Federal 340B Drug Discount Program: Compliance Issues

advertisement

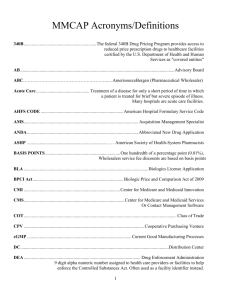

Federal 340B Drug Discount Program: Compliance Issues FDLI/AHLA Conference: The Intersecting Worlds of Drug, Device, Biologics and Health Law Bill von Oehsen General Counsel, Safety Net Hospitals for Pharmaceutical Access Principal, Powers Pyles Sutter & Verville, PC May 22, 2012 Washington, DC Overview I. 340B Primer - Background - OPA database - Calculating ceiling price - GPO exclusion - Anti-diversion - Contract pharmacies - Supply chain dynamics III. 340B Reform Legislation - New covered entities - Changes to discount - Part D changes - Medicaid changes - Integrity provisions - Recertification - GAO report - Orphan drug exclusion II. Medicaid Intersection - Duplicate discounts - Impact on rebates - DSH inpatient pricing - Part D and third party reimbursement IV. Enforcement - Overcharges - Litigation update - Private right of action - Diversion - Audits 1 340B Primer: Background 340B drug discount program requires pharmaceutical manufacturers participating in the Medicaid program to provide discounts on covered outpatient drugs purchased by federally-funded clinics and other safety net providers referred to as “covered entities” (CEs) The rights and obligations of CEs and manufacturers are set forth in Section 340B of the Public Health Service Act (PHSA) Section 1927 of the Social Security Act (SSA) requires manufacturers to enter into a pharmaceutical pricing agreement (PPA) with the Secretary of HHS as a condition of Medicaid and Medicare Part B covering the companies’ outpatient drugs Under the PPA, a manufacturer agrees to provide discounts and otherwise comply with 340B requirements 340B Primer: Background (cont’d) Program is administered by the Health Resources and Services Administration (HRSA) through the Office of Pharmacy Affairs (OPA) Because several aspects of the 340B program depend on interpretation and application of SSA provisions (e.g. average manufacturer price, best price, etc.), the Centers for Medicare & Medicaid Services (CMS) also plays a significant role in 340B program administration Originally 12 categories of CEs: high-Medicaid disproportionate share (DSH) hospitals owned by or under contract with state or local government; community health centers; ADAPs; family planning clinics; AIDS, TB and STD clinics; and other grantees under the Public Health Service Act CEs and manufacturers are listed in the OPA database 2 3 4 340B Primer: Background (cont’d) Discounts are calculated using the Medicaid rebate formula; but 340B pricing is better because (1) sales do not involve retail pharmacies thereby avoiding retail mark-ups and (2) 340B providers regularly negotiate sub-ceiling prices Use of drugs limited to “patients” of 340B CE Medicaid billing procedures may need to be adjusted to avoid manufacturers giving duplicate discounts 340B Primer: Background (cont’d) Two HRSA contractors: Prime Vendor Program (PVP) and Pharmacy Support Services Center (PSSC) PVP contractor: Apexus – Negotiates sub-ceiling pricing on behalf of PVP participants – Provides other value-added services PSSC contractor: American Pharmacists Association – Provides technical assistance to covered entities and other stakeholders – Staffs 340B call center 5 340B Primer: Background (cont’d) Many CEs are only permitted to purchase and use 340Bdiscounted drugs within the scope of their 340Bqualifying federal grants, e.g. HIV, TB, STD, family planning, and other grant programs established under the Public Health Service Act As a result, not all drugs purchased by 340B providers are subject to 340B pricing 340B Primer: Background (cont’d) Examples of non-340B drugs purchased by 340B providers: 1. Drugs other than factor and related products purchased by hospitals that operate hemophilia treatment centers 2. Drugs purchased by state or local health departments that are not used within the scope of their 340B-qualifying federal grants 3. Inpatient drugs purchased by 340B hospitals Purchase of the above drugs through 340B is considered diversion and exposes the covered entity to a potential enforcement action 6 340B Price Comparisons (2005) Private Sector Pricing “Best Price” 63% 42% Source: Data derived from Prices for Brand-Name Drugs Under Selected Federal Programs, Congressional Budget Office (June 2005); Pharmaceutical Discounts under Federal Law: State Program Opportunities, William H. von Oehsen (May 2001). 