Investors Cn HY Inc Srs A

Fund Facts

Fund Objectives

Fund Sponsor: Investors Group

Managed By: I.G. Investment Management Ltd.

Fund Type: MF Trust

Inception date: July 13, 2012

Total Assets: $1,246.8 million

Sales Fee Type: Back End

NAV:$9.95

Management Expense Ratio: 2.09%

Asset Class: High Yield Fixed Income

Min Initial Investment: $50

Min Subsequent Investment: $50

Min Init. Invest.− RRSP: $50

Subsequent RRSP: $50

Restricted: No

The Fund aims to provide a high level of current income while offering the potential

for moderate capital appreciation by investing primarily in high−yielding investments.

In order to change its investment objective, the Fund needs approval from a majority

of its investors who vote at a meeting held for this purpose, unless it is required by

law to make the change.

Returns as at July 31, 2016

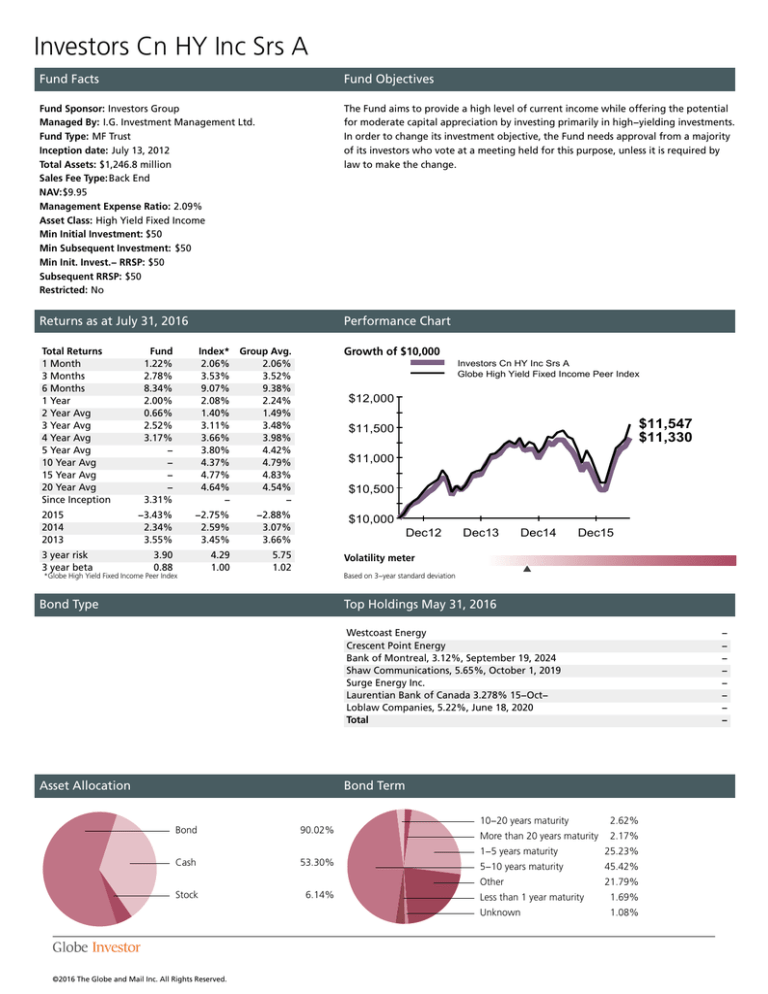

Performance Chart

Total Returns

1 Month

3 Months

6 Months

1 Year

2 Year Avg

3 Year Avg

4 Year Avg

5 Year Avg

10 Year Avg

15 Year Avg

20 Year Avg

Since Inception

2015

2014

2013

3 year risk

3 year beta

Fund

1.22%

2.78%

8.34%

2.00%

0.66%

2.52%

3.17%

−

−

−

−

3.31%

Growth of $10,000

Index* Group Avg.

2.06%

2.06%

3.53%

3.52%

9.07%

9.38%

2.08%

2.24%

1.40%

1.49%

3.11%

3.48%

3.66%

3.98%

3.80%

4.42%

4.37%

4.79%

4.77%

4.83%

4.64%

4.54%

−

−

−3.43%

2.34%

3.55%

−2.75%

2.59%

3.45%

−2.88%

3.07%

3.66%

3.90

0.88

4.29

1.00

5.75

1.02

*Globe High Yield Fixed Income Peer Index

Investors Cn HY Inc Srs A

Globe High Yield Fixed Income Peer Index

$12,000

$11,547

$11,330

$11,500

$11,000

$10,500

$10,000

Dec12

Dec13

Dec14

Dec15

Volatility meter

Based on 3−year standard deviation

Bond Type

Top Holdings May 31, 2016

Westcoast Energy

Crescent Point Energy

Bank of Montreal, 3.12%, September 19, 2024

Shaw Communications, 5.65%, October 1, 2019

Surge Energy Inc.

