nonprofit law: ten issues in search of resolution

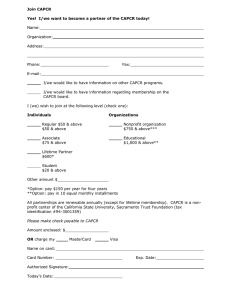

advertisement