Applied Management Accounting Tutorial Letter

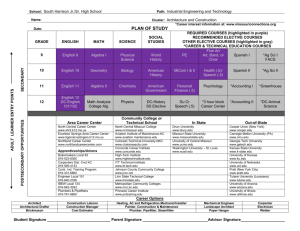

advertisement