The Income Tax Ordinance, 2001 Up-to July 2010

advertisement

2010 – 2011

The Income Tax Ordinance, 2001

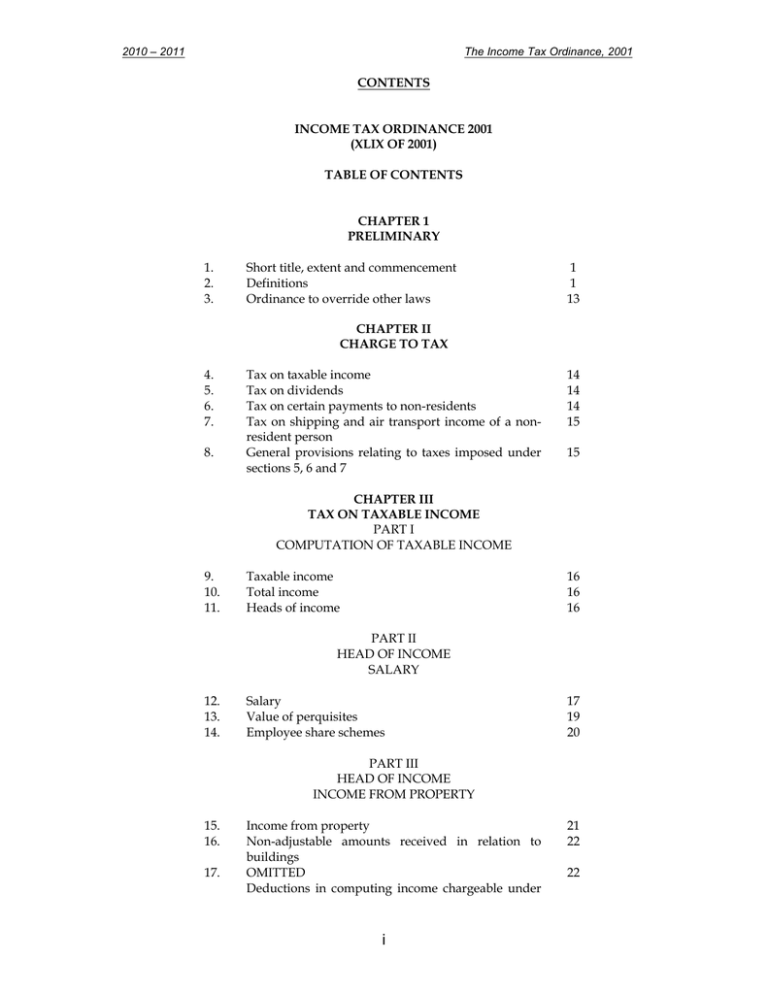

CONTENTS

INCOME TAX ORDINANCE 2001

(XLIX OF 2001)

TABLE OF CONTENTS

CHAPTER 1

PRELIMINARY

1.

2.

3.

Short title, extent and commencement

Definitions

Ordinance to override other laws

1

1

13

CHAPTER II

CHARGE TO TAX

4.

5.

6.

7.

8.

Tax on taxable income

Tax on dividends

Tax on certain payments to non-residents

Tax on shipping and air transport income of a nonresident person

General provisions relating to taxes imposed under

sections 5, 6 and 7

14

14

14

15

15

CHAPTER III

TAX ON TAXABLE INCOME

PART I

COMPUTATION OF TAXABLE INCOME

9.

10.

11.

Taxable income

Total income

Heads of income

16

16

16

PART II

HEAD OF INCOME

SALARY

12.

13.

14.

Salary

Value of perquisites

Employee share schemes

17

19

20

PART III

HEAD OF INCOME

INCOME FROM PROPERTY

15.

16.

17.

Income from property

Non-adjustable amounts received in relation to

buildings

OMITTED

Deductions in computing income chargeable under

i

21

22

22

2010 – 2011

The Income Tax Ordinance, 2001

the head "Income from property"

PART IV

HEAD OF INCOME

INCOME FROM BUSINESS

Division I

Income from Business

18.

19.

Income from business

Speculation business

23

24

Division II

Deductions

General Principles

20.

21.

Deductions in computing income chargeable under

the head "Income from Business"

Deductions not allowed

25

25

Division III

Deductions

Special Provisions

22.

23.

23A.

23B.

24.

25.

26.

27.

28.

29.

29A

30.

31.

Depreciation

Initial allowance

First Year Allowance

Accelerated depreciation to alternate energy

projects.

Intangibles

Pre-commencement expenditure

Scientific research expenditure

Employee training and facilities

Profit on debt, financial costs and lease payments

Bad debts

Provision Regarding Consumer Loans

Profit on non-performing debts of a banking

company or development finance institution

Transfer to participatory reserve

27

30

30

31

31

32

33

33

33

34

35

35

36

Division IV

TAX ACCOUNTING

32.

33.

34.

35.

36.

Method of accounting

Cash-basis accounting

Accrual-basis accounting

Stock-in-trade

Long-term contracts

36

36

37

37

38

PART V

HEAD OF INCOME

CAPITAL GAINS

37.

Capital gains

39

ii

2010 – 2011

The Income Tax Ordinance, 2001

37A.

38.

Capital gain on disposal of securities

Deduction of losses in computing the amount

chargeable under the head "Capital Gains"

40

41

PART VI

HEAD OF INCOME

INCOME FROM OTHER SOURCES

39.

40.

Income from other sources

Deductions in computing income chargeable under

the head "Income from Other Sources"

42

43

PART VII

EXEMPTIONS AND TAX CONCESSIONS

41.

42.

43.

44.

45.

46.

47.

48.

49.

50.

51.

52.

53.

54.

55.

Agricultural income

Diplomatic and United Nations exemptions

Foreign government officials

Exemptions under international agreements

President's honours

Profit on debt

Scholarships

Support payments under an agreement to live apart

Federal and Provincial Government, and local

authority income

Foreign-source income of short-term resident

individuals

Foreign-source income of returning expatriates

Omitted

Exemptions and tax concessions in the Second

Schedule

Exemptions and tax provisions in other laws

Limitation of exemption

44

44

45

45

45

45

46

46

46

47

47

47

57

48

48

PART VIII

LOSSES

56.

56A.

57.

57A.

58.

59.

59A.

59AA

59B.

Set off of losses

Set off of losses of companies operating hotels

Carry forward of business losses

Set off of losses consequent to amalgamation

Carry forward of speculation business losses

Carry forward of capital losses

Limitations on set off and carry forward of lossess

Group Taxation

Group Relief

49

49

49

50

51

51

51

52

52

PART IX

DEDUCTIBLE ALLOWANCES

60.

60A.

60B.

Zakat

Workers’ Welfare Fund

Workers’ Participation Fund

iii

54

55

55

2010 – 2011

The Income Tax Ordinance, 2001

PART X

TAX CREDITS

61.

62.

63.

64.

65.

65A.

65B.

65C.

Charitable donations

Investment in shares

Retirement annuity scheme

Profit on debt

Miscellaneous provisions relating to tax credits

Tax credit to a person registered under the Sales Tax

Act, 1990

Tax credit for investment

Tax credit for enlistment

55

56

57

58

59

59

59

60

CHAPTER-IV

COMMON RULES

PART I

GENERAL

66.

67.

68.

69.

70.

71.

72.

73.

Income of joint owners

Apportionment of deductions

Fair market value

Receipt of income

Recouped expenditure

Currency conversion

Cessation of source of income

Rules to prevent double derivation and double

deductions

61

61

61

61

62

62

62

62

PART II

TAX YEAR

74.

Tax year

62

PART III

ASSETS

75.

76.

77.

78.

79.

Disposal and acquisition of assets

Cost

Consideration received

Non-arm's length transactions

Non-recognition rules

64

64

65

66

66

CHAPTER V

PROVISIONS GOVERNING PERSONS

PART I

CENTRAL CONCEPTS

Division I

Persons

80.

Person

67

Division II

iv

2010 – 2011

The Income Tax Ordinance, 2001

Resident and Non-resident Persons

81.

82.

83.

84.

Resident and non-resident persons

Resident individual

Resident company

Resident association of persons

68

68

68

68

Division III

Associates

85.

Associates

69

PART II

INDIVIDUALS

Division I

Taxation of Individuals

86.

87.

Principle of taxation of individuals

Deceased individuals

70

70

Division II

Provisions Relating to Averaging

88.

88A.

89.

An individual as a member of an association of

persons

Share profits of company to be added to taxable

income.

