The Economics of Accreditation

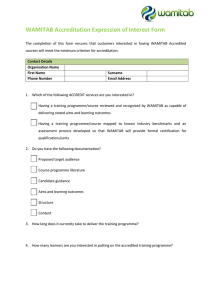

advertisement