© 2012 The Williams Companies, Inc. All rights reserved.

© 2013 The Williams Companies, Inc. All rights reserved.

© 2012 The Williams Companies, Inc. All rights reserved.

20 April – 15 July 2010

Macondo Prospect, Gulf of Mexico

Deepwater Horizon Drilling Rig

11 Fatalities / $40 billion estimated economic loss

Largest accidental marine

oil spill in history

© 2013 The Williams Companies, Inc. All rights reserved.

Risk Management Imperative

“The Chief Counsel‘s team finds that BP and Transocean did not have

adequate procedures in place to properly account for risk…”

“The companies involved at Macondo failed to rigorously analyze the risks

created by key decisions or to develop plans for mitigating those risks.”

Chief Counsel’s Report, National

Commission on the BP Deepwater Horizon

Oil Spill and Offshore Drilling, 2011.

© 2012 The Williams Companies, Inc. All rights reserved.

© 2013 The Williams Companies, Inc. All rights reserved.

Implementation Disappointments

Expectations:

> Quick, efficient implementation

> Improved estimate accuracy

> Smoother project execution

> Overall execution risk reduction

© 2012 The Williams Companies, Inc. All rights reserved.

Realities:

> “Program of the Month”

> “Black Box Magic”

> Onerous and time consuming

> False sense of precision

© 2013 The Williams Companies, Inc. All rights reserved.

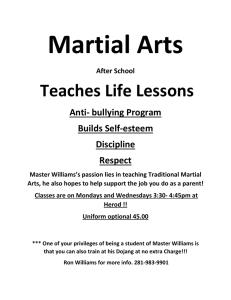

Implementing Risk Assessment Process on

Major Engineering and Construction Projects

Yaroslav Kovalenko

Williams Company

June 12, 2014

© 2012 The Williams Companies, Inc. All rights reserved.

© 2013 The Williams Companies, Inc. All rights reserved.

Discussion Topics

> Organizational mindset around risk assessment and management

> Demystifying Monte Carlo Analysis

> Internal and external risk-based communication

> Implementation Philosophy

© 2012 The Williams Companies, Inc. All rights reserved.

© 2013 The Williams Companies, Inc. All rights reserved.

New Organization Mindset

Fred Pace’s Vision

Note: Fred Pace is the Senior Vice President of Engineering and Construction at Williams Company.

© 2012 The Williams Companies, Inc. All rights reserved.

© 2013 The Williams Companies, Inc. All rights reserved.

© 2012 The Williams Companies, Inc. All rights reserved.

© 2013 The Williams Companies, Inc. All rights reserved.

Single Point Estimate

© 2012 The Williams Companies, Inc. All rights reserved.

© 2013 The Williams Companies, Inc. All rights reserved.

P50 Cost Target

P50

Estimate at completion (EAC)

© 2012 The Williams Companies, Inc. All rights reserved.

© 2013 The Williams Companies, Inc. All rights reserved.

In-service date (ISD)

P50 Cost and Schedule Target

P50

P50

Estimate at completion (EAC)

© 2012 The Williams Companies, Inc. All rights reserved.

© 2013 The Williams Companies, Inc. All rights reserved.

P50

ISD contingency

Base Estimate

EAC contingency

In-service date (ISD)

Contingency

P50

Estimate at completion (EAC)

© 2012 The Williams Companies, Inc. All rights reserved.

© 2013 The Williams Companies, Inc. All rights reserved.

Management Reserve

Management reserve

(MR)

P50

ISD contingency

Base Estimate

EAC contingency

In-service date (ISD)

P90

P50

Estimate at completion (EAC)

© 2012 The Williams Companies, Inc. All rights reserved.

P90

© 2013 The Williams Companies, Inc. All rights reserved.

One-Williams Process

PROCESS

ACTIVITIES

DELIVERABLES

Risk Management

Planning

1.

2.

Define risk management requirements

Develop a Risk Management Plan

Risk

Identification

1.

2.

Identify risks and document causes and effects

Assign risk ownership

Risk

Assessment

1.

2.

3.

Perform qualitative risk assessment (Pre-Mitigation)

Perform qualitative risk assessment (Post-Mitigation)

Perform quantitative risk assessment (Monte Carlo)

Risk Response

Planning

1.

2.

3.

Select risk response strategies

Develop risk mitigation and/or contingency plans

Assign risk mitigation action items

Risk

Monitoring & Control

1.

2.

3.

Follow up on mitigation action items

Periodically review risks

Report risk status and mitigation progress

Risk Management

Reports

Lessons

Learned

1.

2.

3.

Perform project close-out review

Document lessons learned

Collect benchmarking data

Lessons Learned

Log

© 2012 The Williams Companies, Inc. All rights reserved.

