Document

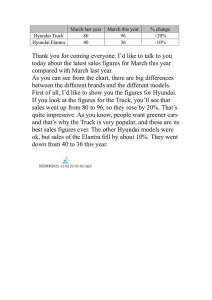

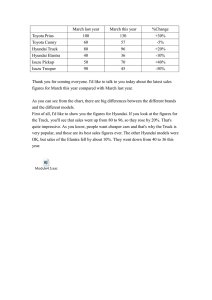

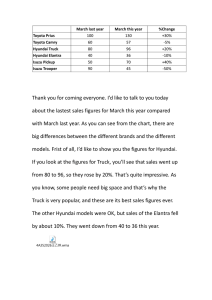

advertisement