured, Death Benefit option, Annuity option etc. which offer options beyond the ones assumed in the benefit illustrations shown here. The customer’s choice with respect to these will not be restricted to what has been shown here and he will be able to choose from all the options available at the time of purchase of the respective products. • For the purpose of illustration, the Company has assumed 8% and 4% as rates of investment returns. The returns shown in the illustration are not guaranteed and they are not the upper or lower limits of what the customer might get back, as the value of the policy depends on a number of factors including future investment performance. • The benefit of this combination solution shall accrue only if the customer continue to pay premiums for the entire premium payment term. • The benefits available under this combination solution shall be as per the policy terms and conditions of the respective products. • The premium shall comprise of base premium, service tax and education cess, as per applicable rates. Please refer Benefit Illustration for the details of the actual premium amount. • The regular income benefit through ICICI Pru Immediate Annuity plan will be applicable subject to the following conditions: - It shall be the sole responsibility of the Policyholder or the nominee, as applicable, to approach the Company on maturity or death to purchase ICICI Pru Immediate Annuity or any other similar product as may be available with the Company at that point in time. - It is not mandatory to purchase ICICI Pru Immediate Annuity or a similar product with the maturity benefit or death benefit, if the Policyholder or the nominee, as applicable, does not wish to get the regular income benefit. - Annuity rates are subject to change from time to time. The actual annuity amount will depend on the prevailing annuity rates at the time of purchase of ICICI Pru Immediate Annuity plan. - The policyholder or the nominee, as applicable, will have the flexibility to choose any of the annuity options offered by ICICI Prudential at that point in time. ICICI Pru Savings Suraksha is a non-linked savings and protection oriented plan. ICICI Pru iCare II is a non-linked non-participating term insurance plan. ICICI Pru Immediate Annuity is a non-linked non-participating insurance plan. IN ULIPs THE INVESTMENT RISK IN THE INVESTMENT PORTFOLIO IS BORNE BY THE POLICY HOLDER ICICI Prudential Life Insurance Company Limited. IRDA Regn. No. 105. CIN: U66010MH2000PLC127837. Unlike traditional products, Unit linked insurance products are subject to market risk, which affect the Net Asset Values and the customer shall be responsible for his/her decision. The name of the Company, Product names or fund options do not indicate their quality or future guidance on returns. Funds do not offer guaranteed or assured returns. Investments are subject to market risk. © 2014, ICICI Prudential Life Insurance Co. Ltd. Registered Address: ICICI Prulife Towers, 1089, Appasaheb Marathe Marg, Prabhadevi, Mumbai-400025. Insurance is the subject matter of the solicitation. For more details on the risk factors, terms and conditions, please read the sales brochure carefully before concluding a sale. UIN: ICICI Pru Savings Suraksha (UIN: 105N135V01), ICICI Pru iCare II (UIN: 105N140V01), ICICI Pru Immediate Annuity (UIN: 105N009V06) Advt No.: L/II/312/2014-15. Call us on 1-860-266-7766 (10am - 7pm, Monday to Saturday, except national holidays. Valid only for calls made from India) BEWARE OF SPURIOUS PHONE CALLS AND FICTITIOUS/FRAUDULENT OFFERS IRDA clarifies to public that IRDA or its officials do not involve in activities like sale of any kind of insurance or financial products nor invest premiums. IRDA does not announce any bonus. Public receiving such phone calls are requested to lodge a police complaint along with details of phone call, number.