340B Primer: Calculating Ceiling Price 340B Ceiling Price = AMP – URA AMP = average manufacturer price in the retail class of trade unless the drug is an infusion, injectible or inhalation product URA = unit rebate amount for generics: URA = 13% for brand names: URA = 23.1% or difference between AMP and manufacturer’s best price, whichever yields a lower price Additional discount is built into URA for brand name drugs if AMP increases faster than the CPI-U rate of inflation 7 340B Primer: Calculating Ceiling Price (cont’d) April 1st – 30th May 1st – 15th June 15th July 1st Days 1-30 Days 31-45 Day 75 Day 90 Manufacturer submits AMP and BP data from Jan-March to CMS CMS validates data and calculates the unit rebate amount and the 340B-ceiling price. Because in middle of 2nd quarter, price not in effect until beginning of 3rd quarter, the next full quarter. Manufacturer sends 340B price to wholesaler &/or entries 340B price in effect for 3rd Quarter, JulySeptember 340B Primer: Calculating Ceiling Price (cont’d) Special procedures for calculating 340B price for new drugs: – Manufacturers must estimate a new drug’s 340B ceiling price for the first 3 quarters that the drug is on the market – After 3 quarters, manufacturers will have AMP and best price data to calculate the ceiling price – If the manufacturer overestimates the new drug’s price during the initial three quarter period, it must issue a refund to the covered entity upon request Penny prices – Under informal HRSA policy, if the 340B formula results in a negative price (because URA exceeds AMP), then the manufacturer must charge a penny for the drug 8 340B Primer: Calculating Ceiling Price (cont’d) Manufacturers should monitor 340B customer purchasing trends to protect against over utilization of discounted drugs Spikes in 340B sales and high 340B utilization rates of drugs that are primarily used for inpatients are red flags Stock replenishment practices make monitoring more difficult Although CMS has established policies for restating AMP and best price for Medicaid rebate purposes, there is no HRSA guidance on how to restate 340B prices and to issue refunds – such guidance is now required as a result of health reform 340B Primer: GPO Exclusion DSH hospitals are subject to a unique restriction, namely, they are prohibited from purchasing covered outpatient drugs through a group purchasing organization (GPO) or other group purchasing arrangement. PHSA 340B(a)(4)(L)(iii) Prohibition against group purchasing does not apply to drugs provided to DSH inpatients Hospitals may be prohibited from entering into bundling, tying or market share agreements if they can be considered group purchasing and involve covered outpatient drugs 9 340B Primer: Anti-Diversion “A covered entity shall not resell or otherwise transfer the [340B-discounted] drug to a person who is not a patient of the entity.” PHSA 340B(a)(5)(B) HRSA has established a three-pronged test for evaluating whether an individual falls within the definition of a “patient.” 61 Fed. Reg. 55,156 (10/24/96) An individual is not a “patient” if the only service received from the CE is the dispensing of a drug or drugs for subsequent self-administration or administration in the home setting. 61 Fed. Reg. 55,156 (10/24/96) 340B Primer: Anti-Diversion (cont’d) 1. 2. 3. The CE has established a relationship with the individual, such that the covered entity maintains records of the individual’s health care; and The individual receives health care services from a health care professional who is either employed by the covered entity or provides health care under contractual or other arrangements (e.g. referral for consultation) such that responsibility for the care provided remains with the covered entity; and The individual receives a health care service or range of services from the covered entity which is consistent with the service or range of services for which grant funding or federally-qualified health center look-alike status has been provided to the entity. 