Authors

70

71

71

Division III

Income Splitting

90.

91.

Transfers of assets

Income of a minor child

71

72

PART III

ASSOCIATIONS OF PERSONS

92.

93.

Principles of taxation of associations of persons

Omitted

72

72

PART IV

COMPANIES

94.

95.

96.

97.

Principles of taxation of companies

Disposal of business by individual to wholly-owned

company

Disposal of business by association of persons to

wholly-owned company

Disposal of asset between wholly-owned companies

v

73

73

74

75

2010 – 2011

The Income Tax Ordinance, 2001

97A.

Disposal of Asset under a scheme of arrangement

and reconstruction.

76

PART V

COMMON PROVISIONS APPLICABLE TO

ASSOCIATIONS OF PERSONS AND COMPANIES

98.

Change in control of an entity

78

PART VA

TAX LIABILITY IN CERTAIN CASES

98A.

98B.

98C.

Change in the constitution of an association of

persons

Discontinuance of business or dissolution of an

association of persons

Succession to business, otherwise than on death

79

79

79

CHAPTER-VI

SPECIAL INDUSTRIES

PART I

INSURANCE BUSINESS

99.

Special provisions relating to insurance business

80

PART II

OIL, NATURAL GAS AND OTHER MINERAL

DEPOSITS

100.

100A.

Special provisions relating to the production of oil

and natural gas, and exploration and extraction of

other mineral deposits

Special Provisions relating to banking business

80

80

CHAPTER VII

INTERNATIONAL

PART I

GEOGRAPHICAL SOURCE OF INCOME

101.

Geographical source of income

81

PART II

TAXATION OF FOREIGN-SOURCE INCOME OF

RESIDENTS

102.

103.

104.

Foreign source salary of resident individuals

Foreign tax credit

Foreign losses

PART III

vi

83

83

84

2010 – 2011

The Income Tax Ordinance, 2001

TAXATION OF NON-RESIDENTS

105.

106.

107.

Taxation of a permanent establishment in Pakistan

of a non-resident person

Thin capitalization

PART IV

AGREEMENTS FOR THE AVOIDANCE OF

DOUBLE TAXATION AND

PREVENTION OF FISCAL EVASION

Agreements for the avoidance of double taxation

and prevention of fiscal evasion

84

85

86

CHAPTER VIII

ANTI-AVOIDANCE

108.

109.

110.

111.

112.

Transactions between associates

Re-characterization of income and deductions

Salary paid by private companies

Unexplained income or assets

Liability in respect of certain security transactions

87

87

87

87

88

CHAPTER IX

MINIMUM TAX

113.

113A.

113B

Minimum tax on the income of certain persons

Tax on Income of certain persons

Taxation of income of certain retailers

89

91

91

CHAPTER X

PROCEDURE

PART I

RETURNS

114.

115.

116.

117.

118.

119.

Return of income

Persons not required to furnish a return of income

Wealth statement

Notice of discontinued business

Method of furnishing returns and other documents

Extension of time for furnishing returns and other

documents

93

95

97

98

98

99

PART II

ASSESSMENTS

120.

120A.

121.

122.

122A.

122B.

122C.

123.

Assessments

Investment Tax on income

Assessment of persons who have not furnished a

return

Amendment of assessments

Revision by the Commissioner

Revision by the Regional Commissioner

Provisional assessment

Provisional assessment in certain cases

vii

100

101

102

102

104

105

105

105

2010 – 2011

The Income Tax Ordinance, 2001

124.

124A.

125.

126.

Assessment giving effect to an order

Powers to tax authorities to modify orders, etc.

Assessment in relation to disputed property

Evidence of assessment

105

107

107

107

PART III

APPEALS

127.

128.

129.

130.

131.

132.

133.

134.

134A.

135.

136.

Appeal to the Commissioner (Appeals)

Procedure in appeal

Decision in appeal

Appointment of the Appellate Tribunal

Appeal to the Appellate Tribunal

Disposal of appeals by the Appellate Tribunal

Reference to High Court

Appeal to Supreme Court [omitted]

Alternate Dispute Resolution

Omitted by the Finance Ordinance, 2002

Burden of proof

108

109

109

110

112

113

114

115

116

117

117

PART IV

COLLECTION AND RECOVERY OF TAX

137.

138.

138A.

138B.

139.

140.

141.

142.

143.

144.

145.

146.

146A.

146B.

Due date for payment of tax

Recovery of tax out of property and through arrest

of taxpayer

Recovery of tax by District Officer (Revenue)

Estate in bankruptcy

Collection of tax in the case of private companies

and associations of persons

Recovery of tax from persons holding money on

behalf of a taxpayer

Liquidators

Recovery of tax due by non-resident member of an

association of persons

Non-resident ship owner or chatterer

Non-resident aircraft owner or chatterer

Collection of tax from persons leaving Pakistan

permanently

Recovery of tax from persons assessed in Azad

Jammu and Kashmir

Initiation, validity, etc., of recovery proceedings.

Tax Arrears settlement incentives scheme

118

118

119

119

119

120

121

121

122

122

122

123

123

124

PART V

ADVANCE TAX AND DEDUCTION OF TAX AT

SOURCE

Division I

Advance Tax Paid by the Taxpayer

147.

Advance tax paid by the taxpayer

viii

125

2010 – 2011

The Income Tax Ordinance, 2001

Division II

Advance Tax Paid to a Collection Agent

148.

Imports

129

Division III

Deduction of Tax at Source

149.

150.

151.

152.

153.

153A.

154.

155.

156.

156A.

156B.

157.

158.

Salary

Dividends

Profit on debt

Payments to non-residents

Payments for goods and services

Payments to non-resident media persons.

Exports

Income from property

Prizes and winnings

Petroleum Products

Withdrawal of Balance under Pension Fund

Omitted by the Finance Ordinance, 2002

Time of deduction of tax

134

134

135

135

138

144

144

145

145

146

146

147

147

Division IV

General Provisions Relating to the Advance

Payment of Tax or the Deduction of Tax at Source

159.

160.

161.

162.

147

148

148

149

163.

164.

Exemption or lower rate certificate

Payment of tax collected or deducted

Failure to pay tax collected or deducted

Recovery of tax from the person from whom tax was

not collected or deducted

Recovery of amounts payable under this Division

Certificate of collection or deduction of tax

165.

166.

167.

168.

169.

Statements

Priority of tax collected or deducted

Indemnity

Credit for tax collected or deducted

Tax collected or deducted as a final tax

149

151

151

151

152

149

149

PART VI

REFUNDS

170.

171.

Refunds

Additional payment for delayed refunds

154

154

PART VII

REPRESENTATIVES

172.

173.

Representatives

Liability and obligations of representatives

PART VIII

ix

155

156

2010 – 2011

The Income Tax Ordinance, 2001

RECORDS, INFORMATION COLLECTION AND

AUDIT

174.

175.

176.

177.

178.

179.

180.

Records

Power to enter and search premises

Notice to obtain information or evidence

Audit

Assistance to Commissioner

Accounts, documents, records and computer-stored

information not in Urdu or English language

Power to collect information regarding exempt

income

157

157

158

159

161

161

161

PART IX

NATIONAL TAX NUMBER CARD

181.

181A.

National Tax Number Card

Active taxpayers’ list

162

162

PART X

PENALTY

182.

183.

184.

185.

186.

187.

188.

189.

190.

Penalty for failure to furnish a return or statement

Penalty for non-payment of tax

Penalty for concealment of income [OMITTED]

Penalty for failure to maintain records [OMITTED]

Penalty for non-compliance with notice [OMITTED]

Penalty for making false or misleading statements

[OMITTED]

Penalty for failure to give notice [OMITTED]

Penalty for obstruction [OMITTED]

Imposition of penalty [OMITTED]

163

166

166

166

166

167

167

167

167

PART XI

OFFENCES AND PROSECUTIONS

191.

192.

192A.

193.

194.

195.

196.

197.

198.

199.

200.

201.

Prosecution for non-compliance with certain

statutory obligations

Prosecution for false statement in verification

Prosecution for concealment of income

Prosecution for failure to maintain records

Prosecution for improper use of National Tax

Number Card

Prosecution for making false or misleading

statements

Prosecution for obstructing an income tax authority

Prosecution for disposal of property to prevent

attachment

Prosecution for unauthorized disclosure of

information by a public servant

Prosecution for abetment

Offences by companies and associations of persons

Institution of prosecution proceedings without

x

168

168

168

169

169

169

170

170

170

170

170

170

2010 – 2011

The Income Tax Ordinance, 2001

202.

