Business Management (BM WSQ) prospectus

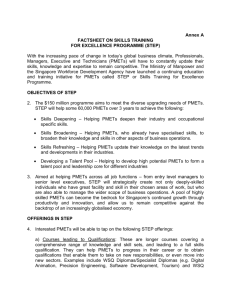

advertisement

Awards and Accreditations #1 Preferred Private Education Institution for Professional Certification, Short Courses and Workshops (2010, 2011 & 2012) JobsCentral Learning Rankings and Survey #1 Preferred Private Education Institution Overall (2012) JobsCentral Learning Ranking and Survey Top 3 Best Private School in Singapore (2009, 2010 & 2013) AsiaOne People’s Choice Awards Top 3 Most Preferred Training Provider 2011 Human Resource Magazine 2010 WDA Distinguished Partner Accolade Appointed Continuing Education and Training Centre (CET) Centre for Employability Skills Appointed Programme Partner in Business Management, Leadership and People Management and Service Excellence Frameworks About the Business Management WSQ (BM WSQ) Framework Business Management Level 3 01. Be a Good Negotiator 02. Effective use of Knowledge Management Systems 03. Manifest Critical and Analytical Thinking 04. Harvesting Stakeholder Relationships 05. The Art of Budget Preparations Business Management Level 4 06. Effective Resource Management 07. Manage Programmes and Activities to Enhance Stakeholder Relationships 08. The Art of Market Intelligence 09. Project Team Management 10. Managing Budgeting and Forecasting Processes for the Business Unit Business Management Financial Management 11. Cash Flow Monitoring 12. Cash Flow Reporting 13. Consolidated Financial Reporting 14. Financial and Treasury Management 15. Financial Budgeting and Planning 16. Financial Statement Analysis 17. Master Credit and Treasury Operations Pg. 04 Pg. 06 Pg. 07 Pg. 08 Pg. 09 Pg. 10 Pg. 13 Pg. 14 Pg. 15 Pg. 16 Pg. 17 Pg. 18 Pg. 19 Pg. 20 Pg. 21 Pg. 22 Pg. 23 Pg. 25 A Singapore Workforce Skills Qualifications Programme About the Business Management WSQ (BM WSQ) Framework The BM WSQ offers competency and application-based training with blended learning options for flexibility, sustainability and continuity. The BM WSQ allows managers to promote efficiency among his or her team. Best practices can ensure that the team achieves maximum output from minimum input by doing things right, right from the beginning. This promotes productivity within the organisation. BM WSQ also promotes effectiveness by embarking on work activities that help organisations to achieve their goals. Blended Learning – Maximum Benefits with Minimum Time The goal of blended learning is to provide the most efficient and effective instruction experience by combining delivery modalities. Blended learning offers a range of learning tools and experiences, which in total focuses on the best learning style for all learners. With a combination of online e-learning and classroom training, learners will enjoy an all-round learning experience. Advantages of Blended Learning: • Reduce time away from the job for training • Structured Flexibility – flexible self-paced structured learning cycle within a defined time frame • Reinforces key learning points with access to learning materials around the clock • Discussion forum for participants to share information and best practices Articulation to University of West England, Bristol BM WSQ-also offers time-strapped PMETs more options to pursue a degree. Individuals who complete 6 managerial modules can earn 180 credits, which will entitle them to a direct pathway to the Bachelor of Arts (Hons) in Business Management Practice awarded by UWE. UWE is consistently one of Britain’s leading new universities with an excellent track record in providing high quality education and training for their students. The University partners with employers and professional bodies in the design and delivery of their courses. These courses can lead to direct progression into some of their graduate and postgraduate programmes. All our classes are conducted with a 1:20 class ratio. About Business Management for Supervisors The Level 3 programme package is designed specially to enhance the effectiveness of the supervisors by: • Imparting of leadership qualities and behaviours so that they can be a more effective and dynamic team leader. • Developing their EQ and communication skills to better equip them to perform and communicate among key stakeholders. • Enhancing their thinking, analytical and decision making abilities to be better equipped to implement strategies. About Business Management for Managers The Level 4 programme package is designed specially to enhance effectiveness by: • Strengthening their leadership abilities in facilitating implementation of organisational strategies and in the promotion of compliance with corporate governance requirements. • Enhancing their effectiveness in the managing of resources during the implementation of strategy. • Equipping the managers with the critical project management skills necessary to manage a project team to achieve the project outcome. • Developing the ability to develop and manage meaningful stakeholders relationship programmes to create shared vision. 