Analog Devices, Inc. Product Revenue from Continuing Operations

advertisement

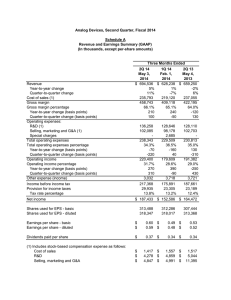

Analog Devices, Inc. Product Revenue from Continuing Operations by Product Type (millions) Converters Q-Q Growth Y-Y Growth % Total Product Revenue Amplifiers Q-Q Growth Y-Y Growth % Total Product Revenue Other Analog Q-Q Growth Y-Y Growth % Total Product Revenue Subtotal Analog Signal Processing Q-Q Growth Y-Y Growth % Total Product Revenue Power management & reference Q-Q Growth Y-Y Growth % Total Product Revenue Total Analog Products Q-Q Growth Y-Y Growth % Total Product Revenue General purpose DSP Q-Q Growth Y-Y Growth % Total Product Revenue Broadband DSL Products Other DSP Total Digital Signal Processing Q-Q Growth Y-Y Growth % Total Product Revenue Total Product Revenue Q-Q Growth Y-Y Growth Q407 $ 286.3 2% 8% 46% $ 155.2 -4% 1% 25% $ 83.5 2% 17% 13% $ 525.0 0% 7% 84% $ 32.3 6% -2% 5% $ 557.3 0% 7% 89% Q108 $ 280.9 -2% 7% 46% $ 155.9 0% 4% 25% $ 80.8 -3% -3% 13% $ 517.6 -1% 4% 84% $ 33.4 3% 6% 5% $ 551.0 -1% 4% 90% Q208 $ 297.6 6% 9% 46% $ 170.6 9% 13% 26% $ 81.8 1% -5% 13% $ 550.0 6% 8% 85% $ 34.7 4% 16% 5% $ 584.7 6% 8% 90% $ 56.0 $ 55.1 $ 6% -2% 2% -1% 9% 9% $ $ $ $ 10.2 $ 7.8 $ $ 66.2 $ 62.9 $ 7% -5% 3% -1% 11% 10% $ 623.5 1% 6% $ 613.9 -2% 4% Q308 $ 302.8 2% 8% 46% $ 170.5 0% 5% 26% $ 80.4 -2% -2% 12% $ 553.7 1% 5% 84% $ 36.7 6% 21% 6% $ 590.4 1% 6% 90% 58.3 $ 6% 18% 9% $ 6.3 $ 64.6 $ 3% 14% 10% $ 649.3 6% 9% Q408 $ 309.5 2% 8% 47% $ 168.6 -1% 9% 26% $ 75.6 -6% -9% 11% $ 553.7 0% 5% 84% $ 38.9 6% 20% 6% $ 592.6 0% 6% 90% Q109 $ 226.0 -27% -20% 47% $ 130.0 -23% -17% 27% $ 51.0 -33% -37% 11% $ 407.0 -26% -21% 85% $ 26.1 -33% -22% 5% $ 433.1 -27% -21% 91% Web Schedule Q209 $ 229.7 2% -23% 48% $ 123.8 -5% -27% 26% $ 54.1 6% -34% 11% $ 407.6 0% -26% 86% $ 28.2 8% -19% 6% $ 435.8 1% -25% 92% Q309 $ 239.1 4% -21% 49% $ 119.9 -3% -30% 24% $ 65.2 21% -19% 13% $ 424.2 4% -23% 86% $ 28.0 -1% -24% 6% $ 452.2 4% -23% 92% 60.5 $ 61.0 $ 40.1 $ 38.2 $ 38.9 4% 1% -34% -5% 2% 14% 9% -27% -34% -36% 9% 9% 8% 8% 8% $ $ $ $ 8.1 $ 7.1 $ 3.4 $ 0.7 $ 0.9 68.6 $ 68.1 $ 43.5 $ 38.9 $ 39.8 6% -1% -36% -11% 2% 11% 3% -31% -40% -42% 10% 10% 9% 8% 8% $ 659.0 1% 7% $ 660.7 0% 6% $ 476.6 -28% -22% $ 474.7 0% -27% $ 492.0 4% -25% FY 2003 $ 663.5 FY 2004 $ 885.1 FY 2005 $ 924.7 $ 39% 395.6 $ 33% 42% 503.2 $ 4% 45% 479.1 $ 23% 184.4 $ 27% 24% 267.1 $ -5% 24% 225.3 $ 11% 1,243.5 $ 45% 13% 1,655.4 $ -16% 11% 1,629.1 $ 73% 161.2 $ 33% 78% 160.4 $ -2% 80% 116.3 $ 9% 1,404.7 $ 0% 8% 1,815.8 $ -27% 6% 1,745.4 29% 86% 82% $ 159.6 $ $ $ 9% 64.5 75.9 300.0 $ 175.3 $ $ $ 10% 8% 56.1 68.3 299.7 1,704.7 $ $ $ 7% 9% 55.3 49.8 291.8 0% 14% 18% $ 186.7 $ 2,115.5 24% 2,037.2 -4% $ 8% 46% 665.6 12% 11% $ 8% 26% 318.6 12% 12% $ $ 21% 26% 267.0 $ 19% 12% 1,865.6 25% 14% $ 2,057.9 -5% 12% $ 2,175.0 10% 12% $ 15% 83% 126.8 10% 85% 124.1 6% 84% 143.7 7% -2% $ 9% 6% 1,992.4 -2% 5% $ 2,182.0 16% 6% $ 2,318.7 10% 11% 14% 89% 10% 90% 6% 90% $ 8% 45% 618.3 $ 7% 25% 334.7 $ $ $ 205.5 $ 214.3 $ 234.9 8% 8% $ $ $ 10% 9% 18.8 $ 33.3 $ 257.6 $ 4% 9% 33.4 247.7 10% 9% $ $ 29.3 $ 264.2 N/A -16% -3% N/A -17% -3% -12% 11% -4% 10% 7% 10% 2,250.0 $ 2,429.7 $ 2,582.9 8% 9% 10% 8% 6% -3% 14% $ 5 Year CAGR 12% 10% 45% 577.6 -4% 86% $ 3 Year CAGR 9% FY 2006 FY 2007 FY 2008 $ 1,021.0 $ 1,104.9 $ 1,190.8 $ The categorization of our products into broad categories is based on the characteristics of the individual products, the specification of the products and in some cases the specific uses that certain products have within applications. The categorization of products into categories is therefore subject to judgment in some cases and can vary over time. In instances where