Charities Update

advertisement

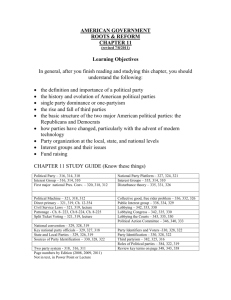

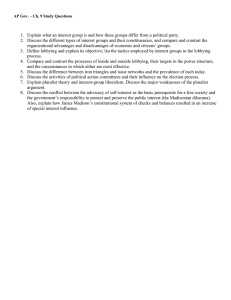

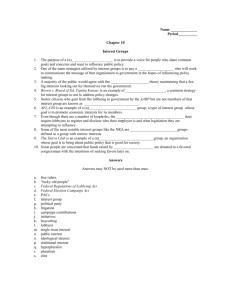

1 | ARTHUR COX Group Briefing CHARITY LAW Charities Update Summer 2015 KEY CONTACTS THE COMPANIES ACT 2014 AND THE REGISTER OF For further information please speak to your usual Arthur Cox contact or: LOBBYING PHILIP SMITH PARTNER +353 1 618 0557 philip.smith@arthurcox.com SARAH MCCAGUE ASSOCIATE +353 1 618 1145 sarah.mccague@arthurcox.com 1. INTRODUCTION The Companies Act 2014 (the “Act”) was generally commenced with effect from 1 June 2015. The Act involves an overhaul of the existing company law regime in place since the 1960’s. The Act segregates companies by corporate type and applies different law to each type of Company. The Act does not apply to charities established as charitable trusts or unincorporated associations. Where charities are incorporated entities, they are generally established as companies limited by guarantee not having share capital (“Guarantee Companies”). This update sets out on overview of the impact of the Act on Guarantee Companies. There is an 18 month transition period (commencing on 15 June 2015) for the introduction of the Act. At the end the transitional period, all of the existing Guarantee Companies will be deemed to be “CLGs” (companies limited by guarantee without a share capital). 2. MAIN CHANGES INTRODUCED BY THE ACT AS THEY APPLY TO CLGS This document contains a general summary of developments and is not a complate or definitive statement of the law. Specific legal advice should be obtained where appropriate. capitalised or lower case and with or without punctuation marks) or the Irish equivalent. However, if an existing Guarantee Company has been granted a license authorising it to dispense with the use of the word ‘Limited’ in its name, that exemption continues to apply and it will not be necessary to end the name of the company or charity with ‘company limited by guarantee’ or ‘CLG’. 2.2 Members The minimum number of members for a CLG has been reduced from seven to one. However, the Revenue Commissioners are unlikely to grant charitable tax exemption to charitable companies having one single member. If there is only one member of a CLG the obligation to hold an annual general meeting (“AGM”) can be waived. 2.3 Directors CLGs must have at least two directors. However, the Revenue Commissioners are likely to continue to require that a charity have at least three independent directors for it to be granted charitable tax exemption. 2.1 Company Name 2.4 Applicable law From the end of the transition period, the company name must end with the words ‘company limited by guarantee’ or the abbreviation ‘CLG’ (whether Table C which currently sets out model articles of association for CLGs will no longer exist. The law that is now 2 | ARTHUR COX CHARITY LAW CHARITIES UPDATE - SUMMER 2015 applicable to CLGs is set out in Parts 1 to 14 of the Act as modified by Part 18 of the Act. Reform, Brendan Howlin T.D., launched the Register of Lobbying website on Thursday 30 April 2015. The first steps organisations must take in order to comply with the requirements of the Lobbying Act are: If charities do not update their Memorandum and Articles of Association (“M&A”) in accordance with the Act existing M&A will continue to apply but certain provisions will be deemed ‘struck-out’ and certain default provisions of the Act will apply instead. The aim of the Lobbying Act is not to restrict the flow of information or views on policy or legislation. The intention is to bring about significantly greater openness and transparency about lobbying activities. 1. Review your organisation’s arrangements for recording relevant communications which might fall within the scope of the Lobbying Act and identify the key personnel involved. 3. WHAT HAS NOT CHANGED 3.1 The CLG will continue to have a two-document constitution (comprising the Memorandum and Articles of Association); 3.2 The M&A of a CLG must contain an objects clause. 4. WHAT STEPS SHOULD THE DIRECTORS OF A GUARANTEE COMPANY TAKE? Existing Guarantee Companies will be required to amend their name by the end of the 18 month transition period (which began on 1 June 2015). Although not strictly necessary to amend their M&A, a review and restatement of the M&A will for many companies be the prudent course of action. We would suggest that you discuss any proposed changes with your legal advisers. 5. REGISTER OF LOBBYING From 1 September 2015, the Regulation of Lobbying Act 2015 (the “Lobbying Act”) provides that organisations that employ more than ten staff (or if their primary activity is lobbying/advocacy, organisations that employ one or more staff) will be required to record all lobbying activity/communications that they engage in with Designated Public Officials in the Register of Lobbying. The Minister for Public Expenditure and arthurcox.com The Lobbying Act is designed to provide information to the public about: • Who is lobbying and on whose behalf is lobbying being carried out; • What are the issues involved in the lobbying and what is the intended result of the lobbying; and; • Who is being lobbied. In general, the Act applies to: • Advocacy groups, non-governmental organisations and charities which have at least one full time employee and which promote particular interests or causes; • Professional lobbyists; • Commercial organisations which have more than 10 full time employees; and • Representative bodies with at least one full time employee. The first formal return of the Register of Lobbying will be required by 21 January 2016 at the latest to cover the period from September to December 2015. Thereafter, a return will need to be made every four months. 2. Where necessary, put in place arrangements to record such information from 1 September 2015. 3. Create an account on www.lobbying. ie and submit a trial registration and return of any lobbying activity which takes place during the period 1 May – 31 August 2015. None of the information submitted during this period will be available for public scrutiny. 4. Identify individual(s) responsible for registration and compilation of returns from 21 January 2016 onwards. Arthur Cox has a long history of involvement in the community and voluntary sector in general, and with charities in particular. Our core Charity Law Group comprises four lawyers from a variety of disciplines. They are assisted by other relevant specialists from our Property, Employment & Industrial Relations, Pensions, Technology, Intellectual Property, Tax, Litigation and Corporate and M&A Groups. The fact that we have an office in Belfast means that clients have the benefit of a full one firm service where charity law issues involve both jurisdictions in Ireland. Dublin +353 1 618 0000 dublin@arthurcox.com London +44 207 823 0200 london@arthurcox.com Belfast +44 28 9023 0007 belfast@arthurcox.com New York +1 212 782 3294 newyork@arthurcox.com Silicon Valley +1 650 943 2330 siliconvalley@arthurcox.com