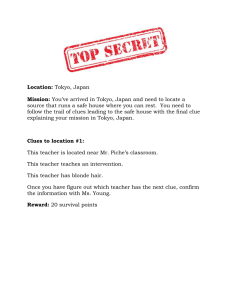

- Tokyo Electron

advertisement