203.

203A.

204.

prejudice to other action

Power to compound offences

Trial by Special Judge

Appeal against the order of a Special Judge

Power to tender immunity from prosecution

170

171

171

171

PART XII

ADDITIONAL TAX

205.

205A.

Additional tax Default surcharge

Reduction in additional tax default surcharge,

consequential to reduction in tax or penalty

172

173

PART XIII

CIRCULARS

206.

206A.

Circulars

Advance ruling

173

173

CHAPTER XI

ADMINISTRATION

PART I

GENERAL

207.

208.

209.

210.

211.

212.

213.

214.

214A.

214B.

214C.

215.

216.

217.

218.

219.

220.

221.

222.

223.

224.

225.

226.

227.

Income Tax Authorities

Appointment of income tax authorities

Jurisdiction of income tax authorities

Delegation

Power or function exercised

Authority of approval

Guidance to income tax authorities

Income tax authorities to follow orders of the Central

Board of Revenue

Condonation of time limit

Power of the Board to call for records

Selection for audit by the Board

Furnishing of returns, documents etc.

Disclosure of information by a public servant

Forms and notices; authentication of documents

Service of notices and other documents

Tax or refund to be computed to the nearest Rupee

Receipts for amounts paid

Rectification of mistakes

Appointment of expert

Appearance by authorized representative

Proceedings under the Ordinance to be judicial

proceedings

Proceedings against companies under liquidation

Computation of limitation period

Bar of suits in Civil Courts

xi

174

175

175

176

177

177

177

177

178

178

178

179

179

181

181

182

182

182

182

182

184

184

184

184

2010 – 2011

The Income Tax Ordinance, 2001

PART II

DIRECTORATE-GENERAL OF INSPECTION

228.

229.

230.

231.

Appointment of Directorate-General of Inspection

Inspection Authorities [Omitted]

Jurisdiction of Inspection Authorities [Omitted]

Functions and Powers of Directorate [Omitted]

185

185

185

185

PART III

DIRECTORATE-GENERAL OF WITHHOLDING

TAXES

230A.

Directorate-General of Withholding Taxes

186

CHAPTER XII

TRANSITIONAL ADVANCE TAX PROVISIONS

231A.

231AA.

231B.

232.

233.

233A.

234.

234A.

235.

236.

236A.

236B.

Cash Withdrawal from Bank

Advance tax on transactions in bank

Advance tax on private motor car

Omitted by the Finance Ordinance, 2002

Brokerage and Commission

Collection of tax by a stock exchange registered in

Pakistan

Transport Business

CNG Stations

Electricity Consumption

Telephone users

Advance tax at the time of sale by auction

Advance tax on purchase of air ticket

186

186

187

187

188

189

190

191

191

193

194

194

CHAPTER XIII

MISCELLANEOUS

237.

237A.

238.

239.

239A.

239B.

240.

Power to make rules

Electronic Record

Repeal

Savings

Transition to Federal Board of Revenue

Reference to authorities

Removal of difficulties

xii

195

196

196

196

198

198

198

2010 – 2011

The Income Tax Ordinance, 2001

SCHEDULES

FIRST SCHEDULE

PART I

RATES OF TAX

201

Division I

Rates of Tax for Individuals and Association of

Persons

201

Division IA

Rate of Tax on certain persons

207

Division IA

Rates of tax for Association of Persons

207

Division II

Rates of Tax for Companies

207

Division III

Rate of Dividend Tax

208

Division IV

Rate of Tax on Certain Payments to Non-residents

208

Division V

Rate of Tax on Shipping or Air Transport Income of

a Non-resident Person

208

Division VI

Income from Property

209

Division VII

Capital Gains on disposal of Securities

PART II

RATES OF ADVANCE TAX

Tax on Import of Goods

211

213

PART III

DEDUCTION OF TAX AT SOURCE

213

Division I

Profit on debt

213

Division II

Payments to non-residents

214

Division III

Payments for Goods or Services

215

xiii

2010 – 2011

The Income Tax Ordinance, 2001

DIVISION IIIA

Payments to non-resident media persons

216

Division IV

Exports

216

Division V

Income from Property

217

Division VI

Prizes and Winnings

218

Division VIA

Petroleum Products

219

Division VIB

CNG Stations

219

PART IV

DEDUCTION OR COLLECTION OF ADVANCE

TAX

221

Division I [OMITTED]

Transfer of Funds

221

Division II

Brokerage Commission

221

Division IIA

Rates for Collection of Tax by a Stock Exchange

Registered in Pakistan

221

Division III

Tax on Motor Vehicles

222

Division IV

Electricity Consumption

223

Division V

Telephone users

224

Division VI

Cash Withdrawal from Bank

224

Division VIA

Telephone Users

224

DIVISION VII

PURCHASE OF MOTOR CARS AND JEEPS

225

DIVISION VIII

Advance tax at the time of sale by auction

225

xiv

2010 – 2011

The Income Tax Ordinance, 2001

Division IX

225

SECOND SCHEDULE

EXEMPTIONS AND TAX CONCESSIONS

PART I

Exemptions from total income

227

PART II

Reduction in tax rates

261

PART III

Reduction in tax liability

271

PART IV

Exemption from specific provisions

275

THIRD SCHEDULE

PART I

Depreciation

297

PART II

Initial allowance and first year allowance

299

PART III

Pre-commencement expenditure

300

FOURTH SCHEDULE

Rules for the computation of the profits and gains of

Insurance Business

301

FIFTH SCHEDULE

305

PART I

Rules for the computation of the profits and gains

from the exploration and production of petroleum

305

PART II

Rules for the computation of the profits and gains

from the exploration and extraction of minerals

deposits (other than petroleum)

309

SIXTH SCHEDULE

311

PART I

Recognized Provident Funds

311

xv

2010 – 2011

The Income Tax Ordinance, 2001

PART II

Approved Superannuation Funds

317

PART III

Approved Gratuity Funds

321

SEVENTH SCHEDULE

RULES FOR THE COMPUTATION OF THE

PROFITS AND GAINS OF A BANKING

COMPANY AND TAX PAYABLE THEREON

******************

xvi

325

2010 – 2011

The Income Tax Ordinance, 2001

1

F.No.2(1)/2001-Pub.- The following Ordinance promulgated by the President is hereby published for

general information:AN

ORDINANCE

to consolidate and amend the law relating to income tax

WHEREAS it is expedient to consolidate and amend the law relating to income tax and to provide for

matters ancillary thereto or connected therewith;

WHEREAS the President is satisfied that circumstances exist which render it necessary to take

immediate action;

NOW, THEREFORE, in pursuance of the Proclamation of Emergency of the fourteenth day of October,

1999, and the Provisional Constitution Order No. 1 of 1999, read with Provisional Constitutional

Amendment Order No. 9 of 1999, and in exercise of all powers enabling him in that behalf, the President of

the Islamic Republic of Pakistan is pleased to make and promulgate the following Ordinance:CHAPTER I

PRELIMINARY

1. Short title, extent and commencement.- (1) This Ordinance may be called the Income Tax Ordinance,

2001.

(2) It extends to the whole of Pakistan.

(3) It shall come into force on [the first day of July, 2002.]♦

2.

Definitions.- In this Ordinance, unless there is anything repugnant in the subject or context –

(1) "accumulated profits" in relation to 1[distribution or payment of] a dividend, 2[include] –

(a) any reserve made up wholly or partly of any allowance, deduction, or exemption admissible under

this Ordinance;

(b) for the purposes of 3[sub-clauses (a), (b) and (e) of clause (19)”] all profits of the company including

income and gains of a trust up to the date of such distribution or such payment, as the case may be; and

(c) for the purposes of 4[sub-clause (c) of clause (19)], includes all profits of the company including

income and gains of a trust up to the date of its liquidation;

5[(1A) Ô

“amalgamation” means the merger of one or more banking companies or non-banking financial

institutions, 6[or insurance companies, 1[or companies owning and managing industrial undertakings 2[or

♦

Substituted by Finance Ordinance 2002 vide S.R.O.381(I)/2002 dated 15th June, 2002 for the words “such date as the Federal

Government may, by notification in official Gazette, appoint.”