04 Information is accurate as of date of print A Singapore Workforce Skills Qualifications Programme The framework develops the core people skills and knowledge of successful, sustainable organisations that maximises your valuable talents, and ongoing investment in process and systems. Information is accurate as of date of print 05 A Singapore Workforce Skills Qualifications Programme Be a Good Negotiator 8 hours / 1 day Full Course Fee: S$283.55 (S$265.00 exclusive of GST) 70% WDA Funding S$85.07 (S$79.50 exclusive of GST) WHO SHOULD ATTEND Personnel who are assuming supervisory roles in their workplace. Employees who may assume managerial and supervisory roles in the future. Personnel who are not in any supervisory or managerial roles but are taking on negotiation functions COURSE DESCRIPTION This is an optional module for Business Management Skills for Supervisors (Level 3). Negotiation builds on common interests and reduces differences to secure an agreement that all parties involved can accept. It is energised by win-win and founded on fairness to all sides. It is different from bargaining. Whether it is with a customer or vendor or a colleague the ability to negotiate is a key skill in work life. LEARNING OUTCOMES On completion of this unit you will have the knowledge and skills in identifying negotiation outcomes, roles and responsibilities, preparing the necessary information for a negotiation, applying basic negotiation techniques and documenting negotiations. You will experience and learn to: –– Identify negotiation outcomes in a commercial situation to establish your organisation’s desired position in the negotiation –– Identify roles and responsibilities needed to suppor t negotiation objectives –– Use negotiation processes and techniques to assist in achieving the desired negotiation outcomes –– Record the negotiation for evaluation and documentation purposes –– P repare relevant back g round information to understand the other parties’ position This course is equivalent to the WSQ course: Apply Basic Negotiation Skills and Techniques 06 Information is accurate as of date of print A Singapore Workforce Skills Qualifications Programme Effective use of Knowledge Management Systems COURSE DESCRIPTION This is an optional module for Business Management Skills for Supervisors (Level 3). Today’s business environment is knowledge rich and it is vital that you be able to make full use of the knowledge available in your organisation to the best use in your daily tasks. Collating and presenting information from a Knowledge Management System (KMS) is an essential skill in the workplace that enhances your effectiveness in your organisation. This programme will enhance your ability through understanding the different information sources that are available in an organisation and will develop your skills in collection, analysis, reporting and presentation of the knowledge to the various relevant stakeholders in the organisation. LEARNING OUTCOMES You will experience and learn to: 01. Identif y infor mation sources in accordance to organisational guidelines and policies –– Identify the information sources of an organisation 03. Present information to relevant stakeholders in an appropriate format, style and structure using suitable business technology to support decision making –– Making sense of the information –– Understand the definition of a knowledge management system 02. Collec t , analyse and repor t information to relevant stakeholders –– Analyse information from a knowledge management system –– Collect, analyse, report and present information –– Understand the organisational requirements in relation to a knowledge management system –– Getting the right information to the right stakeholders 8 hours / 1 day Full Course Fee: S$283.55 (S$265.00 exclusive of GST) 70% WDA Funding S$85.07 (S$79.95 exclusive of GST) WHO SHOULD ATTEND Supervisory staff who need to know how to effectively collect and analyse information obtained from a Knowledge Management System and present it to the various stakeholders in an organisation. –– Understand the related information management systems and business technology This course is equivalent to the WSQ course: Collate and Present Workplace Information from a Knowledge Management System Information is accurate as of date of print 07 A Singapore Workforce Skills Qualifications Programme Manifest Critical and Analytical Thinking 16 hours / 2 days Full Course Fee: S$567.10 (S$530.00 exclusive of GST) 70% WDA Funding S$170.13 (S$159.00 exclusive of GST) WHO SHOULD ATTEND Individuals who are in an operational function or those who are interested to effectively display critical thinking and analytical skills. COURSE DESCRIPTION This is a core module for Business Management Skills for Managers (Level 3). John Dewey describes Critical Thinking as “active, persistent, and careful consideration of any belief or supposed form of knowledge in the light of grounds that support it and the further conclusions to which it tends”. In today’s increasingly dynamic business environment, you need the ability to sieve