products move between product categories we reclassify the amounts in the product categories for all prior periods. Such reclassifications typically do not materially change the sizing of, or the underlying trends of results within, each product category. Analog Devices, Inc. End Market Product Revenue from Continuing Operations (millions) Q407 Q108 Q208 Q308 Q408 Q109 Web Schedule Q209 Q309 FY 2003 FY 2004 FY 2005 FY 2006 FY 2007 FY 2008 $ 921.1 $ 1,164.1 $ 1,108.1 $ 1,250.0 $ 1,319.8 $ 1,384.1 54% 26% 55% -5% 54% 13% 56% 6% 54% 5% 54% Industrial Q-Q Growth Y-Y Growth % Total Product Revenue $ 329.0 $ 332.2 $ 355.4 $ 356.3 $ 340.2 $ 257.3 $ 243.9 $ 252.2 1% 1% 7% 0% -5% -24% -5% 3% 2% -1% 8% 9% 3% -23% -31% -29% 53% 54% 55% 54% 51% 54% 51% 51% Computer Q-Q Growth Y-Y Growth % Total Product Revenue $ 26.1 $ 23.2 $ 22.7 $ 25.0 $ 24.1 $ 15.3 $ 12.9 $ 4% -11% -2% 10% -4% -37% -16% -17% -18% -11% 0% -8% -34% -43% 4% 4% 3% 4% 4% 3% 3% 12.0 -7% -52% 2% $ Communications Q-Q Growth Y-Y Growth % Total Product Revenue $ 119.5 $ 131.3 $ 147.9 $ 147.9 $ 164.3 $ 127.9 $ 138.0 $ 125.5 -10% 10% 13% 0% 11% -22% 8% -9% 10% 21% 26% 12% 37% -3% -7% -15% 19% 21% 23% 22% 25% 27% 29% 26% $ Consumer Q-Q Growth Y-Y Growth % Total Product Revenue $ 148.9 $ 127.2 $ 123.3 $ 129.8 $ 132.1 $ 76.1 $ 79.9 $ 102.3 12% -15% -3% 5% 2% -42% 5% 28% 22% 7% -3% -2% -11% -40% -35% -21% 24% 21% 19% 20% 20% 16% 17% 21% $ Total Product Revenue Q-Q Growth Y-Y Growth $ 623.5 $ 613.9 $ 649.3 $ 659.0 $ 660.7 $ 476.6 $ 474.7 $ 492.0 1% -2% 6% 1% 0% -28% 0% 4% 6% 4% 9% 7% 6% -22% -27% -25% 144.5 $ $ 443.1 $ 346.0 144.4 $ -11% 7% $ 26% 21% 21% 288.3 $ 12% 8% 8% 350.8 162.3 408.4 376.3 $ -15% 5% $ -8% 20% $ 122.8 441.8 435.4 $ -14% 4% $ 8% 20% $ 105.0 478.2 526.7 5 Year CAGR 8% 8% -13% -8% 13% 11% 11% 12% 8% 9% -10% 4% $ 8% 20% $ 95.0 3 Year CAGR 591.4 24% 23% $ 512.4 17% 20% 16% 9% 18% 16% 19% 21% 22% -3% 20% $ 1,704.7 $ 2,115.5 $ 2,037.2 $ 2,250.0 $ 2,429.7 $ 2,582.9 24% -4% 10% 8% 6% The categorization of revenue by end market is determined using a variety of data points including the technical characteristics of the product, the “sold to” customer information, the "ship to" customer information and the end customer product or application into which our product will be incorporated. As data systems for capturing and tracking this data evolve and improve, the categorization of products by end market can vary over time. When this occurs we reclassify revenue by end market for prior periods. Such reclassifications typically do not materially change the sizing of, or the underlying trends of results within, each end market. Analog Devices, Inc. Summary P&L from Continuing Operations Web Schedule (millions) GAAP Total Revenue Less: Revenue from One-Time Licensing of IP Product Sales Q-Q % Y-Y % Q407 Q108 Q208 Q308 Q408 Q109 Q209 Q309 $ 623.5 $ 613.9 $ 649.3 $ 659.0 $ 660.7 $ 476.6 $ 474.7 $ 492.0 $ $ $ $ $ $ $ $ $ 623.5 $ 613.9 $ 649.3 $ 659.0 $ 660.7 $ 476.6 $ 474.7 $ 492.0 1% -2% 6% 1% 0% -28% 0% 4% 6% 4% 9% 7% 6% -22% -27% -25% FY 2006 $ 2,250.0 $ $ 2,250.0 GAAP Gross Margin Less: Revenue from One-Time Licensing of IP Add: Restructuring Related Expense Non-GAAP Gross Margin % Product Sales $ 373.9 $ $ $ 373.9 60.0% $ 375.8 $ $ $ 375.8 61.2% $ 396.0 $ $ $ 396.0 61.0% $ $ $ $ 401.8 401.8 61.0% $ 403.7 $ $ $ 403.7 61.1% $ 269.0 $ $ $ 269.0 56.4% $ 261.6 $ $ $ 261.6 55.1% $ 266.2 $ $ $ 266.2 54.1% $ 1,393.6 $ $ 20.3 $ 1,413.9 62.8% $ $ $ $ 1,508.3 (35.0) 1,473.3 60.6% $ $ $ $ 1,577.3 1,577.3 61.1% GAAP Operating Expense Less: Purchased In-Process Research and Development Less: Restructuring Related Expense Add: Litigation Settlement Payment Received Non-GAAP Operating Expense % Product Sales $ 254.3 $ $ (25.2) $ $ 229.1 36.7% $ 229.9 $ $ $ $ 229.9 37.4% $ 238.8 $ $ $ $ 238.8 36.8% $ $ $ $ $ 240.6 240.6 36.5% $ 242.9 $ $ (3.1) $ $ 239.8 36.3% $ 249.4 $ $ (41.7) $ $ 207.7 43.6% $ 203.6 $ $ (11.9) $ $ 191.7 40.4% $ 187.3 $ $ $ $ 187.3 38.1% $ $ $ $ $ 867.5 (21.7) (1.8) 844.0 37.5% $ $ $ $ $ 939.6 (40.5) 8.5 907.6 37.4% $ $ $ $ $ 952.3 (3.1) 949.2 36.7% GAAP Operating Income from Continuing Operations One time and special items mentioned above Non-GAAP Operating Income from Continuing Operations % Product Sales $ 119.6 $ 145.9 $ 157.2 $ 161.2 $ 160.7 $ 19.6 $ 57.9 $ 78.9 $ 25.2 $ $ $ $ 3.1 $ 41.7 $ 11.9 $ $ 144.8 $ 145.9 $ 157.2 $ 161.2 $ 163.8 $ 61.3 $ 69.8 $ 78.9 23.2% 23.8% 24.2% 24.5% 24.8% 12.9% 14.7% 16.0% $ $ $ 526.1 $ 43.8 $ 569.9 $ 25.3% 568.7 $ (3.0) $ 565.7 $ 23.3% 625.0 3.1 628.1 24.3% GAAP Diluted EPS from Continuing Operations Less: Revenue from One-Time Licensing of IP Add: Purchased In-Process Research and Development Add: Acquisition Related Expense Add: Restructuring Related Expense Less: Litigation Settlement Payment Received Less: Tax Benefit Assoc. with Tax Settlement (Fiscal Years 2001-2003) Less: Gain on Sale of Investment Less: Gain on Sale of Product Line Add: Tax Expense Related to IRS Exam (Fiscal Years 2004-2005) Less: Impact of Reinstatement of R&D Tax Credit Non GAAP Diluted EPS from Continuing Operations $ 0.30 $ $ $ $ 0.064 $ $ $ $ $ 0.014 $ $ 0.38 $ $ $ $ $ $ $ $ $ $ $ $ 1.40 0.042 0.039 (0.095) (0.023) 1.36 1.51 (0.068) 0.017 0.090 (0.037) (0.015) 0.013 (0.030) 1.48 1.77 0.008 (0.011) 1.77 Diluted Shares 313.8 $ $ $ $ $ $ $ $ $ $ $ $ 0.40 0.40 304.3 $ $ $ $ $ $ $ $ $ $ $ $ 0.44 0.44 295.4 $ $ $ $ $ $ $ $ $ $ $ $ 0.44 0.44 295.0 $ 0.49 $ $ $ $ 0.008 $ $ $ $ $ $ (0.011) $ 0.49 $ 0.08 $ $ $ $ 0.099 $ $ $ $ $ $ $ 0.18 $ 0.18 $ $ $ $ 0.029 $ $ $ $ $ $ $ 0.21 293.8 291.2 292.5 $ $ $ $ $ $ $ $ $ $ $ $ 0.22 0.22 293.1 FY 2007 FY 2008 $ 2,464.7 $ 2,582.9 $ (35.0) $ $ 2,429.7 $ 2,582.9 10% 371.0 8% $ $ $ $ $ $ $ $ $ $ $ $ 332.3 6% $ $ $ $ $ $ $ $ $ $ $ $ 297.1 Analog Devices, Inc. Non-GAAP Financial Information These financial schedules include non-GAAP financial measures for prior periods that are not in accordance with, nor an alternative to, generally accepted accounting principles and may be different from non-GAAP measures used by other companies. In addition, these non-GAAP measures are not based on any comprehensive set of accounting rules or principles. Manner in Which Management Uses the Non-GAAP Financial Measures Management uses non-GAAP gross margin, non-GAAP operating expenses, non-GAAP operating income and non-GAAP diluted earnings per share to evaluate the Company’s operating performance against past periods and to budget and allocate resources in future periods. These non-GAAP measures also assist management in understanding and evaluating the underlying baseline operating results and trends in the Company’s business. Economic Substance Behind Management’s Decision to Use Non-GAAP Financial Measures The items excluded from the non-GAAP measures were excluded because they are of a nonrecurring or non-cash nature. The following items are excluded from our Non-GAAP gross margin: Non-Recurring Revenue Associated with the License of Certain Intellectual Property Rights to a Third Party. On November 9, 2006, we received a one-time, non-recurring payment of $35 million in exchange for granting a license of certain intellectual property rights to a third party. This payment increased revenue in the first quarter of fiscal 2007 by $35 million. We exclude this item and the related tax effects from our non-GAAP results because it is a one-time item not associated with