1 Inserted by Finance Act, 2003

2 The word “includes” substituted by the Finance Act, 2005.

3 Substituted for “clauses (a), (d) and (e) of sub-section (20)”, by the Finance Ordinance, 2002.

4 Substituted for “clause (c) of sub-section (20)”, by Finance Ordinance, 2002.

5 Inserted by the Finance Ordinance, 2002.

Ô

EXPLANATION VIDE IT CIR. NO. 1 OF 2005 DATED THE 5TH JULY, 2005. AMALGAMATION OF COMPANIES. [Section 2(1A)]

The term amalgamation was defined under section 2(1A) as “merger of one or more banking companies or non-banking financial

institutions or insurance companies. The scope of this definition has been extended to the industrial sector as well where

amalgamation takes place on or after July 1, 2005.

Further more, previously both the merging companies had to be either public companies or companies incorporated under any law

other than the companies Ordinance 1984. This restriction has also been relaxed by allowing one of the merging companies to be a

private limited company.

6 Words inserted vide Finance Act, 2004

2010 – 2011

2

The Income Tax Ordinance, 2001

companies engaged in providing services and not being a trading company or companies]]] in either case

least one of them] being a public company, or a company incorporated under any law, other than

Companies Ordinance, 1984 (XLVII of 1984), for the time being in force, (the company or companies which

so merge being referred to as the “amalgamating company” or companies and the company with which

they merge or which is formed as a result of merger, as the “amalgamated company”) in such manner that

–

3[at

(a) the assets of the amalgamating company or companies immediately before the amalgamation become

the assets of the amalgamated company by virtue of the amalgamation, otherwise than by purchase of such

assets by the amalgamated company or as a result of distribution of such assets to the amalgamated

company after the winding up of the amalgamating company or companies; 4[and]

(b) the liabilities of the amalgamating company or companies immediately before the amalgamation

become the liabilities of the amalgamated company by virtue of the amalgamation 5[.]

6[

]

(2)

130;]

7[“Appellate

Tribunal” means the Appellate Tribunal Inland Revenue established under section

(3) “approved gratuity fund” means a gratuity fund approved by the Commissioner in accordance with

Part III of the Sixth Schedule;

8 [(3A)

“Approved Annuity Plan” means an Annuity Plan approved by Securities and Exchange

Commission of Pakistan (SECP) under Voluntary Pension System Rules, 2005 and offered by a Life

Insurance Company registered with the SECP under Insurance Ordinance, 2000 (XXXIX of 2000);]

[(3B)

“Approved Income Payment Plan” means an Income Payment Plan approved by Securities and

Exchange Commission of Pakistan (SECP) under Voluntary Pension System Rules, 2005 and offered by a

Pension Fund Manager registered with the SECP under Voluntary Pension System Rules, 2005;]

9

10[(3C)

“Approved Pension Fund” means Pension Fund approved by Securities and Exchange

Commission of Pakistan (SECP) under Voluntary Pension System Rules, 2005, and managed by a Pension

Fund Manager registered with the SECP under Voluntary Pension System Rules, 2005;]

11[(3D)

“Approved Employment Pension or Annuity Scheme” means any employment related

retirement scheme approved under this Ordinance, which makes periodical payment to a

beneficiary i.e. pension or annuity such as approved superannuation fund, public sector pension scheme

and Employees Old-Age Benefit Scheme;

(3E)

“Approved Occupational Savings Scheme” means any approved gratuity fund or recognized

provident fund;]

(4) “approved superannuation fund” means a superannuation fund, or any part of a superannuation

fund, approved by the Commissioner in accordance with Part II of the Sixth Schedule;

1[(5)

“assessment” includes re-assessment and amended assessment and the cognate expressions

shall be construed accordingly;]

Inserted by the Finance Act, 2005.

Words inserted by the Finance Act, 2007.

3 Inserted by the Finance Act, 2005.

4 Added by the Finance Act, 2005.

5 The semi-colon and word “and” substituted by the Finance Act, 2005.

6 Omitted by the Finance Act, 2005. The omitted clause (c) read as follows: “(c) the scheme of amalgamation is approved by the State bank of Pakistan or by the Securities and Exchange Commission of

Pakistan A[on or before thirtieth day of June, B[2006]];]”

A Inserted by the Finance Act, 2003.

7 Substituted for ““Appellate Tribunal” means the Appellate Tribunal established under section 130;” vide the Finance Act, 2010.

8 Inserted by the Finance Act, 2005.

9 Inserted by the Finance Act, 2005.

10 Inserted by the Finance Act, 2005.

11 Clause 3D & 3E inserted by the Finance Act, 2006

1

2

2010 – 2011

2[(5A)

3

The Income Tax Ordinance, 2001

“assessment year” means assessment year as defined in the repealed Ordinance;]

3[(5B)

“asset management company” means an asset management company as defined in the NonBanking Finance Companies and Notified Entities Regulations, 2007;]

(6) “association of persons” means an association of persons as defined in section 80;

(7) “banking company” means a banking company as defined in the Banking Companies Ordinance, 1962

(LVII of 1962) and includes any body corporate which transacts the business of banking in Pakistan;

(8) “bonus shares” includes bonus units in a unit trust;

(9) “business” includes any trade, commerce, manufacture, profession, vocation or adventure or concern

in the nature of trade, commerce, manufacture, profession or vocation, but does not include employment;

(10) “capital asset” means a capital asset as defined in section 37;

(11) 4[“Board” means the Federal Board of Revenue established under the Federal Board of Revenue Act,

1924 (IV of 1924), and on the commencement of Federal Board of Revenue Act, 2007, the Federal Board of

Revenue established under section 3 thereof;]

5[(11A)

“charitable purpose” includes relief of the poor, education, medical relief and the advancement

of any other object of general public utility;]

6[(11B)

“Chief Commissioner” means a person appointed as Chief Commissioner Inland Revenue

under section 208 and includes a Regional Commissioner of Income Tax and a Director General of Income

Tax and Sales Tax;]

(12)

“company” means a company as defined in section 80;

[(13)

“Commissioner” means a person appointed as Commissioner Inland Revenue under section 208

and includes any other authority vested with all or any of the powers and functions of the Commissioner;]

7

8[(13A)

“Commissioner (Appeals)” means a person appointed as Commissioner Inland Revenue

(Appeals) under section 208;]

9[(13B)

“Contribution to an Approved Pension Fund” means contribution as defined in rule 2(j) of the

Voluntary Pension System Rules, 2005 [1];]

1 Substituted by the Finance Ordinance, 2002. The original clause read as follows:

“(5) “assessment” means –

(a) an assessment referred to in section 120;

(b) an assessment raised under section 121;

(c) an amended assessment under section 122;

(d) a demand for an amount due under sections 141, 142, 143 and 144; or

(e) an assessment of penalty under section 190;”.

2 Inserted by the Finance Ordinance, 2002

3 Clause (5B) substituted vide Finance Act, 2008, earlier this clause inserted by the Finance Ordinance, 2002, the old text read as

follows :(5B) “assets management company” means a company registered under the Assets Management companies Rules, 1995;

4 Clause (11) substituted by the Finance Act, 2007, the old clause read as follows: “Central Board of Revenue” means the Central Board of Revenue established under the Central Board of Revenue Act, 1924 (IV of

1924);

5 Inserted by the Finance Ordinance, 2002.

6 Clause (11B) inserted vide the Finance Act, 2010.

7 Substituted by the Finance Act, 2010, the replaced text read as follows: [(13) “Commissioner” means a person appointed as a Commissioner of Income Tax under section 208, and includes a taxation officer

vested with all or any of the powers and functions of the Commissioner;]

Substituted vide Finance Ordinance, 2002. The original clause read as follows:

“(13) “Commissioner” means a person appointed as a Commissioner of Income Tax under section 209”.