through voluminous amounts of information, find those that are pertinent, ascertain the credibility of the information and develop, defend and propose a reasonable position. Critical Thinking & Analytical skills are important in problem solving and those who are able to do both tend to be creative as well. Critical Thinking and Analytical Skills are essential when dealing with business issues related to internal and external stakeholders. This programme will help you develop a critical thinking mindset as well as focus on enhancing the creative thinking skills of those reporting to you. It aims to equip you with the skills necessary to challenge and rethink ideas and to provide insights and recommendations to your organisation’s stakeholders. LEARNING OUTCOMES You will experience and learn to: Develop basic skills in Critical Thinking and Analysis in your work area. You will be taught the basics of developing a critical thinking mindset, how to ask appropriate questions to determine the quality of a finding, argument or assumption and how to enhance creative thinking among reporting staff. In addition you will also learn: 01. Application of logical inquiry to issues 02. Challenges of being creative 03. Ways in which people may contribute to the critical thinking and analysis process This course is equivalent to the WSQ course: Display Critical Thinking and Analytical Skills 08 Information is accurate as of date of print A Singapore Workforce Skills Qualifications Programme Harvesting Stakeholder Relationships COURSE DESCRIPTION This is a core module for Business Management Skills for Supervisors (Level Three). At a supervisory level the key element towards building and maintaining stakeholder relationships in a business management framework is communications. The relationships can be continuously developed via enhancing the organisation’s communication efforts with both the internal and external stakeholders. If you already have a fundamental understanding of internal & external stakeholders you will acquire a further appreciation towards identifying, establishing & maintaining these relationships. LEARNING OUTCOMES You will experience and learn to: Identify Stakeholders Maintain stakeholder relationships –– Primary, secondary, internal & external stakeholders –– Effective use of communication techniques –– Differentiating & grouping stakeholder types –– Rapport building with stakeholders –– Factors af fecting stakeholder relationships Assess relationship between stakeholders & organisation 8 hours / 1 day Full Course Fee: S$283.55 (S$265.00 exclusive of GST) 70% WDA Funding S$85.07 (S$79.50 exclusive of GST) WHO SHOULD ATTEND Team Leaders, Project Leaders, Newly Promoted Supervisors, High Potential Executives –– Alignment of value proposition & key competitive capabilities –– Develop & maintain network –– Address peer level conflicts and issues –– Expectations & needs of stakeholders –– Formulate messages to convey to stakeholders –– Delivery of messages to stakeholders This course is equivalent to the WSQ course: Identify and Establish Internal and External Stakeholder Relationships Information is accurate as of date of print 09 A Singapore Workforce Skills Qualifications Programme The Art of Budget Preparation 24 hours / 3 days Full Course Fee: S$850.65 (S$795.00 exclusive of GST) 70% WDA Funding S$255.20 (S$238.50 exclusive of GST) WHO SHOULD ATTEND Operational and managerial staff who need to analyse functional strategies, objectives and operational plans in order to prepare a budget for a business function and ensure adherence to financial controls. COURSE DESCRIPTION This is an optional module for Business Management Skills for Supervisors (Level 3). Planning, budgeting and control are major activities of management in all organisations. Budgets are central to the process of planning and control in order to allocate resources in an effective and efficient manner to achieve the desired goals and objectives. This course is designed to help you develop an understanding of organisational and business objectives and functions and the information that affects organisations. It will examine various approaches to budgets, types of budgets, the behavioural aspects of budgeting and variance analysis. LEARNING OUTCOMES This module provides a foundation for budget preparation including consideration of the budgetary process. You will be taught the basics of how to prepare budgets, forecasting techniques and how to calculate variances. You will experience and learn to: –– Understand organisational and functional objectives –– Plan budgets to achieve strategic objectives –– Consideration of PESTEL factors –– Forecasting techniques –– Variances analysis This course is equivalent to the WSQ course: Prepare Budget for the Business Unit 10 Information is accurate as of date of print A Singapore Workforce Skills Qualifications Programme Foundation for effective collection & analysis of information. Information is accurate as of date of print 11 A Singapore Workforce Skills Qualifications Programme Assess & Understand Organisational Relationships. 