REZ Fund Report

advertisement

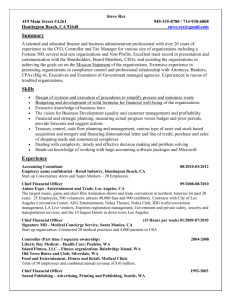

REZ iSharesResidentialRealEstateCappedETF ETF.comSegment:Equity:U.S.RealEstate REZFundDescription OverallRating TheiSharesFTSENAREITResidentialPlusCappedETFtracksamarketcap-weightedindexof USresidential,healthcareandself-storageREITs. REZFactSetAnalyticsInsight REZisostensiblyaresidentialrealestateETF,butinrealitythefundisagrabbagofREITs, manyofwhichfalloutsideresidential realestate.Asanexample,manytop holdingsarenotresidentialREITsat all.PublicStorageInc.—aself-storage firm—makesup10%ofthefundby itself,andseveralhealthcareREITs alsolandnearthetopofthelist.Alltold,thefunddevotesawhopping50%ofitsweightto specializedREITssuchashealthcareandhotelREITs.REZultimatelytracksamuddledindex thatneitherprovidesthediversificationofatotalmarketrealestatefund,northetargeted exposureofapurelyresidentialREITfund.REZcouldbethoughtofbestasanex-commercial REITplay,whichcombinedwithitsdecentliquidityandefficiencyearnsitaspotonour OpportunitiesList. “ manytopholdingsarenot residentialREITsatall ” RatingDetails B 86 73 73 asof09/30/16 97 SegmentAverage REZSummaryData Issuer BlackRock InceptionDate 05/01/07 LegalStructure Open-EndedFund ExpenseRatio 0.48% AssetsUnderManagement $475.79M AverageDaily$Volume REZIndexData IndexTracked FTSENAREITAllResidentialCappedIndex IndexWeightingMethodology IndexSelectionMethodology SegmentBenchmark REZPortfolioData MarketCap Price/EarningsRatio MarketCap Price/BookRatio ThomsonReutersUSResidential&CommercialREITs $2.67M 47.57 2.64 DistributionYield 3.93% NextEx-DividendDate 12/21/16 RelatedETFstoREZ TopCompetingETFs VNQ,IYR,RWR,SCHH,FRI EFFICIENCY REZPortfolioManagement 86 TotalReturns 1Year 30.0% 20.0% ExpenseRatio 0.48% MedianTrackingDifference(12Mo) -0.24% Max.UpsideDeviation(12Mo) -0.08% Max.DownsideDeviation(12Mo) -0.62% REZTaxExposures MaxLT/STCapitalGainsRate 20.00%/39.60% 10.0% CapitalGainsDistributions(3Year) TaxonDistributions 0.0% -- Ordinaryincome DistributesK1 No REZFundStructure LegalStructure Nov Jan2016 Performance Mar 1Month May 3Month YTD Jul 1Year 3Years Sep 5Years 10Years REZ 0.85% -0.05% 7.95% 17.36% 15.13% 14.85% -- REZ(NAV) 0.84% -0.05% 8.03% 17.34% 15.12% 14.76% -- 0.89% 0.13% 8.08% 17.56% 15.51% 15.21% -- ThomsonReutersUS -0.84% Residential&CommercialREITs 0.75% 13.10% 22.00% 13.38% 13.95% -- FTSENAREITAllResidential CappedIndex Open-EndedFund OTCDerivativeUse SecuritiesLendingActive SecuritiesLendingSplit(Fund/Issuer) ETNCounterparty No Yes 70%/30% N/A ETNCounterpartyRisk N/A FundClosureRisk Low PortfolioDisclosure Daily Allreturnsover1yearareannualiz ed.Allreturnsaretotalreturnsunlessotherwisestated. |iS haresResidentialRealEstateCappedETF|01Oc tober2016 Page1of3 TRADABILITY 97 REZFactSetAnalyticsBlockLiquidity AVERAGESPREAD 5 0.13% 4 0.10% 2 0.04% 1 0.01% PREMIUM/DISCOUNT 3 0.07% 0.3% 0.0% Thismeasurementshows howeasyitistotrade 25,000sharesofREZ.REZ israteda5outof5. REZTradability