8 Substituted by the Finance Act, 2010, the replaced text read as follows: [(13A)

“Commissioner (Appeals)” means a person appointed as a Commissioner of Income Tax (Appeals) under section 208;]

(Issued vide the Finance Ordinance, 2002)

9 Inserted by the Finance Act, 2005.

2010 – 2011

4

The Income Tax Ordinance, 2001

(14) “co-operative society” means a co-operative society registered under the Co-operative Societies Act,

1925 (VII of 1925) or under any other law for the time being in force in Pakistan for the registration of cooperative societies;

(15) “debt” means any amount owing, including accounts payable and the amounts owing under

promissory notes, bills of exchange, debentures, securities, bonds or other financial instruments;

(16) “deductible allowance” means an allowance that is deductible from total income under Part IX of

Chapter III;

(17) “depreciable asset” means a depreciable asset as defined in section 22;

(18) “disposal” in relation to an asset, means a disposal as defined in section 75;

(19) “dividend” includes (a) any distribution by a company of accumulated profits to its shareholders, whether capitalised or not, if

such distribution entails the release by the company to its shareholders of all or any part of the assets

including money of the company;

(b) any distribution by a company, to its shareholders of debentures, debenture-stock or deposit certificate

in any form, whether with or without profit, 2[ ] to the extent to which the company possesses accumulated

profits whether capitalised or not;

(c) any distribution made to the shareholders of a company on its liquidation, to the extent to which the

distribution is attributable to the accumulated profits of the company immediately before its liquidation,

whether capitalised or not;

(d) any distribution by a company to its shareholders on the reduction of its capital, to the extent to which

the company possesses accumulated profits, whether such accumulated profits have been capitalised or

not; [3]

(e) any payment by a private company 4[as defined in the Companies Ordinance, 1984 (XLVII of 1984)] or

trust of any sum (whether as representing a part of the assets of the company or trust, or otherwise) by way

of advance or loan to a shareholder or any payment by any such company or trust on behalf, or for the

individual benefit, of any such shareholder, to the extent to which the company or trust, in either case,

possesses accumulated profits; 5[or]

6[(f) 1[remittance

of] after tax profit of a branch of a foreign company operating in Pakistan;]

Words “, but not exceeding five hundred thousand rupees in a tax year” Omitted by the Finance Act, 2006

The words “and any distribution to its shareholders of shares by way of bonus or bonus shares”, omitted by the Finance Ordinance,

2002

3 Word “or” omitted by the Finance Act, 2008.

4 Inserted by Finance Act, 2003

5 Word “or” inserted by the Finance Act, 2008.

6

EXPLANATION ISSUED VIDE CIRCULAR No. 3 DATED THE 17TH JULY, 2009Through Finance Act, 2008 remittances of after tax profit by a branch of foreign company operating in Pakistan were taxed as

dividend income @ 10%. However, due to absence of word “remittance” in the newly inserted sub-section 2(19)(f), a mistaken view

could have been taken to the effect that merely showing of accumulated profits of a branch are taxable as dividend income, whereas

the intention of the legislature was to deem the remittance of after tax profit, by a branch to its head office, outside Pakistan, as

dividend income. In order to remove this ambiguity amendment has been made in the said clause by virtue of which the “remittance

of after tax profit” would be treated as dividend income.

1.1 Apart from above, petroleum exploration and production (E&P) companies operating in Pakistan also became liable to pay tax

on such remittances treated as ‘dividend’ whereas their rate of tax was frozen by Petroleum Concession Agreements signed between

the Government of Pakistan and E&P Companies. In view of this international commitment, such companies have been excluded

from the purview of aforesaid clause.a new sub-clause (iv) in Clause (f) of sub-section (19) of section 2 of the Ordinance has been

inserted by virtue of which the remittances of after tax profit by a branch of non-resident Petroleum Exploration and Production

Company operating in Pakistan has been excluded from the ambit of the dividend.

1.2 Consequential amendment has also been made in subsection (1) of section 5, which imposes a tax on dividend income.

Sub-clause (f) inserted by the Finance Act, 2008.

EXPLANATION ISSUED VIDE CIRCULAR No. 5 DATED THE 5TH JULY, 2008BRANCH REMITTANCE TAX ON TRANSFER OF PROFITS ABROAD. [Section 2(19)(f)].

1

2

2010 – 2011

5

The Income Tax Ordinance, 2001

but does not include (i) a distribution made in accordance with 2[sub-clause] (c) or (d) in respect of any share for full cash

consideration, or redemption of debentures or debenture stock, where the holder of the share or debenture

is not entitled in the event of liquidation to participate in the surplus assets;

(ii) any advance or loan made to a shareholder by a company in the ordinary course of its business, where

the lending of money is a substantial part of the business of the company; [3]

(iii) any dividend paid by a company which is set off by the company against the whole or any part of any

sum previously paid by it and treated as a dividend within the meaning of 4[sub-clause] (c) to the extent to

which it is so set off; 5[and]

6[(iv)

remittance of after tax profit by a branch of Petroleum Exploration and Production (E&P) foreign

company, operating in Pakistan.]

[(19A)

“Eligible Person”, for the purpose of Voluntary Pension System Rules, 2005, means an

individual Pakistani who 7[holds] a valid National Tax Number 8[or Computerized National Identity Card

9[or National Identity Card for Overseas Pakistanis] issued by the National Database and Registration

Authority] [10]11[:]]

12[Provided

that the total tax credit available for the contribution made to approved employment pension

or annuity scheme and approved pension fund under Voluntary Pension System Rules, 2005, should not

exceed the limit prescribed or specified in section 63.]

13[(19B)

the expressions “addressee”, “automated”, “electronic”, “electronic signature”, “information”,

“information system”, “originator” and “transaction”, shall have the same meanings as are assigned to

them in the Electronic Transactions Ordinance, 2002 (LI of 2002);

(19C) “electronic record” includes the contents of communications, transactions and procedures under this

Ordinance, including attachments, annexes, enclosures, accounts, returns, statements, certificates,

applications, forms, receipts, acknowledgements, notices, orders, judgments, approvals, notifications,

circulars, rulings, documents and any other information associated with such communications,

transactions and procedures, created, sent, forwarded, replied to, transmitted, distributed, broadcast,

stored, held, copied, downloaded, displayed, viewed, read, or printed, by one or several electronic

resources and any other information in electronic form;

(19D) “electronic resource” includes telecommunication systems, transmission devices, electronic video or

audio equipment, encoding or decoding equipment, input, output or connecting devices, data processing

A non-resident can form a Pakistani company for operation in Pakistan or conduct business activity through its branch in Pakistan.

After tax profits, in the case of a foreign controlled resident company are distributed through payment of dividend which attracts 10%

income tax whereas, such profits in the case of a branch of a non-resident company are remitted outside Pakistan without payment of

any tax. This had created disparity of taxation between the said two situations.

1.1 After tax profits so transferred by a branch of a foreign company out of Pakistan has been treated as dividend income, under

sub-clause (f) of clause (19) of section 2 of the Income Tax Ordinance, 2001 (hereinafter to be referred as “Ordinance”) and chargeable

to tax @ 10% of gross amount, vide the Finance Act, 2008. It will be in line with the international best practices prevalent in European

Countries, USA, and Canada. It will also check outflow of foreign exchange and provide level playing field to non-residents operating

by incorporating a Pakistani company or through branch of a foreign company.

1 Substituted for “any” vide the Finance Act, 2009.

2 Substituted for “clause” by the Finance Ordinance, 2002

3 Word “and” omitted vide the Finance Act, 2009.

4 Substituted for “clause” by the Finance Ordinance, 2002

5 Word inserted vide the Finance Act, 2009.

6 Paragraph (iv) added vide the Finance Act, 2009.

7 Substituted for “has obtained” by the Finance Act, 2007.

8 Words inserted by the Finance Act, 2007

9 Words inserted by the Finance Act, 2008.

10 Words “but does not include an individual who is entitled to benefit under any other approved employment pension or annuity

scheme” omitted by the Finance Act, 2006

11 Substituted for semicolon by the Finance Act, 2006

12 Proviso added by the Finance Act, 2006

13 Clauses 19B, 19C, 19D and 19E inserted by the Finance Act, 2008.

2010 – 2011

6

The Income Tax Ordinance, 2001

or storage systems, computer systems, servers, networks and related computer programs, applications and

software including databases, data warehouses and web portals as may be prescribed by the Board from

time to time, for the purpose of creating electronic record;

(19E) “telecommunication system” includes a system for the conveyance, through the agency of electric,

magnetic, electro-magnetic, electro-chemical or electro-mechanical energy, of speech, music and other

sounds, visual images and signals serving for the impartation of any matter otherwise than in the form of

sounds or visual images and also includes real time online sharing of any matter in manner and mode as

may be prescribed by the Board from time to time.]

(20) “employee” means any individual engaged in employment;

(21) “employer” means any person who engages and remunerates an employee;

(22) “employment includes –

(a) a directorship or any other office involved in the management of a company;

(b) a position entitling the holder to a fixed or ascertainable remuneration; or

(c) the holding or acting in any public office;

(23) “fee for technical services” means any consideration, whether periodical or lump sum, for the

rendering of any managerial, technical or consultancy services including the services of technical or other

personnel, but does not include –

(a) consideration for services rendered in relation to a construction, assembly or like project undertaken

by the recipient; or

(b) consideration which would be income of the recipient chargeable under the head “Salary”;

(24) 1“financial institution” means an institution 2[as defined] under the Companies Ordinance, 3[1984

(XLVII of 1984)]4 [ ];

(25) “finance society” includes a co-operative society which accepts money on deposit or otherwise for the

purposes of advancing loans or making investments in the ordinary course of business;

(26) “firm” means a firm as defined in section 80;

(27) “foreign-source income” means foreign-source income as defined in sub-section (16) of section 101.