12 Information is accurate as of date of print A Singapore Workforce Skills Qualifications Programme Manage Programmes and Activities to Enhance Stakeholder Relationships COURSE DESCRIPTION This is a core module for Business Management Skills for Managers (Level 4). Blended learning option is available for this module. The course imparts skills and knowledge to enable you to assess organisational relationships with stakeholders to understand rationale and focus programmes and activities to enhance stakeholder relationships, identify and evaluate roles in stakeholder relationship enhancing programmes and activities to support organisational strategies. You will be able to manage working level relationships with peer stakeholders to support stakeholder relationship and carry out identified roles in accordance with programme policies and procedures. LEARNING OUTCOMES You will experience and learn to: Understand stakeholder analysis –– Define stakeholder groups and recognise their impact on organisational strategies Manage working relationship with stakeholders –– Use methods to review history & current standing of relationship with stakeholders –– Able to list the legal and ethical constraints in enhancing programmes and activity –– A ppl y s t r a te g ie s to manag e stakeholder’s relationship –– Able to identify roles of different groups within each relevant programme and activities –– Able to assess role to determine one’s responsibilities Design a communication strategy with stakeholder –– Choose the appropriate channels to engage stakeholder Full Course Fee: S$642.00 (S$600.00 exclusive of GST) 70% WDA Funding S$192.60 (S$180.00 exclusive of GST) WHO SHOULD ATTEND Managers, Project Managers, Executives performing managerial functions, anyone who wants to more effectively manage stakeholders at different occupational levels –– Assess stakeholder relationship with the organisation –– Able to identify stakeholder’s key issues and types of programmes and activities to engage them Identify and evaluate role in stakeholder relationship 16 hours / 2 days –– Review and monitor effectiveness of stakeholder management –– Evaluate effectiveness of programmes and activities Manage Team Synergy – manage peer stakeholders –– Understand and motivate peer stakeholders –– Promote a conducive team environment –– Apply negotiation & conflict resolution strategies –– Effective use of communication techniques and channels –– Seek and provide clarif ication with appropriate personnel, where necessary This course is equivalent to the WSQ course: Manage Programmes and Activities to Enhance Stakeholder Relationships Information is accurate as of date of print 13 A Singapore Workforce Skills Qualifications Programme Effective Resource Management 8 hours / 1 day Full Course Fee: S$321.00 (S$300.00 exclusive of GST) 70% WDA Funding S$96.30 (S$90.00 exclusive of GST) COURSE DESCRIPTION This is a core module for Business Management Skills for Managers (Level 4). Most newly formulated strategies, regardless how well-crafted they are, often fail in their implementation. This course examines the types of resources that must be drawn to support the implementation and how to allocate the required resources. It also looks at how to review and assess the resource plan. LEARNING OUTCOMES You will experience and learn to: WHO SHOULD ATTEND Business Owners, Senior Managers, Senior Executives who are preparing to take on a management role Determine resource needs to ensure successful strategic implementation Assess and review resource allocation outcomes –– Concept of strategy implementation –– Compare resource requirement vs. resource allocated –– Understand the role of resource planning in strategic implementation –– Identify types of resources available –– Review resource plan and re-align resources with strategy Resource allocation process –– Strategic actions vs. strategic intentions –– Aligning resource allocation with corporate strategy –– Assessing resources for sufficiency, adequacy and availability This course is equivalent to the WSQ course: Manage Resource Planning 14 Information is accurate as of date of print A Singapore Workforce Skills Qualifications Programme The Art of Market Intelligence COURSE DESCRIPTION This is an optional module for Business Management Skills for Managers (Level 4). In today’s competitive business environment, organisations are facing increasing challenges in retaining customers, increasing their market share and developing their businesses. Business Managers and Marketing professionals are required to constantly keep themselves abreast of market trends and developments to enable themselves and their organisations to stay ahead and to retain their competitive edge. Understanding market trends and developments, conducting research, sourcing information about the market and interpreting such data has become more and more important. This is because an organisation’s marketing strategies must be driven by how much is known