Laurentian Bank of Canada 3.278% 15−Oct−

Loblaw Companies, 5.22%, June 18, 2020

Total

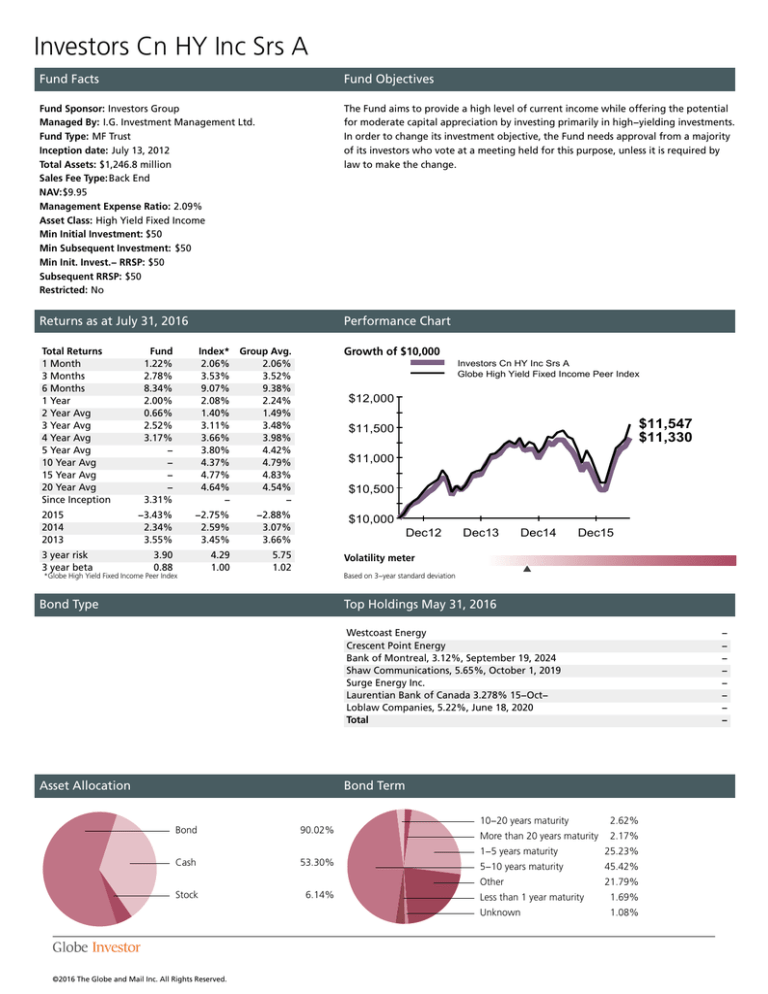

Asset Allocation

−

−

−

−

−

−

−

−

Bond Term

Bond

Cash

Stock

©2016 The Globe and Mail Inc. All Rights Reserved.

90.02%

53.30%

6.14%

10−20 years maturity

More than 20 years maturity

2.62%

2.17%

1−5 years maturity

25.23%

5−10 years maturity

45.42%

Other

21.79%

Less than 1 year maturity

1.69%

Unknown

1.08%

Investors Cn HY Inc Srs A

Disclaimer

Reports produced using this website are for information purposes only and should be used for general information only.

Great−West Life and its representatives have no control over the function or design of the software and it may not

contain accurate or current unit values. The only true report on unit values is the periodic statement prepared and sent by

the company.

The indicated rates of return are annual compounded returns including changes in the unit value and are as of the date

indicated. The investment management fee has been deducted. Unit values and investment returns will fluctuate and past

performance is not necessarily indicative of future performance.

A description of the key features of Great−West’s flexible accumulation annuity (FAA) and flexible income fund (FIF) is

contained in the information folder, available from your financial security advisor. Any amount that is allocated to a

segregated fund is invested at the risk of the policyholder and may increase or decrease in value.

©2016 The Globe and Mail Inc. All Rights Reserved.