(28) “House Building Finance Corporation” means the Corporation constituted under the House Building

Finance Corporation Act, 1952 (XVIII of 1952);

[(29)

“income” includes any amount chargeable to tax under this Ordinance, any amount subject to

collection 6[or deduction] of tax under section 148, 7[150, 152(1), 153, 154, 156, 156A, 233, 233A and], subsection (5) of section 234, 8[any amount treated as income under any provision of this Ordinance] and any

5

EXPLANATION VIDE IT CIR. NO. 1 OF 2005 DATED THE 5TH JULY, 2005.

DEDUCTIBILITY OF BAD DEBTS. [SECTION 2(24)]

A bad debt was previously deductible only in respect of money lent by a financial institution. A “financial institution” was defined, in

clause (24) of section 2, to mean an institution “notified” under the Companies Ordinance. This had restricted the applicability as

most of the financial institutions were not covered by this provision. To enlarge the scope of the provision the expression “notified”

has been substituted by “defined”.

2 The word “notified” substituted by the Finance Act, 2005.

3 Substituted for “1980 (XXXI of 1980)” by the Finance Ordinance, 2002

4 Substituted For “by the Federal Government in the official Gazette as a financial institution” by Finance Act, 2003.

5 Substituted by the Finance Ordinance, 2002. The original clause read as follows:

“(29) “income” includes any amount chargeable to tax under this Ordinance, any amount subject to collection of tax under Division II

of Part V of Chapter X, sub-section (5) of 234 Division III of Chapter XII, and any loss of income;”

6 Inserted by Finance Act, 2003

7 The figures, commas and word “153, 154 and 156,” substituted by the Finance Act, 2005.

8 Inserted by Finance Act, 2003

1

2010 – 2011

7

The Income Tax Ordinance, 2001

loss of income but does not include, in case of a shareholder of a 1[ ] company, the amount representing the

face value of any bonus share or the amount of any bonus declared, issued or paid by the company to the

shareholders with a view to increasing its paid up share capital;]

2

[(29A)

“income year” means income year as defined in the repealed Ordinance;]

3[(29B)

“Individual Pension Account” means an account maintained by an eligible person with a

Pension Fund Manager approved under the Voluntary Pension System Rules, 2005;]

4[(29C)

“Industrial undertaking” means –

(a)

an undertaking which is set up in Pakistan and which employs,-

(i)

ten or more persons in Pakistan and involves the use of electrical energy or any

other form of energy which is mechanically transmitted and is not generated by human or animal energy;

or

(ii) twenty or more persons in Pakistan and does not involve the use of electrical energy or

any other form of energy which is mechanically transmitted and is not generated by human or animal

energy;

and which is engaged in,(i) the manufacture of goods or materials or the subjection of goods or materials to any process which

substantially changes their original condition; or

(ii) ship-building; or

(iii) generation, conversion, transmission or distribution of electrical energy, or the supply of hydraulic

power; or

(iv) the working of any mine, oil-well or any other source of mineral deposits; and

(b)

any other industrial undertaking which the Board may by notification in the Official

Gazette, specify.]

(30) “intangible” means an intangible as defined in section 24;

[(30A) “investment company” means an investment company as defined in the Non-Banking Finance

Companies (Establishment and Regulation) Rules, 2003;]

Omitted by Finance Act, 2003

Inserted by the Finance Ordinance, 2002

3 Inserted by the Finance Act, 2005.

4 Substituted vide the Finance Act, 2010.

INCOME TAX Circular No. 10 dated the the July 16, 2010

DEFINITION OF INDUSTRIAL UNDERTAKINGS [Section 2(29C)].

Editorial nature of changes regarding formatting of paragraphs has been brought in the definition of "industrial undertakings", for

correct understanding and application.

The replaced text read as follows which was inserted by the Finance Act, 2005.: [(29C)

“Industrial undertaking” means –

(a) an undertaking which is set up in Pakistan and which employs, (i) ten or more persons in Pakistan and involves the use of

electrical energy or any other form of energy which is mechanically transmitted and is not generated by human or animal energy; or

(ii) twenty or more persons in Pakistan and does not involve the use of electrical energy or any other form of energy which is

mechanically transmitted and is not generated by human or animal energy and which is engaged in,(i) the manufacture of goods or materials or the subjection of goods or materials to any process which substantially changes their

original condition;

(ii) ship-building;

(iii) generation, conversion, transmission or distribution of electrical energy, or the supply of hydraulic power; or

(iv) the working of any mine, oil-well or any other source of mineral deposits; and

(b) any other industrial undertaking which the Central Board of Revenue may by notification in the official Gazette, specify;]

5 Clause (30A) substituted by the Finance Act, 2008, it was earlier inserted by the Finance Ordinance, 2002, the text read as follows: “investment company” means a company registered under the Investment Companies and Investment Advisors Rules, 1971;

1

2

2010 – 2011

8

The Income Tax Ordinance, 2001

1[(30AA) KIBOR means Karachi Interbank offered Rate prevalent on the first day of each quarter of the

financial year;]

2[(30B)

“leasing company” means a leasing company as defined in the Non-Banking Finance

Companies and Notified Entities Regulation, 2007;]

(31)

“liquidation” in relation to a company, includes the termination of a trust;

3[(31A) “Local Government” shall have the same meaning as in the Punjab Local Government Ordinance,

2001 (XIII of 2001), the Sindh Local Government Ordinance, 2001 (XXVII of 2001), the NWFP Local

Government Ordinance, 2001 (XIV of 2001) and the Balochistan Local Government Ordinance, 2001 (XVIII

of 2001);]

(32) “member” in relation to an association of persons, includes a partner in a firm;

(33) “minor child” means an individual who is under the age of eighteen years at the end of a tax year;

(34) “modaraba” means a modaraba as defined in the Modaraba Companies and Modarabas (Floatation

and Control) Ordinance, 1980 (XXXI of 1980);

(35) “modaraba certificate” means a modaraba certificate as defined in the Modaraba Companies and

Modarabas (Floatation and Control) Ordinance, 1980 (XXXI of 1980);

4[(35A)

“Mutual Fund” means a mutual fund 5[registered or approved by the Securities and Exchange

Commission of Pakistan ];]

6[(35B)

“non-banking finance company” means an NBFC as defined in the Non-Banking Finance

Companies (Establishment and Regulation) Rules, 2003;]

7[(36)

“non-profit organization” means any person other than an individual, which is –

(a) established for religious, educational, charitable, welfare or development purposes, or for the

promotion of an amateur sport;

(b) formed and registered under any law as a non-profit organization;

(c) approved by the Commissioner for specified period, on an application made by such person in the

prescribed form and manner, accompanied by the prescribed documents and, on requisition, such other

documents as may be required by the Commissioner;

and none of the assets of such person confers, or may confer, a private benefit to any other person;]

(37) “non-resident person” means a non-resident person as defined in Section 81;

(38) “non-resident taxpayer” means a taxpayer who is a non-resident person;

EXPLANATION ISSUED VIDE CIRCULAR No. 3 DATED THE 17TH JULY, 2009Definition of the term “KIBOR” has been provided to mean Karachi Interbank Offered Rate applicable on first day of each quarter of

the financial year. This change was required since KIBOR is now to be used for the purpose of applying the rate of compensation on

delayed refunds u/s 171 as well as the rate of additional tax u/s 205 of the Ordinance.

Clause (30AA) inserted vide the Finance Act, 2009.

2 Clause (30B) substituted by the Finance Act, 2008, it was earlier inserted by the Finance Ordinance, 2002, the text read as follows: “leasing company” means a company licensed under the Leasing Companies (Establishment and Regulation) Rules, 2000;

3 Clause (31A) inserted by the Finance Act, 2008

4 Inserted by the Finance Ordinance, 2002

5 Substituted for “set up by the Investment Corporation of Pakistan or by an investment company” by Finance Act, 2003

6 Clause (35b) substituted by the Finance Act, 2008, it was earlier inserted vide Fiance act, 2004.

7 Substituted by the Finance Ordinance, 2002. The original clause read as follows:

“(36) “non-profit organization” means any person –

(a) established for religious, charitable or educational purposes, or for the promotion of amateur sport;

(b) which is registered under any law as a non-profit organization and in respect of which the Commissioner has issued a ruling

certifying that the person is a non-profit organization for the purposes of this Ordinance; and

(c) none of the income or assets of the person confers, or may confer a private benefit on any other person”;.