10 340B Primer: Anti-Diversion (cont’d) ADAP patients – an individual registered in a state operated or funded AIDS drug purchasing assistance program receiving financial assistance under title XXVI of the PHSA will be considered a “patient” of the covered entity for purposes of this definition if so registered as eligible by the state program. DSH patients – two clarifications: 1. Third prong of patient definition does not apply 2. Receipt of care outside the hospital does not disqualify the patient if the individual’s care is initiated at the hospital and there is a proximate relationship between the off-site care and the care provided by the hospital. HRSA letter to SNHPA (1/26/01) 340B Primer: Anti-Diversion (cont’d) Available on SNHPA’s website for both members and non-members are a set of “Principles” that SNHPA developed to assist with complying with patient definition requirements According to SNHPA’s Principles, 340B can be used to fill prescriptions written within the walls of the hospital Prescriptions written outside the walls of the hospital should not be filled with 340B drugs unless they fall within two limited exceptions: 1. follow-up care 2. contractual care 11 340B Primer: Anti-Diversion (cont’d) Follow-up care model must comply with proximate relationship test described in HRSA’s 1/26/01 letter Regarding contractual care, the costs associated with the care must be reimbursable on hospital’s Medicare cost report This limitation prevents abuses because the cost report provides documentation of compliance According to SNHPA’s Principles, 340B should not be used for physician-administered drugs that are administered outside the walls of the hospital 340B Primer: Contract Pharmacies HRSA recognized the difficulties facing 340B covered entities that lack in-house pharmacies (11,000 as of late 1996) In 1996, HRSA issued guidelines approving the use of contract pharmacies to dispense 340B drugs and requiring manufacturers to offer 340B pricing on drugs dispensed by contract pharmacies to 340B-eligible patients Patients may choose to obtain drugs from any pharmacy, not just the contract pharmacy The covered entity must use a “ship to/bill to” arrangement so that drugs are purchased by the CE but sent to the contract pharmacy 12 340B Primer: Contract Pharmacies (cont’d) The CE is responsible for the contract pharmacy’s compliance with 340B requirements The HRSA website contains a model agreement between a CE and contract pharmacy The CE must self-certify to HRSA that the contract pharmacy arrangement meets 340B program requirements The CE must submit information about the contract pharmacy for use in HRSA’s website database Effective April 5, 2010, the 340B contract pharmacy program was expanded such that CEs are no longer limited to one contract pharmacy arrangement. See 75 Fed. Reg. 10272 (3/5/10). 340B Primer: Contract Pharmacies (cont’d) The new guidance allows CEs to establish multiple contract pharmacy arrangements and to supplement inhouse pharmacies with one or more contract pharmacies CE must actively ensure compliance of its contract pharmacy arrangement(s) – HRSA strongly recommends the use of an outside independent auditor If the entity discovers that diversion or a duplicate discount problem has occurred, it must notify OPA of the violation and its plan for remedying the problem, i.e., self-reporting Right of HRSA and manufacturers to audit CEs extends to their contract pharmacy arrangements 13 Supply Chain Dynamics AWP $100 WAC $78 Non-340B $70 340B $51 MANUFACTURER WAC No Medicaid Rebate Chargeback 340B + Non-340B Acc’ts WHOLESALER Non-340B 340B MEDICAID FEE-FORSERVICE Payment Bill AAC COVERED ENTITY CONTRACT PHARMACY Dispensing Fee Dispensed Co-pay Dispensed or Administered Co-pay (if applicable) Bill U+C OTHER PAYERS PATIENT Medicaid Intersection: Duplicate Discounts CE must change their Medicaid billing practices for 340B drugs but are not required by the government to change their billing practices for other payers With respect to Medicaid, CEs should bill at acquisition cost for most drugs dispensed by pharmacies for selfadministration The sole reason that CEs must adjust their Medicaid billing practices is to protect manufacturers from the duplicate discount problem 14 Medicaid Intersection: Duplicate Discounts Step 1: Manufacturer sells drug at 340B discount Step 5: Manufacturer pays rebate on 340B drug