Risk Management

Plan

Risk

Register

Risk Assessment

Reports

Risk Mitigation

Plans

© 2013 The Williams Companies, Inc. All rights reserved.

Project Life Cycle Integration

Cost RA

Schedule RA

Not required

Not required

G0 Discover

Required

May be required*

G1

Select

Required

Required**

G2

Identify key risks and ensure that they are

Objectives manageable or acceptable. Select an option with

the best risk / reward profile.

High-level Risk Register

Deliverables

Factored estimate

Estimate Level conditioned for major

project risks.

Upd. Risk Register

High-level Monte Carlo

High-level estimate

and Monte Carlo

Analysis.

Required

Required**

Define

G3

Deliver

G4 Integrate

Ensure readiness for

managing risks in

execution.

Ensure that key risks

are being managed .

Ensure that lessons

learned are captured.

Upd. Risk Register

Detailed Monte Carlo

Risk Management Plan

Upd. Risk Register

Updated Monte Carlo

Risk Mgmt. Reports

Final Risk Register

Lessons Learned

Benchmarking Data

Detailed estimate and

Monte Carlo Analysis.

Revised estimate and

Monte Carlo Analysis.

Actual data for

benchmarking.

G5

Risk Assessment Notes:

* Required if requested by the Decision Maker

** May be waived for Major Projects

© 2012 The Williams Companies, Inc. All rights reserved.

© 2013 The Williams Companies, Inc. All rights reserved.

Demystifying Monte Carlo Analysis

ML

Min

© 2012 The Williams Companies, Inc. All rights reserved.

Max

© 2013 The Williams Companies, Inc. All rights reserved.

What's in the "Black Box"?

Probability theory is able to predict with uncanny precision the overall outcome

of processes made up out of a large number of individual happenings, each of

which in itself is unpredictable.

© 2012 The Williams Companies, Inc. All rights reserved.

© 2013 The Williams Companies, Inc. All rights reserved.

Risk Assessment Scope

Cost

Uncertainty

Confidence Level

Uncertainty

Event Driven

Risks

Scope

Changes

Commercial

Risks

ML

Min

Probability

x

Impact

Max

- Market Conditions

- Data Quality

- Line Item Ranges

- Uncertain Events

- Potential Cost Impact

- Risk Register Items

Operational

Risks

“Black Swans”

Capital Cost Risk Assessment Scope

© 2012 The Williams Companies, Inc. All rights reserved.

© 2013 The Williams Companies, Inc. All rights reserved.

Modeling Uncertainty and Risks

Weather Delays Example

Uncertainty

Risks

- Continuous ranges

- Market conditions / quality of estimate

- Binary events

- Items on Risk Register

70%

+

30%

x

No Yes

6 Days

10 Days

Best Case Base Allowance

© 2012 The Williams Companies, Inc. All rights reserved.

16 Days

Worst Case

7

14

30 % Chance of 7 to 14 Days

Tropical Storm Risk Event

© 2013 The Williams Companies, Inc. All rights reserved.

Monte Carlo Analysis Explained

Base

Estimate

+

Confidence Level

Uncertainty

+

Event Driven

Risks

$xx

$xx

$xx

$xx

© 2012 The Williams Companies, Inc. All rights reserved.

Probability

Curves

Probability

x

Impact

ML

Min

=

Max

+

+

P10

P50

P90

© 2013 The Williams Companies, Inc. All rights reserved.

Allowances vs. Uncertainty vs. Risks

© 2012 The Williams Companies, Inc. All rights reserved.

© 2013 The Williams Companies, Inc. All rights reserved.

Risk-Based Communication

© 2012 The Williams Companies, Inc. All rights reserved.

© 2013 The Williams Companies, Inc. All rights reserved.

Common Risk Management Language

P90(C)

P90(E)

P90 Mgmt. Reserve

P50(C)

P50(E)

P50 Contingency

Base Cost

0

Cost Risk Assessment Summary

*Base Estimate

Value

$ MM

% of

Base Cost

450

100%

P50 Confidence Level Contingency*

14

3%

P50 Event Driven Contingency**

30

6%

494

109%

P90 Confidence Level Management Reserve***

16

4%

P90 Event Driven Management Reserve****

20

5%

530

118%

P50 Cost Estimate

P90 Cost Estimate

Notes:

**** P50 CL Contingency = P50(C) – Base

**** P50 ED Contingency = P50(E)

**** P90 CL MR = P90(C) – P50(C)

**** P90 ED MR = P90(E) – P50(E)

* Base estimate includes allowances

© 2012 The Williams Companies, Inc. All rights reserved.

© 2013 The Williams Companies, Inc. All rights reserved.

Contracts and Risk Allocation

Williams

© 2012 The Williams Companies, Inc. All rights reserved.