about the market, how relevant an organisation’s forecast can be and how well an organisation can plan their marketing activities to tap on the potentials that the market offers. This course provides you the skills and knowledge of how to understand, source, interpret and utilise valuable information about the market to contribute to your organisations’ business development and growth. LEARNING OUTCOMES This module provides you with skills in understanding how market trends and developments can be sourced and interpreted to help your organisation plan marketing strategies and organise marketing efforts and activities. –– Compile reports and recommendations on market research analysis and findings You will learn the skills required to: –– Types of reporting formats –– I d e n t i f y m a r k e t t r e n d s a n d developments that will impact your organisation’s marketing activities –– Methods of presenting data and information in reports 16 hours / 2 days Full Course Fee: S$642.00 (S$600.00 exclusive of GST) 70% WDA Funding S$192.60 (S$180.00 exclusive of GST) WHO SHOULD ATTEND Managers who are involved with business management, marketing and business development who are involved with developing marketing strategies, plans and organising marketing activities for their organisation. –– Methodologies that can be used for forecasting market trends and developments –– What market trends are relevant to business –– Sources of information on market trends and developments –– Methods of gathering such data and information –– A n a l y s e m a r k e t t r e n d s a n d developments to forecast emerging market needs and develop appropriate recommendations for marketing efforts –– Statistical analysis skills relating to interpreting data and information gathered on market trends and developments This course is equivalent to the WSQ course: Interpret Market Trends and Development Information is accurate as of date of print 15 A Singapore Workforce Skills Qualifications Programme Project Team Management 16 hours / 2 days Full Course Fee: S$642.00 (S$600.00 exclusive of GST) 70% WDA Funding S$192.60 (S$180.00 exclusive of GST) WHO SHOULD ATTEND Business Owners, Senior Managers, Senior Executives who are preparing to take on a management role COURSE DESCRIPTION This is an optional module for Business Management Skills for Managers (Level 4). Managing project teams is the art and science of managing relatively short-term efforts having finite beginning and ending points. The concept of project management involves two equally important components of hardware and software. The hardware of tools and systems make it a science. However, there is much more to managing projects than just applying analytical tools to help monitor, track and control. The bigger problems for project managers are those associated with the human element: conflict resolution, team building, coaching, mentoring and negotiation. This workshop is intended to provide team leaders with the fundamental skills necessary to cope with this element of the art of managing project teams. LEARNING OUTCOMES You will experience and learn to: What is Project Management? Coaching –– Nine Project Management Knowledge Areas –– What is coaching? –– The Project Management Cycle –– 4-Step Coaching Process –– The Project Charter –– Writing SMART Objectives Team Building –– Basics of Teams –– A Coach wears many hats –– Assessing Learning Needs –– Methods of Learning –– Creating the Learning Environment –– Managing Constraints in Coaching –– Everyone Plays a Part –– Feedback skills –– Determinants of Team Cohesiveness Motivation –– Methods of Developing Team Cohesion –– Characteristics of a Productive Team –– Selling ‘Teamwork’ to Workers –– Workers who are Team Mis-fits Communication Skills –– Basic Communication Skills –– Barriers to Communication –– Communication Channels –– Types of Communication –– Positive Language –– Body Language –– Maslow’s Hierarchy –– Expectancy Model –– Shared Vision Creates Motivation Managing Conflicts –– Case: Nobody’s working? –– What is a Conflict? –– Causes of Conflicts –– Methods of Conflict Resolution –– Managing Mindset over Conflict –– Strategies for Managing Conflict Communication –– Five levels of Listening This course is equivalent to the WSQ course: Manage Project Team 16 Information is accurate as of date of print A Singapore Workforce Skills Qualifications Programme Managing Budgeting and Forecasting Processes for the Business Unit COURSE DESCRIPTION This is an optional module for Business Management Skills for Managers (Level 4). Budgeting and forecasting skills are at the heart of every corporate planning cycle, when the management team readies itself for challenges that may be obvious, or require their combined experiences, market knowledge, organisational skills and financial savvy to anticipate new challenges ahead. The skills to manage the budgeting and forecasting processes are critical to enterprises large and small. There are industry-standard best practices that structure the planning process, that