namibia`s energy future - Konrad-Adenauer

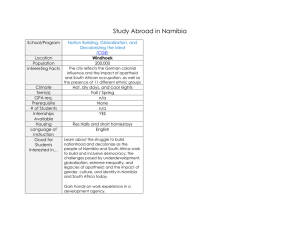

advertisement