Manufacturer Step 4: State submits rebate request Step 3: CE bills Medicaid for 340B drug Covered Entity State Medicaid Agency Medicaid patient Step 2: 340B drug is dispensed to Medicaid patient STEPS 1 AND 5 = DUPLICATE DISCOUNT Medicaid Intersection: Duplicate Discounts Options Covered Entity Procedures State Medicaid Procedures 340B PassThrough Bills state at actual acquisition cost (AAC) and submits pharmacy’s Medicaid billing number to HRSA for posting on website Excludes from rebate request files any claims paid under billing number posted on HRSA website Medicaid Carve-Out Purchases its Medicaid outpatient drugs outside 340B program, bills Medicaid at regular non-340B rates and submits “N/A” for posting on HRSA website Includes covered entity’s claims in rebate request files Shared Savings Same as 340B pass-through option except covered entity and state enter into alternative billing and payment arrangement Pays enhanced dispensing fee or above AAC rates 15 Medicaid Intersection: Duplicate Discounts (cont’d) No need to change billing procedures if there is no duplicate discount problem to begin with. Examples: if 340B drugs are (1) billed to Medicaid managed care organizations (MCOs), or (2) paid for by Medicaid as part of an allinclusive rate or otherwise bundled Historically, there was generally no duplicate discount problem for physician-administered drugs, so 340B providers did not have to adjust how they billed Medicaid for such drugs Situation has changed in light of regulations issued by CMS in 2007 requiring states to collect NDC information in order to facilitate rebate requests for physician-administered drugs Medicaid Intersection: Impact on Rebates 340B prices should have no direct impact on the size of rebates that manufacturers must pay to state Medicaid agencies 340B prices are exempt from Medicaid best price and AMP, and these exemptions apply to both 340B ceiling and sub-ceiling prices By contrast, while 340B ceiling prices are exempt from federal supply schedule (FSS), non-federal AMP (nonFAMP) and federal ceiling prices (FCP), sub-ceiling prices are not exempt unless negotiated through the prime vendor program 16 Medicaid Intersection: DSH Inpatient Pricing Since passage of the Medicare Modernization Act (MMA), inpatient prices paid by DSH hospitals no longer affect Medicaid rebates Section 1002 of MMA requires that, effective December 8, 2003, manufacturers should exclude from their Medicaid “best price” calculations any price of an inpatient drug sold to a 340B hospital Best price exemption AMP exemption for DSH inpatient drugs Under proposed AMP rule, CMS declines to extend inpatient best price exemption to newly-eligible 340B hospitals Medicaid Intersection: DSH Inpatient Pricing (cont’d) Manufacturers have complained about potential adverse impact on FCP and FSS prices SNHPA has tried to work with Department of Veterans Affairs (VA) to address the second issue According to VA “Dear Manufacturer” letter, if a manufacturer extends its outpatient 340B ceiling prices to the inpatient side for all DSH hospitals, the VA will exempt those 340B inpatient prices from the VA’s Non-FAMP calculations and from the FSS most favored customer and price reduction provisions A subsequent VA letter applies FSS hold harmless policy to generic drugs 17 Part D and Third Party Reimbursement Increasing number of Part D plans, Medicaid MCOs, commercial payers and their PBMs are ratcheting down payments to providers 340B provider groups view this trend as undermining intent of 340B program – Medicaid and Part D plans see it as saving tax dollars – Private payers see it as reducing insurance costs for consumers Providers considering market-based and legislative options to address this challenge Drug industry position? 