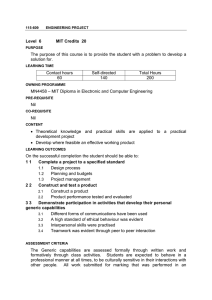

Post Office Money Travel Insurance Policy document

advertisement