1

2010 – 2011

9

The Income Tax Ordinance, 2001

1[(38A) “Officer of Inland Revenue” means any Additional Commissioner Inland Revenue, Deputy

Commissioner Inland Revenue, Assistant Commissioner Inland Revenue, Inland Revenue Officer, Inland

Revenue Audit Officer or any other officer however designated or appointed by the Board for the purposes

of this Ordinance;]

(39) “Originator” means Originator as defined in the Asset Backed Securitization Rules, 1999;

(40) “Pakistan-source income” means Pakistan-source income as defined in section 101;

2[(40A) “Pension Fund Manager” means an asset management company registered under the NonBanking Finance Companies (Establishment and Regulations) Rules, 2003, or a life insurance company

registered under Insurance Ordinance, 2000 (XXXIX of 2000), duly authorized by the Securities and

Exchange Commission of Pakistan and approved under the Voluntary Pension System Rules, 2005, to

manage the Approved Pension Fund;]

(41) Ô

“permanent establishment” in relation to a person, means a 3[fixed] place of business through

which the business of the person is wholly or partly carried on, and includes –

(a) a place of management, branch, office, factory or workshop, 4[premises for soliciting orders,

warehouse, permanent sales exhibition or sales outlet,]other than a liaison office except where the office

engages in the negotiation of contracts (other than contracts of purchase);

(b) a mine, oil or gas well, quarry or any other place of extraction of natural resources;

5[(ba)

an agricultural, pastoral or forestry property;]

(c) a building site, a construction, assembly or installation project 6[but only where such site, project and

its connected supervisory activities continue for a period or periods aggregating more than ninety days

within any twelve-months period] or supervisory activities 7connected with such site or project;

(d) the furnishing of services, including consultancy services, by any person through employees or other

personnel engaged by the person for such purpose 8[ ];

(e) a person acting in Pakistan on behalf of the person (hereinafter referred to as the “agent [”),]

other than an agent of independent status acting in the ordinary course of business as such, if the agent –

(i)

has and habitually exercises an authority to conclude contracts on behalf of the other person;

(ii) has no such authority, but habitually maintains a stock-in-trade or other merchandise from which the

agent regularly delivers goods or merchandise on behalf of the other person; or

(f) any substantial equipment installed, or other asset or property capable of activity giving rise to

income;

(42) “person” means a person as defined in section 80;

(43) “pre-commencement expenditure” means a pre-commencement expenditure as defined in section 25;

(44)

“prescribed” means prescribed by rules made under this Ordinance;

Inserted vide the Finance Act, 2010.

Inserted by the Finance Act, 2005.

Ô

IT CIRCULAR NO. 1 DATED THE 1ST JULY, 2006 DECLARES THAT THREE MONTHS ARE THE MINIMUM PERIOD

REQUIREMENT FOR THE DETERMINATION OF PERMANENT ESTABLISHMENT.

3 Word inserted by the Finance Act, 2006.

4 Inserted by Finance Act, 2003

5 Inserted by Finance Act, 2003

6 Words inserted by the Finance Act, 2006.

7 vide the Finance Act, 2010.

8 Omitted by Finance Act, 2003

9 Substituted for comma by the Finance Ordinance, 2002

1

2

2010 – 2011

1[(44A)

(a)

10

The Income Tax Ordinance, 2001

"Principal officer" used with reference to a company or association of persons includes—

a director, a manager, secretary, agent, accountant or any similar officer; and

(b)

any person connected with the management or administration of the company or association of

persons upon whom the Commissioner has served a notice of treating him as the principal officer thereof;]

(45)

“private company” means a company that is not a public company;

2 [ 3]

(46) “profit on a debt” 4[whether payable or receivable, means] –

(a) any profit, yield, interest, discount, premium or other amount 5[,] owing under a debt, other than a

return of capital; or

(b) any service fee or other charge in respect of a debt, including any fee or charge incurred in respect of a

credit facility which has not been utilised;

(47) “Êpublic company” means –

(a) a company in which not less than fifty per cent of the shares are held by the Federal Government 6[or

Provincial Government];

7[(ab)

a company in which 8[not less than fifty per cent of the] shares are held by a foreign

Government, or a foreign company owned by a foreign Government9[;]]

(b) a company whose shares were traded on a registered stock exchange in Pakistan at any time in the tax

year and which remained listed on that exchange 10[ ] at the end of that year; or

(c) 11[a unit trust whose units are widely available to the public and any other trust as defined in the

Trusts Act, 1882 (II of 1882);]

12[(47A)

“Real Estate Investment Trust (REIT) Scheme” means a REIT Scheme as defined in the Real

Estate Investment Trust Regulations, 2008;

Inserted by Finance Act, 2003

Clauses (45A) & (45B) inserted by the Finance Act, 2007.

3 Clauses (45A) and (45B) omitted by the Finance, Act, 2008, the omitted text read as below: (45A) “Private Equity and Venture Capital Fund” means a fund registered with the Securities and Exchange 53 Commission of

Pakistan under the Private Equity and Venture Capital Fund Rules, 2007;

(45B) “Private Equity and Venture Capital Fund Management Company” means a company licensed by the Securities and Exchange

Commission of Pakistan under the Private Equity and Venture Capital Fund Rules, 2007;

4 Inserted by Finance Act, 2003

5 Comma inserted by the Finance Ordinance, 2002.

Ê

EXPLANATION VIDE IT CIR. NO. 1 OF 2005 DATED THE 5TH JULY, 2005.

PUBLIC COMPANY DEFINITION – FOREIGN GOVERNMENT HOLDINGS [SECTION 2(47)]

Definition of “public company” was extended in 2003 to include “a company in which shares are held by a foreign government, or

foreign company owned by a foreign government.” The percentage of holding was however not specified with the implication that

even a nominal percentage of such share holdings would entitle a company to the tax benefits available to a public company. Subclause (ab) of clause (47) of section 2 has been amended and the condition of at least 50% share holdings by a foreign Government (or

a foreign company owned by a foreign Government) has been inserted. This will bring parity vis-a-vis companies in which the

Federal or the Provincial Governments hold shares.

6 Inserted Finance Act, 2003

7 Inserted by Finance Act, 2003

8 Inserted by the Finance Act, 2005.

9 The full stop substituted by the Finance Act, 2005.

10 The words “and was on the Central Depository System,” omitted by the Finance Ordinance, 2002

11 Substituted for “a unit trust whose units are widely available to the public and any other public trust;” by Finance Act, 2003.

12 Clauses 47A & 47B substituted by the Finance Act, 2008, earlier it was added by the Finance Act, 2006, the old clauses read as

follows: (47A) ÂReal Estate Investment Trust (REIT)” means a scheme which consists of a closed-end collective investment scheme constituted

as a unit trust fund and managed by a REIT management company for the purposes of investment in real estate, approved and

authorized by the Security and Exchange Commission of Pakistan under the Real Estate Investment Trust Rules, 2006;

1

2

Â

Income Tax Cir. No. 1 dated the 1st July, 2006

EXEMPTION FROM INCOME TAX – REAL ESTATE INVESTMENT TRUST (REIT) [Section 2(47A)]

2010 – 2011

11

The Income Tax Ordinance, 2001

(47B) “Real Estate Investment Trust Management Company (REITMC)” means REITMC as defined under

the Real Estate Investment Trust Regulations, 2008;]

(48) “recognised provident fund” means a provident fund recognised by the Commissioner in accordance

with Part I of the Sixth Schedule;

1[(48A)]

(49) “rent” means rent as defined in sub-section (2) of section 15 and includes an amount treated as rent

under section 16;

2[(49A)

“repealed Ordinance” means Income Tax Ordinance, 1979 (XXXI of 1979);]

(50) “resident company” means a resident company as defined in section 83;

(51) “resident individual means a resident individual as defined in section 82;

(52) “resident person” means a resident person as defined in section 81;

(53) “resident taxpayer” means a taxpayer who is a resident person;

(54) 3[“royalty”] means any amount paid or payable, however described or computed, whether periodical

or a lump sum, as consideration for (a) the use of, or right to use any patent, invention, design or model, secret formula or process, trademark

or other like property or right;

(b) the use of, or right to use any copyright of a literary, artistic or scientific work, including films or video

tapes for use in connection with television or tapes in connection with radio broadcasting, but shall not

include consideration for the sale, distribution or exhibition of cinematograph films;

(c) the receipt of, or right to receive, any visual images or sounds, or both, transmitted by satellite, cable,

optic fiber or similar technology in connection with television, radio or internet broadcasting;

(d) the supply of any technical, industrial, commercial or scientific knowledge, experience or skill;

(e) the use of or right to use any industrial, commercial or scientific equipment;

REIT is a security that sells like a stock and invests in real estate directly or indirectly. REIT has been provided exemptions from the

applicability of different provisions of the Income Tax Ordinance, 2001, subject to condition that not less than 90% of its accounting

income of that year, (as reduced by capital gains whether realized or unrealized) is distributing among the unit or certificate holders

or shareholders as the case may be.

