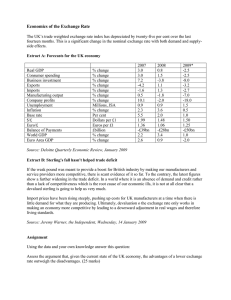

Technology, globalization, and international competitiveness

advertisement