the ongoing operations of our business. Restructuring-Related Expenses. These expenses are incurred in connection with facility closures, consolidation of our manufacturing facilities and other cost reduction efforts. Apart from ongoing expense savings as a result of such items, these expenses and the related tax effects have no direct correlation to the operation of our business in the future. The following items are excluded from our Non-GAAP operating expenses: Purchased In-Process R&D. We incur in-process research and development expenses when technological feasibility for acquired technology has not been established and no future alternative use for such technology exists. We exclude these items because these expenses are not reflective of ongoing operating results in the period incurred. Restructuring-Related Expenses. These expenses are incurred in connection with facility closures, consolidation of our manufacturing facilities and other cost reduction efforts. Apart from ongoing expense savings as a result of such items, these expenses and the related tax effects have no direct correlation to the operation of our business in the future. Proceeds from the one-time settlement of litigation. In the second quarter of fiscal 2007, we settled a lawsuit against Maxim Integrated Products and received a one-time nonrecurring payment of $19 million. A portion of this payment ($8.5 million) was to compensate us for the legal expenses we incurred during the years 2001 through 2007 in connection with this lawsuit. As the original legal expenses were recorded as general and administrative expenses in the income statement, we recorded the recovery of these legal expenses in the same line item in our operating expenses. The remaining $10.5 million was recorded as non-operating income because it is not associated with the normal operations of our business. We exclude this payment and the related tax effects from our nonGAAP results because it is a one-time item not associated with the ongoing operations of our business. The following items are excluded from our Non-GAAP operating income: Non-Recurring Revenue Associated with the License of Certain Intellectual Property Rights to a Third Party. On November 9, 2006, we received a one-time, non-recurring payment of $35 million in exchange for granting a license of certain intellectual property rights to a third party. This payment increased revenue in the first quarter of fiscal 2007 by $35 million. We exclude this item and the related tax effects from our non-GAAP results because it is a one-time item not associated with the ongoing operations of our business. Purchased In-Process R&D. We incur in-process research and development expenses when technological feasibility for acquired technology has not been established and no future alternative use for such technology exists. We exclude these items because these expenses are not reflective of ongoing operating results in the period incurred. Restructuring-Related Expenses. These expenses are incurred in connection with facility closures, consolidation of our manufacturing facilities and other cost reduction efforts. Apart from ongoing expense savings as a result of such items, these expenses and the related tax effects have no direct correlation to the operation of our business in the future. Proceeds from the one-time settlement of litigation. In the second quarter of fiscal 2007, we settled a lawsuit against Maxim Integrated Products and received a one-time nonrecurring payment of $19 million. A portion of this payment ($8.5 million) was to compensate us for the legal expenses we incurred during the years 2001 through 2007 in connection