Consequent to above amendments, the following expressions have been defined in section 2 of the Ordinance and exemptions have

been provided as below:Description

Under Clause

(i)

Real Estate Investment Trust (REIT)

(47A)

(ii) Real Estate Investment Trust Management Company

(47B)

(iii) Exemption to income

(99) Part I of Second Schedule

(iv) Exemption to instrument of redeemable capital

(57) Part I of Second Schedule

Under Clause

(v) Exemption from applicability of provision of;

Part IV of Second Schedule

Section

(11)

(a) 113 (minimum tax)

(33)

(b) 151 (Profit on debt) and 233 (Brokerage and Commission)

(47B)

(c) 150 (Dividends)

(47B) “Real Estate Investment Trust Management Company” means a company licensed by the Security and Exchange Commission of

Pakistan under the Real Estate Investment Trust Rules, 2006;]

1 Clause (41) omitted vide the Finance Act, 2010 and was inserted by the Finance Ordinance, 2002 as follows: “Regional Commissioner” means a person appointed as a Regional Commissioner of Income Tax under section 208 and includes a

Director-General of Income Tax and Sales Tax;

2 Inserted by the Finance Ordinance, 2002

3 Substituted for the word “royalties” by the Finance Ordinance, 2002.

2010 – 2011

12

The Income Tax Ordinance, 2001

(f) the supply of any assistance that is ancillary and subsidiary to, and is furnished as a means of

enabling the application or enjoyment of, any such property or right as mentioned in 1[sub-clauses] (a)

through (e); 2[and]

(g) the disposal of any property or right referred to in 3[sub-clauses] (a) through (e);

(55) “salary” means salary as defined in section 12;

(56) “Schedule” means a Schedule to this Ordinance;

(57) “securitization” means securitization as defined in the Asset Backed Securitization Rules, 1999;

(58) “share” in relation to a company, includes a modaraba certificate and the interest of a beneficiary in a

trust (including units in a trust);

(59) “shareholder” in relation to a company, includes a modaraba certificate holder, 4[a unit holder of a

unit trust] and a beneficiary of a trust;

“Ê Small Company” means a company registered on or after the first day of July, 2005, under

the Companies Ordinance, 1984 (XLVII) of 1984, which,-

5[(59A)

(i)

has paid up capital plus undistributed reserves not exceeding twenty-five million rupees;

6[(ia)

has employees not exceeding two hundred and fifty any time during the year;]

(ii) has annual turnover not exceeding two hundred 7[and fifty] million rupees; and

(iii) is not formed by the splitting up or the reconstitution of business already in existence;]

(60) “Special Purpose Vehicle” means a Special Purpose Vehicle as defined in the Asset Backed

Securitization Rules, 1999;

(61) “speculation business” means a speculation business as defined in section 19;

(62) “stock-in-trade” means stock-in-trade as defined in section 35;

(63) “tax” means any tax imposed under Chapter II, and includes any penalty, fee or other charge or any

sum or amount leviable or payable under this Ordinance;

(64) “taxable income” means taxable income as defined in section 9;

Substituted for the word “clauses” by the Finance Ordinance, 2002.

Added by the Finance Act, 2005.

3 Substituted for the “clauses” by the Finance Ordinance, 2002

4 Inserted for “, a unit holder of a unit trust” by the Finance Ordinance, 2002

5 Inserted by the Finance Act, 2005.

Ê

EXPLANATION VIDE IT CIR. NO. 1 OF 2007 DATED THE 2nd JULY, 2007.

REDEFINING “SMALL COMPANY”. [Section 2(59A)]

The concept of “small company” was introduced through Finance Act, 2005 with incentives of reduced corporate tax rate of 20% and

absolving it to withhold tax under section 153 of the Income Tax Ordinance. This expression has been redefined with following

parameters:

(i)

paid up capital upto Rs. 25 million;

(ii) the threshold of maximum turnover has been raised to Rs.250(m); and

(iii) employees limit not exceeding 250 persons at any time during the year

EXPLANATION VIDE IT CIR. NO. 1 OF 2005 DATED THE 5TH JULY, 2005.

TAXATION OF SMALL COMPANIES. [SECTION 2(59A)]

In order to encourage the small enterprises sector and to incentivize its corporatization, a concessional tax regime for small companies

has been introduced.

The newly inserted section 2(59A) defines “small company” as a company registered on or after the first day of July, 2005, which has

not been formed by splitting up or reconstitution of a company already in existence, having a paid up capital plus undistributed

reserves not exceeding Rs. 25 million and turnover upto Rs.200 million. Companies meeting the criteria shall enjoy a special corporate

tax rate of 20% which shall be applicable from tax year 2006 and onwards. At the same time, these companies have been exempted

from the obligation to act as a withholding agent and from payment of minimum tax under section 113.

6 Paragraph inserted by the Finance Act, 2007.

7 Words inserted by the Finance Act, 2007.

1

2

2010 – 2011

13

The Income Tax Ordinance, 2001

1[(65)]

(66) “taxpayer” means any person who derives an amount chargeable to tax under this Ordinance, and

includes –

(a) any representative of a person who derives an amount chargeable to tax under this Ordinance;

(b) any person who is required to deduct or collect tax under Part V of Chapter X 2[and Chapter XII;] or

(c) any person required to furnish a return of income or pay tax under this Ordinance;

(67) “tax treaty” means an agreement referred to in section 107;

(68) “tax year” means the tax year as defined in sub-section (1) of section 74 and, in relation to a person,

includes a special year or a transitional year that the person is permitted to use under section 74;

(69) “total income” means total income as defined in section 10;

(70) “trust” means a “trust” as defined in section 80;

3[(70A)

“turnover” means turnover as defined in sub-section (3) of section 113;]

(71) “underlying ownership” means an underlying ownership as defined in section 98;

(72) “units” means units in a unit trust;

(73) “unit trust” means a unit trust as defined in section 80; and

4[(74)

“Venture Capital Company” and “Venture Capital Fund” shall have the same meanings as are

assigned to them under the 5[Non-Banking Finance 6[Companies] (Establishment and Regulation) Rules,

2003];]

3. Ordinance to override other laws.- The provisions of this Ordinance shall apply notwithstanding

anything to the contrary contained in any other law for the time being in force.

1 Omitted vide the Finance Act, 2010, the omitted text read as follows: “taxation officer” means any 1[Additional Commissioner of Income Tax, Deputy Commissioner of Income Tax,] Assistant

Commissioner of Income Tax, Income Tax Officer, Special Officer or any other officer however designated appointed by the Central

Board of Revenue for the purposes of this Ordinance;

1 Substituted for the words and comma “Deputy Commissioner of Income Tax, Additional Commissioner of Income Tax” by the

Finance Ordinance, 2002

2 Inserted by the Finance Ordinance, 2002

3

EXPLANATION ISSUED VIDE CIRCULAR No. 3 DATED THE 17TH JULY, 2009Previously the term “turnover” had been defined in section 113 of the Ordinance which was deleted through Finance Act, 2008.

Consequently, the provisions of law (e.g. section 113A) where turnover was defined by reference to definition of turnover in section

113 became meaningless. Moreover in certain sections such as 113B, turnover was not defined. Through Finance Act, 2009, the term

turnover has been defined in section 2 of the Ordinance which will be applicable to the whole of the Ordinance.

Clause (70A) inserted vide the Finance Act, 2009.

4 Added by Finance Ordinance, 2002

5 Substituted for “Venture Capital Company and Venture Capital Funds Rules, 2001” by Finance Act, 2004.