capture and use known information accurately and tests forecasts and “best guesses” for their reliability. These processes, when implemented, also reduce the amount of uncertainty among the planning team, as well as focus attention on the objective of anticipating strategic change – the “acid test” of a useful plan. 24 hours / 3 days Full Course Fee: S$963.00 (S$900.00 exclusive of GST) 70% WDA Funding S$288.90 (S$270.00 exclusive of GST) WHO SHOULD ATTEND Managers, Business Owners, Self Employed LEARNING OUTCOMES You will experience and learn to: –– Define the scope of budgeting and forecasting and the specific business goals –– Define accountability in terms of budget usage and understanding variances –– Prepare and analyse f inancial forecasts, linking to the achievement of clear business objectives –– Present financial forecasts, budgets and budget outcomes to management for review and approvaln –– Use budgets and forecasts to monitor resource allocation and operational effectiveness This course is equivalent to the WSQ course: Manage Project Team Information is accurate as of date of print 17 A Singapore Workforce Skills Qualifications Programme Cash Flow Monitoring 8 hours / 1 day Full Course Fee: S$321.00 (S$300.00 exclusive of GST) 70% WDA Funding S$96.30 (S$90.00 exclusive of GST) WHO SHOULD ATTEND Sales Managers, Finance Managers, Project Managers, Relationship Managers, Programme Managers COURSE DESCRIPTION This course aims to help you in monitoring cash flow reports - this is the process of monitoring, analysing and adjusting your business’ cash flows. For small businesses, the most important aspect of cash flow management is avoiding extended cash shortages caused by having too great a gap between cash inflows and outflows. LEARNING OUTCOMES You will experience and learn to: –– Understand the need for monitoring and controlling finances –– Able to analyse and question the data in Cash Flow Statements –– Able to monitor financial reporting procedures in the organisation in relation to Cash Flow Statements. –– Project cash inflows and outflows for the business unit to better prepare for contingencies –– Review cash flow reports for the business unit to identify items that may impact cash flow management –– Present findings to management for review in accordance with organisational policies and procedures This course is equivalent to the WSQ course: Monitor Cash Flow Reports 18 Information is accurate as of date of print A Singapore Workforce Skills Qualifications Programme Cash Flow Reporting COURSE DESCRIPTION With an in-depth understanding of cash flow statements, managers and executives will be able to analyse the profitability of the organisation from the point of view of its operating dynamics rather than the value of its assets. This workshop will enable non-finance professionals to walk away with a sound knowledge of how to analyse financial statements, understand the framework for making business financing decisions and efficient working capital management. LEARNING OUTCOMES You will experience and learn to: –– Gather and consolidate data on cash inflow and cash outflow transactions so as to identify the activities that affected cash, and classify them into three major activities: operating, investing and financing activities –– Verify and reconcile transactions against financial records to ensure accuracy of the cash flow report –– Generate cash flow reports to determine cash position of the business unit, using two methods: direct and indirect –– Submit cash flow reports to relevant stakeholders for review 8 hours / 1 day Full Course Fee: S$283.55 (S$265.00 exclusive of GST) 70% WDA Funding S$85.06 (S$79.50 exclusive of GST) WHO SHOULD ATTEND Candidates interested in or involved in preparing cash flow reports and the various considerations to be made. These modules are of particular relevance to the Retail, Manufacturing and the Finance Sector This course is equivalent to the WSQ course: Prepare Cash Flow Report for the Business Unit Information is accurate as of date of print 19 A Singapore Workforce Skills Qualifications Programme Consolidated Financial Reporting 18 hours / 2 days Full Course Fee: S$567.10 (S$530.00 exclusive of GST) 70% WDA Funding S$170.13 (S$159.00 exclusive of GST) WHO SHOULD ATTEND Team Leaders, Junior Relationship Managers, Team Leads, IP Administrative Engineer, Project Lead COURSE DESCRIPTION This course aims at developing the advanced skills required to interpret, analyse and assess financial information presented in Consolidated Financial Statements prepared according to the required governing standards. The objective of consolidation is to enhance the relevance, reliability and comparability of the information that a parent entity provides in its separate financial statements and in its consolidated financial statements for a group of entities under its control. LEARNING OUTCOMES You will experience and learn to: –– Understand and gain knowledge about the regulatory and professional requirements related to the preparation and