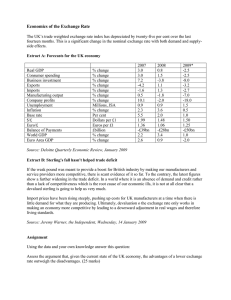

Building India: Accelerating infrastructure projects

advertisement