Avg.DailyShareVolume 40,189 AverageDaily$Volume $2.67M MedianDailyShareVolume 31,025 MedianDailyVolume($) -0.3% -0.5% $2.06M AverageSpread(%) 0.06% AverageSpread($) $0.04 MedianPremium/Discount(12Mo) 0.01% Max.Premium/Discount(12Mo) VOLUME 800K 600K OCT `16 APR JUL 0.15%/-0.26% ImpedimenttoCreations 400K MarketHoursOverlap 200K CreationUnitSize(Shares) None 100.00% 50,000 CreationUnit/Day(45DayAverage) `16 0.62 CreationUnitCost(%) 0.01% UnderlyingVolume/Unit 0% OpenInterestonETFOptions 335 NetAssetValue(Yesterday) $66.30 ETF.comImpliedLiquidity 5 FIT REZBenchmarkComparison 73 REZSector/IndustryBreakdown S ec tor REZTop10Holdings REZ Benc hmark PublicStorage 10.99% REZ 43Holdings SharedHoldings 38(Count) SpecializedREITs 52.46% 38.62% Welltower,Inc. 8.97% ResidentialREITs 45.82% 12.71% Ventas,Inc. 8.17% DiversifiedREITs 1.72% 0.58% AvalonBayCommunities,Inc. 8.10% EquityResidential 7.80% Large HCP,Inc. 4.95% (>12.9B) EssexPropertyTrust,Inc. 4.64% ExtraSpaceStorageInc. 3.77% UDR,Inc. 3.72% Mic ro Mid-AmericaApartmentCommunities,Inc. 2.94% (<600M) TotalTop10Weighting 64.06% REZGeographicExposure Countries UnitedStates REZ 100.00% Benc hmark 100.00% Regions REZ Benc hmark NorthAmerica 100.00% Developed/ 100.00%/ 100.00%/ EmergingSplit 0.00% 100.00% 0.00% Benchmark 181Constituents 99.46%(Weight) REZ WeightedAverage MarketCap Benchmark 17.77B 20.83B 53.62% 53.33% 41.47% 37.82% 4.24% 8.22% 0.67% 0.63% Price/Earnings Ratio Price/BookRatio 47.57 51.17 2.64 2.58 DividendYield 3.56% 3.77% NumberOf Holdings Concentration 43 181 High Medium SizeSplit Mid(>2.7B) S mall (>600M) REZPerformanceStatistics GoodnessofFit(R 2) 0.88 Beta 1.03 UpBeta 1.00 DownBeta DownsideStandardDeviation 1.05 0.39% SegmentBenchmark |iS haresResidentialRealEstateCappedETF|01Oc tober2016 Page2of3 ThomsonReutersUSResidential& CommercialREITs ©2016,ETF.com Thedataandinformationcontainedhereinisnotintendedtobeinvestmentortaxadvice.Areferencetoaparticularinvestmentorsecurity,a creditrating,oranyobservationconcerningasecurityorinvestmentprovidedintheETF.comServiceisnotarecommendationtobuy,sell,or holdsuchinvestmentorsecurityortomakeanyotherinvestmentdecisions.Youshouldnotusesuchinformationforpurposesofanyactual transactionwithoutconsultinganinvestmentortaxprofessional. ETF.comDOESNOTTAKERESPONSIBILITYFORYOURINVESTMENTOROTHERACTIONSNORSHALLETF.comHAVEANYLIABILITY, CONTINGENTOROTHERWISE,FORTHEACCURACY,COMPLETENESS,TIMELINESS,ORCORRECTSEQUENCINGOFANY INFORMATIONPROVIDEDBYETF.comORFORANYDECISIONMADEORACTIONTAKENBYYOUINRELIANCEUPONSUCH INFORMATIONORETF.com. [ETF.comDOESNOTPROVIDEANYRESEARCHOPINIONS.]ETF.comMAKESNOREPRESENTATIONSABOUTTHESUITABILITYOFTHE INFORMATION,PRODUCTSORSERVICESCONTAINEDHEREIN.PASTPERFORMANCEISNOTINDICATIVEOFFUTURERESULTS. Dataprovider:FactSetResearchSystems,Inc. OpportunitiesList:ThisETFrepresentsauniqueoralternativetakeonthesegment,andinvestorsmaywanttotakeacloserlook. |iS haresResidentialRealEstateCappedETF|01Oc tober2016 Page3of3