Analog Devices Reports Third Quarter 2016 Results

advertisement

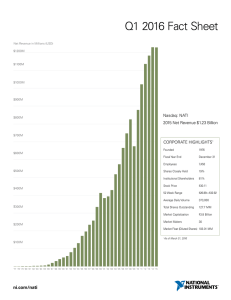

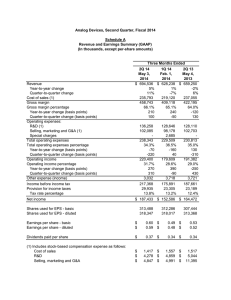

August 17, 2016 Analog Devices Reports Third Quarter 2016 Results Revenue increases to $870 million, Free Cash Flow margin in the quarter increases over 600 basis points compared to the prior year NORWOOD, Mass.--(BUSINESS WIRE)-- Analog Devices, Inc. (NASDAQ: ADI), today announced financial results for its third quarter of fiscal year 2016, which ended July 30, 2016. "We executed well in the third quarter and delivered revenue and diluted earnings per share results that exceeded our revised guidance," said Vincent Roche, President and CEO. "During the quarter, we also announced the proposed acquisition of Linear Technology Corporation, a combination that will create a trusted analog industry leader, capable of delivering tremendous benefits to our customers, our employees, and our shareholders." "Looking ahead to the October quarter, we are planning for revenue to increase sequentially, and be in the range of $910 million to $970 million. By end market, we expect the industrial, automotive, and communications infrastructure markets, in the aggregate, to remain largely stable to their third quarter levels, and to increase in the low-to-mid-single digits compared to the prior year. In the consumer market, strong customer demand in the portables sector leads us to plan for continued sequential revenue growth in this market." ADI also announced that the Board of Directors has declared a cash dividend of $0.42 per outstanding share of common stock. The dividend will be paid on September 7, 2016 to all shareholders of record at the close of business on August 26, 2016. Results for the Third Quarter of Fiscal Year 2016 Revenue totaled $870 million, up 12% sequentially, and up 1% year-over-year Revenue in ADI's B2B markets of industrial, automotive, and communications infrastructure totaled $683 million, down 2% sequentially, and up 4% year-over-year GAAP gross margin of 65.8% of revenue; Non-GAAP gross margin of 66.0% of revenue GAAP operating margin of 30.9% of revenue; Non-GAAP operating margin of 34.1% of revenue GAAP diluted EPS of $0.74; Non-GAAP diluted EPS of $0.82 Please refer to the schedules provided for a summary of revenue and earnings, selected balance sheet information, and the cash flow statement for the third quarter of fiscal year 2016, as well as the immediately prior and year-ago quarters. Additional information on revenue by end market is provided on Schedule D. Outlook for the Fourth Quarter of Fiscal Year 2016 The following statements are based on current expectations, and as indicated, are presented on a GAAP and non-GAAP basis. These statements are forward-looking and actual results may differ materially, as a result of, among other things, the important factors discussed at the end of this release. These statements supersede all prior statements regarding our business outlook set forth in prior ADI news releases, and ADI disclaims any obligation to update these forward-looking statements. GAAP Revenue Gross Margin Operating Expenses Interest & Other Expense Tax Rate $910 million to $970 million approx. 65.2% Slightly up sequentially $20.0 million approx. 12.5% Non-GAAP Adjustments $2.5 million (1) $17.5 million (1) - Non-GAAP $910 million to $970 million approx. 65.5% Slightly up sequentially $20.0 million approx. 12.0% Earnings per Share $0.78 to $0.88 $0.06 (2) $0.84 to $0.94 1. Reflects estimated adjustments for amortization of purchased intangible assets and depreciation of step up value on purchased fixed assets. 2. Represents estimated impact of expenses associated with non-GAAP adjustments on a per share basis. Conference Call Scheduled for Today, Wednesday, August 17, 2016 at 10:00 am ET ADI will host a conference call to discuss third quarter fiscal 2016 results and short-term outlook today, beginning at 10:00 am ET. Investors may join via webcast, accessible at investor.analog.com, or by telephone (call 706-634-7193 ten minutes before the call begins and provide the password "ADI"). A replay will be available two hours after the completion of the call. The replay may be accessed for up to two weeks by dialing 855-859-2056 (replay only) and providing the conference ID: 18291939, or by visiting investor.analog.com. Non-GAAP Financial Information This release includes non-GAAP financial measures that are not in accordance with, nor an alternative to, generally accepted accounting principles and may be different from non-GAAP measures used by other companies. In addition, these non-GAAP measures are not based on any comprehensive set of accounting rules or principles. Schedule E of this press release provides the reconciliation of the Company's historical non-GAAP