GS-1 Project

HESS & Chevron

© 2013 The Williams Companies, Inc. All rights reserved.

Final Thoughts

on Process Implementation

© 2012 The Williams Companies, Inc. All rights reserved.

© 2013 The Williams Companies, Inc. All rights reserved.

The End Game

Improve project performance and predictability

through proactive identification, assessment and management

of opportunities and threats throughout the Project Life Cycle.

© 2012 The Williams Companies, Inc. All rights reserved.

© 2013 The Williams Companies, Inc. All rights reserved.

Implementation Philosophy

Able to…

Want to…

Employee

Competency

Motivation

Company

Process

Culture

Note: model based on guidelines and recommendations following Macondo incident investigation.

© 2012 The Williams Companies, Inc. All rights reserved.

© 2013 The Williams Companies, Inc. All rights reserved.

Progress Measurement

Measure:

• Lack of RM

process

• Unknown risk

posture for the

organization

Exit Criteria:

Define RM

definitions &

objectives

State:

• Processes not

integrated,

unpredictable,

poorly

controlled;

reactive

• Some tools,

procedures exist

but most

projects do their

own way;

Measure:

• Lack of risk ID

(unidentified

risks still

become

problems, etc.)

• Unverifiable risk

posture for the

org

Exit Criteria:

Define RM

process for the

org to follow

© 2012 The Williams Companies, Inc. All rights reserved.

Level 2 – Foundation

State:

• Process

characterized for

projects and often

reactive

• Basic tools,

procedures exist &

shared among few

projects; lack org

support

Measure:

• Lack of full org

engagement

• Improved risk ID but

still lacking insight

into risk posture for

the org

Exit Criteria:

Provide education

and awareness on

the RM

Requirements &

Processes

Provide training to

risk practitioners

and teams

Aid in implementing

RM into projects

(priority)

Level 3 – Structured

(Defined & Repeatable)

State:

• Formalized standard

RM process built-in

and followed

• Tools, procedures

available

• Teams are trained

Measure:

• RM mechanism exists

• PMs regularly

meeting with their

teams to perform

active RM & discuss

risks

• Dedicated RM / RM

resources in projects

• Regular risk reporting

at all levels

Exit Criteria:

% of projects onboard &

demonstrating their

utilization of the

process

Process consistently

used across

enterprise

RM Plans created for

Projects

Level 4 –

Integrated

State:

• Process

utilized,

measured and

controlled

• Active Sr. Mgmt

support exists

• Enterprise has

established a

risk-aware

culture, not

risk-adverse

Measure:

• Proactive RM

• Good & usable

metrics in place

• Trend data

used in RM

Exit Criteria:

Optimizing: Continuing to Improve

State:

• Non-existent

process

• Org not aware

of any RM

process,

assistance, or

tools

Level 1 – Ad Hoc

Level 5 –

Best In Class

Level 0 –

Non-Existent

Meet Level 4

measures

© 2013 The Williams Companies, Inc. All rights reserved.

Risk Management Organization

Project Excellence

Organization

VP of Project Excellence

Director of PLC

RM Process Owner

Project Development

Organization

Project Execution

Organization

FEED Leaders

Risk Specialists

PC Managers

Risk Coordinators

© 2012 The Williams Companies, Inc. All rights reserved.

© 2013 The Williams Companies, Inc. All rights reserved.

Summary

> Organizational mindset around risk assessment and management

– Acknowledgment of risks and uncertainties

– Clearly defined process

– Project Life Cycle Integration

> Demystifying Monte Carlo Analysis

– What’s in the “Black Box”?

– Allowances, Uncertainty, and Risks

> Internal and external risk-based communication

– Common language for PD, PE and Commercial teams

– Basis for contract negotiations and risk allocation

> Implementation Philosophy

– Process, competency, motivation and culture

– Progress Measurement

– Risk Management Organization

© 2012 The Williams Companies, Inc. All rights reserved.

© 2013 The Williams Companies, Inc. All rights reserved.

© 2012 The Williams Companies, Inc. All rights reserved.

© 2013 The Williams Companies, Inc. All rights reserved.

Gulfstar One FPS

Tubular Bells Field, Gulf of Mexico

Executed by Williams!

© 2012 The Williams Companies, Inc. All rights reserved.

© 2013 The Williams Companies, Inc. All rights reserved.

Questions?

© 2012 The Williams Companies, Inc. All rights reserved.

© 2013 The Williams Companies, Inc. All rights reserved.

Yaroslav Kovalenko

Williams Company

yaroslav.kovalenko@williams.com

© 2012 The Williams Companies, Inc. All rights reserved.

© 2013 The Williams Companies, Inc. All rights reserved.