Full Written Report in English

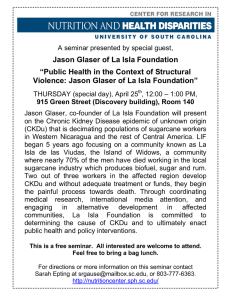

advertisement