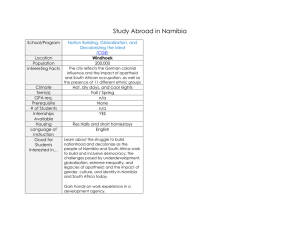

namibia`s energy future - Konrad-Adenauer

advertisement