340B Reform: New Covered Entities Five new categories of hospitals eligible for 340B: – Free-standing children’s hospitals with DSH adjustment > 11.75% – Free-standing cancer hospitals with DSH adjustment > 11.75% – Critical access hospitals – Sole community hospitals and rural referral centers with DSH adjustment ≥ 8% All new hospitals must either be publicly owned or be a private nonprofit contracting with a state or local government to provide indigent care Only children’s and cancer hospitals are subject to GPO exclusion 18 340B Reform: Changes to Discount Percentage and AMP Increased Medicaid rebate percentage for brand name drugs (15.1% to 23.1% ), clotting factor and pediatric drugs (15.1% to 17.1%), and generic drugs (11% to 13%) Reformulated drugs are subject to inflation penalty based on original drug’s launch price adjusted by CPI-U AMP redefined to exclude non-retail prices except for infused, injected, inhaled, instilled or implanted drugs AMP changes under proposed rule would extend to 340B prices 340B Reform: Part D Changes Medicare Part D coverage gap or “donut hole” fixed Co-pays will be reduced to 25% for “donut hole” drugs by 2020 – Manufacturers began covering 50% of cost of brands this year – Government subsidy will eventually cover 25% Manufacturers are not protected from duplicate discount problem when 340B drugs used in coverage gap 19 340B Reform: Medicaid Changes Drugs covered by MCOs now subject to rebates unless purchased through 340B HHS must provide guidance describing options for billing 340B drugs to Medicaid Pending AMP rule would extend Medicaid AAC reimbursement proposal to 340B drugs although CMS is apparently open to shared savings options 340B Reform: Integrity Provisions HHS must issue regulations to establish formal dispute resolution process Current process is voluntary and outcomes are not legally binding Must exhaust this process before proceeding to court Both manufacturers and CEs must use this process HRSA issued an advance notice of proposed rulemaking (ANPRM) soliciting public input. 75 Fed. Reg. 57233 (9/20/10) Proposed rule has not been issued yet 20 340B Reform: Integrity Provisions (cont’d) HHS is also required to make 340B ceiling prices available to CEs, e.g., via a password-protected database HHS must develop a system for verifying the accuracy of 340B price calculations – Methodology and standards for calculating ceiling prices must be developed and published – Government must regularly compare its ceiling price calculations with manufacturer-reported prices – HHS must perform “spot checks” of sales transactions – Pricing discrepancies must be researched and remedied 340B Reform: Integrity Provisions (cont’d) Drug manufacturers must allocate drugs in short supply proportionally between 340B and non-340B providers Refunds are owed to CEs in the event of an overcharge, including when AMP and best price are restated – PVP has a product to help with true-ups HHS is required to issue guidance on the refund process Manufacturers are subject to civil monetary penalties for knowing and intentional overcharges HRSA received comments pursuant to another pending ANPRM. 75 Fed. Reg. 57230 (9/20/10) 21 340B Reform: Integrity Provisions (cont’d) CEs are subject to civil fines for knowing and intentional violations of 340B anti-diversion and Medicaid billing requirements – Fines in form of interest on difference between 340B price and non-340B price Single, universal, and standardized identification system for identifying CE sites CEs must certify 340B compliance and update contact information at least annually Recertification Focus of recertification is that CE information on OPA database is accurate and up to date Hospital recertification process: key dates – 4/20: Rural referral, sole community, children’s and freestanding cancer hospitals – 4/27: DSH hospitals – 5/4: Critical access hospitals Applies to hospitals that have been in program for one year, so does not apply to hospitals that entered program after June 1, 2011 22 Recertification (cont’d) Can only be completed by the hospital’s authorizing official, who will receive an e-mail with an ID and password giving access to the hospital’s recertification information Three weeks to complete process Two-step process in which hospitals must: – Correct information for existing sites and/or decertify sites that no longer exist or use 340B drugs – Certify that hospital meets 340B requirements Recertification (cont’d) Per Recertification Guide on OPA website, CEs will be required to certify that: – CE has continuously met all 340B requirements since enrolling in 340B – CE will disclose to OPA any breach of any 340B requirement; failure to do so could result in CE remitting to manufacturer the 340B discount – All information on database is complete, accurate, and correct – CE maintains auditable records – CE has systems in place to reasonably ensure compliance CEs should check the OPA database after being notified that recertification is complete 23 340B Reform: GAO Report Government Accountability Office (GAO) issued firstever report on 340B in September; ordered by Congress in 2010 as part of health reform Report was to explore: – Should 340B be expanded given that millions of uninsured patients will gain coverage? – Does 340B hinder access at non-340B facilities? – Are CEs using savings “to further program objectives?” 