with this lawsuit. As the original legal expenses were recorded as general and administrative expenses in the income statement, we recorded the recovery of these legal expenses in the same line item in our operating expenses. The remaining $10.5 million was recorded as non-operating income because it is not associated with the normal operations of our business. We exclude this payment and the related tax effects from our nonGAAP results because it is a one-time item not associated with the ongoing operations of our business. The following items are excluded from our Non-GAAP diluted earnings per share: Non-Recurring Revenue Associated with the License of Certain Intellectual Property Rights to a Third Party. On November 9, 2006, we received a one-time, non-recurring payment of $35 million in exchange for granting a license of certain intellectual property rights to a third party. This payment increased revenue in the first quarter of fiscal 2007 by $35 million. We exclude this item and the related tax effects from our non-GAAP results because it is a one-time item not associated with the ongoing operations of our business. Purchased In-Process R&D. We incur in-process research and development expenses when technological feasibility for acquired technology has not been established and no future alternative use for such technology exists. We exclude these items because these expenses are not reflective of ongoing operating results in the period incurred. Acquisition-Related Expense. During the first quarter of fiscal 2007, we recorded a tax adjustment when we finalized the accounting associated with an acquisition which occurred in the fourth quarter of fiscal 2006. We excluded this income tax expense from our non-GAAP results because it was not associated with the income tax expense on our current operating results. Restructuring-Related Expenses. These expenses are incurred in connection with facility closures, consolidation of our manufacturing facilities and other cost reduction efforts. Apart from ongoing expense savings as a result of such items, these expenses and the related tax effects have no direct correlation to the operation of our business in the future. Proceeds from the one-time settlement of litigation. In the second quarter of fiscal 2007, we settled a lawsuit against Maxim Integrated Products and received a one-time nonrecurring payment of $19 million. A portion of this payment ($8.5 million) was to compensate us for the legal expenses we incurred during the years 2001 through 2007 in connection with this lawsuit. As the original legal expenses were recorded as general and administrative expenses in the income statement, we recorded the recovery of these legal expenses in the same line item in our operating expenses. The remaining $10.5 million was recorded as non-operating income because it is not associated with the normal operations of our business. We exclude this payment and the related tax effects from our nonGAAP results because it is a one-time item not associated with the ongoing operations of our business. Tax Savings Associated with IRS Tax Settlement. During the fourth quarter of fiscal 2006 the United States Internal Revenue Service (the IRS) completed its examination of fiscal years 2001, 2002 and 2003 and issued their report. The Company agreed to accept their report and filed its 2005 tax return and an amended return for 2004 to conform to the methodologies agreed to during the 2001-2003 examination. The completion of this examination and the filing of refund claims in other jurisdictions associated with the completion of the IRS audit resulted in an income tax benefit. We excluded these