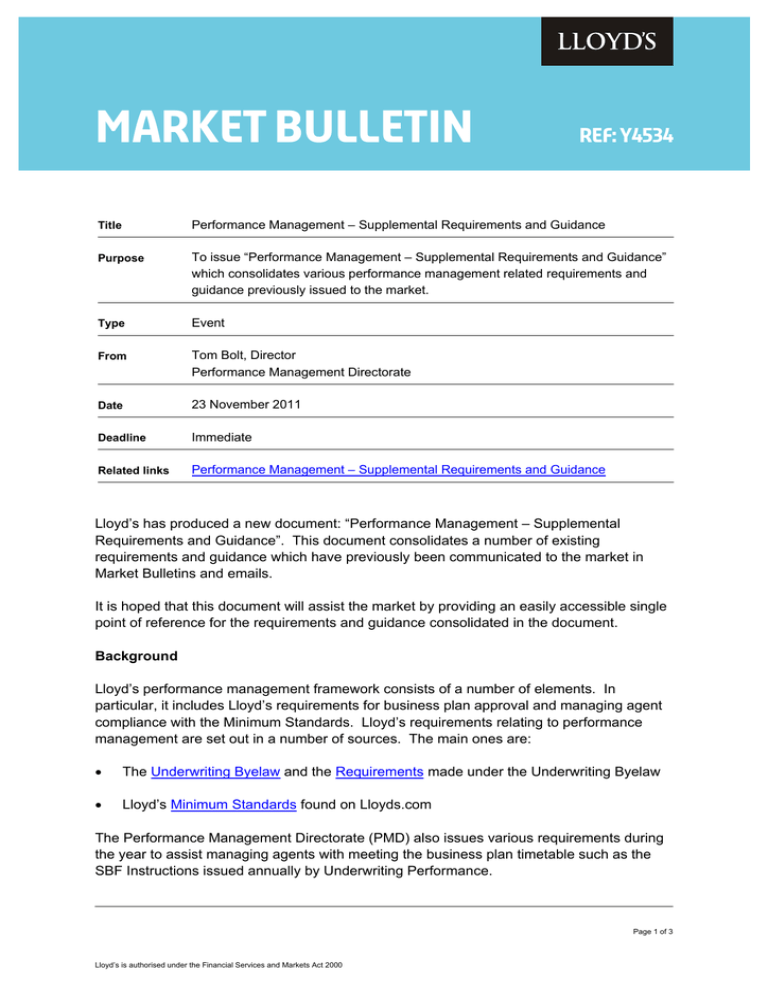

Y4534 - Performance Management – Supplemental

advertisement