revenue and earnings measures to its GAAP measures. Management uses non-GAAP measures to evaluate the Company's operating performance from continuing operations against past periods and to budget and allocate resources in future periods. These non-GAAP measures also assist management in evaluating the Company's core business and trends across different reporting periods on a consistent basis. Management also believes that the presentation of these non-GAAP items is useful to investors because it provides investors with the operating results that management uses to manage the Company and enables investors and analysts to evaluate the Company's core business. The following items are excluded from our non-GAAP gross margin, non-GAAP operating expenses, non-GAAP operating income, non-GAAP operating margin, and non-GAAP diluted earnings per share: Acquisition-Related Expenses: Expenses incurred as a result of prior period acquisitions primarily include expense associated with the fair value adjustments to property, plant and equipment and amortization of acquisition related intangibles, which include acquired intangibles such as purchased technology and customer relationships. We excluded these costs from our non-GAAP measures because they relate to a specific transaction and are not reflective of our ongoing financial performance. The following items are excluded from our non-GAAP operating expenses, non-GAAP operating income, nonGAAP operating margin, and non-GAAP diluted earnings per share: Acquisition-Related Transaction Costs: Costs incurred as a result of the Hittite acquisition and the proposed Linear Technology acquisition, including legal, accounting and other professional fees directly related to these acquisitions. We excluded these costs from our non-GAAP measures because they relate to specific transactions and are not reflective of our ongoing financial performance. Restructuring-Related Expenses: These expenses are incurred in connection with facility closures, consolidation of manufacturing facilities, severance, and other cost reduction efforts. We excluded these expenses from our non-GAAP measures because apart from ongoing expense savings as a result of such items, these expenses and the related tax effects have no direct correlation to the operation of our business in the future. The following items are excluded from our non-GAAP diluted earnings per share: Tax-Related Items: Tax adjustments associated with the non-GAAP items discussed above. We excluded these tax-related items from our non-GAAP measures because they are not associated with the tax expense on our current operating results. Analog Devices believes that these non-GAAP measures have material limitations in that they do not reflect all of the amounts associated with our results of operations as determined in accordance with GAAP and that these measures should only be used to evaluate our results of operations in conjunction with the corresponding GAAP measures. In addition, our non-GAAP measures may not be comparable to the non-GAAP measures reported by other companies. The Company's use of non-GAAP measures, and the underlying methodology when excluding certain items, is not necessarily an indication of the results of operations that may be expected in the future, or that the Company will not, in fact, record such items in future periods. Investors should consider our non-GAAP financial measures in conjunction with the corresponding GAAP measures. Free cash flow is defined as cash provided by (used in) operating activities less capital expenditures. Schedule F of this press release provides a calculation of supplemental free cash flow measures. About Analog Devices Analog Devices designs and manufactures semiconductor products and solutions. We enable our customers to interpret the world around us by intelligently bridging the physical and digital with unmatched technologies that sense, measure and connect. Visit http://www.analog.com. Forward Looking Statements This press release contains forward-looking statements, which address a variety of subjects including, for example, our statements regarding expected revenue, earnings per share, gross margin, operating expenses, interest and other expense, tax rate, and other financial results, expected operating leverage, production and inventory levels, expected market trends, and expected customer demand and order rates for our products, the proposed acquisition of Linear Technology Corporation ("Linear Technology"), the expected benefits and synergies of the transaction, expected growth rates of the combined companies, Analog Devices' expected product offerings, product development, marketing position and technical advances resulting from the transaction. Statements that are not historical facts, including