340B Reform: GAO Report (cont’d) Key findings by GAO: – Program supports and expands access to services – CEs use savings in ways consistent with purpose of program – 340B pricing does not affect provider access with two exceptions – IVIG and penny pricing – 340B providers concerned over drug pricing overcharges 24 340B Reform: GAO Report (cont’d) Other key findings: – – – – – Program has grown significantly Increased use by hospitals and contract pharmacies May result in greater diversion risk Too much reliance on self-policing Integrity provisions in health reform are helpful, but HRSA needs to improve oversight 340B Reform: GAO Report (cont’d) GAO recommendations to HRSA: 1. Conduct selective audits of CEs 2. Finalize new, more specific guidance on the definition of a 340B patient 3. Further specify its 340B nondiscrimination policy for cases in which distribution of drugs is restricted and require reviews of manufacturers’ plans to restrict distribution of drugs at 340B prices 4. Issue guidance to further specify the criteria that private non-profit hospitals must meet to be eligible for 340B 25 340B Reform: GAO Report (cont’d) In the wake of the GAO report, key Republican lawmakers requested HRSA to provide detailed accounting of its oversight of 340B Notes doubling of program in the past decade and says “it is critical that HRSA provides diligent oversight of both the program and its participants.” Sen. Grassley press release implies program only for Medicaid patients, program costing taxpayers, expresses concerns about “sustainability” More recent requests for information directed to SNHPA, PVP, PhRMA and BIO 340B Reform: Orphan Drug Exclusion “Orphan drugs” are excluded from scope of covered outpatient drugs subject to 340B discounts Exclusion only applies to orphan drugs purchased by newly-eligible rural and cancer hospitals “Orphan drugs” – (1) are designed to treat rare diseases and conditions that affect fewer than 200,000 patients in the U.S. or, – (2) if the disease or condition affects more than 200,000 patients in the U.S., will produce sales that fail to cover R&D costs 26 340B Reform: Orphan Drug Exclusion (cont’d) HRSA issued proposed regulation that would: – Limit the prohibition "to uses for the rare disease or condition for which the orphan drug was designated” – Include tracking and recordkeeping requirements See 76 Fed. Reg. 29138 (5/20/11) Congress removed children’s hospital from the ban pursuant to legislation subsequent to health reform SNHPA and other hospital groups are seeking to repeal orphan drug ban entirely Enforcement: Overcharges Prior to health reform, government only had one remedy for addressing manufacturer overcharges – exclusion from Medicaid Consequently, government enforcement actions have been virtually non-existent except in instances when 340B recoveries are included in federal and state efforts to recoup Medicaid overpayments for best price violations, promotion of off-label indications, etc. Department of Justice is investigating allegations of 340B overcharging independent of potential Medicaid rebate violations 27 Enforcement: Litigation Update Manufacturer Name Drug Involved Period/Quarter Covered by Settlement Settlement Date Settlement Amount Bayer Kogenate and other Factor/IVIG Products January 1993 – August 31, 1999 Sept. 2000 $14 Million & $200K for 340B TAP Lupron January 1991 – October 2001 Oct. 2001 $875 Million Pfizer Lipitor 1st Quarter - 4th Quarter 1999 Oct. 2002 $49 Million & $567K for 340B Bayer and GSK Cipro, Adalat CC, Flonase and Paxil Cipro: 1st Qtr ’96 – 1st Qtr ’01 Adalat CC: 4th Qtr ’97 – 1st Qtr ’00 Flonase: 3rd Qtr ’97 – 3rd Qtr ’00 Paxil: 1st Qtr ‘01 April 2003 Bayer Total: $257 Million At least $2.5 