presentation of Consolidated Financial Statements –– Handle and communicate useful information related to the preparation of Consolidated Financial Statements according to the required governing standard –– Analyse and interpret the consolidated financial statements of groups with particular reference to listed companies and multinational groups This course is equivalent to the WSQ course: Prepare Consolidated Financial Reports 20 Information is accurate as of date of print A Singapore Workforce Skills Qualifications Programme Financial and Treasury Management COURSE DESCRIPTION In this 2-day programme, we will look at what endorsing financial and treasury management policies, systems, budgets and plans entails. The key topics covered in this programme include: –– Setting organisational budget plan direction and aligning it to overall organisational strategic plans. –– Reviewing organisational financial and treasury management policies, systems, budgets and plans to evaluate their effectiveness in increasing business value. –– Evaluating financial implications of financial and treasury management policies, systems, budgets and plans on the organisation. –– Advising senior management on refinements to financial and treasury management policies, systems, budgets and plans. –– Evaluating financial and treasury management policies, systems, budgets and plans for endorsement purposes. ASSUMED KNOWLEDGE AND SKILLS Before starting this module, we assume that you already: 18 hours / 2 days Full Course Fee: S$963.00 (S$900.00 exclusive of GST) 70% WDA Funding S$288.90 (S$270.00 exclusive of GST) WHO SHOULD ATTEND Chief Executive Officer, Chief Finance Officer, Chief Communications Officer, Chief Operating Officer, Chief Audit Executive –– Understand how the business environment and financial trends impact the organisation and its strategies and objectives –– Understand relevant organisational strategies, objectives, culture, policies, processes and products / services –– Understand budgeting plan, budgeting objectives, budget processes and its importance to organisational strategies and objectives –– Understand financial risk position, financial management, corporate financing strategies, various types of financial policies and plans –– Have business management skills and business acumen to set organisational budget plan direction –– Have strategic visioning and decision-making skills to direct the organisation –– Have leadership skills to guide the organisation with regard to corporate finance strategies –– Have analytical skills to determine the implications of a budget on organisational strategies and plans and vice versa. LEARNING OUTCOMES You will experience and learn to: –– Set organisational budget plan direction in consultation with relevant stakeholders and aligned to overall organisational strategic plans –– Advise senior management on refinements to financial and treasury management policies, systems, budgets and plans –– Review organisational financial and treasury management policies, systems, budgets and plans to evaluate effectiveness in increasing business value –– Evaluate financial and treasur y management policies, systems, budgets and plans for endorsement purposes –– Evaluate financial implications of financial and treasury management policies, systems, budgets and plans on the organisation Information is accurate as of date of print This course is equivalent to the WSQ course: Endorse Financial and Treasury Management Policies, Systems, Budgets, and Plans 21 A Singapore Workforce Skills Qualifications Programme Financial Budgeting and Planning 16 hours / 2 days Full Course Fee: S$749.00 (S$700.00 exclusive of GST) 70% WDA Funding S$224.70 (S$210.00 exclusive of GST) WHO SHOULD ATTEND Team Leaders, Junior Relationship Managers, Team Leads, IP Administrative Engineer, Project Leads COURSE DESCRIPTION Financial planning is the task of determining how a business can afford to achieve its strategic goals and objectives. Usually a company creates a Financial Plan immediately after the vision and objectives have been set. The Financial Plan describes each of the activities, resources, equipment and materials that are needed to achieve these objectives as well as the time frames involved. Performing Financial Planning is critical to the success of any organisation. It provides the Business Plan with rigor by confirming that the objectives set are achievable from a financial point of view. It also helps the CEO to set financial targets for the organisation and reward staff for meeting objectives within the budget set. PRE-REQUISITE(S) –– Understand how the business environment and financial trends impact the organisation –– Understand relevant organisational strategies, objectives, culture, policies, processes and products / services –– Understand financial management, especially with regard to budget planning and financial forecasting –– Knowledge on business management skills and business acumen to develop financial plans –– Knowledge of strategic visioning and decision making