statements about our beliefs, plans and expectations, are forward-looking statements. Such statements are based on our current expectations and are subject to a number of factors and uncertainties, which could cause actual results to differ materially from those described in the forward-looking statements. The following important factors and uncertainties, among others, could cause actual results to differ materially from those described in these forward-looking statements: any faltering in global economic conditions or the stability of credit and financial markets, erosion of consumer confidence and declines in customer spending, unavailability of raw materials, services, supplies or manufacturing capacity, changes in geographic, product or customer mix, the ability to satisfy the conditions to closing of the proposed transaction with Linear Technology, on the expected timing or at all; the ability to obtain required regulatory approvals for the proposed transaction, on the expected timing or at all, including the potential for regulatory authorities to require divestitures in connection with the proposed transaction; the occurrence of any event that could give rise to the termination of the merger agreement with Linear Technology; the risk of stockholder litigation relating to the proposed transaction, including resulting expense or delay; higher than expected or unexpected costs associated with or relating to the transaction; the risk that expected benefits, synergies and growth prospects of the transaction may not be achieved in a timely manner, or at all; the risk that Linear Technology's business may not be successfully integrated with Analog Devices' following the closing; the risk that Analog Devices and Linear Technology will be unable to retain and hire key personnel; and the risk that disruption from the transaction may adversely affect Linear Technology's or Analog Devices' business and relationships with their customers, suppliers or employees. For additional information about factors that could cause actual results to differ materially from those described in the forward-looking statements, please refer to both Analog Devices' and Linear Technology's filings with the Securities and Exchange Commission ("SEC"), including the risk factors contained in each of Analog Devices' and Linear Technology's most recent Quarterly Reports on Form 10-Q and Annual Report on Form 10-K. Forward-looking statements represent management's current expectations and are inherently uncertain. Except as required by law, we do not undertake any obligation to update forward-looking statements made by us to reflect subsequent events or circumstances. Important Additional Information Will Be Filed With The SEC In connection with the proposed transaction, Analog Devices and Linear Technology intend to file relevant information with the SEC, including a registration statement of Analog Devices on Form S-4 (the "registration statement") that will include a prospectus of Analog Devices and a proxy statement of Linear Technology (the "proxy statement/prospectus"). INVESTORS AND SECURITY HOLDERS OF LINEAR TECHNOLOGY ARE URGED TO CAREFULLY READ THE ENTIRE REGISTRATION STATEMENT AND PROXY STATEMENT/PROSPECTUS AND OTHER RELEVANT DOCUMENTS FILED WITH THE SEC WHEN THEY BECOME AVAILABLE, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT ANALOG DEVICES, LINEAR TECHNOLOGY AND THE PROPOSED TRANSACTION. A definitive proxy statement/prospectus will be sent to Linear Technology's shareholders. The registration statement, proxy statement/prospectus and other documents filed by Analog Devices with the SEC may be obtained free of charge at Analog Devices' website at www.analog.com or at the SEC's website at www.sec.gov. These documents may also be obtained free of charge from Analog Devices by requesting them by mail at Analog Devices, Inc., One Technology Way, P.O. Box 9106, Norwood, MA 02062-9106, Attention: Investor Relations, or by telephone at (781) 461-3282. The documents filed by Linear Technology with the SEC may be obtained free of charge at Linear Technology's website at www.linear.com or at the SEC's website at www.sec.gov. These documents may also be obtained free of charge from Linear Technology by requesting them by mail at Linear Technology Corporation, 1630 McCarthy Blvd., Milpitas, CA, 95035-7417, Attention: Investor Relations, or by telephone at (408) 432-2407. Participants in the Solicitation Linear Technology, Analog Devices and certain of their directors, executive officers and employees may be deemed participants in the solicitation of proxies from Linear Technology shareholders in connection with the proposed transaction. Information regarding the persons who may be deemed to be participants in the solicitation of Linear Technology shareholders