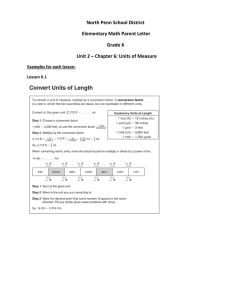

- 56

advertisement