Annual report 2014

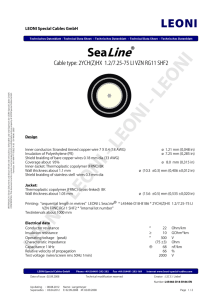

advertisement