income tax benefits from our non-GAAP results because they were not associated with the income tax expense on our current operating results. Gain on Sale of Investment. We realized a gain of $8 million in the first quarter of fiscal 2007 from the sale of a minority shareholding in a company. We excluded this amount and the related tax effects because it is a one-time item not associated with our ongoing operating results. Gain on the Sale of a Product Line. We realized a gain on the sale of our DSP-based DSL ASIC and network processor product line that we sold in the second quarter of fiscal 2006. This amount arose from prior activities and has no direct correlation to the ongoing business operations. Tax Adjustment Associated with IRS Examination. During the fourth quarter of fiscal year 2007, the IRS completed its field examination of fiscal years 2004 and 2005. The IRS issued proposed adjustments related to these two fiscal years. During the fourth quarter of fiscal 2007, we provided $4.4 million for taxes and penalties related to certain of these proposed adjustments. We exclude this income tax expense from our non-GAAP results because it is not associated with the income tax expense on our current operating results. Tax Savings Associated with Reinstatement of the Federal R&D Tax Credit. The IRS reinstated the R&D tax credit in December 2006, retroactive to January 1, 2006. This retroactive reinstatement resulted in a $10 million income tax savings to the Company in the first quarter of fiscal 2007. This credit expired during our first fiscal quarter of 2008, but was reinstated again during our fourth quarter of fiscal 2008, retroactive to January 1, 2008. This retroactive reinstatement resulted in a $3 million income tax savings to the Company in the fourth quarter of fiscal 2008. We excluded this income tax savings from our non-GAAP measures because it is not associated with the income tax expense on our current operating results. Why Management Believes the Non-GAAP Financial Measures Provide Useful Information to Investors Management believes that the presentation of non-GAAP gross margin, non-GAAP operating expenses, non-GAAP operating income, and non-GAAP diluted EPS is useful to investors because it provides investors with the operating results that management uses to manage the Company. Material Limitations Associated with Use of the Non-GAAP Financial Measures Analog Devices believes that non-GAAP gross margin, non-GAAP operating expenses, nonGAAP operating income, and non-GAAP diluted EPS have material limitations in that they do not reflect all of the amounts associated with our results of operations as determined in accordance with GAAP and that these measures should only be used to evaluate our results of operations in conjunction with the corresponding GAAP measures. In addition, our non-GAAP measures may not be comparable to the non-GAAP measures reported by other companies. The Company’s use of non-GAAP measures, and the underlying methodology in excluding certain items, is not necessarily an indication of the results of operations that may be expected in the future, or that the Company will not, in fact, record such items in future periods. Management’s Compensation for Limitations of Non-GAAP Financial Measures Management compensates for these material limitations in non-GAAP gross margin, non-GAAP operating expenses, non-GAAP operating income and non-GAAP diluted EPS by also evaluating our GAAP results and the reconciliations of our non-GAAP measures to the most directly comparable GAAP measure. Investors should consider our non-GAAP financial measures in conjunction with the corresponding GAAP measures.