in connection with the proposed transaction, including a description of their direct or indirect interests, by security holdings or otherwise, will be set forth in the proxy statement/prospectus when it is filed with the SEC. Information about the directors and executive officers of Analog Devices and their ownership of Analog Devices' common stock is set forth in the definitive proxy statement for the Analog Devices' 2016 annual meeting of shareholders, as previously filed with the SEC on January 28, 2016. Information about the directors and executive officers of Linear Technology and their ownership of Linear Technology common stock is set forth in the definitive proxy statement for Linear Technology's 2015 annual meeting of shareholders, as previously filed with the SEC on September 17, 2015. Free copies of these documents may be obtained as described in the paragraphs above. Non-Solicitation This communication shall not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended. Analog Devices and the Analog Devices logo are registered trademarks or trademarks of Analog Devices, Inc. All other trademarks mentioned in this document are the property of their respective owners. Analog Devices, Third Quarter, Fiscal 2016 Schedule A Revenue and Earnings Summary (Unaudited) (In thousands, except per-share amounts) Revenue Year-to-year change Quarter-to-quarter change Cost of sales (1) Gross margin Gross margin percentage Year-to-year change (basis points) Quarter-to-quarter change (basis points) Operating expenses: R&D (1) Selling, marketing and G&A (1) Amortization of intangibles Special charges Total operating expenses Total operating expenses percentage Year-to-year change (basis points) Quarter-to-quarter change (basis points) Operating income Operating income percentage Year-to-year change (basis points) Quarter-to-quarter change (basis points) Other expense Income before income tax Provision for income taxes Tax rate percentage Three Months Ended 3Q 16 2Q 16 3Q 15 July 30, April 30, Aug 1, 2016 2016 2015 $869,591 $778,766 $863,365 1% (5)% 19% 12% 1% 5% 297,301 267,863 294,328 572,290 510,903 569,037 65.8% 65.6% 65.9% (10) (80) 50 20 360 (50) 163,227 122,909 17,447 — 303,583 34.9% (30) (410) 268,707 30.9% 20 430 12,307 256,400 25,970 10.1% 160,235 112,186 17,419 13,684 303,524 39.0% 300 230 207,379 26.6% (370) 130 12,469 194,910 24,337 12.5% 160,784 120,030 22,954 — 303,768 35.2% (240) (80) 265,269 30.7% 290 40 5,791 259,478 43,000 16.6% Net income $230,430 $170,573 $216,478 307,135 310,558 308,790 312,250 313,877 318,187 Shares used for EPS - basic Shares used for EPS - diluted Earnings per share - basic Earnings per share - diluted $ $ 0.75 0.74 $ $ 0.55 0.55 $ $ 0.69 0.68 Dividends paid per share $ 0.42 $ 0.42 $ 0.40 (1) Includes stock-based compensation expense as follows: Cost of sales $ R&D $ Selling, marketing and G&A $ 1,844 6,682 8,093 $ $ $ 1,986 6,646 7,327 $ $ $ 2,196 6,839 7,329 Analog Devices, Third Quarter, Fiscal 2016 Schedule B Selected Balance Sheet Information (Unaudited) (In thousands) Cash & short-term investments Accounts receivable, net Inventories (1) Other current assets Total current assets PP&E, net Investments Goodwill Intangible assets, net Other Total assets 3Q 16 2Q 16 3Q 15 July 30, April 30, Aug 1, 2016 2016 2015 $3,803,434 $3,754,081 $3,099,961 452,944 398,979 451,511 392,303 399,459 424,475 79,207 75,355 173,945 4,727,888 4,627,874 4,149,892 629,094 626,162 631,269 54,077 50,680 40,324 1,639,033 1,639,165 1,640,381 529,035 548,374 601,882 105,926 78,037 67,313 $7,685,053 $7,570,292 $7,131,061 Deferred income on shipments to distributors, net $ 327,444 $ 317,290 $ 307,265 Other current liabilities 351,249 367,310 375,753 Debt, current — — 374,371 Long-term debt 1,731,758 1,731,336 495,189 Non-current liabilities 291,269 280,655 513,322 Shareholders' equity 4,983,333 4,873,701 5,065,161 Total liabilities & equity $7,685,053 $7,570,292 $7,131,061 (1) Includes $2,554, $2,719, and $2,935 related to stock-based compensation in 3Q16, 2Q16, and 3Q15, respectively. Analog Devices, Third Quarter, Fiscal 2016 Schedule C Cash Flow Statement (Unaudited) (In thousands) Three Months Ended 3Q 16 2Q 16 3Q 15 Cash flows from operating activities: Net Income Adjustments to reconcile net income to net cash provided by operations: Depreciation Amortization of intangibles Stock-based compensation expense Other non-cash activity Excess tax benefit - stock options Deferred income taxes Changes in operating assets and liabilities Total adjustments Net cash provided by operating activities Percent of revenue Net decrease in cash and cash equivalents Cash and cash equivalents at beginning of period Cash and cash equivalents at end of period April 30, 2016 $ 230,430 $ 170,573 33,732 18,916 16,619 1,127 (2,982) 12,250 (56,089) 23,573 254,003 29.2% Cash flows from investing activities: Purchases of short-term available-for-sale investments Maturities of short-term available-for-sale investments Sales of short-term available-for-sale investments Additions to property, plant and equipment Payments for acquisitions, net of cash acquired Change in other assets Net cash used for investing activities Cash flows from financing activities: Payments for deferred financing fees Dividend payments to shareholders Repurchase of common stock Proceeds from employee stock plans Excess tax benefit - stock options Contingent consideration payment Change in other financing activities Net cash used for financing activities Effect of exchange rate changes on cash July 30, 2016 (2,284,166) 2,078,716 139,805 (37,528) — (8,591) (111,764) (22,208) (128,954) (23,022) 16,633 2,982 — (2,093) (156,662) (1,569) 33,483 18,440 15,959 500 (3,212) 539 83,921 149,630 320,203 41.1% Aug 1, 2015 $ 216,478 33,650 23,898 16,364 3,827 (6,373) (17,168) (73,537) (19,339) 197,139 22.8% (1,939,750) (1,403,600) 1,522,688 1,083,474 102,316 215,998 (25,517) (35,164) (2,203) (6,947) (2,746) (1,180) (345,212) (147,419) — (129,925) (213,650) 16,480 3,212 — (2,786) (326,669) 898 — (125,511) (31,340) 19,988 6,373 (1,767) 4,327 (127,930) (509) (15,992) (350,780) 1,119,662 1,470,442 $1,103,670 $1,119,662 (78,719) 636,216 $ 557,497 Analog Devices, Third Quarter, Fiscal 2016 Schedule D Revenue Trends by End Market (Unaudited) (In thousands) The categorization of revenue by end market is determined using a variety of data points including the technical characteristics of the product, the "sold to" customer information, the "ship to" customer information and the end customer product or application into which our product will be incorporated. As data systems for capturing and tracking this data evolve and improve, the categorization of products by end market can vary over time. When this occurs we reclassify revenue by end market for prior periods. Such reclassifications typically do not materially change the sizing of, or the underlying trends of results within, each end market. Three Months Ended July 30, April 30, Aug 1, 2016 2016 2015 Revenue %* Q/Q % Y/Y % Revenue Revenue Industrial $374,735 43% (3)% (3)% $384,973 $ 384,473 Automotive 134,617 15% (2)% 3% 138,056 130,228 Consumer 186,101 21% 131% (10)% 80,592 206,656 Communications 174,138 20% (1)% 23% 175,145 142,008 Total Revenue $869,591 100% 12% 1% $778,766 $ 863,365 * The sum of the individual percentages does not equal the total due to rounding. Analog Devices, Third Quarter, Fiscal 2016 Schedule E Reconciliation from GAAP to Non-GAAP Revenue and Earnings Measures (In thousands, except per-share amounts) (Unaudited) See "Non-GAAP Financial Information" in this press release for a description of the items excluded from our non-GAAP measures. 3Q 16 July 30, 2016 GAAP Gross Margin Gross Margin Percentage Acquisition-Related Expenses Non-GAAP Gross Margin Gross Margin Percentage $ GAAP Operating Expenses Percent of Revenue Acquisition-Related Expenses Acquisition-Related Transaction Costs Restructuring-Related Expense Non-GAAP Operating Expenses Percent of Revenue $ GAAP Operating Income/Margin Percent of Revenue Acquisition-Related Expenses Acquisition-Related Transaction Costs Restructuring-Related Expense Non-GAAP Operating Income/Margin Percent of Revenue $ GAAP Diluted EPS Acquisition-Related Expenses Acquisition-Related Transaction Costs Restructuring-Related Expense Non-GAAP Diluted EPS (1) $ $ $ $ $ Three Months Ended 2Q 16 April 30, 2016 572,290 65.8% 1,888 574,178 66.0% $ 303,583 34.9% (17,582) (8,310) — 277,691 31.9% $ 268,707 30.9% 19,470 8,310 — 296,487 34.1% $ 0.74 0.06 0.02 — 0.82 $ $ $ $ $ 3Q 15 Aug 1, 2015 510,903 $ 65.6 % 1,476 512,379 $ 65.8 % 569,037 65.9 % 1,307 570,344 66.1 % 303,524 $ 39.0 % (17,517) — (13,684) 272,323 $ 35.0 % 303,768 35.2 % (23,490) (5,139) — 275,139 31.9 % 207,379 $ 26.6 % 18,993 — 13,684 240,056 $ 30.8 % 265,269 30.7 % 24,797 5,139 — 295,205 34.2 % 0.55 0.06 — 0.04 0.64 $ $ 0.68 0.08 0.02 — 0.77 (1) The sum of the individual per share amounts may not equal the total due to rounding Schedule F SUPPLEMENTAL CASH FLOW MEASURES (Unaudited) (In thousands) Three Months Ended 3Q 16 2Q 16 3Q 15 July 30, April 30, Aug 1, 2016 2016 2015 Net cash provided by operating activities $254,003 $320,203 $197,139 Capital expenditures (37,528) (25,517) (35,164) Free cash flow $216,475 $294,686 $161,975 % of revenue 24.9% 37.8% 18.8% View source version on businesswire.com: http://www.businesswire.com/news/home/20160817005191/en/ Analog Devices, Inc. Mr. Ali Husain, 781-461-3282 781-461-3491 (fax) Treasurer and Director of Investor Relations investor.relations@analog.com Source: Analog Devices, Inc. News Provided by Acquire Media