skills to identify and prioritise the organisation’s financial needs –– Have analytical skills to determine the implications of a budget on organisational strategies and plans LEARNING OUTCOMES You will experience and learn to: –– Determine short and long term financial needs to assess current financial situation –– Formulate financial plans aligned to overall organisational strategies –– Establish allocation of resources in accordance with organisational financial plans –– Review draft budget –– Monitor and evaluate actual figures against budget to identify and address variances –– Report findings, recommendations and options to relevant stakeholders –– Review financial forecasts to anticipate changes in circumstances This course is equivalent to the WSQ course: Develop and Establish Financial Budget and Plans 22 Information is accurate as of date of print A Singapore Workforce Skills Qualifications Programme Financial Statement Analysis COURSE DESCRIPTION This course aims to summarise the process of making informed decisions in three key areas: investment, financing and operations. Banking professionals responsible for evaluating management success in these areas can turn to this curriculum for a set of crucial financial statement analysis techniques, culminating in business valuation principles. You will learn why financial analysis is performed, how it is done and who uses the results. It is designed to allow you to be able to analyse and interpret financial data, perform financial analysis and report the findings to key stakeholders. LEARNING OUTCOMES You will experience and learn to: –– Define the areas in which management makes decisions –– Calculate the ratios used in long and short-term risk analysis –– Identify the information contained in the three main financial statements –– Determine the debt and profit risk in a company using ratio analysis –– Define how profitability and rate of return on assets are calculated –– Adjust for differences in reporting to put companies on a comparable basis 40 hours / 5 days Full Course Fee: S$1,417.75 (S$1,325.00 exclusive of GST) 70% WDA Funding S$425.33 (S$397.50 exclusive of GST) WHO SHOULD ATTEND Team Leaders, Junior Relationship Managers, Team Leads, IP Administrative Engineer, Project Leads This course is equivalent to the WSQ course: Analyse Financial Statement Information is accurate as of date of print 23 A Singapore Workforce Skills Qualifications Programme A comprehensive understanding of treasury management strategies. 24 Information is accurate as of date of print A Singapore Workforce Skills Qualifications Programme Master Credit and Treasury Operations COURSE DESCRIPTION This programme is designed to provide you with a comprehensive understanding of treasury management strategies, techniques and tools, so as to enable you to provide risk management services for corporate and private banking customers. 40 hours / 5 days Full Course Fee: S$1,605.00 (S$ 1,500.00 exclusive of GST) 70% WDA Funding ASSUMED KNOWLEDGE Before starting this module, we assume that you already: S$481.50 (S$450.00 exclusive of GST) –– Understand how the business environment impacts the organisation –– Understand relevant organisational strategies, objectives, culture, policies, processes and products / services –– Have an understanding and working knowledge of financial accounting concepts –– Have an understanding and working knowledge of foreign exchange and credit concepts, foreign exchange markets and money markets –– Have analytical skills to assess the finance environment and to evaluate methods for managing credit and foreign exchange –– Have information gathering skills to gather and compile necessary data from external information sources (eg.. Bloomberg and Reuters) –– Have numeracy skills to prepare cash projections WHO SHOULD ATTEND Treasury Marketing Executives, Private Banking Executives, Corporate Finance Managers, FX & Money Market Managers, Treasury Operations and Settlements Personnel LEARNING OUTCOMES –– Review analysis of the local and international finance environment to determine the impact on organisational finance strategies and credit policies –– Monitor and evaluate foreign exchange and credit policies effectiveness in managing the organisation’s finances to obtain optimal financial risk level –– Evaluate methods for managing credit and foreign exchange in accordance with organisational financial objectives –– Grant credit facilities in consultation with immediate super visors in accordance with the organisation’s credit policies –– Implement and manage foreign exchange exposure and credit policies to reduce risk and maximise returns for the organisation This course is equivalent to the WSQ course: Manage Credit and Treasury Options Information is accurate as of date of print 25 Devan Nair Institute for Employment and Employability 80 Jurong East Street 21, #06-02, Singapore 609607 65 6733 1877 www.kaplan.com.sg/professional Registered with the Council for Private Education, UEN: 199701260K, Validity: 20.05.2010 - 19.05.2014