Final ITS on Forbearance and non

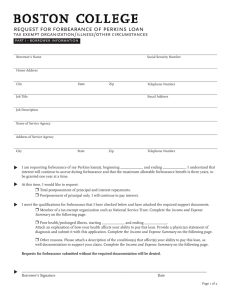

advertisement