Million to 340B entities GSK Total: $87.6 Million At least $9.4 Million to 340B entities Enforcement: Litigation Update (cont’d) Manufacturer Name Drug Involved Period/Quarter Covered by Settlement Settlement Date Settlement Amount AstraZeneca Zoladex January 1991 – December 31, 2002 June 2003 $355 Million Schering-Plough Claritin January 1998 – December 31, 2002 July 2004 Total: $345 Million At least $10.6 Million to 340B entities KING Pharmaceuticals Entire Drug Line January 1994 – December 31, 2002 October 31, 2005 $124 Million At least $7 Million to 340B entities Schering-Plough Claritin RediTabs and K-DUR Redi-Tabs: 4th Qtr ’98 – 2nd Qtr ’02 August 29, 2006 $255 Million civil settlement ($180 Million criminal fines) At least $3.9 million to 340B entities K-DUR: 2nd Qtr ’96 – 2nd Qtr ’01 28 Enforcement: Litigation Update (cont’d) Manufacturer Name Drug Involved Period/Quarter Covered by Settlement Settlement Date Settlement Amount Bristol-Myers Squibb Serzone 1st Qtr ’97 – 4th Qtr ‘97 September 28, 2007 $515 million $124,000 to 340B entities Merck Zocor, Vioxx April 1998 – March 2006 February 7, 2008 $671 million $9 million to 340B entities Cephalon Inc. Gabitril, Actiq, and Provigil January 2001 through at least 2006 October 2008 Total: $425 Million At least $1.8 Million for 340B entities Enforcement: Litigation Update (cont’d) Manufacturer Name Drug Involved Period/Quarter Covered by Settlement Settlement Date Settlement Amount Eli Lilly Zyprexa September of 1999 - March of 2001 January 2009 Total: $1.43 Billion More than $75,000 to 340B entities Aventis Pharmaceuticals Azmacort, Nasacort, and Nasacort AQ October. 1, 1995 to September 30, 2000 May 28, 2009 $95.5 million total $6.5 Million to 340B entities 2000-2004 October 19, 2009 $118 Million, $7.3 Million for 340B entities Mylan Pharmaceuticals Inc. and UDL Laboratories Inc Various 29 Enforcement: CE Private Right of Action Neither the 340B statute nor implementing guidelines explicitly give covered entities a private right of action against manufacturers for alleged overcharges In a federal case called Santa Clara v. Astra U.S.A. the U.S. Court of Appeals for the Ninth Circuit held that 340B providers do have a private right of action based on their status of as third party beneficiaries of the pharmaceutical pricing agreements between manufacturers and HHS U.S. Supreme Court overturned Ninth Circuit in a unanimous 8-0 decision rendered on March 29, 2011. Enforcement: Diversion There are few documented instances of diversion The most visible incident of diversion involved Aliquippa Community Hospital (ACH) reselling 340B drugs to freestanding cancer clinics SNHPA reported ACH to HRSA which led to ACH being audited and terminated Federal government invoked its criminal enforcement powers under the Prescription Drug Marketing Act – sending a strong message of intolerance to CEs A manufacturer successfully brought a claim against ACH to recoup its 340B discounts using HRSA’s dispute resolution process 30 Enforcement: Audits HRSA commenced auditing CEs in January in response to GAO report HRSA intends to conduct 50 audits in 2012 and 5 will be “targeted” Audits are focused primarily on hospitals Corrective action expected HRSA acknowledges current patient definition is difficult to apply No final audit reports issued yet Not aware of any manufacturer audits yet Additional 340B Resources Office of Pharmacy Affairs ◦ www.hrsa.gov/opa 340B Prime Vendor Program ◦ www.340Bpvp.com Pharmacy Services Support Center ◦ 1-800-628-6297 or www.pssc.aphanet.org 31 Upcoming Conferences 16th Annual 340B Coalition Conference July 9-11, 2012 Omni Shoreham Hotel Washington, DC www.340bcoalition.org Special discounts for Monitor subscribers and PVP suppliers! Drug Discount Monitor www.drugdiscountmonitor.com Comprehensive coverage of 340B, Medicaid rebates, Part D, PAPs, drug pricing litigation & investigations Call (202) 552-5856 to subscribe or click “Subscribe” on our home page Discounts on multi-user subscriptions & 340B Coalition conference fees 32 SNHPA Contacts Bill von Oehsen General Counsel (202) 872-6765 william.vonoehsen@snhpa.org Ted Slafsky President/CEO (202) 552-5860 ted.slafsky@snhpa.org Tom Mirga Executive Editor, Drug Discount Monitor (202) 552-5853 tom.mirga@drugdiscountmonitor.com 33